- My presentations

Auth with social network:

Download presentation

We think you have liked this presentation. If you wish to download it, please recommend it to your friends in any social system. Share buttons are a little bit lower. Thank you!

Presentation is loading. Please wait.

INTRODUCTION TO STRATEGIC THINKING

Published by Arabella Morgan Modified over 5 years ago

Similar presentations

Presentation on theme: "INTRODUCTION TO STRATEGIC THINKING"— Presentation transcript:

Strategies to Make Your Reading Time More Effective and Efficient

Intelligence Give a definition of intelligence that you could defend, explaining why you believe you could defend it. Give examples of ways your definition.

Planning and Strategic Management

Taking Effective Notes

1 Pertemuan 23 Strategic Leadership by Executives Matakuliah: MPG / Leadership and Organisation Tahun: 2005 Versi: versi/revisi 0.

Strategic and Systems Thinking for the Public Sector - 29th-31st March 1999 Why use Oval Mapping? * useful method for being able to see the whole picture.

Business Policy and Strategy MGT599

Strategic Human Resource Management

STRATEGIC MANAGEMENT 1

Opportunities & Implications for Turkish Organisations & Projects

Strategic Management and the Entrepreneur

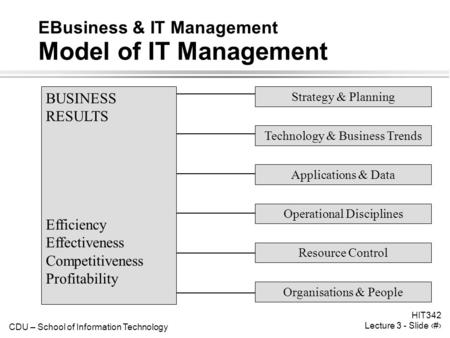

EBusiness & IT Management Model of IT Management

Nature and Scope of Marketing Research

Strategic management.

Logistics and supply chain strategy planning

Semester 2: Lecture 9 Analyzing Qualitative Data: Evaluation Research Prepared by: Dr. Lloyd Waller ©

Part 1 Unit 1 Introduction and Overview Risk Management and Strategic Planning.

CREATING OUR STRATEGIC DIRECTION FOR 2015 Innovating our way to a successful and sustainable future:

FYITS – Students Mktg Briefing Nov 2010 BSc (Hons) Engineering Management Nature of Course The course seeks to equip students with management knowledge.

About project

© 2024 SlidePlayer.com Inc. All rights reserved.

- SUGGESTED TOPICS

- The Magazine

- Newsletters

- Managing Yourself

- Managing Teams

- Work-life Balance

- The Big Idea

- Data & Visuals

- Reading Lists

- Case Selections

- HBR Learning

- Topic Feeds

- Account Settings

- Email Preferences

How to Demonstrate Your Strategic Thinking Skills

- Nina A. Bowman

Don’t be shy about bringing your ideas to the table.

Developing your strategic thinking skills isn’t enough to get you promoted. In order to advance in your career, you need to demonstrate them. Leaders want to know what you think, and they view your worthiness for promotion through the lens of how ready you are to make bigger decisions. Ask yourself: “Do people know where I stand?” If not, what do you need to do to bring your perspective to the table? It’s also important to demonstrate that you can put new ideas into action. Take the initiative on new projects that show how your understanding extends beyond your current function.

We all know that developing strategic thinking skills is important , but many don’t realize how critical it is to your career advancement to show these skills to your boss and other senior leaders. Showing strategic thinking skills tells your bosses that you’re able to think for yourself and make decisions that position the organization for the future. It assures them that you aren’t making decisions in a vacuum but are considering how other departments might be affected or how the outside world will respond.

- NB Nina A. Bowman is a Managing Partner at Paravis Partners, an executive coaching and leadership development firm. Previously, she held various advisory and leadership roles in strategy. She is an executive coach and speaker on issues of strategic leadership, leadership presence, and interpersonal effectiveness. She is also a contributing author to the HBR Guide to Coaching Employees and HBR Guide to Thinking Strategically .

Partner Center

Thinking strategically

In the late 1970s, Fred Gluck led an effort to revitalize McKinsey’s thinking on strategy while, in parallel, Tom Peters and Robert Waterman were leading a similar effort to reinvent the Firm’s thinking on organization. The first published product of Gluck’s strategy initiative was a 1978 staff paper, "The evolution of strategic management."

The ostensible purpose of Gluck’s article was to throw light on the then-popular but ill-defined term "strategic management," using data from a recent McKinsey study of formal strategic planning in corporations. The authors concluded that such planning routinely evolves through four distinct phases of development, rising in sophistication from simple year-to-year budgeting to strategic management, in which strategic planning and everyday management are inextricably intertwined.

But the power of the article comes from the authors’ insights into the true nature of strategy and what constitutes high-quality strategic thinking. The article is also noteworthy for setting forth McKinsey’s original definition of strategy as "an integrated set of actions designed to create a sustainable advantage over competitors" and includes a description of the well-known "nine-box" matrix that formed the basis of McKinsey’s approach to business portfolio analysis.

Ten years later, a team from the Firm’s Australian office took portfolio analysis a step further. Rather than basing portfolio strategy only on metrics of a business unit’s absolute attractiveness, as suggested by the nine-box matrix, John Stuckey and Ken McLeod recommended adding a key new decision variable: how well-suited is the parent company to run the business unit as compared with other possible owners? If the parent is best suited to extract value from a unit, it often makes no sense to sell, even if that unit doesn’t compete in a particularly profitable industry. Conversely, if a parent company determines that it is not the best possible owner of a business unit, the parent maximizes value by selling it to the most appropriate owner, even if the unit happens to be in a business that is fundamentally attractive. In short, the "market-activated corporate strategy framework" prompts managers to view their portfolios with an investor’s value-maximizing eye.

The evolution of strategic management

Frederick W. Gluck, Stephen P. Kaufman, and A. Steven Walleck

A minor but pervasive frustration that seems to be unique to management as a profession is the rapid obsolescence of its jargon. As soon as a new management concept emerges, it becomes popularized as a buzzword, generalized, overused, and misused until its underlying substance has been blunted past recognition. The same fate could easily befall one of the brightest new concepts to come along lately: strategic management.

In seeking to understand what strategic management is, we have conducted a major study of the planning systems at large corporations. This study is unique in that it attempts to pass judgment on the quality of the business plans produced rather than only on the planning process.

We found that planning routinely progresses through four discrete phases of development. The first phase, financial planning, is the most basic and can be found at all companies. It is simply the process of setting annual budgets and using them to monitor progress. As financial planners extend their time horizons beyond the current year, they often cross into forecast-based planning, which is the second phase. A few companies have advanced beyond forecast-based planning by entering the third phase, which entails a profound leap forward in the effectiveness of strategic planning. We call this phase externally oriented planning, since it derives many of its advantages from more thorough and creative analyses of market trends, customers, and the competition. Only phase four—which is really a systematic, company-wide embodiment of externally oriented planning—earns the appellation strategic management, and its practitioners are very few indeed.

It doesn’t appear possible to skip a step in the process, because at each phase a company adopts attitudes and gains capabilities needed in the phases to come. Many companies have enjoyed considerable success without advancing beyond the rudimentary levels of strategic development. Some large, successful enterprises, for instance, are still firmly embedded in the forecast-based planning phase. You might well ask, are these companies somehow slipping behind, or are they simply responding appropriately to an environment that changes more slowly? The answer must be determined on a case-by-case basis.

Phase one: Financial planning

Financial planning, as we have said, is nothing more than the familiar annual budgeting process. Managers forecast revenue, costs, and capital needs a year in advance and use these numbers to benchmark performance. In well over half of the companies McKinsey studied—including some highly successful ones—formal planning was still at this most basic phase.

Note the word formal. Many firms that lack a sophisticated formal planning process make up for it with an informal "implicit strategy" worked out by the chief executive officer and a few top managers. Formal strategic planning, in fact, is just one of the possible sources of sound strategy development. There are at least two others: strategic thinking and opportunistic strategic decision making (Exhibit 1). All three routes can result in an effective strategy, which we define as "an integrated set of actions designed to create a sustainable advantage over competitors."

Phase-one companies, then, do have strategies, even though such companies often lack a formal system for planning them. The quality of the strategy of such a company depends largely on the entrepreneurial vigor of its CEO and other top executives. Do they have a good feel for the competition? Do they know their own cost structures? If the answer to such questions is yes, there may be little advantage to formal strategic planning. Ad-hoc studies by task forces and systematic communication of the essence of the strategy to those who need to know may suffice.

Phase two: Forecast-based planning

Still, most large enterprises are too complex to be managed with only an implicit strategy. Companies usually learn the shortcomings of phase-one planning as their treasurers struggle to estimate capital needs and make trade-offs among various financing plans, based on no more than a one-year budget. Ultimately, the burden becomes unbearable, and the company evolves toward phase two. At first, phase-two planning differs little from annual budgeting except that it covers a longer period of time. Very soon, however, planners become frustrated because the real world does not behave as their extrapolations predict. Their first response is usually to develop more sophisticated forecasting tools: trend analysis, regression models, and, finally, simulation models.

This initial response brings some improvement, but sooner or later all extrapolative models fail. At this point, a creative spark stirs the imaginations of the planners. They suddenly realize that their responsibility is not to chart the future—which is, in fact, impossible—but, rather, to lay out for managers the key issues facing the company. We call this spark "issue orientation."

The tough strategic issue that most often triggers the move to issue orientation is the problem of resource allocation: how to set up a flow of capital and other resources among the business units of a diversified company. The technique most commonly applied to this problem is portfolio analysis, a means of depicting a diversified company’s business units in a way that suggests which units should be kept and which sold off and how financial resources should be allocated among them. McKinsey’s standard portfolio analysis tool is the nine-box matrix (Exhibit 2), in which each business unit is plotted along two dimensions: the attractiveness of the relevant industry and the unit’s competitive strength within that industry. Units below the diagonal of the matrix are sold, liquidated, or run purely for cash, and they are allowed to consume little in the way of new capital. Those on the diagonal—marked "Selectivity, earnings"—can be candidates for selective investment. And business units above the diagonal, as the label suggests, should pursue strategies of either selective or aggressive investment and growth.

Phase three: Externally oriented planning

Once planners see their main role as identifying issues, they shift their attention from the details of their companies’ activities to the outside world, where the most profound issues reside. The planners’ in-depth analyses, previously reserved for inwardly focused financial projections, are now turned outward, to customers, potential customers, competitors, suppliers, and others. This outward focus is the chief characteristic of phase three: externally oriented planning.

The process can be time-consuming and rigorous—scrutinizing the outside world is a much larger undertaking than studying the operations of a single company—but it can also pay off dramatically. Take the example of a heavy-equipment maker that spent nine person-months reverse engineering its competitor’s product, reconstructing that competitor’s manufacturing facilities on paper, and estimating its production costs. The result: the company decided that no achievable level of cost reduction could meet the competition and that it therefore made no sense to seek a competitive advantage on price.

Phase-three plans can sometimes achieve this kind of dramatic impact because they are very different from the kind of static, deterministic, sterile plans that result from phase-two efforts. In particular, they share the following features:

Phase-three resource allocation is dynamic rather than static. The planner looks for opportunities to "shift the dot" of a business into a more attractive region of the portfolio matrix. This can be done by creating new capabilities that will help the company meet the most important prerequisite for success within a market, by redefining the market itself, or by changing the customers’ buying criteria to correspond to the company’s strengths.

Phase-three plans are adaptive rather than deterministic. They do not work from a standard strategy, such as "invest for growth." Instead, they continually aim to uncover new ways of defining and satisfying customer needs, new ways of competing more effectively, and new products or services.

Phase-three strategies are often surprise strategies. The competition often does not even recognize them as a threat until after they have taken effect.

Phase-three plans often recommend not one course of action but several, acknowledging the trade-offs among them. This multitude of possibilities is precisely what makes phase three very uncomfortable for top managers. As in-depth dynamic planning spreads through the organization, top managers realize that they cannot control every important decision. Of course, lower-level staff members often make key decisions under phase-one and phase-two regimes, but because phase three makes this process explicit, it is more unsettling for top managers and spurs them to invest even more in the strategic-planning process.

Phase Four: Strategic management

When this investment is successful, the result is strategic management: the melding of strategic planning and everyday management into a single, seamless process. In phase four, it is not that planning techniques have become more sophisticated than they were in phase three but that they have become inseparable from the process of management itself. No longer is planning a yearly, or even quarterly, activity. Instead, it is woven into the fabric of operational decision making.

No more than a few of the world’s companies—mainly diversified multinationals that manufacture electrical and electronic products—have reached this fourth phase. Perhaps the need to plan for hundreds of fast-evolving businesses serving thousands of product markets in dozens of nations has accelerated evolution at these companies. Observing them can teach executives much about strategic management.

The key factor that distinguishes strategically managed companies from their counterparts in phase three is not the sophistication of their planning techniques but rather the care and thoroughness with which they link strategic planning to operational decision making. This often boils down to the following five attributes:

A well-understood conceptual framework that sorts out the many interrelated types of strategic issues. This framework is defined by tomorrow’s strategic issues rather than by today’s organizational structure. Strategic issues are hung on the framework like ornaments on a Christmas tree. Top management supervises the process and decides which issues it must address and which should be assigned to operating managers.

Strategic thinking capabilities that are widespread throughout the company, not limited to the top echelons.

A process for negotiating trade-offs among competing objectives that involves a series of feedback loops rather than a sequence of planning submissions. A well-conceived strategy plans for the resources required and, where resources are constrained, seeks alternatives.

A performance review system that focuses the attention of top managers on key problem and opportunity areas, without forcing those managers to struggle through an in-depth review of each business unit’s strategy every year.

A motivational system and management values that reward and promote the exercise of strategic thinking.

Although it is not possible to make everyone at a company into a brilliant strategic thinker, it is possible to achieve widespread recognition of what strategic thinking is. This understanding is based on some relatively simple rules.

Strategic thinking seeks hard, fact-based, logical information. Strategists are acutely uncomfortable with vague concepts like "synergy." They do not accept generalized theories of economic behavior but look for underlying market mechanisms and action plans that will accomplish the end they seek.

Strategic thinking questions everyone’s unquestioned assumptions. Most business executives, for example, regard government regulation as a bothersome interference in their affairs. But a few companies appear to have revised that assumption and may be trying to participate actively in the formation of regulatory policies to gain a competitive edge.

Strategic thinking is characterized by an all-pervasive unwillingness to expend resources. A strategist is always looking for opportunities to win at low or, better yet, no cost.

Strategic thinking is usually indirect and unexpected rather than head-on and predictable. Basil Henry Liddell Hart, probably the foremost thinker on military strategy in the 20th century, has written, "To move along the line of natural expectation consolidates the opponent’s balance and thus his resisting power." "In strategy," says Liddell Hart, "the longest way around is often the shortest way home." 1 1. See B. H. Liddell Hart, Strategy , second edition, Columbus, Ohio: Meridian Books, 1991.

It appears likely that strategic management will improve a company’s long-term business success. Top executives in strategically managed companies point with pride to many effective business strategies supported by coherent functional plans. In every case, they can identify individual successes that have repaid many times over the company’s increased investment in planning.

About the Authors

Frederick Gluck was the managing director of McKinsey from 1988 to 1994; Stephen Kaufman and Steven Walleck are alumni of McKinsey’s Cleveland office. This article is adapted from a McKinsey staff paper dated October 1978.

MACS: The market-activated corporate strategy framework

Ken McLeod and John Stuckey

McKinsey’s nine-box strategy matrix, prevalent in the 1970s, plotted the attractiveness of a given industry along one axis and the competitive position of a particular business unit in that industry along the other. Thus, the matrix could reduce the value-creation potential of a company’s many business units to a single, digestible chart.

However, the nine-box matrix applied only to product markets: those in which companies sell goods and services to customers. Because a comprehensive strategy must also help a parent company win in the market for corporate control—where business units themselves are bought, sold, spun off, and taken private—we have developed an analytical tool called the market-activated corporate strategy (MACS) framework.

MACS represents much of McKinsey’s most recent thinking in strategy and finance. Like the old nine-box matrix, MACS includes a measure of each business unit’s stand-alone value within the corporation, but it adds a measure of a business unit’s fitness for sale to other companies. This new measure is what makes MACS especially useful.

The key insight of MACS is that a corporation’s ability to extract value from a business unit relative to other potential owners should determine whether the corporation ought to hold onto the unit in question. In particular, this issue should not be decided by the value of the business unit viewed in isolation. Thus, decisions about whether to sell off a business unit may have less to do with how unattractive it really is (the main concern of the nine-box matrix) and more to do with whether a company is, for whatever reason, particularly well suited to run it.

In the MACS matrix, the axes from the old nine-box framework measuring the industry’s attractiveness and the business unit’s ability to compete have been collapsed into a single horizontal axis, representing a business unit’s potential for creating value as a stand-alone enterprise (Exhibit 3). The vertical axis in MACS represents a parent company’s ability, relative to other potential owners, to extract value from a business unit. And it is this second measure that makes MACS unique.

Managers can use MACS just as they used the nine-box tool, by representing each business unit as a bubble whose radius is proportional to the sales, the funds employed, or the value added by that unit. The resulting chart can be used to plan acquisitions or divestitures and to identify the sorts of institutional skill-building efforts that the parent corporation should be engaged in.

The horizontal dimension: The potential to create value

The horizontal dimension of a MACS matrix shows a business unit’s potential value as an optimally managed stand-alone enterprise. Sometimes, this measure can be qualitative. When precision is needed, though, you can calculate the maximum potential net present value (NPV) of the business unit and then scale that NPV by some factor—such as sales, value added, or funds employed—to make it comparable to the values of the other business units. If the business unit might be better run under different managers, its value is appraised as if they already do manage it, since the goal is to estimate optimal, not actual, value.

That optimal value depends on three basic factors:

Industry attractiveness is a function of the structure of an industry and the conduct of its players, both of which can be assessed using the structure-conduct-performance (SCP) model. Start by considering the external forces impinging on an industry, such as new technologies, government policies, and lifestyle changes. Then consider the industry’s structure, including the economics of supply, demand, and the industry chain. Finally, look at the conduct and the financial performance of the industry’s players. The feedback loops shown in Exhibit 4 interact over time to determine the attractiveness of the industry at any given moment.

The position of your business unit within its industry depends on its ability to sustain higher prices or lower costs than the competition does. Assess this ability by considering the business unit as a value delivery system, where "value" means benefits to buyers minus price. 2 2. See Michael J. Lanning and Edward G. Michaels, 'A business is a value delivery system,' on page 53 of this anthology.

Chances to improve the attractiveness of the industry or the business unit’s competitive position within it come in two forms: opportunities to do a better job of managing internally and possible ways of shaping the structure of the industry or the conduct of its participants.

The vertical dimension: The ability to extract value

The vertical axis of the MACS matrix measures a corporation’s relative ability to extract value from each business unit in its portfolio. The parent can be classified as "in the pack," if it is no better suited than other companies to extract value from a particular business unit, or as a "natural owner," if it is uniquely suited for the job. The strength of this vertical dimension is that it makes explicit the true requirement for corporate performance: extracting more value from assets than anyone else can.

Many qualities can make a corporation the natural owner of a certain business unit. The parent corporation may be able to envision the future shape of the industry—and therefore to buy, sell, and manipulate assets in a way that anticipates a new equilibrium. It may excel at internal control: cutting costs, squeezing suppliers, and so on. It may have other businesses that can share resources with the new unit or transfer intermediate products or services to and from it. (In our experience, corporations tend to overvalue synergies that fall into this latter category. Believing that the internal transfer of goods and services is always a good thing, these companies never consider the advantages of arm’s-length market transactions.) Finally, there may be financial or technical factors that determine, to one extent or other, the natural owner of a business unit. These can include taxation, owners’ incentives, imperfect information, and differing valuation techniques.

Using the framework

Once a company’s business units have been located on the MACS matrix, the chart can be used to plan preliminary strategies for each of them. The main principle guiding this process should be the primary one behind MACS itself: the decision about whether a unit ought to be part of a company’s portfolio hangs more on that company’s relative ability to extract value from the unit than on its intrinsic value viewed in isolation.

The matrix itself can suggest some powerful strategic prescriptions—for example:

Divest structurally attractive businesses if they are worth more to someone else.

Retain structurally mediocre (or even poor) businesses if you can coax more value out of them than other owners could.

Give top priority to business units that lie toward the far left of the matrix—either by developing them internally if you are their natural owner or by selling them as soon as possible if someone else is.

Consider improving a business unit and selling it to its natural owner if you are well equipped to increase the value of the business unit through internal improvements but not in the best position to run it once it is in top shape.

Of course, the MACS matrix is just a snapshot. Sometimes, a parent company can change the way it extracts value, and in so doing it can become the natural owner of a business even if it wasn’t previously. But such a change will come at a cost to the parent and to other units in its portfolio. The manager’s objective is to find the combination of corporate capabilities and business units that provides the best overall scope for creating value.

MACS, a descendent of the old nine-box matrix, packages much of McKinsey’s thinking on strategy and finance. We have found that it serves well as a means of assessing strategy along the critical dimensions of value creation potential and relative ability to extract value.

Ken McLeod is an alumnus of McKinsey’s Melbourne office, and John Stuckey is a director in the Sydney office. This article is adapted from a McKinsey staff paper dated July 1989. Copyright © 1989, 2000 McKinsey & Company. All rights reserved.

Explore a career with us

IMAGES

COMMENTS

Strategic thinking is a key skill for leaders. By understanding some of the components involved, a leader can begin to create conversations around critical issues and foster a shared understanding of who we are, where we are going, and how we'll get there.

Discover the integrated components of strategic leadership Explore the key elements of strategic leadership, including strategic thinking Learn a model which can be used to grow your strategic thinking skills Be introduced to tools aligned with growing skills in each component of the strategic thinking model

This presentation draws on ideas from Professor Porter's books and articles, in particular, Competitive Strategy (The Free Press, 1980); Competitive Advantage (The Free Press, 1985); "What is Strategy?" (Harvard Business Review, Nov/Dec 1996); On Competition (Harvard Business Review, 2008); and "Creating Shared Value" (Harvard Business Review, Jan 2011). No part of this publication ...

Strategic Thinking is a thinking skill in 'seeing' issues, problems, opportunities and threats in a larger and broader perspective ('the big picture') and being able to understand the inter-relation of all the elements involved so that the best course of action could be formulated to achieve the desired goals. 5 What is Strategic Thinking?

Strategic thinking is defined as the ability to generate new insights on a continual basis to achieve competitive advantage. An insight is the combination of two or more pieces of information or data in a unique way that leads to the creation of new value.

ed throughout the academic year. The Strategic Thinking Framework further explains the components of strategic thinking and provides an approach. o inform senior leader judgment. The goal is to develop strate-gies that align an organization's future direc-tion (or vision) with the future environme. to.

Strategic planning is the channeling of business insights into an action plan to achieve goals and objectives. A key distinction between strategic thinking and strategic planning is that the former occurs on a regular basis, as part of our daily activities, while the latter occurs periodically (quarterly, semi-annually or annually).

The keys to strategic thinking were identified during five years of research and interaction with executives from start-ups to Fortune 100 companies. Through this research, five key areas have emerged as tangible ways to learn to practice the art of strategic thinking.

Understand the WHY-HOW-WHAT Framework and it's application to strategic thinking and strategic planning. Identify and understand what it means to think and act strategically in order to accomplish our life's work. BIG GOAL: Get YOU to a place where you have acquired the skills, knowledge and mindsets that are essential to being strategic.

Abstract. In this PDF-presentation I present what is Strategic Thinking according to myself, Henry Minzberg, Liedtka, Juha Näsi and John Pisapia. In my opinion the ability to strategic thinking ...

In explaining the difference between strategic planning and strategic thinking, Mintzberg argues that strategic planning is the systematic programming of pre-identified strategies from which an action plan is developed. Strategic thinking, on the other hand, is a synthesizing process utilizing intuition and creativity whose outcome is "an ...

The Strategic Thinking Module is a 2-3 hour training program to develop more intentional strategic thinking skills. It will begin with a definition of Strategic Thinking, a description of what it is designed to accomplish, and the learning outcomes we want to achieve through this module. Next we will ask you to look over a newspaper article and ...

Developing your strategic thinking skills isn't enough to get you promoted. In order to advance in your career, you need to demonstrate them. Leaders want to know what you think, and they view ...

m organizational success. Strategy is an essential component of strategic thinking, a necessary skill for leaders and one that's highly sought after by employers.1 Being able to think strategically about the big picture and make reasoned decisions that will drive employees in the organization in a common direction means leaders can con

Strategic thinking is a way of thinking or mindset underlying the strategic management philosophy. Strategic planning is the periodic process of creating strategy or a plan using strategic thinking.

What's In It For You? At Work? Personally? 11 Key Components of Strategic Thinking 1. Knowing 2. Thinking 3. Speaking 4. Acting 12 Knowing -- Be Curious

Thinking strategically | McKinsey. In the late 1970s, Fred Gluck led an effort to revitalize McKinsey's thinking on strategy while, in parallel, Tom Peters and Robert Waterman were leading a similar effort to reinvent the Firm's thinking on organization. The first published product of Gluck's strategy initiative was a 1978 staff paper ...

The exercises focus on four skill areas: reflective thinking, questioning and information seeking, making connections across disparate information, and anticipating future states. ... Many skills are associated with strategic thinking.

Research by authors Carroll and Mui underscore the importance of strategic thinking at the orga- Strategic thinking is defined as the generation of nizational level as well. The authors studied 750 business insights on a continual basis to achieve bankruptcies of companies with at least $500 competitive advantage. Strategic thinking is million in assets in the last quarter before bank ...

The importance of the role of str ategic thinking can be explained twofold: by the company's. need to find and adopt the right strategy and, based on the literature, by the lack of efficient ...