Applications and Essay Online

Essay On Inflation In Pakistan – 100, 150, 200, 250, 300, 500 words

Inflation in Pakistan has been a persistent economic challenge that has significantly impacted the nation’s economy and the livelihood of its people. As prices of goods and services continue to rise, the purchasing power of individuals diminishes, leading to a decrease in their standard of living. Understanding the causes and consequences of inflation in Pakistan is crucial for policymakers, economists, and the general public to develop effective strategies to mitigate its effects.

In this collection of essays, we will delve into the various aspects of inflation in Pakistan, exploring its root causes, its impact on different sectors of the economy, and potential solutions to address this issue. From analyzing the role of government policies and global economic trends to examining inflation’s effects on businesses, consumers, and the overall economy, these essays will provide a comprehensive overview of the challenges posed by inflation in Pakistan.

Through insightful analysis and critical thinking, we aim to shed light on this pressing issue and offer valuable perspectives on how Pakistan can navigate the complex landscape of inflation to build a more stable and prosperous economy for its citizens.

100 words Essay On Inflation In Pakistan

Inflation in Pakistan has been a persistent challenge for the economy, with prices rising steadily over the years. The main factors contributing to inflation include high food prices, energy costs, currency devaluation, and government borrowing. The country’s reliance on imported goods, especially oil, further exacerbates the problem. In recent years, inflation has soared to double-digit levels, putting pressure on the common man’s purchasing power. The government has attempted various measures to curb inflation, such as tight monetary policy and subsidy programs. However, these efforts have had limited success, and inflation remains a significant concern for the country’s economy.

150 words Essay On Inflation In Pakistan

Inflation in Pakistan has been a persistent issue, affecting the economy and the common man alike. The country has been experiencing high inflation rates for many years due to various factors such as increasing global oil prices, depreciation of the Pakistani rupee, and government policies.

The rise in inflation has led to a decrease in the purchasing power of the people, making it difficult for them to afford basic necessities. The cost of living has skyrocketed, causing a strain on the middle and lower class population. The government has tried to control inflation through measures like increasing interest rates and reducing government spending. However, these steps have not been able to bring down inflation significantly.

To combat inflation effectively, the government needs to focus on stabilizing the currency, promoting domestic production, and reducing reliance on imports. Additionally, measures should be taken to increase employment opportunities and boost the overall economy. Only through coordinated efforts can Pakistan successfully tackle its inflation problem.

200 words Essay On Inflation In Pakistan

Inflation in Pakistan has been a longstanding issue, affecting the economy, businesses, and the general populace. Rising inflation rates have led to a decrease in the purchasing power of the average citizen, making it difficult for them to afford basic necessities. The main factors contributing to inflation in Pakistan include excessive government spending, high import costs, fluctuating exchange rates, and global oil prices.

The government’s response to inflation has been mixed. On one hand, they have implemented measures such as tightening monetary policy, increasing interest rates, and introducing subsidy programs to alleviate the burden on the population. However, these measures have not been able to curb inflation effectively.

Furthermore, corruption and mismanagement in the government have also played a role in exacerbating the inflation crisis. The lack of transparency and accountability in economic policies has led to a situation where the rich get richer while the poor struggle to make ends meet.

In order to combat inflation, Pakistan needs to focus on improving its fiscal policies, reducing corruption, and promoting sustainable economic growth. Additionally, investing in education and skills development can help boost productivity and reduce reliance on imports, thus mitigating inflation pressures in the long run.

250 words Essay On Inflation In Pakistan

Inflation in Pakistan has been a persistent issue that has significantly impacted the economy and the lives of its citizens. Inflation is the rate at which the general level of prices for goods and services is rising, leading to a decrease in the purchasing power of currency. The major factors contributing to inflation in Pakistan include high government debt, devaluation of the Pakistani rupee, increase in global oil prices, and inadequate production of essential goods.

One of the primary causes of inflation in Pakistan is the excessive government borrowing to finance its budget deficit. This increases the money supply in the economy, leading to higher prices. The devaluation of the Pakistani rupee against major currencies such as the US dollar also plays a significant role in driving inflation. Imports become costlier, leading to higher prices of goods and services.

Moreover, the rise in global oil prices has a direct impact on inflation in Pakistan as it is a net importer of oil. This leads to an increase in transportation costs, which are passed on to consumers in the form of higher prices. Additionally, the inadequate production of essential goods such as wheat, sugar, and electricity further exacerbates inflationary pressures.

Inflation in Pakistan has far-reaching consequences, especially for the common man. It erodes the purchasing power of individuals, leading to a decrease in the standard of living. Additionally, high inflation rates make it challenging for businesses to plan and invest, affecting economic growth.

In conclusion, inflation in Pakistan is a complex issue that requires a multi-faceted approach to address. The government needs to implement sound fiscal and monetary policies to control inflation and stabilize prices. Additionally, measures should be taken to enhance domestic production and reduce dependence on imports to mitigate inflationary pressures.

300 words Essay On Inflation In Pakistan

Inflation in Pakistan has been a persistent issue that has affected the economy and the livelihood of its people. Inflation is the rate at which the general level of prices for goods and services is rising, leading to a decrease in the purchasing power of a currency.

There are numerous factors contributing to inflation in Pakistan. One of the major factors is excessive government borrowing and printing of money to finance its budget deficit. This results in an increase in the money supply, which leads to higher prices for goods and services. Additionally, rising global oil prices also play a significant role in driving inflation in Pakistan as the country heavily relies on imported oil to meet its energy needs.

Another key factor contributing to inflation in Pakistan is the depreciation of the Pakistani rupee against major currencies such as the US dollar. A weaker rupee makes imports more expensive, leading to higher prices for goods and services in the domestic market.

The impact of inflation in Pakistan is widespread and severe. It erodes the purchasing power of the people, especially those on fixed incomes or with lower incomes, pushing them further into poverty. Businesses also suffer as higher input costs lead to lower profit margins and reduced competitiveness in the global market.

To combat inflation in Pakistan, the government and the central bank have taken several measures, such as increasing interest rates to curb excess borrowing, tightening monetary policy to control the money supply, and implementing price controls on essential commodities. However, these measures have not been entirely successful in bringing down inflation to manageable levels.

In conclusion, inflation remains a significant challenge for Pakistan, impacting the economy, businesses, and the livelihood of its people. Addressing the root causes of inflation, such as excessive government borrowing and the depreciation of the rupee, will be crucial in tackling this issue effectively and ensuring a stable and prosperous economy for the country.

500 words Essay On Inflation In Pakistan

Inflation is considered to be a common economic problem in many developing countries, including Pakistan. In simple terms, inflation refers to the increase in the prices of goods and services, leading to a decrease in the purchasing power of the currency. In the case of Pakistan, inflation has been a persistent issue that has plagued the economy for decades.

There are several factors that contribute to the high inflation rate in Pakistan. One of the main factors is the increase in the money supply in the economy. The State Bank of Pakistan, the central bank of the country, plays a crucial role in regulating the money supply. However, due to poor monetary policy decisions and political interference, the money supply has often exceeded the level of economic growth, leading to inflation.

Another key factor contributing to inflation in Pakistan is the rise in energy prices. Pakistan heavily relies on imported oil and gas to meet its energy needs, and any increase in international oil prices directly impacts the domestic prices of energy. This, in turn, leads to higher production costs for businesses and ultimately results in higher prices for consumers.

Furthermore, the depreciation of the Pakistani rupee against major international currencies has also played a significant role in the inflationary pressures in the country. A weaker currency makes imports more expensive, which not only affects the prices of imported goods but also contributes to the overall increase in prices across the economy.

In addition to these external factors, domestic issues such as poor governance, corruption, and inefficiencies in the tax system have also fuelled inflation in Pakistan. The lack of effective policies to control price hikes, hoarding, and smuggling further exacerbates the inflationary pressures in the economy.

The impact of inflation in Pakistan has been profound, especially on the lower-income segments of the population. With rising prices of essential commodities such as food, transportation, and healthcare, the cost of living has become increasingly burdensome for the average Pakistani household. This has led to a decrease in the standard of living and an increase in poverty levels in the country.

Moreover, high inflation rates have also dampened investment and economic growth in Pakistan. Businesses are hesitant to invest in an environment of uncertainty and rising costs, which hinders economic development and job creation. Furthermore, high inflation erodes the competitiveness of Pakistani goods in the international market, making exports less attractive and widening the trade deficit.

To address the issue of inflation in Pakistan, a multi-faceted approach is required. The government needs to focus on implementing sound monetary policies that aim to control the money supply and stabilize the currency. Efforts should also be made to diversify the energy mix and reduce reliance on imported fuels to mitigate the impact of international oil price fluctuations.

Furthermore, structural reforms are needed to address governance issues, enhance transparency, and improve the efficiency of the tax system. This would help in curbing corruption, reducing production costs, and ensuring a fair distribution of resources in the economy.

In conclusion, inflation remains a persistent challenge for Pakistan’s economy, with various internal and external factors contributing to its high rates. Addressing inflation requires a comprehensive strategy that involves prudent monetary policies, structural reforms, and good governance practices to stabilize prices, promote economic growth, and improve the standard of living for all Pakistanis.

Final Words

In conclusion, inflation in Pakistan remains a significant challenge that continues to impact the overall economic stability and the lives of the people. The root causes of inflation, such as government borrowing, high oil prices, and supply chain disruptions, need to be addressed through sound economic policies and effective governance. It is crucial for the government to implement measures that can help control inflation, such as fiscal discipline, monetary policy measures, and structural reforms to boost productivity and reduce reliance on imports. Additionally, there is a need for social safety nets to protect the most vulnerable populations from the adverse effects of inflation. With a concerted effort from policymakers, businesses, and society as a whole, inflation in Pakistan can be managed effectively to ensure sustainable economic growth and improve the overall well-being of the people.

Similar Posts

Essay on actions speak louder than words – 100, 150, 200, 250, 300, 500 words.

Actions speak louder than words is a common phrase that emphasizes the importance of taking concrete steps and showing through actions rather than merely speaking about intentions. This concept highlights the idea that what we do reflects our true character and values more than what we say. In a world where words are often used…

Essay On Childhood Vs Adulthood – 100, 150, 200, 250, 300, 500 words

The transition from childhood to adulthood is a pivotal journey that every individual embarks on. It is a phase marked by profound changes, challenges, and growth that shape one’s identity and perspective on life. In this blog post, we will explore the contrasting experiences of childhood and adulthood, delving into the unique qualities and responsibilities…

Essay On Equality – 100, 150, 200, 250, 300, 500 words

In today’s society, the concept of equality stands as a pillar of justice and fairness. The pursuit of equality has been at the forefront of numerous social movements and governmental policies aimed at ensuring that all individuals are given the same opportunities and rights regardless of their background or circumstances. In this collection of essays…

Essay On Why Best Friends Are So Special – 100, 150, 200, 250, 300, 500 words

Best friends are like rare gems – precious, invaluable, and cherished. They hold a unique place in our hearts, providing a source of joy, comfort, and unwavering support. The bond we share with our best friends goes beyond mere friendship; it is a sacred connection that uplifts us, sustains us, and enriches our lives in…

Essay On Amritsar – 100, 150, 200, 250, 300, 500 words

Amritsar, a city in the northwest region of India, holds immense historical and cultural significance. This vibrant city is known for its rich Sikh heritage, iconic landmarks, and tumultuous past. From the serene Golden Temple, the holiest shrine of Sikhism, to the poignant Jallianwala Bagh memorial, which commemorates a tragic event in India’s struggle for…

Essay On National Integration Day – 100, 150, 200, 250, 300, 500 words

National Integration Day is a significant occasion celebrated in India on November 19th every year. The day marks the birth anniversary of former Prime Minister of India, Indira Gandhi, who worked tirelessly towards promoting unity and harmony among the diverse communities of the country. This day is dedicated to promoting the values of unity, peace,…

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

- Privacy Policy

Essay on inflation/Rising prices in Pakistan with quotations

Rising prices / inflation essay 300 - 400 words.

Inflation essay for 2nd year, class 12 PDF download

Inflation is taxation without legislation - Milton Friedman

Inflation is the crabgrass in your savings - Robert Orben

Inflation is the parent of unemployment and the unseen robber of those who have saved - Margret Thatcher

Production is the only answer to inflation - Anonymous

9 comments:

Just better butnit good

Nice Good effort

It's short a little bit but the content is good

Post a Comment

Trending Topics

Latest posts.

- Class 11 Total marks | FA, FSC, ICS, I.com

- Islamiat lazmi complete notes for 10th class pdf download

- 2nd Year English Complete Notes in PDF

- 1st year English complete notes pdf download

- 2nd year all subjects notes PDF Download

- 2nd Year Part II Book II Questions Notes free PDF Download

- ICS all Subjects names list of books

- 10th class all subjects notes PDF download

- My Country Short English Essay

- 2nd year Pakistan studies new book 2022 PDF Download

- FBISE SSC total marks and syllabus 2023

- BISE Hyderabad

- BISE Lahore

- bise rawalpindi

- BISE Sargodha

- career-counseling

- how to pass

- Punjab Board

- Sindh-Board

- Solved mcqs

- Student-Guide

Premium Content

Republic Policy

Constitutional Law

Criminal Law

International Law

Civil Service Law

Recruitment

Appointment

Civil Services Reforms

Legislature

Fundamental Rights

Civil & Political Rights

Economic, Social & Cultural Rights

Focused Rights

Political Philosophy

Political Economy

International Relations

National Politics

- Organization

Abdullah Anwar

Inflation is a critical economic phenomenon that affects the lives of individuals, businesses, and governments worldwide. In Pakistan, inflation has been a persistent challenge, with multifaceted causes and significant consequences for the economy and society. This research paper aims to comprehensively analyze the dynamics of inflation in Pakistan, examining its causes, consequences, and policy implications. Using a combination of quantitative data analysis, literature review, and policy evaluation, this paper provides valuable insights into the factors contributing to inflation in Pakistan and offers policy recommendations to address this complex issue.

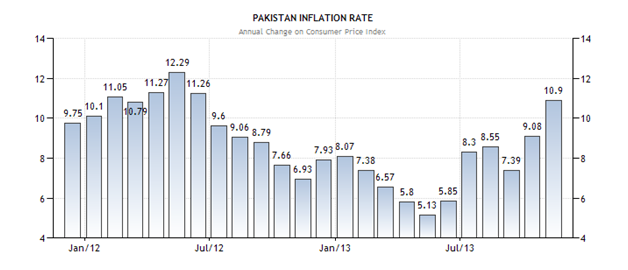

This graph shows how just over a year there has been hyperinflation in Pakistan and it is still increasing.

Inflation, defined as the sustained increase in the general price level of goods and services over time, is a macroeconomic phenomenon that affects economies worldwide. It has far-reaching implications for various economic agents, including households, businesses, and governments. The dynamics of inflation are complex, driven by a multitude of factors, and its consequences can be both positive and negative, depending on the rate and stability of inflation. In Pakistan, it has been a persistent challenge with significant economic and social consequences. The country’s diverse population, reliance on agriculture, and fiscal and monetary issues make understanding inflation crucial. Pakistan has experienced fluctuating inflation rates, influenced by factors such as monetary policies, fiscal deficits, global oil prices, and geopolitical tensions. Inflation’s impact extends beyond economics, affecting income distribution, poverty, access to services, and political stability.

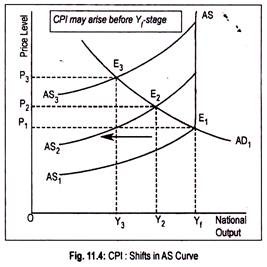

Inflation, as a fundamental concept in economics, represents the sustained increase in the general price level of goods and services over time.Inflation is characterized by rising prices, which means that consumers need more money to purchase the same basket of goods and services over time.As prices rise, the purchasing power of money declines. This means that the same amount of money can buy fewer goods and services. Inflation can be caused by changes in both demand and supply. Demand-pull inflation occurs when demand for goods and services exceeds their supply, leading to price increases. Cost-push inflation, on the other hand, results from rising production costs that are passed on to consumers in the form of higher prices. Economists use various indices to measure inflation, with the Consumer Price Index (CPI) and the Producer Price Index (PPI) being common tools. These indices track the prices of a representative basket of goods and services over time. Inflation can be categorized into different types based on its magnitude and persistence. Mild inflation, often considered beneficial for economic growth, is called “creeping inflation.” When inflation rates become excessively high and volatile, it can lead to “hyperinflation,” which has devastating effects on an economy. Understanding the concept of inflation is essential for policymakers and economists when formulating monetary and fiscal policies.

Theories of inflation are pivotal in explaining the underlying mechanisms and driving forces that lead to changes in price levels within an economy. Demand-Pull Theory tells inflation results from excessive demand outstripping supply. Factors like increased spending or government expenditures can lead to demand-pull inflation.Central banks use tools like interest rates to manage it. Cost-Push Theory explains how inflation arises from higher production costs, like wages or energy. These cost increases get passed on to consumers. It’s driven by supply-side factors and is challenging to control with monetary policy alone. The monetary theory also known as the quantity theory of money states that increasing the money supply, without a corresponding rise in economic output, leads to inflation. Central banks monitor and manage the money supply to control inflation. Expectations theory is what people expect about future prices that can influence current inflation. If people foresee higher prices, they may demand higher wages and prices today, fueling inflation.Phillips Curve suggests an inverse relationship between inflation and unemployment in the short term. Policymakers face trade-offs between the two. However, this trade-off is considered temporary.It is essential to note that inflation is often the result of a complex interplay of multiple factors, and different theories may apply in different economic contexts. In the case of Pakistan, understanding these theories and their applicability can provide insights into the causes of inflation, which can inform effective policy responses to manage and control inflationary pressures.

Inflation is a significant concern for emerging market economies, including Pakistan. Emerging markets are often more vulnerable to external shocks, such as fluctuations in global commodity prices and changes in investor sentiment. These external factors can exert upward pressure on inflation. Exchange rate fluctuations can influence inflation in emerging markets. Depreciation of the domestic currency can lead to higher import costs, contributing to inflationary pressures. Balancing inflation control with economic growth poses challenges for central banks in emerging markets. Inadequate infrastructure, supply chain inefficiencies, and regulatory obstacles can limit production and contribute to inflation. Effective inflation control often requires a blend of fiscal and monetary policies tailored to evolving economic conditions by policymakers in emerging markets. Emerging markets often engage in regional and international cooperation to address common challenges, including inflation. Trade agreements and coordination with global financial institutions can play a role in managing inflation. In Pakistan’s context, understanding the unique challenges and dynamics of inflation as an emerging market economy is crucial for policymakers and economists when formulating strategies to manage and control inflationary pressures.

In Pakistan, inflation has had a significant historical presence, shaped by various factors: over the years, Pakistan has experienced fluctuating inflation rates, influenced by both domestic and global factors. Government policies, including fiscal decisions and monetary strategies, have played a vital role in shaping inflation trends. Global factors, such as changes in oil prices and geopolitical tensions, have also left their mark on inflation in Pakistan. The country’s economic structure, with a substantial reliance on agriculture and various fiscal and monetary challenges, has contributed to the inflation dynamics. Inflation in Pakistan has broad socioeconomic consequences, affecting income distribution, access to basic services, and especially political stability. Hence, understanding this historical perspective is crucial for comprehending the unique drivers of inflation in Pakistan.

In Pakistan there are multiple drivers of inflation, this section dissects the primary causes of inflation in the country, categorizing them into monetary, fiscal, and supply-side factors. Monetary factors are central contributors to inflation in Pakistan: One of the primary determinants of inflation is the expansion of the money supply within an economy. When the money supply grows significantly without a corresponding increase in the production of goods and services, it often leads to inflation. This phenomenon is typically associated with excess liquidity in the financial system, which can result from factors such as loose monetary policy or an influx of foreign remittances. The State Bank of Pakistan, as the nation’s central bank, plays a pivotal role in managing inflation. It employs a set of monetary policy tools to control the money supply and influence inflation. Key among these tools are interest rates and reserve requirements. Adjustments in interest rates, such as raising them to curb lending and borrowing, are used to influence overall demand in the economy. Reserve requirements dictate the amount of funds banks must keep in reserve, impacting their lending capacity and, in turn, the money supply. Lastly, fluctuations in exchange rates can have a notable impact on inflation in Pakistan, this depreciation can lead to higher import costs which further contribute to overall inflationary pressures.

Fiscal policies and government actions also contribute to inflation: The level of government spending, especially when not adequately matched by revenue generation, can be a significant driver of inflation. When the government injects a substantial amount of money into the economy through its expenditures, it increases the overall demand for goods and services. If this heightened demand is not met with a corresponding increase in supply, prices tend to rise. Large budget deficits, indicating a misalignment between government revenues and expenditures, can lead to increased borrowing. This borrowing can expand the money supply, potentially contributing to inflation. Effective management of budget deficits is therefore a critical aspect of controlling inflationary pressures. Supply-side factors are essential components of inflation dynamics too: Pakistan’s economy is particularly susceptible to fluctuations in food prices, which can have a significant impact on overall inflation. Supply disruptions, whether due to natural disasters, inefficient supply chains, or inadequate infrastructure, can result in periodic surges in food prices. Given the importance of food in household budgets, such fluctuations often have cascading effects on the general price level. Energy prices, specifically the cost of fuels and electricity, represent a significant supply-side factor influencing inflation in Pakistan. These prices can have a cascading effect on various sectors of the economy, ultimately contributing to overall inflationary pressures.

Exchange rate dynamics are a critical element influencing inflation in Pakistan. Fluctuations in the exchange rate, especially the depreciation of the domestic currency, can have significant consequences for the overall price level within the country. A depreciation of the domestic currency relative to other currencies can lead to higher import costs. As Pakistan relies on imports for a variety of goods, including energy and essential commodities, increased import costs can contribute to inflation. These higher costs are often passed on to consumers through elevated prices for imported goods. Exchange rate changes affect the balance of trade, potentially improving exports but also raising inflation through costlier imports. Exchange rate movements may trigger policy responses by the central bank. For example, if the currency depreciates rapidly, the central bank might intervene to stabilize the exchange rate. These interventions can have implications for monetary policy and money supply growth, which, in turn, can impact inflation.

Global factors, including changes in international commodity prices, geopolitical events, and global economic conditions, exert significant influence on inflation dynamics in Pakistan. Pakistan, like many countries, is sensitive to fluctuations in global commodity prices, particularly oil. A surge in oil prices can lead to higher costs for energy and transportation, which, in turn, contribute to inflation. Conversely, declining commodity prices can help curb inflationary pressures. The state of the global economy can influence Pakistan’s inflation. A robust global economy can stimulate demand for Pakistani exports, potentially improving the country’s trade balance and reducing inflation. Conversely, a global economic downturn can reduce demand for exports, negatively impacting Pakistan’s trade balance and possibly increasing inflation. Political tensions and conflicts in the region or globally can disrupt supply chains and lead to uncertainties in commodity markets, hence creating inflationary pressures in Pakistan. Pakistan is highly sensitive to fluctuations in global oil prices, as oil is a crucial import. When oil prices rise, it increases energy costs, affecting transportation and production. These increased costs are often passed on to consumers, contributing to inflation. Global food price changes, driven by factors like climate events and global supply and demand dynamics, can impact Pakistan’s food inflation as certain food items that are imported would sell at higher prices.

Now we will explore the far-reaching consequences of inflation in Pakistan. Inflation, when not effectively managed, can have significant economic, social, and political implications, impacting various sectors of society. First and foremost we will talk about the economic consequences: one of the most direct economic consequences of inflation is a decrease in the purchasing power of individuals and households. As prices rise, consumers can afford fewer goods and services with the same amount of money, leading to a decline in their standard of living. Then high or unpredictable inflation rates can introduce economic uncertainty. Businesses may find it challenging to plan for the future, make investments, or set prices, which can hinder economic growth and stability. Furthermore, inflation often leads to higher nominal interest rates. Borrowers face increased borrowing costs, potentially constraining investment and economic expansion. Savers, on the other hand, may see reduced real returns on their savings. Lastly, Persistent high inflation can distort investment decisions. Investors may prioritize assets that offer protection against inflation, such as real estate and commodities, rather than productive investments in the real economy.

This graph evidently shows us the hike in food prices in Pakistan as the price of milk has nearly doubled its original amount which shows us the consequences of the inflation.

Moreover, we will talk about the social consequences of inflation: at first, inflation can exacerbate income inequality. Those with fixed or low incomes, such as pensioners and low-wage workers, may struggle to keep pace with rising prices, while those with assets that appreciate during inflation, like real estate or stocks, may see their wealth increase. Hence, inflation can push more people into poverty, especially if wages do not rise commensurately with rising living costs. Vulnerable populations are often hit the hardest. Most importantly, high inflation can strain public services like education and healthcare, making it more challenging for governments to provide essential services to their citizens.

Ultimately we will see the political consequences due to inflation: the first thing that is most likely to take place is public dissatisfaction which when inflation erodes purchasing power and living standards, can lead to public dissatisfaction and protests. Governments may face increased pressure to address inflationary concerns. Furthermore, managing inflation can be politically challenging. Tough measures to control inflation, such as raising interest rates or reducing government spending, can be unpopular but may be necessary to curb rising prices. Above all, persistent inflation can contribute to macroeconomic instability, affecting the overall economic environment and investor confidence. Understanding these consequences of inflation is crucial for policymakers in Pakistan to implement effective measures that strike a balance between economic growth and price stability. Managing inflation is not only an economic imperative but also a key factor in ensuring social and political stability in the country.

Carrying forward from the last paragraph it is essential to manage inflation and it can be accomplished by effective policy-making as it can manage inflation, maintain economic stability, and enhance the well-being of the population. The most essential policies are the monetary policies for example the State Bank of Pakistan (SBP) should adopt a vigilant monetary policy stance. Utilizing interest rates as a tool to control money supply growth and inflation is imperative. When inflationary pressures emerge, the SBP should consider raising interest rates to reduce borrowing and curb demand, thus mitigating inflation. Effective management of exchange rates is pivotal. The central bank should aim for exchange rate stability to minimize the impact of currency depreciation on imported inflation. Timely intervention in the foreign exchange market may be necessary to achieve this stability.

Fiscal policies are principal as well such as,the government should prioritize addressing budget deficits by focusing on revenue generation and adopting prudent fiscal management practices. Reducing the need for borrowing to finance deficits can help contain money supply growth and, consequently, inflation. Furthermore, while subsidies can serve as a short-term measure to alleviate the impact of rising prices on consumers, they should be targeted, efficiently managed, and periodically reviewed to minimize their fiscal burden. Gradual subsidy reform can help ensure fiscal sustainability. With fiscal policies supply-side policies are important too, for instance, infrastructure investment including transportation and logistics, should be a priority. Improved infrastructure can enhance supply chain efficiency, reduce production costs, and contribute to overall price stability. Additionally, enhancing productivity and resilience in the agriculture sector is essential. Investments in irrigation, technology, and market access can mitigate the impact of food price fluctuations and reduce supply-side shocks on inflation.

This chart transparently shows us chronic deflation in China due to their monetary and fiscal policies.

Next up global economic policies should be taken into consideration for example, Pakistan should diversify its export markets and reduce reliance on specific commodities. Efforts to expand the range of exportable goods and services can reduce vulnerability to global price fluctuations. Moreover, maintaining an adequate level of foreign exchange reserves is crucial. These reserves serve as a buffer against excessive exchange rate volatility and speculative attacks on the currency. Inclusive policies and public awareness are much vital as well, investing in education and healthcare to improve human capital and reduce inflation’s impact on healthcare and education expenses. Developing robust social safety nets to protect vulnerable populations from inflation’s adverse effects, in addition to this, Prioritizing transparency in policies and communicating openly with the public to manage inflation expectations. Lastly, promoting financial literacy to empower individuals to make informed financial decisions amid inflation.

However, the most substantial policy would be international collaboration as it would be the most effective in overcoming inflationary hurdles. Collaborating with neighboring countries and international organizations can help address common inflationary challenges, particularly related to food price fluctuations. Sharing information and best practices can lead to more effective responses. Supremely, engaging in trade agreements and regional economic initiatives can promote economic stability and reduce inflationary pressures. Expanding trade opportunities and diversifying trading partners can enhance resilience to global economic fluctuations. These detailed policy implications and recommendations are designed to guide policymakers in Pakistan as they work to effectively manage inflation and create an environment of economic stability and improved living standards for the population.

In this final section, we provide a summary of the key findings and insights from our analysis of the dynamics of inflation in Pakistan, its causes, consequences, and policy implications. In this final section, we provide a summary of the key findings and insights from our analysis of the dynamics of inflation in Pakistan, its causes, consequences, and policy implications. Monetary policy, including interest rate management and exchange rate stability, plays a critical role in controlling inflation. Fiscal policies that address budget deficits and subsidy reform are equally vital.Supply-side policies, such as infrastructure investment and agricultural sector improvements, can mitigate inflationary pressures. Diversifying exports and maintaining foreign exchange reserves are important in managing external shocks. Inclusive policies, including social safety nets and investments in education and healthcare, are crucial for protecting vulnerable populations from the adverse effects of inflation. Public awareness, transparency, and financial literacy are essential for managing inflation expectations and empowering individuals to make informed financial decisions. International collaboration, both regionally and through trade agreements, can enhance economic stability and reduce inflationary pressures. To effectively manage inflation in Pakistan and ensure economic stability and improved living standards for its citizens, policymakers must adopt a holistic and coordinated approach. This includes prudent monetary and fiscal policies that respond to inflationary pressures, additionally, Supply-side measures that enhance productivity and reduce production costs. Investments in education, healthcare, and social safety nets to protect vulnerable populations is vital too. Transparent communication with the public to manage inflation expectations and above all, active engagement in international collaboration and trade agreements to reduce external vulnerabilities. Nevertheless, continued research and adaptation of policies are essential to address the evolving dynamics of inflation in Pakistan. Monitoring global economic conditions, commodity price trends, and regional developments will be crucial for effective policy-making. This research paper provides a comprehensive analysis of inflation in Pakistan, shedding light on its causes, consequences, and policy implications. By understanding the complex dynamics of inflation, policymakers, economists, and stakeholders can develop effective strategies to mitigate its adverse effects and promote sustainable economic growth and social development in Pakistan.

Please, subscribe to the website of republicpolicy.com

Can Nawaz Sharif be a Messiah of Good Governance in Pakistan?

Leave a Comment Cancel Reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Search the Blog

Preservation of language, script and culture: Explaining Article 8 of the Constitution of Pakistan

The Importance of Public Trust in the Government

Poverty Alleviation and Social Protection System in Pakistan

The Intricate Issue of IPPs in Pakistan

The Vital Importance of Information Literacy Skills in the 21st Century

Pakistan’s Salaried Class Bears Unprecedented Income Tax Burden: A Critical Review

Critical Crossroads for Pakistan’s Textile and Garments Industry: Adaptive Strategies Amidst Challenging Conditions

The Plight of Sports in Pakistan: A Nation’s Decline in International Sporting Arena

The Plight of Household Workers in Society

Nationwide Curfew and Telecommunications Blackout in Bangladesh Amid Violent Anti-Quota Protests

Support our Cause

"Republic Policy Think Tank, a team of dedicated volunteers, is working tirelessly to make Pakistan a thriving republic. We champion reforms, advocate for good governance, and fight for human rights, the rule of law, and a strong federal system. Your contribution, big or small, fuels our fight. Donate today and help us build a brighter future for all."

Qiuck Links

- Op Ed columns

Contact Details

- Editor: +923006650789

- Lahore Office: +923014243788

- E-mail: [email protected]

- Lahore Office: 143-Gull-e-Daman, College Road, Lahore

- Islamabad Office: Zafar qamar and Co. Office No. 7, 1st Floor, Qasim Arcade, Street 124, G-13/4 Mini Market, Adjacent to Masjid Ali Murtaza, Islamabad

- Submission Guidelines

- Terms & Conditions

- Privacy & Policy

Copyright © 2024 Republic Policy

| Developed and managed by Abdcorp.co

Inflation in Pakistan: Causes and Consequences

“inflation in pakistan: causes and consequences”.

Write an Essay on “ What are the Causes and Consequences of Inflation in Pakistan: ” for CSS and PMS Exams.

Inflation in Pakistan: Causes and Consequences Essay

Inflation is a rise in the general price level of goods and services in an economy over a period of time. When prices are rising, the purchasing power of money is falling, and people need more money to buy the same goods and services. Inflation can be caused by a variety of factors, including an increase in the money supply, a decrease in the supply of goods and services, and an increase in production costs.

Pakistan has experienced high levels of inflation in recent years. According to data from the World Bank, the annual inflation rate in Pakistan reached a peak of 13.7% in 2018, and it has remained above 10% for much of the past decade. There are several factors that have contributed to this high level of inflation in Pakistan.

One factor is the country’s high level of government borrowing, which has led to an increase in the money supply. When the government prints more money, it can lead to an increase in prices, as there is more money chasing the same number of goods and services.

Another factor is the country’s high level of food and energy prices, which have driven up the cost of living. For example, Pakistan is heavily dependent on imported oil, and fluctuations in the price of oil can have a significant impact on the country’s inflation rate. In addition, Pakistan has experienced food shortages in recent years due to a variety of factors, including extreme weather events and conflict, which has led to a rise in food prices.

Finally, Pakistan has also experienced high levels of corruption, which can lead to an increase in production costs and a rise in prices. For example, if companies have to pay bribes in order to get licenses or permits, it can increase the cost of doing business and lead to higher prices for consumers.

Inflation can have a variety of negative impacts on an economy and its people. For example, high levels of inflation can lead to a decline in the value of money, making it harder for people to save and invest. In addition, high levels of inflation can lead to a decline in purchasing power, as people need more money to buy the same goods and services. Finally, high levels of inflation can also lead to economic instability, as people may be less likely to make long-term plans or investments if they are concerned about the rising cost of living.

There are several consequences of this high level of inflation in Pakistan, including a decline in the value of money, a decline in purchasing power, economic instability, a decrease in savings, a decrease in real wages, and an increase in poverty.

One consequence of inflation in Pakistan is a decline in the value of money. As prices rise, the purchasing power of money falls, and people need more money to buy the same goods and services. This decline in the value of money can make it harder for people to save and invest, as the money they save today will be worth less in the future. In addition, a decline in the value of money can also lead to a decline in purchasing power, as people need more money to buy the same goods and services. This decline in purchasing power can make it harder for people to meet their basic needs and can lead to an increase in poverty.

Another consequence of inflation in Pakistan is economic instability. High levels of inflation can lead to uncertainty about the future value of money, which can make people less likely to make long-term plans or investments. This can lead to a decline in business confidence and investment, which can hurt the overall economy. In addition, economic instability can also lead to a decrease in savings, as people may be less likely to save money if they are concerned about the declining value of money. This can have negative consequences in the long run, as a low savings rate can make it harder for people to cope with unexpected expenses or to plan for the future.

A decrease in real wages is another consequence of inflation in Pakistan. When wages do not keep up with the rising cost of living, people’s purchasing power declines. This can lead to an increase in income inequality and a decline in the standard of living for many people. In addition, a decrease in real wages can also contribute to an increase in poverty, as people may not be able to afford the rising cost of living. This can lead to an increase in hunger and malnutrition and can have serious negative consequences for people’s health and well-being.

In short, Inflation in Pakistan is a serious problem that has had a variety of negative consequences for the country’s people and economy. Some of the key causes of inflation in Pakistan include an increase in the money supply, high food and energy prices, and corruption. The consequences of this high level of inflation have included a decline in the value of money, a decline in purchasing power, economic instability, a decrease in savings, a decrease in real wages, and an increase in poverty. In order to address these consequences and reduce the level of inflation in Pakistan, it will be important for the government and other stakeholders to implement a range of measures, including controlling the money supply, investing in agriculture and infrastructure, and addressing corruption. By taking these steps, Pakistan can work to reduce inflation and create a more stable and prosperous economy for its people.

This is not the final draft of the essay on the topic “Essay on “Inflation in Pakistan: Causes and Consequences”. It may need further improvement. Don’t copy it without your own research, we are not responsible for any mislead. So, please let us know about your feedback on SeekerGK.com [ [email protected] ] or write in the box below that on which topic you want us to write an essay:)

For MCQs of all competitive exams, visit CSS MCQs

To Download Essay on “Inflation in Pakistan: Causes and Consequences” in PDF Click below

You might also like, essay on world food systems: the economics of agriculture [css 2022], pakistan is a rich country but poor in management, old habits die hard [tehsildar exam 2021], expanding information technology: can be a curse and a blessing [css 2019], china-pakistan economic corridor (cpec): challenges, opportunities and suggestions.

Pakistan and its evergreen friend China (Pak-China Relationship Essay)

Essay on “patriotism” [tehsildar exam kpk 2007], css 2023 solved essay “instruction in youth is like engaging in stone.”, leave a reply cancel reply.

Save my name, email, and website in this browser for the next time I comment.

{{#message}}{{{message}}}{{/message}}{{^message}}Your submission failed. The server responded with {{status_text}} (code {{status_code}}). Please contact the developer of this form processor to improve this message. Learn More {{/message}}

{{#message}}{{{message}}}{{/message}}{{^message}}It appears your submission was successful. Even though the server responded OK, it is possible the submission was not processed. Please contact the developer of this form processor to improve this message. Learn More {{/message}}

Submitting…

Inflation in Pakistan – Its Effects & Drivers | Complete FREE Essay with Outline

Inflation is again high in Pakistan, having risen further to 8.2 per cent.

- What is Inflation?

- Moderate Inflation

- Erosion of Currency

- Moderate Inflation in Pakistan

- Poor Vs. Rich

- Inflation Discourages Investment

- Inflation Erodes Trust in National Currency

- Money Growth

- Global Oil Price Movements

- Domestic Supply Shocks

Inflation is a situation of a sustained increase in the general price level in an economy. In othe words, it means an increase in the cost of living as the price of goods and services rise. Importantly, inflation is a tax that erodes the purchasing power of the currency.

If all inflation is bad and whether it should be zero? The answer is no. Most economists today only consider inflation above high single digits to be bad.

Moderate inflation, in the 3pc to 6pc range is generally considered desirable, and inflation below 3pc can actually be risky. Why? Moderate inflation can serve as a useful signal of demand pressures in normal times, and also lends flexibility to an economy adjusting to adverse shocks: if inflation is near zero, disinflation must involve nominal wage cuts, which are politically difficult.

In Pakistan, this erosion of currency has been significant: by the mid-1970s, the Pakistani rupee had lost half of the purchasing power it had in 1956; and by the early 1990s, it had lost 90pc.

Large as it seems, it is a much less dramatic decline than witnessed by Turkey, Egypt and Morocco. And a comparison starting in 1980, and excluding rich countries, suggests Pakistan has done no worse than its South Asian neighbours.

For much of Pakistan’s history, inflation has been moderate, with two noticeable exceptions: 1972-76 and 2008-14, both of which coincided with record-high international oil prices; and followed/ accompanied public or private spending booms.

Although inflation has picked up in the past few months and is now in the upper single digits, its level is still low by recent historical standards.

Inflation is again high in Pakistan, having risen further to 8.2 per cent in February 2019. Increase in Inflation rates comes with its own costs.

For the poor, a rise in the prices of essential items (if it exceeds income growth) can be a death knell, both literally (for subsistence households), and indirectly, due to the inability to afford needed medical and health spending. It can also force parents to choose between whether their child goes to school or works.

Thus, the poor, who hold much of their assets in cash, bear this tax disproportionately, while the rich can partly evade it by holding assets that are return-bearing (like bonds), increasing in value (like land), or in a stable foreign currency (like the dollar).

By raising uncertainty about the future, inflation discourages investment in projects that raise the economy’s productive capacity. Businesses start focusing on projects with short-term returns, or transactions in foreign currency.

Inflation erodes trust in the national currency as a store of value, it also erodes the associated national pride, and this is felt by all citizens.

Given this, the key policy issues for inflation management are: avoiding the big spikes (that take inflation above the desirable range), and ensuring that the poor are well protected against inflation. On the former, we note that there are several (not one) drivers of inflation:

The first is money growth. For a fixed supply of goods, more money in circulation means higher prices. Monetary loosening can happen due to structural factors like fiscal dominance, where the central bank is forced to print money to finance fiscal deficits; and/ or cyclical surges in capital inflows, and the accompanying credit/ real estate booms.

Fiscal dominance has been a perennial problem in Pakistan, as evinced by the strong co-movement of inflation and State Bank credit to the government over the past 15 years (only Egypt is worse in this regard).

Two things can help fix it: a rise in the tax-to-GDP ratio so that there is a buffer in public finances; and greater de jure and de facto independence for the State Bank (progression on this has been quite uneven).

Capital inflow booms have been rarer but equally impactful, eg the mid-2000s real estate boom financed by Gulf money, which ended badly for the economy. With the government trying to lure investments from China and the Gulf, care would have to be taken to ensure the resource inflow expands the productive capacity of the economy and does not just fuel prices.

The second is factors that affect import prices. As a heavily oil-reliant importer, and with no real foreign exchange or fiscal buffers to limit pass-through to domestic prices, a part of Pakistani inflation is simply determined by global oil price movements.

At one level, a government neither deserves credit for lower inflation when oil prices fall (as they did from 2014-16) nor the blame for higher inflation when they rise (as they sporadically did in 2017-18). However, to be constantly at the mercy of a known exogenous quantity is not pardonable:

Pakistan must make a concerted effort to diversify its energy reliance away from oil and towards hydro, solar, nuclear, clean coal.

Currency depreciation affects inflation similarly, except that they raise the domestic price of all imported goods, not just oil.

Depreciations are needed to fix balance-of-payments problems which can arise due to unsustainable spending booms (as in the aftermath of the mid-2000s, as well as 2014-17); adverse terms of trade shocks (like oil price rises); or weakening global demand for Pakistani goods and services (as occurred during the 2008 global financial crisis).

Governments cannot do much to avoid depreciation when they are needed, but they can make them less dramatic by allowing a more flexible exchange rate regime.

The third is the domestic supply shocks. Floods, droughts, crop pests can all raise the price of domestic goods, and often goods that are essential to the poor. While governments cannot wish these shocks away, it can and must invest in resilience mechanisms, as these are likely to benefit the poor most.

In sum, inflation is a multi-source problem. It has been high, but manageable, in Pakistan. But because it affects the poor disproportionately, the government must continue to take structural measures to keep it low and to compensate the poor via lifeline tariffs and cash transfers for any temporary surges.

By Nadir Cheema

The writer teaches economics at SOAS University of London, and is a senior research fellow at Bloomsbury Pakistan.

@NadirCheema

The essays included here are from numerous sources or authors (sources mentioned in each essay). The most important question is ‘how to write an essay?’ The answer varies from person to person. Yet, the main purpose of Essaypspedia/Tech Urdu is to give you an idea of the essays. It is now up to you, being an aspirant of the competitive examinations, to edit/update/improve/add in it. You can also submit your essays at [email protected]

Top#10 Essays Worth Your Time

- Digital Revolution in Pakistan | Complete Essay with Outline

- The Crises of Urban Housing | Complete Essay with Outline

- Climate Change – A Ticking Bomb | Complete Essay with Outline

- Reading Culture | Complete Essay with Outline

- Population Peril | Complete Essay with Outline

- Regional Risks for Doing Business – The Case of Pakistan | Complete Essay with Outline

- Top#5 Essays on Social/Society Issues Related Matters

- Pollution – Impacts, Types, History and Control | Complete Essay with Outline

- Human Development – The Status of Pakistan | Complete Essay with Outline

- Top #5 Water Scarcity Issues in Pakistan Essays

About The Author

Naeem Javid

Naeem Javid Muhammad Hassani is working as Deputy Conservator of Forests in Balochistan Forest & Wildlife Department (BFWD). He is the CEO of Tech Urdu (techurdu.net) Forestrypedia (forestrypedia.com), All Pak Notifications (allpaknotifications.com), Essayspedia, etc & their YouTube Channels). He is an Environmentalist, Blogger, YouTuber, Developer & Vlogger.

See author's posts

Related Posts

Culture and Cognition – Complete Essay with Outline

Pakistan – from a “Water-Stressed” to a “Water-Scarce” Country | Complete Essay with Outline

Leave a comment cancel reply.

Your email address will not be published. Required fields are marked *

This site uses Akismet to reduce spam. Learn how your comment data is processed .

Essay On How to Control Inflation in Pakistan

by Pakiology | Jul 20, 2024 | Essay | 0 comments

Inflation is a persistent rise in the general price level of goods and services in an economy over a period of time. It has a profound impact on the purchasing power of individuals and affects the overall economy of a country. In Pakistan, inflation has been a persistent problem, and all segments of society have felt its effects. The inflation rate in Pakistan has reached double-digit levels, causing severe economic difficulties for the average person. In this article, we will discuss the causes of inflation in Pakistan and offer practical solutions to control inflation and stabilize the economy.

Page Contents

Understanding the Roots of Inflation in Pakistan

Mitigating the effects of inflation through monetary policy, tackling inflation through fiscal policy, enhancing agricultural productivity to control inflation, empowering the private sector to foster economic growth, conclusion:.

Inflation in Pakistan is a complex issue that has several root causes. Some of the major causes of inflation in Pakistan include:

- Overpopulation and the demand-supply gap

- Shortage of electricity and gas

- Political instability and weak governance

- Currency devaluation and high inflation expectations

- Trade deficit and external shocks

Monetary policy is the primary tool used by the central bank to control inflation in Pakistan. The State Bank of Pakistan (SBP) can use several monetary policy tools to reduce inflation, including:

- Reducing the money supply

- Regulating credit and lending

- Strengthening the exchange rate

Fiscal policy refers to the government’s approach to managing its revenue and expenditure. To control inflation in Pakistan, the government can implement several fiscal policy measures, including:

Reducing government spending Increasing taxes and duties Implementing price controls Encouraging investment and economic growth

Agriculture is a crucial sector in Pakistan, and its growth and productivity are essential for controlling inflation. The government can implement several measures to increase agricultural productivity, including:

- Providing subsidies and incentives to farmers

- Improving irrigation systems and water management

- Encouraging the use of modern technologies and techniques

- Improving market access for farmers

The private sector is the driving force behind economic growth and development. To control inflation in Pakistan, the government can implement several measures to empower the private sector, including:

- Encouraging entrepreneurship and innovation

- Improving the business environment and reducing red tape

- Encouraging foreign investment and trade

- Providing access to finance and support services

How does inflation affect the economy of Pakistan?

Inflation reduces the purchasing power of individuals, leading to a decline in consumer demand and economic growth. It also contributes to rising costs of production, reducing the competitiveness of domestic goods and services in the international market.

What is the role of monetary policy in controlling inflation in Pakistan?

Monetary policy is the primary tool used by the central bank to control inflation in Pakistan. The State Bank of Pakistan can use various monetary policy tools, including increasing interest rates, reducing the money supply, and regulating credit and lending, to control inflation.

What are some of the fiscal policy measures that can be used to control inflation in Pakistan?

To control inflation in Pakistan, the government can implement several fiscal policy measures, including reducing government spending, increasing taxes and duties, implementing price controls, and encouraging investment and economic growth.

How can agriculture play a role in controlling inflation in Pakistan?

Agriculture is a crucial sector in Pakistan and its growth and productivity are essential for controlling inflation. The government can implement several measures, such as providing subsidies and incentives to farmers, improving irrigation systems, and encouraging the use of modern technologies, to increase agricultural productivity and control inflation.

Inflation is a persistent problem in Pakistan, affecting the purchasing power of individuals and the overall economy. The root causes of inflation in Pakistan are complex. Still, they can be addressed through a combination of monetary and fiscal policy measures, as well as enhancing agricultural productivity and empowering the private sector. By implementing these measures, the government can take steps to control inflation, stabilize the economy, and improve the standard of living for all citizens. It’s crucial for policymakers to work together to tackle the inflation epidemic and ensure a bright future for the people of Pakistan.

Find more Essays on the following Topics

Ask Your Questions

You might like, democracy in pakistan essay with quotations.

Explore the evolution, challenges, and progress of democracy in Pakistan in this in-depth essay. Gain insights into...

Problems of Karachi Essay | 200 & 500 Words

Explore the multifaceted challenges faced by Karachi in this comprehensive essay. From overpopulation to traffic...

A True Muslim Essay With Quotations 2023

A true Muslim essay is about the qualities of a true Muslim and how they embody the teachings of Islam in their daily...

Women Empowerment Essay For Students

This women empowerment essay highlights the importance of empowering women for the growth and development of society....

Submit a Comment Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Submit Comment

- class-9-notes

- Friendship quotes

- Scholarships

- Science News

- Study Abroad

- Study in Australia

- SZABMU MDCAT

- UHS Past MCQs

- Universities

Inflation in Pakistan essay

Updated at Oct 02, 2023 | by Admin

What is Inflation:

In economics, inflation is the increase in general prices of goods and services. Inflation in Pakistan has raised up to an alarming level in recent times. Inflation reduces the buying power of the currency because, as the prices of goods and services increase, people will have to spend more money to buy them. Eventually, it reduces the value of the currency as well as the buying power of people. Inflation is measured by the amount of rise in prices of goods and services yearly and is called inflation rate. From 1960 to 2022, the average inflation rate in Pakistan was 8.4% per year. But from May 2022 to May 2023 the inflation rate jumped to 37.97%.

Types of Inflation:

There are three main types of inflation that an economy can face:

- Demand-pull inflation.

- Cost-push inflation.

- Built-in inflation

Deman-pull Inflation:

Demand-pull inflation is a type inflation in which the prices of services and goods increase due to the increase in demand of those goods and services. When people start increasing the demand of a product or service more than a certain level, its supplier start rising its price and the increase in price does not affect its demand because when people are desperate for a product or service, they easily get ready to pay more money for it. This process causes demand-pull inflation.

Example of Demand-pull Inflation:

In Ramadan, the demand of fruits increases as everyone wants to buy fruits for Iftaar. Now, as demand increases, the prices of fruits also increase to an abnormal level but people still buy fruits. This is a perfect example of demand-pull inflation.

Cost-push Inflation:

Cost-push inflation is a type of inflation in which manufacturing cost of a product increases and as a result the price of that product also increases. Now, the question is why manufacturing cost increases? The answer is very simple, cost-push inflation comes in when an economy is already facing demand-pull inflation. Due to demand-pull inflation, the prices of raw materials (required for a product) increases, as a result the price of the final product also increases. The businesses, who manufacture those products, lose their profit if they do not increase the prices of those products.

Example of Cost-push Inflation:

If the prices of chicken and rice start increasing continuously, eventually all the restaurants will have to charge more for chicken-pulao.

Built-in Inflation:

When demand-pull inflation and cost-push inflation occurs, it becomes difficult for salary persons to survive on same salary(they were getting before inflation). They start demanding a rise in their salaries from their employers. Now, if the employers do not increase their salaries, they will lose most of those employees, ending up with a labour shortage. And if the employers increase the salaries, as a result their cost of production also increases. Eventually, businesses will have to increase the prices of their products if they do not want to compromise on their profit levels. This is a situation of built-in inflation.

Which type of Inflation Pakistan is facing:

Right now, Pakistan is facing both demand-pull and cost-push inflation. The prices of commonly used goods and services are continuously going up and the most dangerous thing is, these commodities are not always available in the market as the market faces shortage even on significantly high prices. Even if people are ready to pay more money, they do not always get their desired product. Government of Pakistan should take necessary steps to control or tackle inflation within the state.

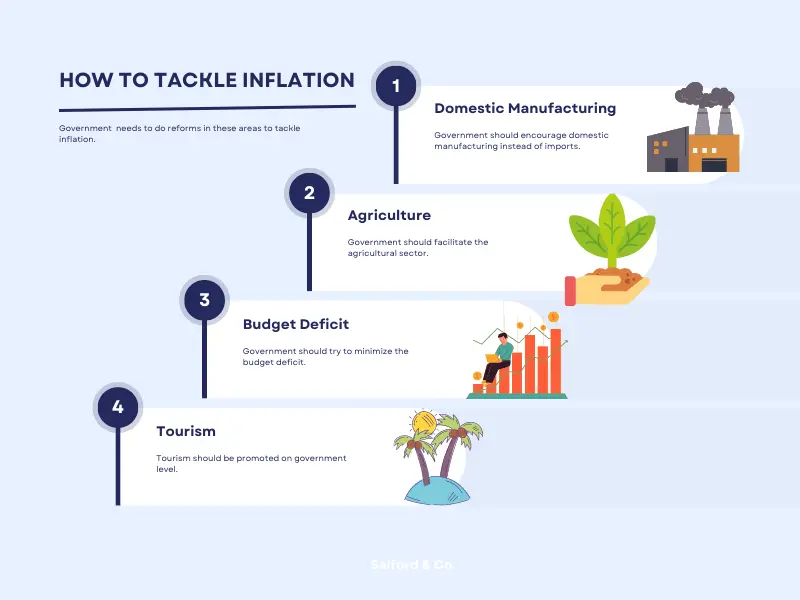

How to Tackle Inflation:

Inflation is perhaps the biggest challenge for an economy and its growth. It is also the most clear hurdle in the way of development of a state. So, it is very important to sensibly tackle inflation. Government of Pakistan can do multiple reforms to tackle inflation within the state, some of them can be, reducing the budget deficit, encouraging domestic production instead of imports, facilitating agriculture sector, attracting foreign investments, tourism should be promoted. Education system should be improved, technology is the future and if we want to secure our future, we have realize the importance of technical education . Government should promote technical education by different initiatives throughout the country to help our youth acquire quality technical education. The government needs to take a lot steps on state level and on lower levels as well but the most important is to set up a strong monitoring system to keep an eye on each and every aspect of the whole process. It will also help to improve the performance in every sector.

Other Essays

Essay On Inflation 📈 (200 & 500 words)

Learning essay on inflation for students is important because it helps them understand the causes and effects of inflation on the economy and society. Inflation is a general increase in prices and a fall in the purchasing value of money.

It affects the cost of living, the standard of living, the interest rates, the exchange rates, the investment decisions, and the government policies. By writing an essay on inflation, students can learn how to analyze data, use evidence, and present arguments in a clear and logical way. Writing an essay on inflation can also improve their communication skills, critical thinking skills, and creativity skills..

Essay On Inflation 200 words

Inflation is a term used to describe the increase in the price of goods and services over a period of time. Various factors, including an increase in the supply of money, a decrease in the supply of goods and services, or an increase in demand for goods and services, can cause inflation. Inflation can significantly impact the economy, as it can reduce the purchasing power of consumers and lead to a decrease in economic growth.

Inflation is measured using various indices, including the Consumer Price Index (CPI) and the Producer Price Index (PPI). The CPI measures the price of goods and services purchased by consumers, while the PPI measures the price of goods and services produced by businesses. Inflation is typically measured on an annual basis, with the rate of inflation representing the percentage increase in prices over the course of a year.

One of the main causes of inflation is an increase in the money supply. When the central bank increases the supply of money, it can lead to an increase in the amount of money in circulation, which can lead to an increase in demand for goods and services. This increase in demand can cause prices to rise, leading to inflation.

Another factor that can cause inflation is a decrease in the supply of goods and services. A shortage of goods and services can lead to an increase in the price of those goods and services. This can occur due to various factors, including natural disasters , supply chain disruptions, and changes in government policies.

Inflation can significantly impact the economy, as it can reduce the purchasing power of consumers. When prices rise, consumers cannot purchase as many goods and services with the same amount of money. This can lead to decreased economic growth, as consumers are less likely to spend money on goods and services.

To combat inflation, central banks can increase interest rates, reducing the amount of money in circulation and decreasing demand for goods and services. Governments can also implement policies to increase the supply of goods and services, such as investing in infrastructure or reducing trade barriers.

In conclusion, inflation is a term used to describe the increase in the price of goods and services over a period of time. Various factors, including an increase in the supply of money, a decrease in the supply of goods and services, or an increase in demand for goods and services, can cause inflation. Inflation can significantly impact the economy, as it can reduce the purchasing power of consumers and lead to a decrease in economic growth. Governments and central banks have various tools to combat inflation, including interest rate increases and policies to increase the supply of goods and services.

Essay On Inflation 500 words

Inflation is a phenomenon that affects every economy around the world. It occurs when the general price level of goods and services rises over a period of time. While inflation is natural, high inflation can be problematic for individuals and businesses. In this essay, we will discuss the causes and effects of inflation and explore possible measures to mitigate its effects.

One of the primary causes of inflation is an increase in the money supply. When the central bank increases the money supply, it increases the amount of money in circulation. This, in turn, increases the demand for goods and services, increasing prices. In addition, when consumers have more money, they are willing to pay more for goods and services, leading to further price increases.

Another cause of inflation is a decrease in the supply of goods and services. This can happen for various reasons, such as natural disasters, supply chain disruptions, and changes in government policies. When there is a shortage of goods and services, prices increase due to the laws of supply and demand. Moreover, when production costs increase, businesses pass on the additional costs to consumers, resulting in higher prices.

The effects of inflation can be far-reaching. One of the significant impacts of inflation is the decrease in the purchasing power of consumers. As prices increase, the same amount can purchase fewer goods and services. This can lead to a decrease in economic growth, as consumers are less likely to spend money on goods and services. Businesses may also be affected, as they may face difficulty in maintaining profit margins due to higher production costs.

To combat inflation, governments, and central banks have several tools at their disposal. One of the most commonly used methods is the increase in interest rates. When interest rates rise, borrowing becomes more expensive, decreasing the amount of money in circulation. This, in turn, reduces the demand for goods and services, which leads to lower prices. Similarly, governments can implement policies to increase the supply of goods and services, such as investing in infrastructure, reducing trade barriers, and encouraging businesses to increase production.

In conclusion, inflation is a natural occurrence in every economy. However, high inflation can be problematic for both individuals and businesses. It can decrease the purchasing power of consumers and lead to a decrease in economic growth.

The primary causes of inflation are the increase in the money supply and the decrease in the supply of goods and services. Governments and central banks have various tools to combat inflation, such as interest rate increases and policies to increase the supply of goods and services. Using these measures, we can mitigate the effects of inflation and promote economic growth.

Related Essays:

- Essay On Consumer Culture

- Essay On Unemployment In Pakistan

- The Impact Of Covid-19 On Education Essay

- Essay On An Accident

- Essay On Democracy

- Essay On My Home

- Essay On My Dreams

- Essay On My Country Pakistan [200 & 500 Words]

- Essay On Women’s Rights

Sana Mursleen is a student studying English Literature at Lahore Garrison University (LGU). With her love for writing and humor, she writes essays for Top Study World. Sana is an avid reader and has a passion for history, politics, and social issues.

Inflation – A result of poor economic policies or a part of global economic woes

- Syed Muhammad Hamza

- July 5, 2023

- Daily Write-Ups , Featured , Opinions

- 39407 Views

The following article is written by Syed Muhammad Hamza , a student of Sir Syed Kazim Ali . Moreover, the article is written on the same pattern, taught by Sir to his students, scoring the highest marks in compulsory subjects for years. Sir Kazim has uploaded his students’ solved past paper questions so other thousands of aspirants can understand how to crack a topic or question, how to write relevantly, what coherence is, and how to include and connect ideas, opinions, and suggestions to score the maximum.

Burgeoning inflation, an increase in the price of commodities over a given period, erodes the stability of a state’s economy. With the unprecedented fluctuation in the inflation rate, a country’s economy becomes a point of hesitation for investors and creditors to invest in the country. Nevertheless, Pakistan has been a victim of inflation, or hyperinflation to some academicians, for the last few years. Inflation has hit the country hard with a list of factors behind it. However, among external and internal factors of inflation, poor economic policies stand out as a valid and certain reason behind the record-making inflation of 38 per cent. Although the global economic woes cannot be ignored in the discussion, many countries across the world have been able to secure themselves from the unpredictable rise of inflation because of effective economic policies. On the other hand, import-oriented economies, oil-dependent countries, and poor fiscal policymaking countries have, for sure, found themselves entrapped in the vicious cycle of inflation. For the same reason, Pakistan’s inflation is much attributed to its poor economic policies. Whereas other global factors, such as the disruption of the global supply chain due to covid, combined with the US–China trade war and the breakdown of the Russia–Ukraine war, have further worsened the situation in the case of Pakistan. Therefore, Pakistan must gauge the intensity of the issue and take pragmatic steps like aligning its fiscal policies according to its priorities, attracting FDI by giving rational subsidies and strengthening the taxation system in the country. At last, it is time for Pakistan to take the short–term and long-term steps to combat rampant inflation.