Uncovering Hidden Risks: A Comprehensive Guide to Business Plan Risk Analysis

A modern business plan that will lead your business on the road to success must have another critical element. That element is a part where you will need to cover possible risks related to your small business. So, you need to focus on managing risk and use risk management processes if you want to succeed as an entrepreneur.

How can you manage risks?

You can always plan and predict future things in a certain way that will happen, but your impact is not always in your hands. There are many external factors when it comes to the business world. They will always influence the realization of your plans. Not only the realization but also the results you will achieve in implementing the specific plan. Because of that, you need to look at these factors through the prism of the risk if you want to implement an appropriate management process while implementing your business plan.

By conducting a thorough risk analysis, you can manage risks by identifying potential threats and uncertainties that could impact your business. From market fluctuations and regulatory changes to competitive pressures and technological disruptions, no risk will go unnoticed. With these insights, you can develop contingency plans and implement risk mitigation strategies to safeguard your business’s interests.

This guide will provide practical tips and real-life examples to illustrate the importance of proper risk analysis. Whether you’re a startup founder preparing a business plan or a seasoned entrepreneur looking to reassess your risk management approach, this guide will equip you with the knowledge and tools to navigate the complex landscape of business risks.

Why is Risk Analysis Important for Business Planning?

Risk analysis is essential to business planning as it allows you to proactively identify and assess potential risks that could impact your business objectives. When you conduct a comprehensive risk analysis, you can gain a deeper understanding of the threats your business may face and can take proactive measures to mitigate them.

One of the key benefits of risk analysis is that it enables you to prioritize risks based on their potential impact and likelihood of occurrence . This helps you allocate resources effectively and develop contingency plans that address the most critical risks.

Additionally, risk analysis allows you to identify opportunities that may arise from certain risks , enabling you to capitalize on them and gain a competitive advantage.

It is important to adopt a systematic approach to effectively analyze risks in your business plan. This involves identifying risks across various market, operational, financial, and legal areas. By considering risks from multiple perspectives, you can develop a holistic understanding of your business’s potential challenges.

What is a Risk for Your Small Business?

In dictionaries, the risk is usually defined as:

The possibility of dangerous or bad consequences becomes true .

When it comes to businesses, entrepreneurs , or in this case, the business planning process, it is possible that some aspects of the business plan will not be implemented as planned. Such a situation could have dangerous or harmful consequences for your small business.

It is simple. If you don’t implement something you have in your business plan, there will be some negative consequences for your small business.

Here is how you can write the business plan in 30 steps .

Types of Risks in Business Planning

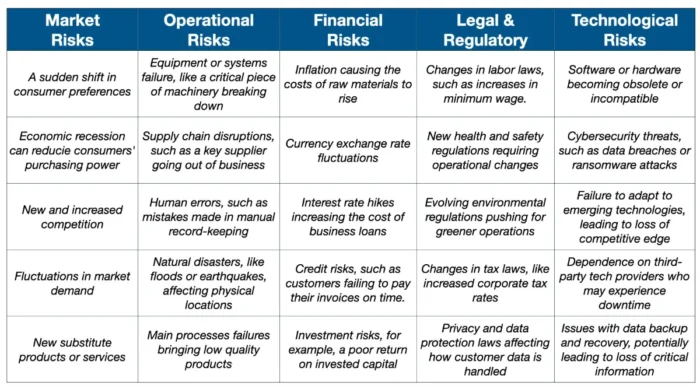

When conducting a business risk assessment for your business plan, it is essential to consider various types of risks that could impact your venture. Here are some common types of risks to be aware of:

1. Market risks

These risks arise from fluctuations in the market, including changes in consumer preferences, economic conditions, and industry trends. Market risks can impact your business’s demand, pricing, and market share.

2. Operational risk

Operational risk is associated with internal processes, systems, and human resources. These risks include equipment failure, supply chain disruptions, employee errors, and regulatory compliance issues.

3. Financial risks

Financial risks pertain to managing financial resources and include factors such as cash flow volatility, debt levels, currency fluctuations, and interest rate changes.

4. Legal and regulatory risks

Legal and regulatory risks arise from changes in laws, regulations, and compliance requirements. Failure to comply with legal and regulatory obligations can result in penalties, lawsuits, and reputational damage.

5. Technological risks

Technological risks arise from rapid technological advancements and the potential disruptions they can cause your business. These risks include cybersecurity threats, data breaches, and outdated technology infrastructure.

Basic Characteristics of Risk

Before you start with the development of your small business risk management process, you will need to know and consider the essential characteristics of the possible risk for your company.

What are the basic characteristics of a possible risk?

The risk for your company is partially unknown.

Your entrepreneurial work will be too easy if it is easy to predict possible risks for your company. The biggest problem is that the risk is partially unknown. Here we are talking about the future, and we want to prepare for that future. So, the risk is partially unknown because it will possibly appear in the future, not now.

The risk to your business will change over time.

Because your businesses operate in a highly dynamic environment, you cannot expect it to be something like the default. You cannot expect the risk to always exist in the same shape, form, or consequence for your company.

You can predict the risk.

It is something that, if we want, we can predict through a systematic process . You can easily predict the risk if you install an appropriate risk management process in your small business.

The risk can and should be managed.

You can always focus your resources on eliminating or reducing risk in the areas expected to appear.

Risk Management Process You Should Implement

The risk management process cannot be seen as static in your company. Instead of that, it must be seen as an interactive process in which information will continuously be updated and analyzed. You and your small business members will act on them, and you will review all risk elements in a specified period.

Adopting a systematic approach to identifying and assessing risks in your business plan is crucial. Here are some steps to consider:

1. Risk Identification

First, you must identify risk areas . Ask and respond to the following questions:

- What are my company’s most significant risks?

- What are the risk types I will need to follow?

In business, identifying risk areas is the process of pinpointing potential threats or hazards that could negatively impact your business’s ability to conduct operations, achieve business objectives, or fulfill strategic goals.

Just as meteorologists use data to predict potential storms and help us prepare, you can use risk identification to foresee possible challenges and create plans to deal with them.

Risk can arise from various sources, such as financial uncertainty, legal liabilities, strategic management errors, accidents, natural disasters, and even pandemic situations. Natural disasters can not be predicted or avoided, but you can prepare if they appear.

For example, a retail business might identify risks like fluctuating market trends, supply chain disruptions, cybersecurity threats, or changes in consumer behavior. As you can see, the main risk areas are related to types of risk: market, financial, operational, legal and regulatory, and technological risks.

You can also use business model elements to start with something concrete:

- Value proposition,

- Customers ,

- Customers relationships ,

- Distribution channels,

- Key resources and

- Key partners.

It is not necessarily that there will be risk in all areas and that the risk will be with the same intensity for all areas. So, based on your business environment, the industry in which your business operates, and the business model, you will need to determine in which of these areas there is a possible risk.

Also, you must stay informed about external factors impacting your business, such as industry trends, economic conditions, and regulatory changes. This will help you identify emerging risks and adapt your risk management strategies accordingly.

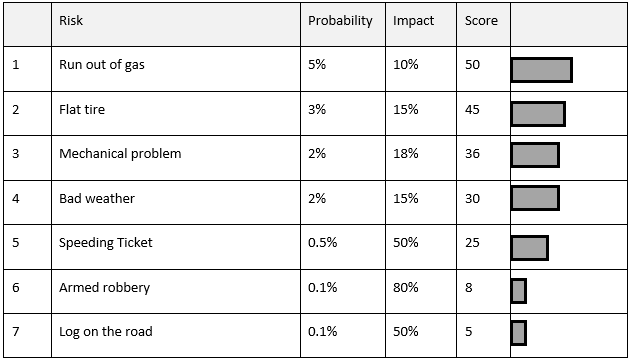

The idea for this step is to create a table where you will have identified potential risks in each important area of your business.

2. Risk Profiling

Conduct a detailed analysis of each identified risk, including its potential impact on your business objectives and the likelihood of occurrence. This will help you develop a comprehensive understanding of the risks you face.

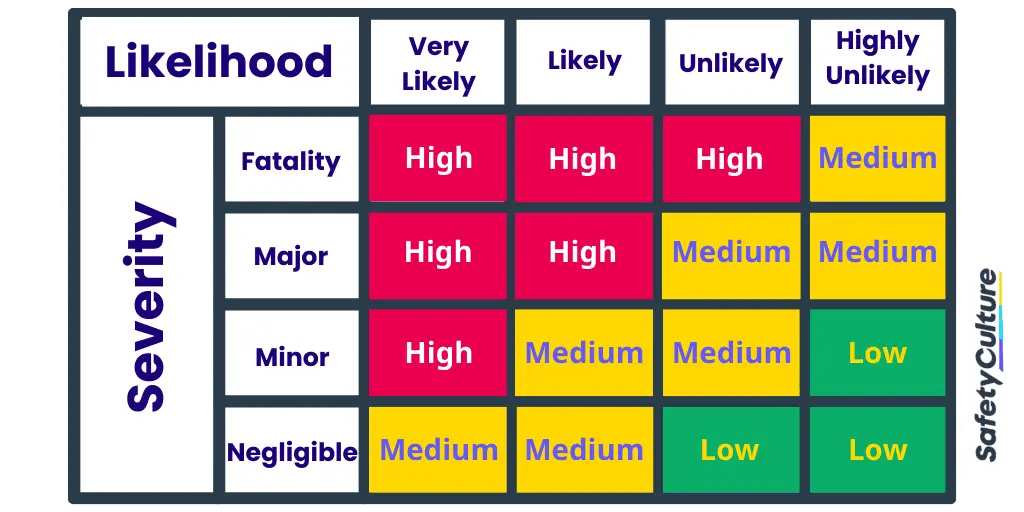

Qualitative Risk Analysis

The qualitative risk analysis process involves assessing and prioritizing risks based on ranking or scoring systems to classify risks into low, medium, or high categories. For this analysis, you can use customer surveys or interviews.

Qualitative risk analysis is quick, straightforward, and doesn’t require specialized statistical knowledge to conduct a business risk assessment. The main negative side is its subjectivity, as it relies heavily on thinking about something or expert judgment.

This method is best suited for initial risk assessments or when there is insufficient quantitative analysis data .

For example, if we consider the previously identified risk of a sudden shift in consumer preferences, a qualitative analysis might rate its likelihood as 7 out of 10 and its impact as 8 out of 10, placing it in the high-priority quadrant of our risk matrix. But, qualitative analysis can also use surveys and interviews where you can ask open questions and use the qualitative research process to make this scaling. This is much better because you want to lower the subjectivism level when doing business risk assessment.

Quantitative Risk Analysis

On the other side, the quantitative risk analysis method involves numerical and statistical techniques to estimate the probability and potential impact of risks. It provides more objective and detailed information about risks.

Quantitative risk analysis can provide specific, data-driven insights, making it easier to make informed decisions and allocate resources effectively. The negative side of this method is that it can be time-consuming, complex, and requires sufficient data.

You can use this approachfor more complex projects or when you need precise data to inform decisions, especially after a qualitative analysis has identified high-priority risks.

For example , for the risk of currency exchange rate fluctuations, a quantitative analysis might involve analyzing historical exchange rate data to calculate the probability of a significant fluctuation and then using your financial data to estimate the potential monetary impact.

Both methods play crucial roles in effectively managing risks. Qualitative risk analysis helps to identify and prioritize risks quickly, while quantitative analysis provides detailed insights for informed decision-making.

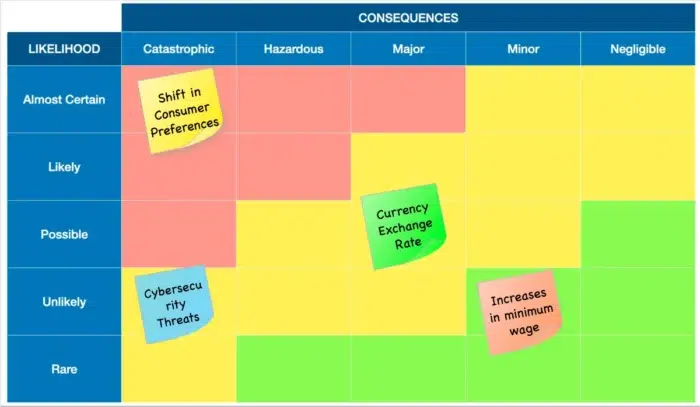

3. Business Risk Assessment Matrix

Once you have identified potential risks and analyzed their likelihood and potential impact, you can create a business risk assessment matrix to evaluate each risk’s likelihood and impact. This matrix will help you prioritize risks and allocate resources accordingly.

A business risk assessment matrix, sometimes called a probability and impact matrix, is a tool you can use to assess and prioritize different types of risks based on their likelihood (probability) and potential damage (impact). Here’s a step-by-step process to create one:

- Step 1: Begin by listing out your risks . For our example, let’s consider four of the risks we identified earlier: a sudden shift in consumer preferences (Market Risk), currency exchange rate fluctuations (Financial Risk), an increase in the minimum wage (Legal), and cybersecurity threats (Technological Risk).

- Step 2: Determine the likelihood of each risk occurring . In the process of risk profiling, we’ve determined that a sudden shift in consumer preferences is highly likely, currency exchange rate fluctuations are moderately likely, an increase in the minimum wage, and cybersecurity threats are less likely but still possible.

- Step 3: Assess the potential impact of each risk on your business if it were to occur . In our example, we might find that a sudden shift in consumer preferences could have a high impact, currency exchange rate fluctuations a moderate impact, an increase in minimum wage minor impact, and cybersecurity threats a high impact.

- Step 4: Plot these risks on your risk matrix . The vertical axis represents the likelihood (high to low), and the horizontal axis represents the consequences (high to low).

By visualizing these risks in a risk assessment matrix format, you can more easily identify which risks require immediate attention and which ones might need long-term strategies.

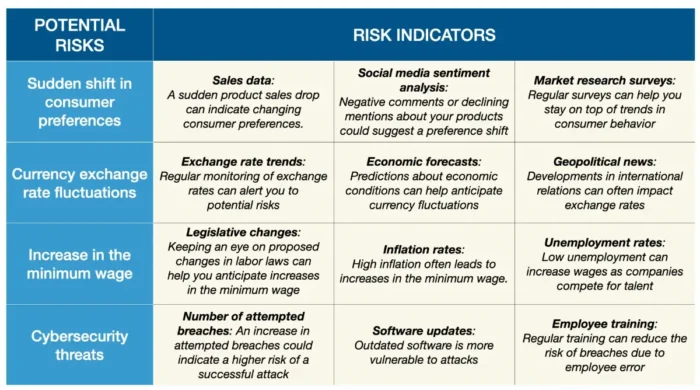

4. Develop Risk Indicators for Each Risk You Have Identified

The question is, how will you measure the business risks for your company?

Risk indicators are metrics used to measure and predict potential threats to your business. Simply, a risk indicator is a measure that should tell you whether the risk appears or not in a particular area you have defined previously. They act like a business’s early warning system. When these indicators change, it’s a signal that the risk level may be increasing.

For example, for distribution channels, an indicator can be a delay in delivery for a minimum of three days. This indicator will tell you something is wrong with that channel, and you must respond appropriately.

Now, let’s consider some risk indicators for the risks we have already identified and analyzed:

If you conduct all the steps until now, you can have a similar table with risk indicators in your business plan. You should monitor these indicators regularly, and if you notice a significant change, such as a drop in sales or an increase in attempted breaches, it’s time to investigate and take some action steps. This might involve updating your product line, hedging against currency risk, budgeting for higher wages, or improving your cybersecurity measures.

Remember, risk indicators can’t predict the future with certainty. But they can give you valuable insights that can help you prepare for potential threats.

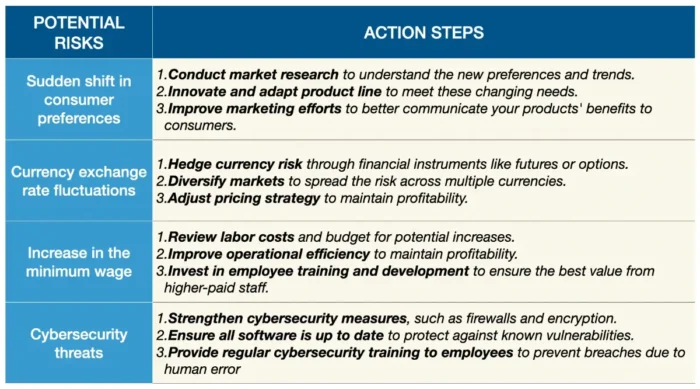

5. Define Possible Action Steps

The question is, what can you do regarding the risk if the risk indicator tells you that there is a potential risk?

Once the risk has appeared and is located, it is time to take concrete action steps. The goals of this step are not only to reduce or eliminate the impact of the risk for your company but also to prevent them in the future and reduce or eliminate their influence on the business operations or the execution of your business plan.

For example, for distribution channels with delivery delayed more than three days, possible activities can be the following:

- Apologizing to the customers for the delay,

- Determining the reasons for the delay,

- Analysis of the reasons,

- Removing the reasons,

- Consideration of alternative distribution channels, etc.

In this part of the business plan for each risk area and indicator, try to standardize all possible actions. You can not expect that they will be final. But, you can cover some basic guidelines that must be implemented if the risk appears. Here is an example of how this part will look in your business plan related to risks we have already identified through the risk assessment process.

6. Monitoring

Because this risk management process is dynamic , you must apply the monitoring process. In such a way, you can ensure the elimination of a specific kind of risk in the future, and you will allocate your resources to new possible risks.

After implementing the actions, you need to ask yourself the following questions:

- Are the actions taken regarding the risk the proper measures?

- Can you improve something regarding the risk management process? Is there a need for new risk indicators?

Techniques and Tools for Business Plan Risk Assessment

Various risk analysis methods, techniques, and tools are available to conduct an effective risk analysis for your business plan. Here are some commonly used ones:

1. SWOT analysis

A SWOT (Strengths, Weaknesses, Opportunities, Threats) analysis can help you identify internal strengths and weaknesses and external opportunities and threats. This analysis provides valuable insights into possible business risks and opportunities.

2. PESTEL analysis

A PESTEL (Political, Economic, Sociocultural, Technological, Environmental, Legal) analysis assesses the external factors that could impact your business. This analysis will help you identify risks and opportunities arising from these factors.

3. Scenario analysis

Consider different scenarios that could impact your business, such as best-case, worst-case, and most likely scenarios, as a part of your risk assessment process. You can anticipate potential risks and develop appropriate response strategies by analyzing these scenarios.

4. Monte Carlo simulation

Monte Carlo simulation uses random sampling and probability distributions to model various scenarios and assess their potential impact on your business. This technique provides you with a more accurate understanding of risk exposure.

5. Risk register

A risk register is a risk analysis tool that helps you record and track identified risks and their relevant details, such as impact, likelihood, mitigation strategies, and responsible parties. This tool ensures that risks are appropriately managed and monitored.

6. Business Impact Analysis (BIA)

Business impact analysis helps you understand the potential effects of various disruptions on your business operations and objectives. It’s about identifying what could go wrong and understanding how it could impact your bottom line. So, you can conduct business impact analysis as a part of your risk assessment inside your business plan.

7. Failure Mode and Effects Analysis (FMEA)

Using FMEA in your risk assessment process, you can proactively address potential problems, ensuring your business operations run as smoothly as you planned. It’s all about preparing for the worst while striving for the best.

8. Risk-Benefit Analysis (RBA)

The risk-benefit analysis allows you to make informed decisions, balancing the potential for gain against the potential for loss. It helps you choose the best path, even when the way forward isn’t entirely clear. This tool is a systematic approach to understanding the specific business risk and benefits associated with a decision, process, or project.

9. Cost-Benefit Analysis

By conducting a cost-benefit analysis as a part of your risk assessments, you can make data-driven decisions that consider both the possible risks (costs) and rewards (benefits). This approach provides a clear picture of the potential return on investment, enabling more effective and confident decision-making.

These techniques and tools allow you to conduct a comprehensive risk analysis for your business plan.

Mitigating and Managing Risks in a Business Plan

Identifying risks in your business plan is only the first step. To ensure the success of your venture, it is crucial to develop effective risk mitigation and management strategies. Here are some critical steps to consider:

- Risk avoidance : Some risks may be too high to justify taking. In such cases, consider avoiding these risks altogether by adjusting your business plan or exploring alternative strategies.

- Risk transfer : Transferring risks to third parties, such as insurance companies or outsourcing partners, can help mitigate their impact on your business. Evaluate opportunities for risk transfer and consider appropriate insurance coverage.

- Risk reduction : Implement measures to reduce the likelihood and impact of identified risks. This may involve improving internal processes, implementing safety protocols, or diversifying your supplier base .

- Risk acceptance : Some risks may be unavoidable or negatively impact your business. In such cases, accepting the risks and developing contingency plans can help minimize their impact.

In conclusion, a comprehensive risk analysis is essential for identifying, assessing, and managing different types of risk that could impact your success.

Conducting a thorough risk analysis can safeguard your business’s interests, capitalize on opportunities, and increase your chances of long-term success.

Related Posts

How to Write a Business Plan in 36 Steps

Risk Tolerance in Entrepreneurship: A Guide to Successful Business

Business Goals Questions to Develop SMART Goals

Risk Management Guide: Everything You Need to Know About Business Risk

Start typing and press enter to search.

- GLOBAL SEARCH

- WEB SUPPORT

13 Entrepreneurs Reveal The Platforms That Are Important For Marketing In the Next 5 Years

18 Entrepreneurs Share Essential Skills One Needs to be a CEO

16 Entrepreneurs Explain What Work Means to Them

25 entrepreneurs share essential skills one needs to be a ceo.

22 Entrepreneurs Share How They Incorporate Health and Fitness into Their Day

8 Entrepreneurs Reveal How Much They Work In a Week

11 Entrepreneurs Reveal Their Why/Motivation

12 Entrepreneurs Share Views on Whether Entrepreneurs are Born or Made

7 Entrepreneurs Share Essential Skills One Needs to be a CEO

- Wordpress 4 CEOs

How to Create a Google Business Profile / Tips to Optimize Google Business Profile

How to Get Your Product Into Walmart- {Infographic}

Make Money using Facebook – Make Great Posts

2 Interesting Updates from WordPress 4.8 Evans

How To Know If Your Business Idea Will Succeed

This is How to Write a Converting Email Autoresponder Series

15 Entrepreneurs Explain What They Love And/Or Hate About WordPress

6 Updates That I’m Paying Attention to with WordPress 4.7 – Vaughan

Download Our Free Guide

29 Entrepreneurs Reveal Their Best Leadership Tips

5 Entrepreneurs Share Their Favorite Business Books

18 Entrepreneurs and Business Owners Reveal Their Best Leadership Tips

30 Entrepreneurs Share Their Thoughts On the Role of Middle Management Within Organizations

7 Entrepreneurs Reveal Their Business Goals for 2024

27 Entrepreneurs List Their Favorite Business Books

14 Entrepreneurs Describe Their Leadership Style

30 Entrepreneurs Define The Term Disruption

25 Entrepreneurs Define Innovation And Disruption

16 Entrepreneurs Define The Term Disruption

- GUEST POSTS

- WEBSITE SUPPORT SERVICES

- FREE CBNation Buzz Newsletter

- Premium CEO Hack Buzz Newsletter

Business Plan 101: Critical Risks and Problems

When starting a business, it is understood that there are risks and problems associated with development. The business plan should contain some assumptions about these factors. If your investors discover some unstated negative factors associated with your company or its product, then this can cause some serious questions about the credibility of your company and question the monetary investment. If you are up front about identifying and discussing the risks that the company is undertaking, then this demonstrates the experience and skill of the management team and increase the credibility that you have with your investors. It is never a good idea to try to hide any information that you have in terms of risks and problems.

Identifying the problems and risks that must be dealt with during the development and growth of the company is expected in the business plan. These risks may include any risk related to the industry, risk related to the company, and risk related to its employees. The company should also take into consideration the market appeal of the company, the timing of the product or development, and how the financing of the initial operations is going to occur. Some things that you may want to discuss in your plan includes: how cutting costs can affect you, any unfavorable industry trends, sales projections that do not meet the target, costs exceeding estimates, and other potential risks and problems. The list should be tailored to your company and product. It is a good idea to include an idea of how you will react to these problems so your investors see that you have a plan.

Related Posts

Business Plan 101: Overall Schedule

Business plan 101: personal financial statement.

This Teach a CEO focuses on Google Business Profile formerly Google My Business. List your business on Google with a...

How can you get your products into Walmart? Many entrepreneurs struggle with the lack of ideas on where exactly they...

As we know that ‘Content is the King’, therefore, you must have an ability to write and share good quality...

WordPress 4.8 is named "Evans" in honor of jazz pianist and composer William John “Bill” Evans. There's not a log of...

Business Plan 101: Financial History

Leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

Privacy Policy Agreement * I agree to the Terms & Conditions and Privacy Policy .

This site uses Akismet to reduce spam. Learn how your comment data is processed .

Join CBNation Buzz

Our Latest CBNation Content:

- IAM2228 – Holistic Dietitian Nutritionist and Founder Passionate About Encouraging Wellness Through Knowledge

- IAM2227 – Certified Personal Trainer Helps Clients Achieve Success in Health and Fitness Through Mindset Change

- IAM2226 – CEO Specializes in Developing Unique Solutions in the Pharmaceutical Industry

- Founder and Author Shares His Insights On Effective Leadership and Embracing Curiosity

- CEO and Founder Discusses the Evolution of Public Relations and the Importance of Storytelling in Business

- Founder and Coach Shares on How to Master Relationship-Building in Business

Our Sponsors

Join thousands of subscribers & be the first to get new freebies.

What is CBNation?

We're like a global business chamber but with content... lots of it.

CBNation includes a library of blogs, podcasts, videos and more helping CEOs, entrepreneurs and business owners level up

CBNation is a community of niche sites for CEOs, entrepreneurs and business owners through blogs, podcasts and video content. Started in much the same way as most small businesses, CBNation captures the essence of entrepreneurship by allowing entrepreneurs and business owners to have a voice.

CBNation curates content and provides news, information, events and even startup business tips for entrepreneurs, startups and business owners to succeed.

+ Mission: Increasing the success rate of CEOs, entrepreneurs and business owners.

+ Vision: The media of choice for CEOs, entrepreneurs and business owners.

+ Philosophy: We love CEOs, entrepreneurs and business owners and everything we do is driven by that. We highlight, capture and support entrepreneurship and start-ups through our niche blog sites.

Our Latest Content:

- IAM2225 – CEO Shares on How to Find Joy and Fulfillment in Leadership

- IAM2224 – CEO and Real Estate Investor Stresses the Importance of Creativity and Multiple Streams of Income

- IAM2223 – Fractional CMO Transforms Businesses with Holistic Marketing Strategies

- IAM2222 – CEO and E-Commerce Expert Utilizes AI Tools for Business Growth and Leadership

Privacy Overview

- Teach A CEO

Share on Mastodon

This free Notion document contains the best 100+ resources you need for building a successful startup, divided in 4 categories: Fundraising, People, Product, and Growth.

This free eBook goes over the 10 slides every startup pitch deck has to include, based on what we learned from analyzing 500+ pitch decks, including those from Airbnb, Uber and Spotify.

This free sheet contains 100 accelerators and incubators you can apply to today, along with information about the industries they generally invest in.

This free sheet contains 100 VC firms, with information about the countries, cities, stages, and industries they invest in, as well as their contact details.

This free sheet contains all the information about the top 100 unicorns, including their valuation, HQ's location, founded year, name of founders, funding amount and number of employees.

12 Types of Business Risks and How to Manage Them

Description

Everything you need to raise funding for your startup, including 3,500+ investors, 7 tools, 18 templates and 3 learning resources.

Information about the countries, cities, stages, and industries they invest in, as well as their contact details.

List of 250 startup investors in the AI and Machine Learning industries, along with their Twitter, LinkedIn, and email addresses.

List of startup investors in the BioTech, Health, and Medicine industries, along with their Twitter, LinkedIn, and email addresses.

List of startup investors in the FinTech industry, along with their Twitter, LinkedIn, and email addresses.

90% of startups fail .

Thanks to the explosion of the digital economy, business founders have plenty of opportunities that they can tap into to build a winning business.

Unfortunately, there is a myriad of challenges your new business has to navigate through. These risks are inevitable, and they are a part of life in the business world.

However, without the right plan, strategy, and instruments, your business might be drowned by these challenges.

Therefore, we have created this guide to show you how can your business utilize risk management to succeed in 2022.

There are many types of startup and business risks that entrepreneurs can expect to encounter in 2022. Most of these threats are prevalent in the infancy stages of a business.

To know what you’ll be up against, here is a breakdown of the 12 most common threats.

12 Business Risks to Plan For

1) economic risks.

Failure to acquire adequate funding for your business can damage the chances of your business succeeding.

Before a new business starts making profits, it needs to be kept afloat with money. Bills will pile up, suppliers will need payments, and your employees will be expecting their salaries.

To avoid running into financial problems sooner or later, you need to acquire enough funds to shore up your business until it can support itself.

On the side, world and business country's economic situation can change either positively or negatively, leading to a boom in purchases and opportunities or to a reduction in sales and growth.

If your business is up and running, a great way to limit the effect of negative economic changes is to maintain steady cash flow and operate under the lean business method.

Here's an article from a founder explaining how he set up a lean budget on his $400k/year online business.

2) Market Risks

Misjudging market demand is one of the primary reasons businesses fail .

To avoid falling into this trap, conduct detailed research to understand whether you will find a ready market for what you want to sell at the price you have set.

Ensure your business has a unique selling point, and make sure what you offer brings value to the buyers.

To know whether your product will suit the market, do a survey, or get opinions from friends and potential customers.

Building a Minimum Viable Product of that business idea you've had is the recommendations made by most entrepreneurs.

This site, for example, was built in just 3 weeks and launched into the market to see if there was any interest in the type of content we offered.

The site was ugly, had little content and lacked many features. Yet, +7,700 users visited it within the first week, which made us realize we should keep working on this.

90% of startups fail. Learn how to not to with our weekly guides and stories. Join 40,000+ founders.

3) Competitive Risks

Competition is a major business killer that you should be wary of.

Before you even start planning, ask yourself whether you are venturing into an oversaturated market.

Are there gaps in the market that you can exploit and make good money?

If you have an idea that can give you an edge, register it. This will prevent others from copying your product, re-innovating it, and locking you out of what you started.

Competitive risks are also those actions made by competitors that prevent a business from earning more revenue or having higher margins.

4) Execution Risks

Having an idea, a business plan, and an eager market isn’t enough to make your startup successful.

Most new companies put a lot of effort into the initial preparation and forget that the execution phase is equally important.

First, test whether you can develop your products within budget and on time. Also, check whether your product will function as intended and whether it’s possible to distribute it without taking losses.

5) Strategic Risks

Business strategies can lead to the growth or decline of a company.

Every strategy involves some risk, as time & resources are generally involved to put them into practice.

Strategic risk in the chance that an implemented strategy, therefore, results in losses.

If, for example, the Marketing Department of a company implements a content marketing strategy and a lot of months, time & money later the business doesn't see any ROI, this becomes a strategic risk.

6) Compliance Risks

Compliance risks are those losses and penalties that a business suffers for not complying with countries' and states' regulations & laws.

There are some industries that are highly-regulated so the compliance risks of businesses within them are super high.

For example, in May 2018, the EU Commission implemented the General Data Protection Regulation (GDPR), a law in privacy and data protection in the EU, which affected millions of websites.

Those websites that weren't adapted to comply with this new rule, were fined.

7) Operational Risks

Operational risks arise when the day-to-day running of a company fail to perform.

When processes fail or are insufficient, businesses lose customers and revenue and their reputation gets ruined.

One example can be customer service processes. Customers are becoming every day less willing to wait for support (not to mention, receive bad quality one).

If a business customer service team fails or delays to solve customer's issues, these might find their solution in the business competitors.

8) Reputational Risks

Reputational risks arise when a business acts in an immoral and discourteous way.

This led to customer complaints and distrust towards the business, which means for the company a big loss of sales and revenue.

With the rise of social networks, reputational risks have become one of the main concerns for businesses.

Virality is super easy among Twitter so a simple unhappy customer can lead to a huge bad press movement for the company.

A recent example is the Away issue with their toxic work environment, as a former employee reported in The Verge .

The issue brought lots of critics within social networks which eventually led the CEO, Steph Korey, to step aside from the startup ( she seems to be back, anyway 🤷♂️! ).

9) Country Risks

When a business invests in a new country, there is a high probability it won't work.

A product that is successful in one market won't necessarily be in another one, especially when people within them are so different in cultures, climates, tastes backgrounds, etc.

Country risk is the existing failure probability businesses investing in new countries have to deal with.

Changes in exchange rates, unstable economic situations and moving politics are three factors that make these country risks be even more delicate.

10) Quality Risks

When a business develops a product or service that fails to meet customers' needs and quality expectations, the chance these customers will ever buy again is low.

In this way, the business loses future sales and revenue. Not to mention that some customers will ask for refunds, increasing business costs, as well as publicly criticize the company's products, leading to bad reputation (and a viral cycle that means even less $$ for the business).

11) Human Risk

Hiring has its benefits but also its risks.

Employees themselves involve a huge risk for a business, as they become to represent the company through how they work, mistakes committed, the public says and interactions with customers & suppliers,

A way to deal with human risk is to train employees and keep a motivated workforce. Yet, the risk will continue to exist.

12) Technology Risk

Security attacks, power outrage, discontinued hardware, and software, among other technology issues, are the events that form part of the technology risk.

These issues can lead to a loss of money, time and data, which has many connections with the previously mentioned risks.

Back-ups, antivirus, control processes, and data breach plans are some of the ways to deal with this risk.

How Businesses Can Use Risk Management To Grow Business

To mitigate any future threats, you need to prepare a comprehensive risk management plan.

This plan should detail the strategy you will use to deal with the specific challenges your business will encounter. Here’s what to do.

1) Identify Risks

Every business encounters a different set of challenges.

Before mapping the risks, analyze your business and note down its key components such as critical resources, important services or products, and top talent.

2) Record Risks

Once risks have been identified, you need to assess and document the threats that can affect each component.

Identify any warning signs or triggers of that recorded risk, also.

3) Anticipate

The best way to beat a threat is to detect and prepare for it in advance.

Once you know your business can be affected by a certain scenario, develop steps that you will take to stop the risk or to blunt its effects.

4) Prioritize Risks

Not all types of business risk have the same effect. Some can bring your startup to its knees, while others will only cause minimal effects.

To keep your business alive, start by putting in place measures that protect the vital functions from the most severe and most probable risks.

5) Have a Backup Plan

For every risk scenario, have at least two plans for countering the threat before it arrives.

The strategy you put in place should be in line with the current technology and trends.

Ensure your communicate these measures with all your team members.

6) Assign Responsibilities

When communicating measures with the team, assign responsibilities for each member in case any of the recorded risks affect the business.

These members should also be responsible for controlling the risks every certain time and maintaining records about them.

What is a Business Risk?

The term "business risk" refers to the exposure businesses have to factors that can prevent them from achieving their set financial goals.

This exposure can come from a variety of situations, but they can be classified into two:

- Internal factors: The risk comes from sources within the company, and they tend to be related to human, technological, physical or operational factors, among others.

- External factors: The risk comes from regulations/changes affecting the whole country/economy.

Any of these factors led to the business being unable to return investors and stakeholders the adequate amounts.

What Is Risk Management?

Risk management is a practice where an entrepreneur looks for potential risks that their business may face, analyzes them, and takes action to counter them.

The steps you take can eliminate the threat, control it, or limit the effects.

A risk is any scenario that harms your business. Risks can emanate from a wide variety of sources such as financial problems, management errors, lawsuits, data loss, cyber-attacks, natural calamities, and theft.

The risk landscape changes constantly, therefore you need to know the latest threats.

By setting up a risk management plan, your business can save money and time, which in some cases can be the determinant to keep your startup in business.

Not to mention, on the side, that risk management plans tend to make managers feel more confident to carry out business decisions, especially the risky ones, which can put their startups in a huge competitive advantage.

Wrapping Up

Becoming your own boss is one of the most rewarding things you can do.

However, launching a business is not a walk in the park; risks and challenges lurk around every corner.

If you are planning to establish a new business come 2022, make sure you secure its future by creating a broad risk management plan.

90% of startups fail. Learn how not to with our weekly guides and stories. Join +40,000 other startup founders!

An all-in-one newsletter for startup founders, ruled by one philosophy: there's more to learn from failures than from successes.

100+ resources you need for building a successful startup, divided into 4 categories: Fundraising, People, Product, and Growth.

- Business Ideas

- Startup Plans

- Advertising

6 Critical Risks in a Business Plan

- by Olaoluwa

- November 8, 2023 August 28, 2024

Business Plan Risks Analysis, Problem, Challenging Factors and Mitigation Strategies

What is a major example of critical risk in a business plan? Every business is prone to facing certain business risks, which might appear very critical in the real world.

As a business person, you must be able to spend sufficient time in drafting your business plan so that it is capable of addressing the critical risks and assumptions that your business might face.

You should be able to envision and determine, in your business plan, critical risks in a restaurant business plan that might pose a threat to the overall success of your business. When you do not pay enough attention to these risks, it could cause your readers – most important of which are potential investors and bankers – to negatively evaluate your business plan.

Below are some critical business risks and contingencies in a business plan that you must ensure to properly handle before they pose a threat to the success of your business.

Conducting Business Plan Risk Assessment – Business Plan Risk Factors

• Risk of Overestimated Figures

The number one critical business risk that might land your business into problem by getting too much negative attention has to do with figures that have been overestimated. We are talking about high sales profit that seem too optimistic; salaries that appear to be too high or outrageous for a business of its age; and profitability. These three, if you overestimate the figures, will inadvertently pose as a serious business risk.

For salaries, it will be wise for you to go for the minimum as a startup business, together with any additional incomes that come in the form of profits.

For sales and profits, it will be wise of you to always give figures that appear to be more likely, not figures that seem to match your optimism. Your business’ profitability largely depends on your ability to meet sales projections, and your ability to be able to operate in the confines of your costs. • Risk of Indecisive Conversion Rates

Conversion rate (also hit rate) has to do with the percentage of people, out of the total number of people you approached, that purchased or patronized your product or services. Conversion rate could be best tested through test marketing or pre-selling.

When you test market, it simply means you offer the sales of your product within a particular limited area, for a particular period of time. Usually, you would offer incentives to buyers to encourage them help you outline your actual target customers for your business.

When you pre-sell, you are making introduction of your products or services to prospective customers, and even accepting orders for deliveries.

Your goal is to accurately know the conversion rate such that a reader may be able to take your projected market size, apply the conversion rate, and be able to deduce what the total sales estimate might be. • Risk of Ignored Competition

Here is another critical business risk that many entrepreneurs fail to curtail. As an entrepreneur, you are the master and captain of your game. You are to take charge and seize your market. How do you do that? You are to know every competitor in the industry of your business. Yes, it is an obligation you can never overlook.

Many entrepreneurs feel they know their competitors very well, when in actually reality, they have no real clue as to who their major competitors are. You must ensure you have adequate knowledge of your immediate competitors, as well as substitutes and potential or latent competitors.

If you want to prove your long-term vision for your business, you must always keep abreast with the latest development regarding your competitors. You should even envision businesses that, in later years, might stand as competitors.

• Financial Risk

Most businesses today fold up as a result of financial difficulties. Lack of adequate financial resources is a very critical business risk that might make a business to close.

In most cases, the business runs out of enough money; many customers are taking too long to pay up; unforeseen expenses and too much miscellaneous; accidents and costly financial mistakes could pose a very critical business risk to the business, and even lead to the eventual folding up if the business does not have enough money saved for rainy days to handle such problems.

In your business plan, you should demonstrate that you have adequate financial strength to operate your business until break-even and even after that. Provide the amount of needed investments and loans you will obtain to start and even run the business successfully – even if you are sure your sales volume will generate as much needed money to run the business.

• Risk of Inadequate Payback

When drafting your business plan, it is pertinent to always think about what the readers of your business plan will be expecting. For most people, it is how you intend to pay back the loan or investment you obtained, or the line of credit you hope to obtain from external sources such as banks.

For bankers, they would analyze the business plan critically to understand how exactly you have made plans to settle up the loans or line of credit you want to obtain from the bank. Your cash flows and your collateral issues are highly significant.

In the case of investors, the growth rates and profit margins of the business are highly critical because these are the factors that will actually determine how much they would earn.

For very vital employees, analyzing the business plan helps them have a good grasp of the business’ operation; this in turn would help them envision their future with the business. • Strategic Risk

Another critical business risk factor to your business plan is the strategic risk. Sometimes, your best well-laid business plan might very quickly, actually look so obsolete.

The strategic risk is the business risk that your business strategy might actually become too rigid and no longer efficient in shooting your business to its desired level; your business then starts struggling in order to achieve its business goals.

This business risk could be as a result of a very powerful new competitor in the industry; technological advancement; a shift in the demand of customers; or even a rise in the cost of raw materials or other market changes.

You should take out time to write your business plan such that whenever you face a strategic risk, you should be able to easily tweak your business strategy and adapt, and be able to come up with a viable solution.

Related Posts

- How To Start Transportation Business

- How To Start Food Business

- How To Start Healthcare Business

- How to Make Money From Business Plan

- How To Start Financial Service Business

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

How to Highlight Risks in Your Business Plan

Tallat Mahmood

5 min. read

Updated October 25, 2023

One of the areas constantly dismissed by business owners in their business plan is an articulation of the risks in the business.

This either suggests you don’t believe there to be any risks in your business (not true), or are intentionally avoiding disclosing them.

Either way, it is not the best start to have with a potential funding partner. In fact, by dismissing the risks in your business, you actually make the job of a lender or investor that much more difficult.

Why a funder needs to understand your business’s risks:

Funding businesses is all about risk and reward.

Whether it’s a lender or an investor, their key concern will be trying to balance the risks inherent in your business, versus the likelihood of a reward, typically increasing business value. An imbalance occurs when entrepreneurs talk extensively about the opportunities inherent in their business, but ignore the risks.

The fact is, all funders understand that risks exist in every business. This is just a fact of running a business. There are risks that exist with your products, customers, suppliers, and your team. From a funder’s perspective, it is important to understand the nature and size of risks that exist.

- There are two main reasons why funders want to understand business risks:

Firstly, they want to understand whether or not the key risks in your business are so fundamental to the investment proposition that it would prevent them from funding you.

Some businesses are not at the right stage to receive external funding and placate funder concerns. These businesses are best off dealing with key risk factors prior to seeking funding.

The second reason why lenders and investors want to understand the risk in your business is so that they can structure a funding package that works best overall, despite the risk.

In my experience, this is an opportunity that many business owners are wasting, as they are not giving funders an opportunity to structure deals suitable for them.

Here’s an example:

Assume your business is seeking equity funding, but has a key management role that needs to be filled. This could be a key business risk for a funder.

Highlighting this risk shows that you are aware of the appointment need, and are putting plans in place to help with this key recruit. An investor may reasonably decide to proceed with funding, but the funding will be released in stages. Some will be released immediately and the remainder will be after the key position has been filled.

The benefit of highlighting your risks is that it demonstrates to investors that you understand the danger the risks pose to your company, and are aware that it needs to be dealt with. This allows for a frank discussion to take place, which is more difficult to do if you don’t acknowledge this as a problem in the first place.

Ultimately, the starting point for most funders is that they want to invest in you, and want to validate their initial interest in you.

Highlighting your business risks will allow the funder to get to the nub of the problem, and give them a better idea of how they may structure their investment in order to make it work for both parties. If they are unsure of the risks or cannot get clear explanations from the team, it is unlikely they will be forthcoming when it comes to finding ways to make a potential deal work.

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

- The right way to address business risks:

The main reason many business owners don’t talk about business risks with potential funders is because they don’t want to highlight the weaknesses in their business.

This is a fair concern to have. However, there is a right way to address business risk with funders, without turning lenders and investors off.

The solution is to focus on how you mitigate the risks.

In other words, what are the steps you are taking in your business as a direct reaction to the risks that you have identified? This is very powerful in easing funder fears, and in positioning you as someone who has a handle on their business.

For example, if a business risk you had identified was a high level of customer concentration, then a suitable mitigation plan would be to market your products or services targeting new clients, as opposed to focusing all efforts on one client.

Having net profit margins that are lower than average for your market would raise eyebrows and be considered a risk. In this instance, you could demonstrate to funders the steps you are putting in place over a period of time to help increase those margins to at least market norms for your niche.

The process of highlighting risks—and, more importantly, outlining key mitigating actions—not only demonstrates honesty, but also a leadership quality in solving the problems in your business. Lenders and investors want to see both traits.

- The impact on your credibility:

Any lender or investor backs the leadership team of a business first, and the business itself second.

This is because they realize that it is you, the management team, who will ultimately deliver value and grow the business for the benefit for all. As such, it is imperative that they have the right impression about you.

The consequence of highlighting business risks in your business plan with mitigations is that it provides funders a real insight into you as a business leader. It demonstrates that not only do you have an understanding of their need to understand risk in your business, but you also appreciate that minimizing that risk is your job.

This will have a massive impact on your credibility as a business owner and management team. This impact is more acute when compared to the hundreds of businesses they will meet that omit discussing the risks in their business.

The fact is, funders have seen enough businesses and business plans in all sectors to instinctively know what risks to expect. It’s just more telling if they hear it from you first.

- What does this mean for you going forward?

Funders rely on you to deliver on your inherent promise to add value to your business for all stakeholders. The weight of this promise becomes much stronger if they can believe in the character of the team, and that comes from your credibility.

A business plan that discusses business risks and mitigations is a much more complete plan, and will increase your chances of securing funding.

Not only that, but highlighting the risks your business faces also has a long-term impact on your character and credibility as a business leader.

Tallat Mahmood is founder of The Smart Business Plan Academy, his flagship online course on building powerful business plans for small and medium-sized businesses to help them grow and raise capital. Tallat has worked for over 10 years as a small and medium-sized business advisor and investor, and in this period has helped dozens of businesses raise hundreds of millions of dollars for growth. He has also worked as an investor and sat on boards of companies.

Table of Contents

- Why a funder needs to understand your business’s risks:

Related Articles

8 Min. Read

How to Forecast Personnel Costs in 3 Steps

5 Min. Read

9 Common Mistakes with Business Financial Projections

How to Improve the Accuracy of Financial Forecasts

11 Min. Read

How to Create a Sales Forecast

The LivePlan Newsletter

Become a smarter, more strategic entrepreneur.

Your first monthly newsetter will be delivered soon..

Unsubscribe anytime. Privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

Strategic Risk Management: Complete Overview (With Examples)

As businesses continue to operate in an increasingly competitive and uncertain environment exacerbated by threats to their operations, such as cyberattacks, supply chain disruptions, and climate catastrophes, strategic risk management has become a key factor in ensuring an organization's success.

According to Racounteur , 85% of business leaders feel they are operating in a moderate to high-risk environment, and 79% of boards believe that improved risk management will be critical in enabling their organization to protect and build value in the next five years.

It's clear that organizations need to be prepared for the different types of strategic risk coming their way and have strong strategic risk management in place to not only reduce the impact on their operations but even take advantage of the context and transform it into an opportunity.

In this article, we'll dive into the world of strategic risk, the different types of strategic risks, and how to manage them to reduce the chances of disruption. We'll also give you real-life examples and a ready-to-use, free Risk Management Template to help your business be in strategic control and start your journey toward effective strategic risk management.

What Is Strategic Risk?

Strategic risk is the probability of the organization’s strategy failing. It is an estimation of the future success of the chosen strategy. Since strategy is a set of clear decisions, strategic risk reflects the aggregate of the risks of those decisions.

At its core, strategic risks affect an organization's overall strategy . It can sometimes be difficult to spot and manage.

This means that particularly at an executive level, leaders and teams need to be able to look for strategic risks and, instead of categorizing them as things to hedge or mitigate, develop the acumen to ask the appropriate questions:

- Are we going to resist this, avoid it, or maybe push it away?

- Or do we embrace it, use it as an indicator for the market and take it as an opportunity for a strategic change?

🤓Want to learn more? Download our FREE Strategic Risk Guide (PDF) with examples, definitions, and a clear framework to help you and your organization better manage strategic risk.

What Is Strategic Risk Management?

Strategic risk management is the process of recognizing risks, identifying their causes and effects, and taking the relevant actions to mitigate them. Risks arise from inside and outside factors such as manufacturing failures, economic changes, shifts in consumer tastes, etc.

Strategic risk can disrupt a business’s ability to accomplish its goals , break out in the market or even survive. Effective, efficient management puts the power in leaders’ hands to avoid potential obstacles to success and maximize their performance.

Why Is Strategic Risk Management Important?

Organizations that fail to do proper risk management face significant threats. At times, they face existential threats. Kodak was a pioneer in the photography space (they actually filed a patent for one of the first digital cameras), but they lost the digital camera race . Blockbuster made $6 billion in revenue at its peak, but there is only one store left in the world ! MySpace was once one of the dominant social networks until Facebook came along .

You could argue that these companies failed to innovate. Maybe, but they also failed to evaluate the threat properly and the risk involved in not dealing with it.

Every great company takes risks.

Smartphones, eReaders, car-sharing services, even natural cleaning products — so much of what we as consumers now take for granted was a brave step, once upon a time. But Apple , Amazon , Zipcar, and Method didn’t launch their category-defining products overnight.

These organizations safeguarded their success with a strong risk management strategy. They knew what success would look like, which factors could cause them to fail, what failure could cost them, and how they would respond to obstacles in their path.

Managing strategic risk is an essential activity for all businesses, whether you’re launching an innovative solution to market or just trying to stay ahead of the competition.

Understanding the dangers (however small) and their potential impact (however minor) empowers leaders at different levels to make smart, well-informed decisions.

But that’s easier said than done. Risk management is a dynamic process - it shifts focus as internal and external influences change. It also requires joined-up thinking and communication across an organization.

If you’re tasked with strategic planning and execution within your business, it can seem like an insurmountable task. Yet, armed with the right information, you can help ensure that your organization achieves its goals.

The Two Kinds Of Strategic Risk Factors

One of the first things you need to do to better manage risks is learn to identify them. There are mainly 2 kinds of strategic risk factors that you should look out for.

1. Internal strategic risk factors

Every business has strategic objectives and established routines.

Strategic risk relates to the dangers companies face in trying to accomplish their strategic objectives. Even though your plan might seem viable and on track for success, analyzing the strategic risks involved can help organizations identify obstacles (or opportunities)—and address them before it’s too late.

Strategic risks relate to a business’s internal choices, such as product development routines, advertising, communication tools, sales processes, investments in cutting-edge technologies, and more. These examples all directly impact function, performance, and overall results.

2. External strategic risk factors

Some strategic risks originate outside the company.

These could apply to the current or projected environment into which products will be released.

It’s often easier to understand strategic risk through real-world examples. For instance, a new type of smartphone might be in high demand today, but economic changes could lead to a drop in commercial interest, leaving the business in a totally different position than it might have expected.

Or a competitor may release a groundbreaking product or innovative service that fills the gap first, creating significant risk to the success of a strategy.

And let’s not forget that technology’s swift evolution could cause a new product to become obsolete within a few months—I’m sure that the manufacturers of wired headphones felt their stomachs drop when they saw Apple had cut the headphone jack.

These types of risks pose a real danger to companies. Investing in a business model with little chance of achieving the envisioned success can lead to severe financial strain, loss of revenue, and damage to reputation.

And none of these are easy to recover from.

Strategic Risk Assessment: How To Identify Strategic Risks?

Recognizing and taking action on strategic risks is vital to mitigate costly problems.

In your strategic risk management toolkit, you’ll need two essentials:

- An in-depth understanding of where your organization stands . This includes your target audience, market sector, competitors, and the environment in which your business operates.

- A clear awareness of your organization’s core strategic goals , from conception to proposed execution .

Gathering data on both areas can take time and investment, but it’s worthwhile to achieve accurate insights into strategic risks.

The more information you have to draw upon, the more likely it is that you’ll be able to implement processes and safeguards that facilitate organizational success.

Teams have a choice of different approaches when identifying strategic risks.

Initiate “What if” discussions

Gather employees from across the business to explore ‘what-if’ scenarios .

By mind mapping risk factors collaboratively —with a mix of perspectives and experiences from different departments—Heads of Strategy, Change Managers, and Business Analysts may discover risks they wouldn’t have thought of on their own.

All potential risks are worth considering, no matter how unlikely they may seem at first. That’s why participants should be encouraged to let their minds wander and suggest virtually any viable risk that occurs to them.

It’s best to have a long list that can be reduced through elimination: underestimating risks can lead to businesses being unprepared down the line.

📚 Recommended reading: Risk Matrix: How To Use It In Strategic Planning

Gather input from all stakeholders

Speak with the whole range of stakeholders and consider their views on strategic risks.

If you consult a wide enough group, you’ll gather expanded perspectives about your organization or issues and not just the ones from your core employees.

Collecting a wide range of perspectives creates a holistic view of risk factors which can prove hugely beneficial when trying to understand the dangers the organization faces.

Their broad awareness of how the company operates can raise unexpected possibilities that need to be factored in.

Strategic Risk Examples

The specific strategic risks relevant to your business will largely depend on your industry, sector, product range, consumer base, and many other factors. That being said, there are some broad types of strategic risk, each of which should be on your radar.

Regulatory risks

Let’s demonstrate the importance of regulatory risks with an example.

Imagine an organization working on a new product or planning a fresh service set to transform the market. Perhaps it spots a gap in the industry and finds a way to fill it, yet needs years to bring it to fruition.

However, in this time, regulations change and the product or service suddenly becomes unacceptable. The company can’t deliver the result of its hard work to the target audience, risking a substantial loss of revenue.

Fortunately, the organization had prepared for unexpected regulatory change. Now, elements of the completed project can be incorporated into another or adapted to offer a slightly different solution.

The lesson here?

It’s vital for companies to stay updated on all regulations relevant to their market and be aware of upcoming changes as early as possible.

Competitor risks

Most industries are fiercely competitive. Companies can lose ground if their market rivals release a similar product at a similar or lower cost. Pricing may even be irrelevant if the product is suitably superior.

Competitor analysis can help mitigate this strategic risk: businesses should never operate in a vacuum.

📚 Recommended read: 6 Competitive Analysis Frameworks: How to Leave Your Competition In the Dust

Economic risks

Economic risks are harder to predict, but they pose a real danger to even the most well-realized strategy. For example, economic changes can lead a business’s target audience to lose much of its disposable income or scale back on perceived luxuries.

Customer research is imperative to stay aware of what target audiences desire, their spending habits, lifestyles, financial situations, and more.

Change risks

Change risks refer to the challenges that arise from changes in technology, market trends, consumer preferences, or industry standards.

For instance, a company heavily invested in a particular technology may face significant risks if a disruptive innovation renders their current technology obsolete. Having a strong change management strategy to adapt to change and embracing innovation are key strategies to mitigate this risk.

Reputational risks

Reputational risks arise when a company's actions or associations damage its brand image and public perception. Negative publicity, customer dissatisfaction, product recalls, or ethical controversies can all contribute to reputational risks.

Safeguarding the company's reputation through transparent communication, ethical practices, and proactive crisis management is crucial.

Governance risks

Governance risks refer to the effectiveness and integrity of a company's management and decision-making processes. Weak corporate governance, lack of oversight, non-compliance with regulations, or unethical behavior by key executives can lead to significant strategic risks.

Establishing robust governance frameworks, maintaining transparency, and fostering a culture of accountability are essential to mitigate these risks.

Political risks

Political risks stem from changes in government policies, regulations, or geopolitical events. These risks can impact businesses operating domestically or internationally. Political instability, trade restrictions, sanctions, or changes in tax policies can disrupt operations and affect profitability.

Companies must closely monitor political developments and have contingency plans to navigate such risks effectively.

Financial risks

Financial risks involve challenges related to capital management, funding, cash flow, and financial stability. Factors such as market volatility, credit risks, liquidity constraints, or inadequate financial planning can expose a company to strategic risks.

Implementing sound financial strategies, conducting risk assessments, and maintaining a healthy balance sheet are crucial in managing these risks effectively.

Operational risks

Operational risks are inherent in day-to-day business activities and processes. These risks encompass issues such as supply chain disruptions, equipment failures, cybersecurity breaches, human errors, or natural disasters.

Ensuring robust operational processes, implementing contingency plans, and investing in risk mitigation measures can help minimize the impact of operational risks.

Managing Strategic Risk Vs. Operational Risk

Strategic risks and operational risks are two distinct kinds. While strategic risks originate from both internal and external forces, operational risks stem solely from the internal processes within a business and they stand to disrupt workflow.

However, the biggest difference between them is the level of the decisions they reflect.

Strategic risks reflect the risk of the decisions at a higher level, where the overall strategic plan is considered. The operational risks reflect the risk of the decisions at a lower level, the operational level, where the execution of the strategic plan is outlined.

Simply put, strategic risk is about what you do, and operational risk is how you do it.

Operational risks examples

Operational risks are critical to consider and must be dealt with as soon as possible. They directly impact a business’s work and can tie in with strategic risks, as the resources, processes, or staff available may be unable to achieve the established goals.

One example of operational risk is outdated machinery. They can cause a slowdown in production, delay completion, and ultimately damage employee morale. In this case, the operational risk might stem from what appears to be a non-critical problem but has the potential to drag productivity down to rock bottom. So the decision of whether to upgrade the machinery should be considered.

Another example of operational risk is a company’s current payroll system. Let’s say they outsource to a small team with a weak reputation purely because it’s a cheaper alternative to working with a more reliable payroll solution . But this option could create a higher risk of late payments, processing errors, or other issues with the potential to frustrate the company’s most valuable asset: its employees.

Risk Mitigation Strategies

Implementing effective risk mitigation strategies is essential for businesses to navigate uncertainties and protect their long-term success. By identifying potential risks and proactively addressing them, companies can minimize the impact of adverse events and capitalize on opportunities for growth.

Discuss opportunities and risks separately

This is something that needs to happen before the risk identification process. Mixing in the same conversation potential opportunities and their risks handicaps the opportunity conversation.

You want your people to free their minds, brainstorm ideas, and locate all possible growth and incremental opportunities. Don’t allow that process to shrink and miss out on great opportunities. Discuss risks in a different meeting on a different day.

Distribute resources at the operational level

Once you have decided on your company’s strategy, you’ll have to align every department and person with it.

Allocate your resources in a way that serves your overall strategy to succeed. That means starving certain departments or regions to feed the ones that contribute the most to your strategic objectives.

Mitigating strategic risks is often nothing more than focusing on a great execution of your strategic plan.

Align your incentive structure

Focus on execution takes another form besides resource redistribution.

You have to visit and align with your strategic objectives the incentive structure of your top and middle management. This is a crucial step in executing your strategy because it eradicates internal conflicts.

If your leadership team is rewarded according to an older strategic plan, don’t expect them to take care of your new plan’s risks. They simply won’t have the incentive to do so.

Strategy Risk Management Examples

Let’s examine two specific real-life examples of strategic risk. One that happened a little while ago, and one that is still happening now.

Complacency vs Disruption

Before Netflix, HBO Go, Amazon Prime, Disney + , and all the other streaming platforms, people used to go to Blockbuster.

In its prime, Blockbuster had over 9,000 locations around the world and became synonymous with movie rental. It had a huge slice of the market share and looked pretty peachy until the late nineties. Until 1997, when a little company called Netflix came knocking.

At the time, Netflix didn't stream. It simply delivered rentals in the mail for a set fee each month. There were no late fees (which was one of the biggest gripes from Blockbuster customers), and movie delivery was very convenient.

Netflix was a pretty obvious strategic risk to Blockbuster, which needed to manage it somehow. This could also be seen as a clear opportunity for Blockbuster since they were in a position to buy Netflix but refused to do so.

Yes, Blockbuster passed on the $50 Million deal with Netflix and sealed its fate in the process.

Regulatory complexity

This story is still in development, so who knows how it will end.

Uber is known as the company that shook the cab industry around the world, but things are still changing. Uber is a tech company and understands that change happens, and risk evolves faster than ever before.

This is why they began investing in self-driving technology early on. At first glance, this seems counter-intuitive since moving in this direction could really upset the thousands of Uber drivers out there, but Uber gets it.

They know that if they do nothing, someone else will sweep in and, soon enough, turn Uber into another Blockbuster story.

Uber is a great example of strategic risk management since they not only have to manage things like implementing self-driving cars, but they have also had to navigate through complex regulatory risks in multiple countries.

They have also faced issues around customer safety, assaults, and constant battles with all kinds of protests and regulatory issues.

How To Measure Strategic Risk

So now you know the strategic risks your organization faces, you need a quantifiable figure to measure them. We suggest the following metrics and tools:

Economic Capital

This relates to the amount of equity a business needs to cover any unplanned losses, according to a standard of solvency (based on the organization’s ideal debt rating).

This metric allows businesses to quantify all types of risks related to launching new products, acquiring enterprises, expanding into different territories, or internal transformation . Then, it can take the necessary actions to mitigate against it.

RAROC: Risk-Adjusted Return On Capital

This applies to the expected after-tax return on a scheme once divided by the economic capital.

Companies can leverage this metric to determine if a strategy is viable and offers value, helping to guide leaders’ decision-making process. Any initiative with a RAROC below the capital amount offers no value and should be scrapped (sorry!).

Decision trees

Businesses on all scales can utilize both metrics to measure strategic risk, but the stakes will be different for a small enterprise than for a global corporation. The former may never recover from a bad investment, while the latter has a higher chance of weathering the storm.