You are using an outdated browser. Please upgrade your browser to improve your experience.

Health & Nursing

Courses and certificates.

- Bachelor's Degrees

- View all Business Bachelor's Degrees

- Business Management – B.S. Business Administration

- Healthcare Administration – B.S.

- Human Resource Management – B.S. Business Administration

- Information Technology Management – B.S. Business Administration

- Marketing – B.S.

- Accounting – B.S. Business Administration

- Finance – B.S.

- Supply Chain and Operations Management – B.S.

- Communications – B.S.

- User Experience Design – B.S.

- Accelerated Information Technology Bachelor's and Master's Degree (from the School of Technology)

- Health Information Management – B.S. (from the Leavitt School of Health)

- View all Business Degrees

Master's Degrees

- View all Business Master's Degrees

- Master of Business Administration (MBA)

- MBA Information Technology Management

- MBA Healthcare Management

- Management and Leadership – M.S.

- Accounting – M.S.

- Marketing – M.S.

- Human Resource Management – M.S.

- Master of Healthcare Administration (from the Leavitt School of Health)

- Data Analytics – M.S. (from the School of Technology)

- Information Technology Management – M.S. (from the School of Technology)

- Education Technology and Instructional Design – M.Ed. (from the School of Education)

Certificates

- Supply Chain

- Accounting Fundamentals

- Digital Marketing and E-Commerce

Bachelor's Preparing For Licensure

- View all Education Bachelor's Degrees

- Elementary Education – B.A.

- Special Education and Elementary Education (Dual Licensure) – B.A.

- Special Education (Mild-to-Moderate) – B.A.

- Mathematics Education (Middle Grades) – B.S.

- Mathematics Education (Secondary)– B.S.

- Science Education (Middle Grades) – B.S.

- Science Education (Secondary Chemistry) – B.S.

- Science Education (Secondary Physics) – B.S.

- Science Education (Secondary Biological Sciences) – B.S.

- Science Education (Secondary Earth Science)– B.S.

- View all Education Degrees

Bachelor of Arts in Education Degrees

- Educational Studies – B.A.

Master of Science in Education Degrees

- View all Education Master's Degrees

- Curriculum and Instruction – M.S.

- Educational Leadership – M.S.

- Education Technology and Instructional Design – M.Ed.

Master's Preparing for Licensure

- Teaching, Elementary Education – M.A.

- Teaching, English Education (Secondary) – M.A.

- Teaching, Mathematics Education (Middle Grades) – M.A.

- Teaching, Mathematics Education (Secondary) – M.A.

- Teaching, Science Education (Secondary) – M.A.

- Teaching, Special Education (K-12) – M.A.

Licensure Information

- State Teaching Licensure Information

Master's Degrees for Teachers

- Mathematics Education (K-6) – M.A.

- Mathematics Education (Middle Grade) – M.A.

- Mathematics Education (Secondary) – M.A.

- English Language Learning (PreK-12) – M.A.

- Endorsement Preparation Program, English Language Learning (PreK-12)

- Science Education (Middle Grades) – M.A.

- Science Education (Secondary Chemistry) – M.A.

- Science Education (Secondary Physics) – M.A.

- Science Education (Secondary Biological Sciences) – M.A.

- Science Education (Secondary Earth Science)– M.A.

- View all Technology Bachelor's Degrees

- Cloud Computing – B.S.

- Computer Science – B.S.

- Cybersecurity and Information Assurance – B.S.

- Data Analytics – B.S.

- Information Technology – B.S.

- Network Engineering and Security – B.S.

- Software Engineering – B.S.

- Accelerated Information Technology Bachelor's and Master's Degree

- Information Technology Management – B.S. Business Administration (from the School of Business)

- User Experience Design – B.S. (from the School of Business)

- View all Technology Master's Degrees

- Cybersecurity and Information Assurance – M.S.

- Data Analytics – M.S.

- Information Technology Management – M.S.

- MBA Information Technology Management (from the School of Business)

- Full Stack Engineering

- Front End Web Developer with CodeSignal

- Java Developer with CodeSignal

- ServiceNow Application Developer

3rd Party Certifications

- IT Certifications Included in WGU Degrees

- View all Technology Degrees

- View all Health & Nursing Bachelor's Degrees

- Nursing (RN-to-BSN online) – B.S.

- Nursing (Prelicensure) – B.S. (Available in select states)

- Health Information Management – B.S.

- Health and Human Services – B.S.

- Psychology – B.S.

- Health Science – B.S.

- Public Health – B.S.

- Healthcare Administration – B.S. (from the School of Business)

- View all Nursing Post-Master's Certificates

- Nursing Education—Post-Master's Certificate

- Nursing Leadership and Management—Post-Master's Certificate

- Family Nurse Practitioner—Post-Master's Certificate

- Psychiatric Mental Health Nurse Practitioner —Post-Master's Certificate

- View all Health & Nursing Degrees

- View all Nursing & Health Master's Degrees

- Nursing – Education (BSN-to-MSN Program) – M.S.

- Nursing – Leadership and Management (BSN-to-MSN Program) – M.S.

- Nursing – Nursing Informatics (BSN-to-MSN Program) – M.S.

- Nursing – Family Nurse Practitioner (BSN-to-MSN Program) – M.S. (Available in select states)

- Nursing – Psychiatric Mental Health Nurse Practitioner (BSN-to-MSN Program) – M.S. (Available in select states)

- Nursing – Education (RN-to-MSN Program) – M.S.

- Nursing – Leadership and Management (RN-to-MSN Program) – M.S.

- Nursing – Nursing Informatics (RN-to-MSN Program) – M.S.

- Master of Healthcare Administration

- Master of Public Health

- MBA Healthcare Management (from the School of Business)

- Business Leadership (with the School of Business)

- Supply Chain (with the School of Business)

- Accounting Fundamentals (with the School of Business)

- Digital Marketing and E-Commerce (with the School of Business)

- Java Developer (with CodeSignal and the School of Technology)

- Front End Web Developer (with CodeSignal and the School of Technology)

- Full Stack Engineering (with the School of Technology)

- ServiceNow Application Developer (with the School of Technology)

- Single Courses

Apply for Admission

Admission requirements.

- New Students

- WGU Returning Graduates

- WGU Readmission

- Enrollment Checklist

- Accessibility

- Accommodation Request

- School of Education Admission Requirements

- School of Business Admission Requirements

- School of Technology Admission Requirements

- Leavitt School of Health Admission Requirements

Additional Requirements

- Computer Requirements

- No Standardized Testing

- Clinical and Student Teaching Information

Transferring

- FAQs about Transferring

- Transfer to WGU

- Transferrable Certifications

- Request WGU Transcripts

- International Transfer Credit

- Tuition and Fees

- Financial Aid

- Scholarships

Other Ways to Pay for School

- Tuition—School of Business

- Tuition—School of Education

- Tuition—School of Technology

- Tuition—Leavitt School of Health

- Your Financial Obligations

- Tuition Comparison

- Applying for Financial Aid

- State Grants

- Consumer Information Guide

- Responsible Borrowing Initiative

- Higher Education Relief Fund

FAFSA Support

- Net Price Calculator

- FAFSA Simplification

- See All Scholarships

- Military Scholarships

- State Scholarships

- Scholarship FAQs

Payment Options

- Payment Plans

- Corporate Reimbursement

- Current Student Hardship Assistance

- Military Tuition Assistance

WGU Experience

- How You'll Learn

- Scheduling/Assessments

- Accreditation

- Student Support/Faculty

- Military Students

- Part-Time Options

- Virtual Military Education Resource Center

- Student Outcomes

- Return on Investment

- Students and Gradutes

- Career Growth

- Student Resources

- Communities

- Testimonials

- Career Guides

- Skills Guides

- Online Degrees

- All Degrees

- Explore Your Options

Admissions & Transfers

- Admissions Overview

Tuition & Financial Aid

Student Success

- Prospective Students

- Current Students

- Military and Veterans

- Commencement

- Careers at WGU

- Advancement & Giving

- Partnering with WGU

Bachelor of Science Business Administration

Online Accounting Degree

An online accounting degree that sets you apart.

Every business relies on accountants to help them meet regulations, achieve financial security, and make money. This accounting degree ensures you will stand out from the competition with your knowledge of GAAP, ledgers, journal entries, and more. A knack for numbers and a passion for financial performance can help you get into a career where you're sure to thrive and make a difference. This online accounting degree empowers you to help organizations meet standards and obey laws, benefiting individuals, companies, and entire communities.

WGU’s Bachelor of Science in Accounting is also the first step toward your CPA certification . Continuing on to earn your Master of Accounting (also known as Master of Accountancy) from an online college for accounting will help you meet the 150 semester hours required to sit for the CPA exam in most states. The CPA license gives you additional experience and credentials, boosting your résumé and qualifying you for elite positions in finance and business. View requirements for CPA licensure by state.

Compare this degree: Also considering the B.S. Finance degree program? This article can help you understand the differences .

62% of graduates finish within

WGU lets you move more quickly through material you already know and advance as soon as you're ready. The result: You may finish faster.

*WGU Internal Data

Tuition per six-month term is

Tuition charged per term—rather than per credit—helps students control the ultimate cost of their business management degree. Finish faster, pay less!

Average salary increase

B.S. business management graduates report an average salary increase of $6,469 after completing their degree at Western Governors University.

Ready to Start Your WGU Journey?

Next Start Date: {{startdate}}

Start Dates the 1st of Every Month

Accounting Courses

Program consists of 41 courses

At WGU, we design our curriculum to be timely, relevant, and practical—all to help you show that you know your stuff.

The WGU B.S. Accounting degree program is an affordable, online way to prepare for a rewarding career in accounting, auditing, or bookkeeping, or as a CPA . Once you earn your accounting degree, you'll be ready to complete your accounting certification. Learn to evaluate and manage business performance and develop the financial skills needed to keep companies running smoothly. You will learn auditing, financial recording, taxes, payroll, financial planning, and other essential accounting principles while preparing for the CPA or other licensing exams.

To ensure WGU graduates acquire the knowledge and skills sought by today’s employers, our online bachelor of science in accounting degree was developed with significant input from experts and business leaders who serve on the Western Governors University Business Program Council .

An unofficial estimated 14 courses are fulfilled by your associate degree leaving 27 courses.

This is an unofficial estimate of your transfer credits. You may receive more or less credits depending upon the specific courses taken to complete your degree and other credits you may have. Below are the anticipated courses that will be fulfilled based on your indication that you have earned an associate’s degree. During the enrollment process this information will be verified.

Applied Probability and Statistics is designed to help students develop competence in the fundamental concepts of basic statistics including: introductory algebra and graphing; descriptive statistics; regression and correlation; and probability. Statistical data and probability are often used in everyday life, science, business, information technology, and educational settings to make informed decisions about the validity of studies and the effect of data on decisions. This course discusses what constitutes sound research design and how to appropriately model phenomena using statistical data. Additionally, the content covers simple probability calculations, based on events that occur in the business and IT industries. No prerequisites are required for this course.

English Composition I introduces candidates to the types of writing and thinking that are valued in college and beyond. Candidates will practice writing in several genres with emphasis placed on writing and revising academic arguments. Instruction and exercises in grammar, mechanics, research documentation, and style are paired with each module so that writers can practice these skills as necessary. Composition I is a foundational course designed to help candidates prepare for success at the college level. There are no prerequisites for English Composition I.

This introductory communication course allows candidates to become familiar with the fundamental communication theories and practices necessary to engage in healthy professional and personal relationships. Candidates will survey human communication on multiple levels and critically apply the theoretical grounding of the course to interpersonal, intercultural, small group, and public presentational contexts. The course also encourages candidates to consider the influence of language, perception, culture, and media on their daily communicative interactions. In addition to theory, candidates will engage in the application of effective communication skills through systematically preparing and delivering an oral presentation. By practicing these fundamental skills in human communication, candidates become more competent communicators as they develop more flexible, useful, and discriminatory communicative practices in a variety of contexts. Note: There are references within this video to Taskstream. If Taskstream is not part of your student experience, please disregard, and locate your task(s) within your course.

Reasoning and Problem Solving helps candidates internalize a systematic process for exploring issues that takes them beyond an unexamined point of view and encourages them to become more self-aware thinkers by applying principles of problem identification and clarification, planning and information gathering, identifying assumptions and values, analyzing and interpreting information and data, reaching well-founded conclusions, and identifying the role of critical thinking in disciplines and professions.

Applied Algebra is designed to help you develop competence in working with functions, the algebra of functions, and using some applied properties of functions. You will start learning about how we can apply different kinds of functions to relevant, real-life examples. From there, the algebra of several families of functions will be explored, including linear, polynomial, exponential, and logistic functions. You will also learn about relevant, applicable mathematical properties of each family of functions, including rate of change, concavity, maximizing/minimizing, and asymptotes. These properties will be used to solve problems related to your major and make sense of everyday living problems. Students should complete Applied Probability and Statistics or its equivalent prior to engaging in Applied Algebra.

This introductory humanities course allows candidates to practice essential writing, communication, and critical thinking skills necessary to engage in civic and professional interactions as mature, informed adults. Whether through studying literature, visual and performing arts, or philosophy, all humanities courses stress the need to form reasoned, analytical, and articulate responses to cultural and creative works. Studying a wide variety of creative works allows candidates to more effectively enter the global community with a broad and enlightened perspective.

English Composition II introduces candidates to the types of research and writing that are valued in college and beyond. Candidates will practice writing, with emphasis placed on research, writing, and revising an academic argument. Instruction and exercises in grammar, mechanics, research documentation, and style are paired with each module so that writers can practice these skills as necessary. Composition II is a foundational course designed to help candidates prepare for success at the college level. Composition I is the prerequisite for Composition II.

This course presents a broad and thematic survey of U.S. history from European colonization to the mid-twentieth century. Students will explore how historical events and major themes in American history have affected a diverse population.

This course provides students with an overview of the basic principles and unifying ideas of the physical sciences: physics, chemistry, and earth sciences. Course materials focus on scientific reasoning and practical, everyday applications of physical science concepts to help students integrate conceptual knowledge with practical skills.

This course teaches students to think like sociologists, or, in other words, to see and understand the hidden rules, or norms, by which people live, and how they free or restrain behavior. Students will learn about socializing institutions, such as schools and families, as well as workplace organizations and governments. Participants will also learn how people deviate from the rules by challenging norms and how such behavior may result in social change, either on a large scale or within small groups.

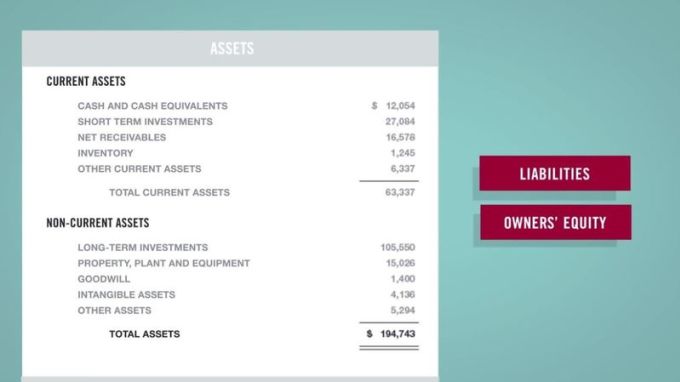

Financial Accounting focuses on ways in which accounting principles are used in business operations. Students learn the basics of financial accounting, including how the accounting cycle is used to record business transactions under generally accepted accounting principles (GAAP). Students will also be introduced to the concepts of assets, liabilities, and equity. This course also presents bank reconciliation methods, balance sheets, and business ethics. Principles of Accounting is a prerequisite for this course.

This course focuses on the taxation of individuals. It provides an overview of income taxes of both individuals and business entities in order to enhance awareness of the complexities and sources of tax law and to measure and analyze the effect of various tax options. The course will introduce taxation of sole proprietorships. Students will learn principles of individual taxation and how to develop effective personal tax strategies for individuals. Students will also be introduced to tax research of complex taxation issues.

Cost and Managerial Accounting focuses on the concepts and procedures needed to identify, collect, and interpret accounting data for management control and decision-making. Topics covered include budgeting, cost-volume-profit analysis, job costing, process costing, activity-based costing, standard costing, and differential analysis. Prerequisites include Principles of Accounting and Financial Accounting.

Business Law for Accountants is designed to provide the advanced accounting student an understanding of the legal environment and issues encountered in the profession. Topics include the Uniform Commercial Code (UCC), contracts, securities regulation, Sarbanes-Oxley Act, legal entities, ethics, agency, and bankruptcy. The prerequisite to this course is Financial Accounting.

Intermediate Accounting I is the first of three in-depth financial accounting courses for accounting majors. The course builds upon topics covered in Principles of Accounting and Financial Accounting. The course focuses on financial accounting and accounting standards; the conceptual framework of the U.S. generally accepted accounting principles (GAAP); the income statement, the statement of cash flows, and the balance sheet; cash and receivables; and inventory valuation. The prerequisite to this course is Financial Accounting.

Intermediate Accounting II is the second of three in-depth financial accounting courses for accounting majors. The course focuses on acquisition and disposition of noncurrent assets; depreciation, impairments, and depletion; intangible assets; current liabilities and contingencies; long-term obligations; stockholders' equity; dilutive securities; and time value of money concepts. The prerequisite to this course is Intermediate Accounting I.

Accounting Information Systems (AIS for short) introduces students to AIS, with particular emphasis on the accountant’s role in management and financial reporting systems. Topics include transaction cycles and related information technology (IT) controls, data management, enterprise resource planning (ERP) and e-commerce systems, systems development and acquisition, documentation, and IT auditing. D103 Intermediate Accounting I and D104 Intermediate Accounting II are the prerequisites to this course.

Intermediate Accounting III provides comprehensive coverage of investments, revenue recognition, accounting for income taxes, pension plans, and leases. This course completes the intermediate accounting journey. The course explores further advanced topics, including accounting changes and error analysis, full disclosure requirements in financial reporting, and interpretation of the statement of cash flows. Intermediate Accounting I and II are the prerequisites for this course.

Auditing covers the entire auditing process. This course will help students gain an understanding of the different assurance services, the AICPA Code of Professional Conduct, and the conceptual framework for members in public practice. The course will teach students how to assess for audit risk, develop an audit strategy, and gain an understanding of the audit client. Audit evidence and a client’s system of internal control will be discussed in depth. The course requires students to assess risk response by identifying and evaluating tests of controls and substantive procedures. In addition, the course will have students evaluate risk response using data analytics and audit sampling for substantive tests. The course concludes with the completion of the audit through subsequent events, engagement wrap-up and management representation, and reporting on the audit with an unqualified audit report or a modification of the audit report. The prerequisites to this course are Intermediate Accounting I, II, and III, Accounting Information Systems, and Business Law for Accountants.

This course provides an introduction to the management of human resources, the function within an organization that focuses on recruitment, management, and direction for the people who work in the organization. Students will be introduced to topics such as strategic workforce planning and employment; compensation and benefits; training and development; employee and labor relations; and occupational health, safety, and security.

This course reviews the legal and regulatory framework surrounding employment, including recruitment, termination, and discrimination law. The course topics include employment-at-will, EEO, ADA, OSHA, and other laws affecting the workplace. This course covers how to analyze current trends and issues in employment law and apply this knowledge to manage risk effectively in the employment relationship.

Compensation and Benefits develops competence in the design and implementation of compensation and benefits systems in an organization. The total rewards perspective integrates tangible rewards (e.g., salary, bonuses) with employee benefits (e.g., health insurance, retirement plan) and intangible rewards (e.g., location, work environment). This perspective allows students to use all forms of rewards fairly and effectively to enable job satisfaction and organizational performance. There are no prerequisites.

Principles of Management provides students with an introductory look at the discipline of management and its context within the business environment. Students of this course build on previously mastered competencies by taking a more in-depth look at management as a discipline and how it differs from leadership while further exploring the importance of communication within business. This course provides students with a business generalist overview in the areas of strategic planning, total quality, entrepreneurship, conflict and change, human resource management, diversity, and organizational structure.

This introductory course provides students with an overview of the field of business and a basic understanding of how management, organizational structure, communication, and leadership styles affect the business environment. It also introduces them to some of the power skills that help make successful business professionals, including time management, problem solving, emotional intelligence and innovation; while also teaching them the importance of ethics. This course gives students an opportunity to begin to explore their own strengths and passions in relation to the field while also acclimating them to the online competency-based environment.

Principles of Financial and Managerial Accounting provides students with an introduction to the discipline of accounting and its context within the business environment. In this course, students will learn to differentiate between financial, cost, and managerial accounting and where these accounting types fit into the business environment. This course will help students gain a fundamental knowledge of the budgeting process, how to analyze basic financial statements, and how to use spreadsheets to analyze data. This course provides students with a business generalist overview of the field of accounting and acts as a preview course for the accounting major.

Information Technology Management Essentials includes topics such as information systems analysis, database resource management, spreadsheet literacy, and computer literacy concepts. This course will help students understand the importance of information technology in an organization and apply databases to solve business problems.

This course provides students with an introductory look at the discipline of finance and its context within the business environment. Students gain the knowledge to differentiate between personal and business finance and how they may overlap in a business environment. Students also gain a fundamental knowledge of financial forecasting and budgeting, statement analysis, and decision making. This course provides the student a business generalist overview of the field of finance and builds on previous acquired competencies related to using spreadsheets.

Concepts in Marketing, Sales, and Customer Contact introduces students to the discipline of marketing and its role within the strategic and operational environments of a business. This course covers fundamental knowledge in the area of marketing planning, including the marketing mix, while also describing basic concepts of brand management, digital marketing, customer relationship management, and personal selling and negotiating. All of this helps students identify the role of marketing within an organization. This course provides students with a business generalist overview of the field of marketing and an exploration of the marketing major.

Principles of Economics provides students with the knowledge they need to be successful managers, including basic economic theories related to markets and how markets function. This course starts by defining economics, differentiating between microeconomics and macroeconomics, and explaining the fundamental economic principles of each. It then looks at microeconomics and how it is used to make business and public policy decisions, including the principles of supply, demand, and elasticity, market efficiency, cost of production, and different market structures. The course finishes by looking at macroeconomics and how it is used to make business and public policy decisions, including measurement of macroeconomic variables, aggregate supply and demand, the concepts of an open economy, and how trade policies influence domestic and international markets.

Business Environment Applications 1 provides students with a generalist overview of the business environment and a deeper look at a number of topics that make up the non-discipline areas of business which are required for a business person to be successful within any business environment. The first part of the course focuses on knowledge about organizations and how people operate within organizations, including the areas of organizational theory, structure, and effectiveness. The course then looks at business from a legal perspective with an overview of the legal environment of business. The course will prepare the student to consider specific legal situations and to make legal and ethical decisions related to those situations.

Business Environment II: Logistics, Process, and Operations provides students with a generalist overview of the business environment as they explore themes of ethics, problem-solving, and innovative thinking. This course adds to the students’ business skills and knowledge in a number of professional areas. The first part of the course uncovers a series of business processes like project and risk management. The second part gives an introductory-level look at the specialized areas of operations management, supply chains, and logistics. The course finishes with models of change management and how to use them to overcome barriers in organizations.

Managing in a Global Business Environment provides students with a generalist overview of business from a global perspective, while also developing basic skills and knowledge to help them make strategic decisions, communicate, and develop personal relationships in a global environment. Business today is by its very nature a global environment, and individuals working in business will experience the global nature of business as they progress through their careers. This course builds on previously acquired competencies by providing an overview of U.S. federal laws in relation to doing business in a global environment.

This course covers an important part of being a business professional: the knowledge and skills used in building and implementing business strategy. The course helps students build on previously acquired competencies in the areas of management, innovative thinking, and risk management while introducing them to the concepts and theories underpinning business strategy as a general business perspective. The course will help students gain skills in analyzing different business environments and in using quantitative literacy and data analysis in business strategy development and implementation. This course helps to provide students with a generalist overview of the area of business strategy.

Emotional and Cultural Intelligence focuses on key personal awareness skills that businesses request when hiring personnel. Key among those abilities is communication. Students will increase their skills in written, verbal, and nonverbal communication skills. The course then looks at three areas of personal awareness including emotional intelligence (EI), cultural awareness, and ethical self-awareness – building on previously acquired competencies and adding new ones. This course helps start students on a road of self-discovery, cultivating awareness to improve both as a business professional and personally.

This course ties together all the skills and knowledge covered in the business courses and allows the student to prove their mastery of the competencies by applying them in a simulated business environment. This course will help take the student's knowledge and skills from the theoretical to applicable.

Values-Based Leadership guides students to learn by reflection, design, and scenario planning. Through a combination of theory, reflection, value alignment, and practice, the course helps students examine and understand values-based leadership and explore foundations in creating a culture of care. In this course, students are given the opportunity to identify and define their personal values through an assessment and reflection process. Students then evaluate business cases to practice mapping the influence of values on their own leadership. In this course, students also participate in scenario planning, where they can practice implementing their values in their daily routine (i.e., behaviors) and then in a leadership setting. The course illustrates how values-driven leadership is used in goal setting as well as problem-solving at an organizational level. There are no prerequisites for this course.

Operations and Supply Chain Management provides a streamlined introduction to how organizations efficiently produce goods and services, determine supply chain management strategies, and measure performance. Emphasis is placed on integrative topics essential for managers in all disciplines, such as supply chain management, product development, and capacity planning. This course guides students in analyzing processes, managing quality for both services and products, and measuring performance while creating value along the supply chain in a global environment. Topics include forecasting, product and service design, process design and location analysis, capacity planning, management of quality and quality control, inventory management, scheduling, supply chain management, and performance measurement.

Organizational Behavior and Leadership explores how to lead and manage effectively in diverse business environments. Students are asked to demonstrate the ability to apply organizational leadership theories and management strategies in a series of scenario-based problems.

Business Ethics is designed to enable students to identify the ethical and socially responsible courses of action available through the exploration of various scenarios in business. Students will also learn to develop appropriate ethics guidelines for a business. This course has no prerequisites.

Quantitative Analysis for Business explores various decision-making models, including expected value models, linear programming models, and inventory models. This course helps student learn to analyze data by using a variety of analytic tools and techniques to make better business decisions. In addition, it covers developing project schedules using the Critical Path Method. Other topics include calculating and evaluating formulas, measures of uncertainty, crash costs, and visual representation of decision-making models using electronic spreadsheets and graphs. This course has no prerequisites.

The Introduction to Spreadsheets course will help students become proficient in using spreadsheets to analyze business problems. Students will demonstrate competency in spreadsheet development and analysis for business applications (e.g., using essential spreadsheet functions, formulas, tables, charts, etc.). Introduction to Spreadsheets has no prerequisites.

Program consists of 41 courses

Accounting Success

Join Our Growing Alumni

The WGU undergraduate accounting program was founded in 2002 and has over 7,400 graduates.

Skills For Your Résumé

As part of this program, you will develop a range of valuable skills that employers are looking for.

- Accounting: Meticulously recorded day-to-day financial transactions, ensuring precision and completeness, and skillfully reconciled discrepancies to deliver accurate and timely financial statements.

- Finance: Successfully identified and utilized appropriate financial tools and techniques to inform critical financial decisions.

- Financial Statements: Expertly analyzed financial statements, utilizing prior year sales and industry standard return data, to evaluate the company's performance and debt ratio, contributing to informed decision-making and financial stability.

- Communications: Articulated ideas, opinions, and information with precision and relevance, tailored to suit the needs of specific target audiences, leading to enhanced communication and understanding.

- Detail Oriented: Demonstrated proficiency in manipulating complex financial data with meticulous accuracy, ensuring error-free financial analysis and reporting.

- Research: Conducted thorough research analysis, gathering relevant data and extracting valuable insights.

“I got this job because I was a graduate with my bachelor's in accounting from WGU. My new degree got me my new job.”

—Raymond Baker B.S. Accounting

WGU vs. Traditional Universities Compare the Difference

Traditional Universities

TUITION STRUCTURE

Per credit hour

Flat rate per 6-month term

Schedule and wait days or even weeks to meet with one of many counselors

Simply email or call to connect with your designated Program Mentor who supports you from day one

Scheduled time

Whenever you feel ready

Professor led lectures at a certain time and place

Courses available anytime, from anywhere

TIME TO FINISH

Approximately 4 years, minimal acceleration options

As quickly as you can master the material, typically less than 3 years

TRANSFER CREDITS

Few accepted, based on certain schools and specific courses

A generous transfer policy that is based on your specific situation

Earning Potential

A degree can dramatically impact your earning potential. After graduation WGU accounting students report earning $15,053* more per year.

Entirely Online

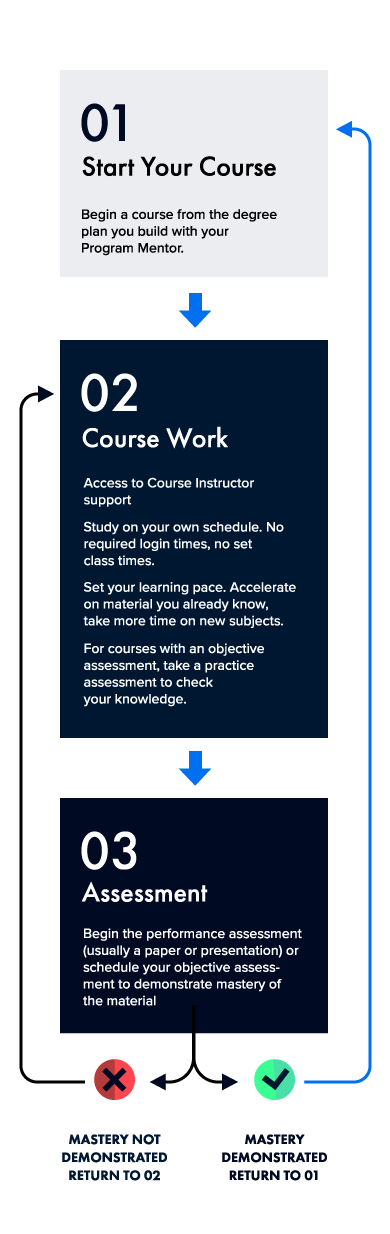

Competency-based education means you can move as quickly through your degree as you can master the material. You don't have to log in to classes at a certain time—you are truly in the driver's seat of your education.

Ready For Your Next Step

Graduates of this program are ready to progress toward a MAcc program, CPA examination , or a specific job. WGU's accounting bachelor's program is a crucial step in eligibility to sit for the accounting certification exam, and prepares you for success in the field.

Accredited, Respected, Recognized™

One important measure of a degree’s value is the reputation of the university where it was earned. When employers, industry leaders, and academic experts hold your alma mater in high esteem, you reap the benefits of that respect. WGU is a pioneer in reinventing higher education for the 21st century, and our quality has been recognized.

COST & TIME

How Much Does it Cost to Get an Accounting Degree Online?

By charging per term rather than per credit—and empowering students to accelerate through material they know well or learn quickly—WGU helps students control the ultimate cost of their degrees. The faster you complete your program, the less you pay for your degree.

Need help paying for college? Be sure to check with the AICPA and your state CPA society for scholarship opportunities! Both are a great resource for students and can provide a pathway to industry professionals. In addition to scholarship opportunities, many state societies also offer free student memberships and networking events.

An Accounting Degree Within Reach

There is help available to make paying for school possible for you:

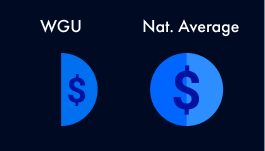

The average student loan debt of WGU graduates in 2022 (among those who borrowed) was less than half* the national average.

Most WGU students qualify for financial aid, and WGU is approved for federal financial aid and U.S. veterans benefits.

Many scholarship opportunities are available. Find out what you might be eligible for. You can also learn more about the CMA scholarship nomination process here .

* WGU undergraduate students have approximately half the debt at graduation compared to the national average, according to the Institute for College Access and Success (2022).

FLEXIBLE SCHEDULE

A Different Way to Learn: Degree Programs Designed to Fit Your Life—and All the Demands on Your Time

Professional responsibilities. Family obligations. Personal commitments. At WGU, we understand schedules are tight and often unpredictable for adult students. That’s why we offer a flexible, personalized approach to how education should be. No rigid class schedules. Just a solid, career-focused teaching program that meshes with your current lifestyle. You'll be challenged. You'll work hard. But if you commit yourself and put in the hours needed, WGU makes it possible for you to earn a highly respected degree as a busy working adult.

“Now that I'm doing full-cycle accounting, I understand the scope. I understand where you start and where you're supposed to wind up. It just makes a lot more sense. Earning my degree has really helped me fill in the blanks and take my job satisfaction to a higher level because I actually understand why I'm doing what I'm doing now.”

—Kate Leger B.S. Accounting

CAREER OUTLOOK

Your Accounting Degree Can Be One of Your Greatest Assets

Taxes. Audits. Payroll. Financial planning. Businesses need professionals who can help manage their finances and help everything run smoothly with budgets and taxes. This online degree from WGU prepares you for a lucrative and successful career as an accountant in whatever field or specialty you're passionate about. You can also be prepared to sit for the accounting certification exam and become a certified public accountant.

As long as there is money, there will be a need for qualified accountants. When you have completed your B.S. Accounting degree, your skills will be in high demand because every business, no matter the size or industry, has to balance its books and comply with government regulations.

Return on Your Investment

On average, wgu graduates see an increase in income post-graduation.

Average income increase from all degrees in annual salary vs. pre-enrollment salary. Source: 2023 Harris Poll Survey of 1,655 WGU graduates.

Survey was sent to a representative sample of WGU graduates from all colleges. Respondents received at least one WGU degree since 2017.

Employment of accountants and auditors is projected to grow 6% through 2033 . The median salary for an accountant and auditor is almost $80,000 per year.

—U.S. Bureau of Labor Statistics

WGU Accounting Grads Are Thriving in Rewarding Careers

Our 2,600-plus B.S. Accounting alumni have great jobs and satisfying careers:

- Accounting manager

- Financial director

- Vice president of finance and operations

- Chief financial officer

- Forensic accountant

Diverse Industries

- Business and corporations

- Tax preparation

- U.S. military

- Colleges and universities

Major Employers

- State of Nevada

- U.S. Department of Veteran Affairs

- Jackson Hewitt Tax Services

- Northrop Grumman

WGU Grads Hold Positions With Top Employers

ADMISSIONS & TRANSFERS

Admission Requirements - Accounting

Applicants to undergraduate School of Business programs must possess a high school diploma or its equivalent AND demonstrate program readiness through one of the following options below:

- Option 1 : Submit all transcripts documenting completion of college-level coursework with a cumulative GPA of 2.0 or higher.

- Option 2: Possess a bachelors or associate degree (A.A or A.S. acceptable) from an accredited post-secondary institution.

- Option 3: Submit high school transcripts for review with a cumulative GPA of 2.0 or higher.

NOTE: You do not need to take the ACT or SAT to be admitted to this program. Learn why we don't require these tests .

Get Your Enrollment Checklist

Download your step-by-step guide to enrollment.

Get Your Questions Answered

Talk to an WGU Enrollment Counselor.

Transfer Credits

Get added support and flexibility as you start your degree take a course or two at your pace before committing to a full degree program. strengthen your study habits, gain essential learning skills and, best of all, each completed course counts toward your degree requirements. .

Learn More about Pathways to Starting

MORE DETAILS

WGU Certificates in Accounting

Each of WGU’s Bachelor’s in Business degree programs begin with the same 4 terms of core classes, covering business basics and including valuable certificates. For the accounting degree, you'll earn the accounting, strategic thinking and innovation, and leadership certificates. After finishing these core courses, you move forward to courses in your chosen major of Accounting, Business Management, Healthcare Management, Human Resource Management, Marketing, or IT Management.

FAQs about Accounting Programs

- General Accounting Program Questions

- Online Accounting Program Questions

What can I do with a degree in accounting?

A degree in accounting qualifies you to work in a number of positions related to accounting and finance. The positions you qualify for depend on your level of education. With a bachelor’s degree, you may be most qualified for entry-level positions as a bookkeeper, accounts payable specialist, or assistant payroll administrator. With a master’s degree in accounting and as a certified public accountant, you may find you’re more qualified for leadership positions and senior-level roles. These include accounting manager, auditor, investment banker, and chief financial officer.

How long does it take to complete an online accounting degree?

In general, it takes about four years or 120 credits to complete an online accounting degree. However, with a competency-based education model, like what is offered at WGU, students can graduate more quickly by passing assessments using their existing skills and knowledge.

Can you get a bachelor's degree in accounting online?

Yes! There are many online programs that offer accredited bachelor's degree programs for students to pursue. These online bachelor's degree programs can be a great option for students who are working full-time so they can continue to pursue their online education while still earning money.

What can I do with a bachelor's in accounting?

With a bachelor’s degree in accounting, you may be able to secure a job in a number of different accounting-related areas. While Certified Public Accountants often work more in management and senior-level positions, with a bachelor’s degree in accounting you may be qualified for some of the following entry-level positions:

- Payroll specialist

- Tax accountant

- Financial analyst

How much does it cost to get an accounting degree online?

The cost of your online accounting degree will vary based on the school you choose—different schools will have different tuition and fee amounts. WGU is one of the most affordable options for an online accounting degree, with tuition costing just $3,755 per six-month term. Tuition is charged per term, not per credit, so you can take as many courses as you're able during your six-month term. That means graduating faster will cost less!

Can you earn an accounting degree online?

Yes! There are many online degree programs that offer accounting degrees online. Do your research to learn which kind of online university is the best fit for you. For example, WGU offers entirely online degrees and no set class times—you do your coursework on your schedule. This helps you take control of your education and earn an online accounting degree on your timeline.

What's the best online college for accounting?

There are many online colleges that offer accounting degree programs, so it's important to do your research to find the best fit for you. Look at tuition costs, accreditation, educational models, and coursework to figure out which program is best. WGU is highly reputable, accredited, and affordable. Our online accounting degree program has helped thousands of students pursue an accounting career and find success.

Is an online accounting degree worth anything?

An online accounting degree is extremely valuable if you want to become an accountant. For most accounting positions you will need at least a bachelor's degree. This will help you learn about fundamental accounting principles, rules, regulations, financial statements, and more. And if you want to become a CPA you'll absolutely need at least a bachelor's degree, if not a master's degree.

Does an online accounting degree meet certification requirements?

In order to sit for the CPA exam you'll need to have an accredited bachelor's degree, and in many states also a master's degree in accounting. An online bachelor's degree program will be a crucial first step in preparing for CPA certification. When researching an online accounting degree, you'll need to ensure that your online degree is from an accredited institution.

Is an online accounting degree right for me?

An online accounting degree can be a fantastic choice if you are currently working full-time and want to maintain your job while furthering your education. An online accounting degree also allows you to get valuable credentials that boost your résumé, preparing you to move forward in your career. An online accounting degree can be a great option for many working professionals and students who are looking for an accessible degree option.

The University

For students.

- Student Portal

- Alumni Services

Most Visited Links

- Business Programs

- Student Experience

- Diversity, Equity, and Inclusion

- Student Communities

- Business Essentials

- Leadership & Management

- Credential of Leadership, Impact, and Management in Business (CLIMB)

- Entrepreneurship & Innovation

- Digital Transformation

- Finance & Accounting

- Business in Society

- For Organizations

- Support Portal

- Media Coverage

- Founding Donors

- Leadership Team

- Harvard Business School →

- HBS Online →

- Online Business Certificate Courses

- Business Strategy

- Leadership, Ethics, and Corporate Accountability

Financial Accounting

Key concepts, who will benefit, college students and recent graduates, those considering an mba, mid-career professionals.

What You Earn

Certificate of Completion

Boost your resume with a Certificate of Completion from HBS Online

Earn by: completing this course

Certificate of Specialization

Prove your mastery of finance and accounting

Earn by: completing any three courses within this subject area to earn a Certificate of Specialization

The Accounting Equation

- Accounting Equation Components

- Basic Transactions and the Equation

- Accounting Principles and Rules

- Formal Definitions of Accounting Terms

Featured Exercise

Recording transactions.

- Journal Entries and T-Accounts

- Advanced Journal Entries

- The Trial Balance

Featured Exercises

Financial statements.

- The Balance Sheet

- The Income Statement

Adjusting Journal Entries

- Accruals and Deferrals

- Long-Lived Assets

- Credit Risk Management

- Deferred Taxes

The Statement of Cash Flows

- Operating: Direct Method

- Operating: Indirect Method

- Investing and Financing

Analyzing Financial Statements

- Profitability

- Other Ratios

- Impact of Policy Differences

Accounting for the Future

- Pro Forma and Free Cash Flows

- Lease Accounting

A Manager's Guide to Finance & Accounting

Our difference, about the professor.

V.G. Narayanan Financial Accounting

Dates & eligibility.

No current course offerings for this selection.

All learners must be at least 18 years of age, proficient in English, and committed to learning and engaging with fellow participants throughout the course.

Learn about bringing this course to your organization .

Learner Stories

Financial Accounting FAQs

How does the financial accounting certificate program relate to the credential of readiness program.

In addition to being a standalone certificate program, Financial Accounting is also one component course of the Credential of Readiness (CORe) program , which also includes Economics for Managers and Business Analytics . Designed for those interested in learning business fundamentals more broadly, CORe program participants progress through the three courses in tandem, and the program concludes with a final exam.

What are the learning requirements in order to successfully complete Financial Accounting, and how are grades assigned?

Participants are expected to fully complete all coursework in a thoughtful and timely manner. This will mean meeting each week’s course module deadlines and fully answering questions posed therein, including satisfactory performance on the quizzes at the end of each module (earning an average score of 50% or greater). This helps ensure your cohort proceeds through the course at a similar pace and can take full advantage of social learning opportunities. A module is composed of a series of teaching elements (such as faculty videos, simulations, reflections, or quizzes) designed to impart the learnings of the course. In addition to module and assignment completion, we expect participation in the social learning elements of the course by offering feedback on others’ reflections and contributing to conversations on the platform. Participants who fail to complete the course requirements will not receive a certificate and will not be eligible to retake the course.

More detailed information on individual course requirements will be communicated at the start of the course. No grades are assigned for Financial Accounting. Participants will either be evaluated as complete or not complete.

Are there grants for Financial Accounting? How do I qualify?

Financial Accounting participants may be eligible for financial aid based on demonstrated financial need. To receive financial aid, you will be asked to provide supporting documentation. Please refer to our Payment & Financial Aid page .

What materials will I have access to after completing Financial Accounting?

You will have access to the materials in every prior module as you progress through the program. Access to course materials and the course platform ends 60 days after the final deadline in the program. At the end of each course module, you will be able to download a PDF summary of the module’s key takeaways. At the end of the program, you will receive a PDF compilation of all of the module summary documents.

How should I list my certificate on my resume?

Harvard Business School Online Certificate in Financial Accounting [Cohort Start Month and Year]

List your certificate on your LinkedIn profile under "Education" with the language from the Credential Verification page:

School: Harvard Business School Online Dates Attended: [The year you participated in the program] Degree: Other; Certificate in Financial Accounting Field of Study: Leave blank Grade: Complete Activities and Societies: Leave blank

For the program description on LinkedIn, please use the following:

Financial Accounting is an 8-week, 60-hour online certificate program from Harvard Business School. This course teaches the fundamentals of financial accounting from the ground up. Participants learn how to prepare and interpret financial statements—the balance sheet, income statement, and cash flow statement—and calculate and interpret critical ratios. The course concludes with an introduction to forecasting and valuation. Financial Accounting was developed by leading Harvard Business School faculty and is delivered in an active learning environment based on the HBS signature case-based learning method.

Can I take CORe if I've taken Financial Accounting?

By enrolling in the Financial Accounting certificate program, participants will be ineligible to enroll in the CORe program. By enrolling in the CORe program, participants will be ineligible to enroll in Financial Accounting.

Related Programs

Credential of Readiness (CORe)

Designed to help you achieve fluency in the language of business, CORe is a business fundamentals program that combines Business Analytics, Economics for Managers, and Financial Accounting with a final exam.

Leading with Finance

Build an intuitive understanding of financial principles to better communicate with key stakeholders, drive business performance, and grow your career.

Economics for Managers

Gain economic insights and learn how markets work and firms compete to craft successful business strategies.

IMAGES

VIDEO