- Digital Marketing

- Facebook Marketing

- Instagram Marketing

- Ecommerce Marketing

- Content Marketing

- Data Science Certification

- Machine Learning

- Artificial Intelligence

- Data Analytics

- Graphic Design

- Adobe Illustrator

- Web Designing

- UX UI Design

- Interior Design

- Front End Development

- Back End Development Courses

- Business Analytics

- Entrepreneurship

- Supply Chain

- Financial Modeling

- Corporate Finance

- Project Finance

- Harvard University

- Stanford University

- Yale University

- Princeton University

- Duke University

- UC Berkeley

- Harvard University Executive Programs

- MIT Executive Programs

- Stanford University Executive Programs

- Oxford University Executive Programs

- Cambridge University Executive Programs

- Yale University Executive Programs

- Kellog Executive Programs

- CMU Executive Programs

- 45000+ Free Courses

- Free Certification Courses

- Free DigitalDefynd Certificate

- Free Harvard University Courses

- Free MIT Courses

- Free Excel Courses

- Free Google Courses

- Free Finance Courses

- Free Coding Courses

- Free Digital Marketing Courses

AI in Banking [10 Case Studies] [2024]

In the rapidly altering finance landscape, AI has emerged as a pivotal significance, extending banks’ abilities and reshaping traditional financial patterns. From enhancing customer experiences to mitigating financial risks, AI’s role in banking is pivotal and transformative. This exploration delves into ten distinct case studies where leading banks have successfully implemented AI to address complex challenges in the industry. These examples showcase AI’s innovative applications and highlight its potential to revolutionize banking operations, improve customer service, and bolster financial security. As we navigate through these case studies, we gain insights into the strategic advantages and practical impacts of AI in the banking sector, underscoring its importance in shaping the future of finance.

Related: High-Paying Banking Jobs & Career Paths

Case Study 1: JP Morgan Chase: Streamlining Loan Approvals

The traditional loan approval process is notoriously cumbersome and slow, heavily reliant on manual data handling. This results in prolonged wait times, leading to significant customer dissatisfaction and increasing operational costs due to the extensive need for human oversight and intervention.

To address these inefficiencies, JP Morgan Chase has implemented an advanced AI system that automates key aspects of the loan approval process. This system utilizes machine learning to swiftly and accurately analyze various data points, including applicants’ credit history, recent transaction data, and current financial behaviors. Doing so enhances the speed and accuracy of creditworthiness assessments, reduces reliance on manual processes, and improves overall customer experience by expediting loan approvals.

Overall Impact:

- Increased Speed: Loan processing times have dramatically reduced from days to minutes and hours.

- Enhanced Customer Satisfaction: Faster loan approvals increase customer satisfaction and loyalty.

- Cost Efficiency: Reduced reliance on manual processes decreases operation expenses and improves profitability.

- Scalable Operations: The bank can handle more loan applications without significantly increasing staff or resources.

Key Learnings:

- Process Efficiency: AI drastically cuts down the time required for loan approvals.

- Operational Cost Reduction: Automation reduces the labor-intensive elements of loan processing.

- Enhanced Risk Management: AI provides a more accurate and comprehensive loan risk assessment.

- Customer Retention: Improved process speeds and accuracy improve customer retention rates.

Future Prospects:

AI algorithms could be enhanced for faster processing, achieving near-instant approval times. Future iterations may further integrate broader economic indicators to refine credit risk assessments, enhancing personalized lending strategies.

Case Study 2: Bank of America: Erica, the AI-Powered Financial Assistant

As digital banking gains traction, customer expectations are also evolving. Users now demand personalized services on-demand and easily accessible through their digital devices. This shift has pushed banks to find innovative solutions to meet these new customer demands without compromising service quality.

Bank of America responded to this digital shift by launching Erica, an AI-driven virtual assistant designed to enhance the mobile banking experience. Accessible via mobile apps, Erica offers a wide range of functionalities that cater to the modern banking customer’s needs. These include handling transaction queries, updating credit reports, and providing proactive financial advice. Erica’s capabilities are powered by sophisticated algorithms that analyze user behavior and large datasets, enabling customized and efficient service that meets the high expectations of today’s bank customers.

- Personalized Customer Interaction: Erica offers tailored banking advice, enhancing user engagement.

- Increased Accessibility: Round-the-clock availability allows customers to receive instant assistance without waiting for human help.

- Data-Driven Insights: Erica provides insights based on a deep analysis of user transactions and behaviors, helping customers manage their finances better.

- Operational Efficiency: The AI assistant handles regular inquiries, leaving humans to deal with more complex issues.

- Enhanced User Experience: AI-driven tools like Erica improve customer experience by providing quick, personalized service.

- Operational Scalability: AI can manage increasing volumes of consumer interactions without additional human resources.

- Proactive Service: AI enables proactive engagement, offering financial advice and alerts that can prevent issues before they arise.

- Customer Data Utilization: Using AI to analyze customer data effectively can lead to more accurate and useful financial advice.

Erica could develop more sophisticated natural language processing capabilities to manage increasingly complex inquiries and transactions. Integration with IoT devices and other platforms may offer holistic financial management solutions, extending personalized services beyond traditional banking.

Case Study 3: HSBC: Enhancing Anti-Money Laundering Efforts

Money laundering remains a formidable challenge for financial institutions worldwide. Traditional systems designed to detect such activities often struggle under modern financial transactions’ heavy volume and complex nature. These systems can be overwhelmed, resulting in undetected fraudulent activities and significant regulatory penalties for banks.

In response, HSBC has integrated an AI-driven system to bolster its anti-money laundering (AML) efforts. This advanced system employs sophisticated machine learning algorithms to analyze many real-time transactions. By detecting unusual patterns and potential illegal activities, the system can far more effectively differentiate between normal and suspicious activities than traditional methods. This AI-enhanced approach allows HSBC to address the complexities of modern financial crime while improving compliance and reducing the risk of oversight.

- Improved Detection Rates: The AI system has significantly increased the detection of suspicious transactions, reducing the risk of financial crimes.

- Reduced False Positives: Enhanced accuracy in distinguishing legitimate from suspicious activities, minimizing disruptions to innocent customers.

- Compliance Efficiency: AI assists in maintaining compliance with evolving regulatory requirements, adapting more quickly to new rules.

- Cost Reduction: Automating surveillance reduces the need for extensive manual review teams, lowering operational costs.

- Accuracy in Surveillance: AI technologies improve the accuracy and efficiency of financial monitoring systems.

- Adaptive Compliance: AI can adapt quickly to new regulatory changes, aiding compliance efforts.

- Resource Optimization: Implementing AI reduces the need for large human oversight teams, optimizing resource use.

Future developments may incorporate predictive analytics to detect and predict laundering schemes before they are fully enacted. Integration with international finance monitoring systems could enhance global compliance and tracking capabilities.

Related: Is Banking a stressful job?

Case Study 4: Citibank: Optimizing Customer Service with AI Chatbots

In the fast-paced banking world, high demand for customer service can lead to long wait times and inconsistent service experiences. Such delays and variability often detract from customer satisfaction and can negatively impact customer retention rates. As digital interactions become the norm, banks face the challenge of maintaining high service standards while managing large volumes of customer inquiries efficiently.

Citibank has implemented AI-powered chatbots across its digital platforms to address this challenge. These chatbots are arranged to address a spectrum of consumer inquiries, offer real-time support, and efficiently settle typical issues. By deploying these AI chatbots, Citibank ensures a uniform and agile consumer service experience. The chatbots are equipped to understand and process user queries quickly, offering solutions and guidance instantaneously. This technology reduces the burden on human customer service representatives and enhances overall customer satisfaction by providing timely and reliable support.

- Enhanced Customer Service: Immediate response to inquiries improves customer satisfaction.

- 24/7 Availability: Customers receive help anytime without needing human agent availability.

- Consistent Experience: AI ensures that every customer interaction is handled uniformly, enhancing service reliability.

- Operational Savings: The chatbots handle routine inquiries, decreasing the workload on human client service agents and decreasing operational costs.

- Service Accessibility: AI tools can provide constant and consistent consumer service.

- Cost Efficiency: Automating routine interactions can significantly reduce customer service costs.

- Customer Engagement: Real-time interactions facilitated by AI can boost customer engagement and loyalty.

AI chatbots could evolve to handle more sophisticated negotiations and problem-solving tasks, further reducing the need for human intervention. Future versions might seamlessly integrate into omnichannel customer service strategies, providing a unified interface across all banking platforms.

Case Study 5: Santander: Predictive Analytics for Loan Default Prevention

Loan defaults pose a great financial risk to banks, affecting their profits and stability. Traditional risk assessment models often fall short in accurately predicting defaults before they occur, primarily because they may not account for dynamic changes in customers’ financial situations or broader economic trends. This limitation leads to unexpected financial losses and inefficient allocation of resources for risk management.

Santander has adopted a proactive approach to this challenge by integrating predictive analytics models powered by AI into its risk management strategy. These models use a combination of historical data analysis and real-time monitoring of account behaviors to detect early warning signs of potential loan defaults. By identifying at-risk customers before defaults occur, Santander can engage with them to offer tailored financial advice, restructuring options, or other support measures. This early intervention helps mitigate risks associated with loan defaults and improves the bank’s and its customers’ overall financial health.

- Reduced Default Rates: Early identification and intervention have led to a decrease in loan defaults.

- Enhanced Customer Support: At-risk customers receive tailored advice and restructuring options, improving financial outcomes.

- Operational Efficiency: The bank optimizes resource allocation by focusing efforts where they are needed the most.

- Improved Risk Management: Better predictive capabilities allow for more accurate risk pricing and reserve allocation.

- Proactive Risk Management: Early detection of potential defaults enables more effective mitigation strategies.

- Customer Retention: Proactive engagement helps maintain customer relationships and loyalty.

- Financial Health: Improved risk assessment contributes to the bank’s overall financial health and stability.

- Resource Allocation: AI enables more targeted and efficient use of resources in risk management activities.

Integrating wider socio-economic data could improve predictive models, offering even more precise forecasts of potential defaults. These enhancements allow customized intervention strategies tailored to individual customer profiles and economic conditions.

Case Study 6: Wells Fargo: Fraud Detection Enhancement

Real-time fraud detection in financial transactions presents a major challenge, as traditional methods often lag behind fraudsters’ sophisticated techniques. Wells Fargo faced significant challenges in effectively identifying and preventing fraudulent activities. Their traditional systems struggled to keep up without mistakenly flagging legitimate transactions as fraudulent, leading to customer dissatisfaction and operational inefficiencies.

To address this issue, Wells Fargo implemented an AI-based fraud detection system employing deep learning algorithms to scrutinize real-time transaction patterns. This advanced system is designed to compare each transaction against an extensive database of known fraudulent behaviors, enhancing its ability to make accurate assessments instantly. By doing so, the system significantly improves fraud detection accuracy, minimizing false positives and ensuring that legitimate customer transactions are not disrupted. This method boosts security and enhances the overall customer experience by minimizing delays and errors in transaction processing.

- Improved Fraud Detection: The AI system has a higher accuracy rate in identifying fraudulent transactions, reducing the incidence of fraud.

- Minimized Customer Disruption: Accurate fraud detection means fewer legitimate transactions are flagged incorrectly, ensuring smoother customer experiences.

- Enhanced Security: The system enhances overall transaction security, giving customers greater confidence in using Wells Fargo’s services.

- Cost Efficiency: Decreased fraud incidence reduces financial losses and related costs for the bank.

- Real-Time Processing: AI can process and analyze real-time transactions, offering immediate fraud alerts.

- Data Utilization: Leveraging large datasets enhances the system’s ability to identify and learn from emerging fraud patterns.

- Customer Trust: Improved security measures boost customer trust and satisfaction.

Wells Fargo plans to integrate further enhancements into the AI system, such as adaptive learning capabilities that can evolve with changing fraud tactics. This will allow for even more dynamic and robust fraud prevention mechanisms.

Case Study 7: Barclays: Streamlining Wealth Management

Barclays faced challenges in meeting the high expectations of its high net-worth clients who demand personalized, efficient wealth management services. Traditional methods were slow and often ineffective in providing the customization and rapid service these clients expected, leading to dissatisfaction and operational inefficiencies.

Barclays introduced an AI-driven platform to transform its wealth management services. This platform uses advanced analytics to deeply understand individual client preferences and performance, enabling tailored investment advice and automated portfolio adjustments. This automation enhances service speed and accuracy, improving client satisfaction and streamlining operations.

- Personalized Service: Clients receive highly customized investment advice, improving satisfaction and engagement.

- Increased Efficiency: The AI platform automates routine portfolio management tasks, freeing up advisors to focus on client relationships.

- Better Investment Performance: AI-enhanced analytics provide deeper insights into market trends, aiding better investment decisions.

- Scalability: The platform can efficiently manage many portfolios, scaling as the client base grows.

- Enhanced Customization: AI enables a high degree of personalization in delivering services. This technology tailors interactions to meet individual user needs effectively.

- Advisor Efficiency: Automating routine tasks allows wealth managers to focus more on strategic client interaction.

- Data-Driven Decisions: Utilizing AI for data analysis improves the accuracy and timeliness of investment decisions.

Barclays intends to refine its AI capabilities further, incorporating more comprehensive data sources, including global economic indicators and social trends, to enhance investment strategy recommendations.

Related: Banking Cybersecurity Case Studies

Case Study 8: Deutsche Bank: Optimizing Credit Card Fraud Detection

Credit card fraud poses a major problem for banks, resulting in annual losses amounting to millions and eroding customer trust. This persistent issue challenges financial institutions to enhance their security measures and maintain client confidence. Deutsche Bank faced the challenge of rapidly identifying and mitigating fraudulent credit card activities without affecting genuine transactions.

Deutsche Bank implemented an AI-based solution specifically designed to improve credit card fraud detection. This solution uses advanced machine learning models to monitor and analyze real-time credit card transactions. The system can quickly identify anomalies that suggest fraudulent activity by learning from historical transaction data and continuously adapting to new fraud patterns.

- Increased Detection Accuracy: The AI system significantly enhances the ability to spot fraudulent transactions, reducing financial losses.

- Enhanced Customer Trust: Customers feel more secure using their credit cards, knowing that advanced measures are in place to protect them.

- Operational Efficiency: The automated system allows for faster response times and reduces the workload on manual review teams.

- Reduced False Positives: The system effectively minimizes disruptions to innocent customers by accurately distinguishing between legitimate and fraudulent activities.

- Adaptive Learning: Machine learning models adapting to new data and evolving fraud tactics are more effective than static models.

- Customer Experience: Maintaining a balance between aggressive fraud detection and customer convenience is crucial for customer satisfaction.

- Security as a Priority: Investing in advanced security measures like AI protects the bank’s assets and builds customer loyalty.

Deutsche Bank plans to integrate more granular behavioral analytics to refine the system’s accuracy further. Additionally, collaborating with global financial networks to share fraud intelligence could enhance the system’s predictive capabilities, setting a new standard for fraud prevention in the banking industry.

Case Study 9: Credit Suisse: Enhancing Mortgage Underwriting with AI

Credit Suisse encountered significant challenges in its mortgage underwriting process, which relied heavily on manual input, making it both time-consuming and prone to creating backlogs of applications. This inefficient process delayed loan disbursals and negatively impacted customer satisfaction, as clients experienced lengthy wait times and unpredictable service levels. Streamlining this process was crucial to improving operational efficiency and maintaining customer trust and loyalty.

Credit Suisse adopted an AI-driven approach to transform its mortgage underwriting process. The AI system uses machine learning to assess applicant data such as income, credit score, employment history, market trends, and property evaluations more quickly and accurately than manual methods. This automation allows for faster decision-making and more precise risk assessment.

- Faster Processing Times: The time taken to approve mortgages has been significantly reduced, enhancing customer satisfaction.

- Increased Accuracy: AI provides more accurate assessments of applicant risk profiles, reducing the likelihood of loan defaults.

- Operational Efficiency: Automating routine tasks allows human underwriters to concentrate on handling more complex cases. This shift frees up valuable resources for more critical and detailed work.

- Scalable Underwriting Capacity: The system can handle more applications without additional staff.

- Automation in Risk Assessment: The use of AI for processing and analyzing complex applicant data streamlines risk assessment.

- Improved Customer Experience: Reducing wait times for loan approvals directly impacts customer satisfaction positively.

- Enhanced Decision Making: AI tools provide a deeper insight into potential risks and applicant credibility, aiding better decision-making.

Credit Suisse plans to further enhance the capabilities of its AI system by integrating it with real-time economic indicators and more detailed applicant lifestyle data to predict future financial stability more accurately. This advancement aims to streamline the process and tailor mortgage products more specifically to individual needs, setting a new standard in personalized banking services.

Case Study 10: Standard Chartered: Streamlining Trade Finance Operations

Standard Chartered faced complexities in managing trade finance operations, which involve extensive documentation and verification processes that are traditionally manual and error-prone. These challenges resulted in slow transaction times and higher operational costs, affecting client satisfaction and competitiveness in the global market.

Standard Chartered introduced an AI-driven platform designed to automate and enhance the efficiency of its trade finance operations. Utilizing sophisticated machine learning algorithms, the platform efficiently verifies documents, authenticates data, and streamlines the entire approval process for trade transactions. This integration of advanced technology ensures faster, more accurate handling of the complex documentation and regulatory requirements inherent in trade finance, improving overall transaction speed and reliability. By automating these key steps, the bank has significantly reduced manual errors and sped up the processing of trade finance operations.

- Reduced Processing Time: Transaction times for trade finance operations have been drastically reduced, increasing client satisfaction and transaction volumes.

- Decreased Operational Costs: Automation has minimized the need for extensive manual intervention, significantly cutting operational costs.

- Enhanced Accuracy: The AI system provides a higher level of precision in document verification and data authentication, decreasing the risk of fraud and errors.

- Improved Compliance: The system ensures better adherence to international trade regulations through accurate and automated compliance checks.

- Efficiency through Automation: Automating complex, repetitive tasks can significantly enhance efficiency and accuracy in high-stakes financial operations.

- Client Satisfaction: Quicker processing times and fewer errors directly enhance client relationships and contribute to business expansion.

- Regulatory Compliance: AI tools are vital in ensuring compliance with the continuously changing international trade laws. They help organizations adapt quickly to regulatory updates, maintaining legal integrity across global operations.

Standard Chartered is looking to expand its AI capabilities to include predictive analytics for assessing the potential risks and opportunities in trade finance. Further integration with blockchain technology could enhance security and transparency in international trade transactions, setting new industry standards for efficiency and trust.

Related: Will Banking jobs be Automated?

The integration of AI in banking, as demonstrated through these ten case studies, marks a significant leap toward a more efficient, secure, and customer-centric future in finance. Banks like JP Morgan Chase, Bank of America, HSBC, Citibank, and Santander are at the forefront, harnessing AI to enhance decision-making, streamline operations, and enrich customer interactions. These cases vividly illustrate how AI can effectively address traditional banking challenges, driving significant service delivery and risk management improvements. As the banking industry continues to evolve, the strategic deployment of AI will not only be a competitive advantage but a necessity, paving the way for innovative solutions that meet the complex demands of modern finance.

- What is Sentient AI [Pros & Cons][Deep Analysis] [2024]

- AI in Product Development [5 Case Studies] [2024]

Team DigitalDefynd

We help you find the best courses, certifications, and tutorials online. Hundreds of experts come together to handpick these recommendations based on decades of collective experience. So far we have served 4 Million+ satisfied learners and counting.

10 Ways AI is Being Used in Agriculture [2024]

How can AI be used by a Financial Planning Professional? [10 Ways] [2024]

Top 20 AI Marketing Interview Questions & Answers [2024]

AI in Home Automation: 5 Case Studies [2024]

10 Ways AI is Being Used to Help People Stay Fit [2024]

10 Ways AI Is Being Used in Speakers [2024]

Case Study: How a global bank increased cross-selling effectiveness and realized a significant increase on commercial performance

Data analysis, strategic digital tools, and nudges can enhance the commercial effectiveness of bank relationship managers when up-selling and cross-selling high value products and services.

Cross-selling is a critical component of growth in banking. Cross-selling and upselling increases customer lifetime value, generates revenues at low incremental cost, and deepens the customer relationship and loyalty to the institution.

However, the ability to cross-sell effectively and efficiently can be challenging especially with new regulations, tighter controls, and fewer in-person interactions after the COVID-19 pandemic.

A leading global bank was startled to see a steady decline in performance from efforts to cross-sell high-value products like funds, investments, and life insurance to clients after the pandemic.

High-value financial products can be especially hard to sell as they are usually complex, come with a lot of technicalities, and require specialized financial knowledge. Its a buying process that requires effort and focus, and people tend to put it off. Communications of such products on digital channels have to be accessible, and the customer journey simple and barrier-free. Additionally, the role of a knowledgeable and trusted advisor is pivotal to help clients navigate some of these barriers.

How can the bank improve the way it cross-sells and up-sells high-value, complex financial products in an increasingly digital, post-pandemic world?

Leveraging data, analytics and behavioral science, Simon-Kucher introduced a modern, systematic approach to help this bank optimize sales interactions, improve the client experience, and empower its sales and relationship managers.

Identifying buying barriers - There are a number of psychological barriers that are particularly relevant when it comes to derailing a buying decision in financial products and services. These include decision-fatigue, it-can-wait thinking, status-quo bias, and more. As an important first step, Simon-Kucher conducted market tests to validate hypotheses on the most relevant cognitive barriers impacting the high-value financial products offered by the bank.

Sales process audit - To determine if the bank's sales team and sales processes are properly aligned with the buying decisioning process, Simon-Kucher conducted a thorough assessment, audit, and analysis. This methodological process to identify areas for improvement included observing how digital journeys were structured, how information was communicated on digital channels, and how sales were typically conducted paying close attention to the relationship manager's selling speech, what marketing material were available as aids and which ones were used during interactions with clients.

Optimizing sales performance - Another critical element to improve the performance of cross-selling efforts is to leverage optimized digital journeys, selling tools, nudges, and other strategies to enhance sales interactions. For example, working closely with Simon-Kucher, the bank developed pre-defined, interactive scripts to train and guide communications with the client. Communications on digital channels and tools for relationship managers were supported with nudging elements to ensure they help clients progress through the buying journey with recalling mechanisms, anchoring, and default options. There were also mechanisms to ensure the managers followed-up with clients, used approachable language to replace jargon when explaining concepts, and employed examples and simple logics to reduce complexity.

Testing and validation - Testing and validation is an important step in any product development lifecycle to evaluate if the new sales processes are functioning as intended and to ensure quality. Simon-Kucher's rigorous validation testing protocols ensures only the most effective solutions are implemented, and critical business elements are performing.

Optimized communication, new behavioral tools and an improved sales process were able to improve the client experience while increasing their commercial effectiveness, to realize a 50 percent increase on conversion rate.

Visit our BE Digital landing page to read more.

Optimizing digital for breakthrough results.

Related Insights

Sales incentives to turbo charge growth for a global fintech

Decoding the Current State of Industrial IoT

What’s Driving Beverage Trends in 2024?

Value Monetization in the Age of AI

Understanding the Pricing Power of PEOs

Where tech meets better animal welfare and management

International Key Account Management drives growth for animal health company

Maximizing up- and cross-sell opportunities for a package tour operator

Our experts are always happy to discuss your issue. Reach out, and we’ll connect you with a member of our team.

- Global | EN

- Global | DE

- Global | FR

- Global | CN

- Global | JA

- Starting Your Business How To Create a Full-Fledged Ecommerce Website: 7 Steps October 25, 2022

- Starting Your Business Omnichannel E-commerce: What You Need to Succeed October 28, 2022

- Starting Your Business The Guide To Opening An Online Retail Store [With 8 Steps To Follow] October 28, 2022

Digital transformation in banking: A complete guide

August 02, 2023

Digital transformation is a challenge for the banking industry, but it is necessary to adapt to the modern world where customers expect fast, efficient, and convenient services. Traditional approaches no longer meet the needs of the modern consumer. So, banks that want to remain competitive must abandon conservative methods and fully immerse themselves in the process of digital transformation.

This article discusses what is digital transformation in banking, key factors driving digital transformation , and successful examples of digital transformation in the banking industry.

What is digital transformation in banking?

5 key factors driving digital transformation in banking, technologies that drive digital transformation in banking, successful examples of digital transformation in the banking industry, how can soloway tech help you digitally transform your business.

Digital transformation in banking refers to applying new digital technologies and strategies to change and improve banking operations. This includes various changes to increase efficiency, meet customer needs, improve operational effectiveness, and develop new digital products and services.

Mobile applications and personal cabinets on the website are vivid examples of banks’ digital transformation. It is enough to press the buttons on a smartphone or computer to open an account, take out a loan, or order a new plastic card. The services are available not only to individuals but also to legal entities. The accounting departments use client-bank programs to transfer salaries to employees, pay taxes, and receive money from customers.

When you call the hotline of your financial organization, you are answered not by a specialist but by a robot. Virtual assistants have replaced some employees. Moreover, some US banks operate without branches at all. There are employees only in the head office, and customer transactions are conducted exclusively through the Internet.

It is more convenient for people to work with banks remotely, so credit institutions invest a lot of money in digital transformation. It is important that the interface of applications is user-friendly and understandable and transactions are fast. This will attract more customers and, accordingly, increase the profits of the financial company.

Pros and cons of digital transformation in banking

Digital transformation in banking is developing at a rapid pace. It has objective advantages:

- Services of financial organizations are available from anywhere in the world

- The cost of remote operations is cheaper

- There are no queues

- Improved customer service

- Improved operational efficiency

- Big Data and analytics

- Innovation and new opportunities

But there are disadvantages too:

- Dependence on the Internet

- Vulnerability of security systems and regular hacker attacks

- Inaccessibility for some customers

- Threat of job losses

- Dependence on technology

Technology should become a tool that will give banks more flexibility in decision-making and reduce risks.

Fintech companies, which have recently created large-scale services with significantly more interaction points with the client than the classic banking business, are taking the lead. Given that over the last 10 years, the banking industry has experienced a serious tightening of regulatory requirements, fintech is becoming a severe competitor for banks. The solution that banks have found is to change their business model with a focus on digitalization, create their own ecosystems, and develop non-financial services.

Ecosystems are a new global standard for business development and a major stage in the development of the economy. They aggregate data on producers and consumers and help optimize the resources of both. There is no turning back. Creating ecosystems seems to be a common vertical integration strategy for banks when related businesses are pulled up to the core business.

We highlight 5 key factors driving digital transformation in banking:

- Customer experience. Providing convenience and personalization for customers is a crucial factor in digital transformation. Banks should develop and implement innovative digital channels, such as mobile apps, online banking, chatbots, and others, to facilitate access to financial services and improve customer satisfaction.

- Automation and process optimization. The use of automation technologies, such as robo-advisors, machine learning, and artificial intelligence, helps reduce routine operations, lower costs, and improve efficiency. This can include automating lending, foreign exchange, internal audit, and more.

- Evolving regulatory landscape. Regulatory changes and initiatives have pushed banks to adopt digital transformation. Open banking regulations, data protection regulations (such as GDPR), and initiatives promoting competition and innovation have compelled banks to invest in technology to comply with regulations, foster innovation, and enhance transparency.

- Competitive pressure. Fintech startups and tech giants have disrupted the traditional banking landscape. These non-traditional players offer innovative and agile financial services, posing a competitive threat to traditional banks. To remain competitive, banks invest in digital technologies to improve their offerings, provide unique value propositions, and stay ahead of the competition.

- Enhanced customer insights. Digital transformation enables banks to gain deeper insights into customer behavior, preferences, and needs. By analyzing customer data, banks can offer personalized services, targeted marketing campaigns, and customized product recommendations, leading to higher customer satisfaction and loyalty.

These factors interact with each other and require a comprehensive approach for successful digital transformation in the banking industry.

An important point is cybercrime. The emergence of new technologies has left hackers with many loopholes for hacking into networks and devices. At the current growth rate, cyberattack damage will amount to about $10.5 trillion annually by 2025 —a 300% increase from 2015.

However, cyber threats are not slowing down digital transformation. On the contrary, they drive it (this applies to banks and other organizations). The search for vulnerabilities is a never-ending process that contributes to developing security systems.

The main principle of the fight against cybercrime in many banks is that the fight should be at all levels. It means from the protection of external perimeters to specific systems at specific addresses and ports. This includes protection against DoS attacks, firewalls, full control of the bank’s systems, control of viruses to avoid data leakage, etc.

Technologies are evolving at an incredible pace. Artificial Intelligence (AI), Big Data, Blockchain, and other innovations transform how we live, work, and do business.

For example, artificial intelligence allows banks to automate processes and make customer interaction more personalized and efficient. Machine learning can analyze large amounts of data, identify patterns and trends that help make better decisions and predict risks. Machine learning and neural networks also greatly help in document recognition and remote customer verification.

Big Data analysis is becoming a valuable tool in the banking sector, allowing banks to identify patterns, trends, and useful insights hidden in huge amounts of data. It can be used to develop personalized products and services, improve decision-making, detect fraud , and understand and predict customer behavior.

Blockchain is another innovative technology that can tremendously change the banking industry. Most of the current problems in the banking sector are related to the human factor. In particular, they include high commission costs and time spent on money transfers and transactions, internal and external fraud, human error, leakage of personal data, and much more. There are several main areas where blockchain technology can be used in the banking industry:

- Smart contracts

- International payments, settlements for foreign trade transactions, and internal payments

- Transactions with securities

- National digital currency

Other technologies that drive digital transformation in banking include Cloud Computing, Internet of Things (IoT), Robotic Process Automation (RPA), Biometrics, and Open Banking APIs.

Many success stories of digital transformation in banking demonstrate how digitalization improves customer banking experience and operational efficiency. For example:

- DBS Bank (Singapore). DBS Bank is considered one of the leaders in digital transformation. They have developed a digital platform, DBS Digibank, which provides customers with a wide range of banking services through mobile apps and online banking. They actively use artificial intelligence and analytics to provide personalized recommendations and improve customer experience.

- JPMorgan Chase (USA). JPMorgan Chase has embraced digital transformation to improve operational efficiency and customer service. They have developed their proprietary digital platform, Chase Mobile Banking, which allows customers to perform various banking transactions through mobile devices. They also actively apply machine learning and analytics to better analyze data and deliver services.

- ING Bank (Netherlands). ING Bank has moved from a traditional bank to a digital organization. They provide customers convenient online services and mobile apps and actively use data analytics to provide personalized offers and improve customer experience. They have also implemented digital tools within the bank to streamline processes and improve efficiency.

- BBVA (Spain). BBVA focused on digital transformation and innovation to improve customer experience and banking processes. They developed the BBVA Digital Banking platform, which provides customers with a wide range of services through mobile apps and online banking. They have also implemented blockchain technology to improve the security and efficiency of financial transactions.

- Ally Bank (USA). Ally Bank is an example of a successful digital transformation. They provide a full range of banking services through an online platform, including account opening, lending, investments, and mortgages. Ally Bank actively utilizes digital channels and tools to provide convenience and accessibility to customers.

These examples demonstrate how banks use digital technologies to increase the availability of services, improve customer experience, and optimize their operations.

At SoloWay Tech, we specialize in providing comprehensive digital transformation and consulting services to help businesses thrive in the digital age. With our expertise and industry knowledge, we can guide your organization through the complex digital transformation process, enabling you to unlock new opportunities and achieve sustainable growth. We can:

- Consult regarding the digital transformation of your business

- Develop a digital transformation strategy

- Design digital customer experience

- Optimize business processes

- Automate business processes

- Re-engineer legacy apps

- Develop innovative products and services

- Implement end-to-end ML and AI engines

- Engineer IoT

- Build Big Data infrastructure

- Consult regarding the best implementation of IT infrastructure in your business.

At SoloWay Tech, we understand that each business has unique challenges and requirements. Our collaborative approach, deep industry expertise, and proven methodologies empower us to tailor our services to your specific needs, enabling you to achieve sustainable growth and competitive advantage through digital transformation.

Embark on your digital transformation journey with SoloWay Tech and unlock the full potential of your business in the digital era. Contact us today to learn more about our services and how we can help you drive innovation, efficiency, and success.

Digital transformation has become imperative for the banking industry to adapt to the evolving needs and expectations of customers in the modern world. The shift towards digitalization offers numerous advantages, such as enhanced customer experiences, improved operational efficiency, access to Big Data analytics, and new opportunities for innovation. However, there are also challenges to consider, including cybersecurity risks, potential job losses, and dependence on technology.

To embark on a successful digital transformation journey, businesses may seek the expertise of companies like SoloWay Tech that specialize in assisting organizations in their digitalization efforts. With the right guidance and implementation strategies, banks can harness the power of digital technologies to stay competitive, meet customer expectations, and drive innovation in the ever-evolving banking landscape.

Similar articles

Finance 2025: Digital Transformation in Finance

How To Develop A Blockchain Mobile App: Examples And Development Process

Blockchain Game Development: How to Use Blockchain Technology in Gaming Industry

Digitizing Customer Experience: Step-by-Step Guide for Business Success

We use cookies to provide you with a better on website experience, privacy setting.

This website uses cookies to improve your experience while you navigate through the website.

View the Cookie Policy

Fill the form below and Do your Solo

Company name, how can we help you.

- Tech & Privacy

- Product Safety

- Press Releases

- Our Experts

Consumer Reports is an independent nonprofit organization that works for a fair, safe and transparent marketplace.

Since we were founded as Consumers Union in 1936, we have advocated for the rights of all consumers. Now, we are united under the Consumer Reports name, bringing together our trusted testing, research, journalism, and advocacy.

We hope you will partner with us and our six million members for a better world.

For 85 years CR has worked for laws and policies that put consumers first. Learn more about CR’s work with policymakers, companies, and consumers to help build a fair and just marketplace at TrustCR.org

Banking apps: The case study for a digital finance standard

Executive Summary

Checking and savings accounts are one of the primary tools that consumers use to manage their financial lives, and the majority of consumers use a mobile banking app. A nationally representative Consumer Reports (CR) survey of 2,097 U.S. adults conducted in February 2023 found that 75% of Americans use one or more banking apps. Such apps allow users to check their balances; monitor their transactions; transfer and receive money; locate physical locations like ATMs, branches, and partner retail stores; pay bills; deposit checks; connect with customer service; and more.

This study builds on CR’s recent evaluations of peer-to-peer (P2P) payment apps and buy now, pay later (BNPL) services by applying CR’s Fair Digital Finance Framework to evaluate banking apps. We evaluated the banking apps across six principles of the Framework: Safety, Privacy, Transparency, User-Centricity, Support for Financial Well-Being, and Inclusivity. This evaluation explores the mobile banking apps, websites, and features related to checking and savings products of five large, traditional banks (Bank of America, Capital One, JPMorgan Chase, U.S. Bank, and Wells Fargo) and five digital banking providers (Albert, Ally, Chime, Current, and Varo).

We identified five key findings with numerical ratings based on those evaluations:

1. Most traditional banks charge maintenance fees; most digital banking providers don’t: Most digital banking providers offer free checking and savings accounts without maintenance fees, while few traditional banks do. Digital banking providers also tend to offer higher interest rates on their savings accounts. All five digital banking providers offer free checking, compared to only one of the five traditional banks. The costs of financial services matter, particularly for low-income consumers. Maintenance fees chip away at the disposable income available to consumers. Low interest rates on savings accounts can inhibit wealth-building opportunities. To avoid banking fees, many consumers choose not to use formal deposit accounts and lose access to important conveniences like electronic payments and remote deposit.

2. Data sharing needs controls and transparency: Most banking service providers tend to share more data than needed to deliver their core service, while only some banking apps offer the ability to opt out of targeted advertising. While these apps may provide conveniences to consumers through customized services and targeted offers, data sharing with third parties and across broader corporate structures leaves consumers vulnerable to predatory practices based on intimate details gathered about their financial lives. This finding represents the biggest opportunity for improvement for the industry; none of the 10 banking apps received high scores.

3. Inconsistent availability of digital tools for financial well-being: Traditional banking apps typically offer more financial well-being tools and features than digital banking providers offer. We reviewed the apps for the following tools: automated savings features, such as setting automatic transfers to savings or round-up savings, where transactions are rounded up to the nearest whole dollar and the change automatically directed to savings; the ability to send a portion of the user’s direct deposit to savings; budgeting tools; goal-setting features; and spending indicators. Although we found that a number of apps do provide a number of these features, only three banking apps we evaluated offer all five of these tools directly in the app.

4. Accessibility features uneven across sector: Traditional banks are more likely than digital banking providers to offer their websites, apps, and policies in Spanish. Banking websites are more likely than banking apps to have built-in accessibility features for people with disabilities. Financial products should be accessible to all users. Language and disability should not be a barrier to using banking apps.

5. Incomplete commitment to fraud protection: Some banking service providers do not explicitly commit to monitoring fraud in real time and to notifying users in the event of suspicious activity. While all banking service providers that we evaluated have fraud education materials on their websites, three do not offer similar materials within their apps. The risks to consumers of banking fraud and scams continue to increase, and banking apps can do more to support users with information and education.

Consumer Reports scored each banking app on the data supporting the five key findings. See the full report for the scores for each banking app. Each company has areas where it excelled and areas for improvement.

- Azure Marketplace

- Search for:

The 6 Definitive Data Analytics Use Cases in Banking and Financial Services

Financial services organizations were traditionally product-centric, but they turned to be customer-centric with the evolving tech landscape. Digital transformation in financial services is more profound than leveraging data and digitization.

Personalization and customer experience now deepened after the pandemic. With the shift towards mobile, almost 89% of customers now prefer mobile banking channels , and digital-only banks are transcending traditional banks. Unlike financial services organizations, fintech start-ups leverage technology and data analytics as per customer preferences.

Intense competition and tech disruption are the game-changer for fintech. Let us talk about the example of loan disbursal. Banks have a lot of KYC and due diligence processes that delay the loan disbursal. But data analytics and AI make it easier for fintech start-ups to decide in minutes. Many leaders were leveraging compelling data analytics use cases in banking and financial services. But they have to be updated regularly with the evolving tech landscape.

Why do banks need to leverage advanced analytics?

Customer experience is the new competitive battleground for banks and financial services – In traditional banking business models, customer service was synonymous with customer experience. But now, ease of access, ease of use, and resolutions in no time seems to be the new face of customer experience. The financial services industry has more challenges with the data flow from these multiple channels with omnichannel presence.

AI is critical in the new CX – The applications are manifold in financial services – chatbots, AI-powered automation, and AI data analytics. Predicting the customer needs, providing services, and resolving queries in no time enhance customer experience, the new norm for financial services.

Data analytics is not about cutting costs but focusing on productivity – Do you know that leveraging advanced data analytics for fraud detection can save costs up to 20%? Earlier it was just automation of a document management system or repetitive processes. But now, it is more about leveraging technology for credit modeling, risk analysis, and fraud to leave humans for more critical projects.

Advanced Analytics in BFSI – Benefits

Updating the data analytics use cases in banking and financial services with the evolving data science methodologies can help organizations sustain stronger customer relationships. Let us look at a few more benefits of advanced analytics.

Customer 360-degree insights – By leveraging advanced analytics, financial services organizations can know more about customer preferences, multichannel touchpoints, and buyer behavior factors. There is a high chance that the sales folks might perceive a different need, but the data speaks another consumer behavior. Understanding the customer in detail is critical for banking and financial services , unlike other industries.

Personalized customer experience – Experts perceive personalization as another critical aspect in BFSI to reduce churn and improve revenues. Offering the right product at the right time while also reaching out with personalized information after understanding every consumer detail is now the norm for sales teams in BFSI. A report from Forrester says that a single point improvement in financial services organizations’ CX score can improve revenues from $5-$123 mn.

Reduction in operational costs – Banks and financial services organizations are under constant pressure to maintain sleek profit margins and improve operations. Financial services firms can leverage predicting analytics, visualization, and AI to automate their workflows. Replacing paper-based forms with digital applications and using NLP technologies where ever necessary also helps in reducing manual efforts and errors.

Risk mitigation – The main challenge for BFSI firms is to analyze risks like credit, claims, and fraud. Though the practice is not new, banks, insurance companies, and investment bankers need to update their risk approach with the evolving technologies and exploding data from multi-channels. Financial services organizations can modernize their risk management practices more efficiently using predictive, behavioral, and advanced analytics .

Competitive advantage – Fintech organizations with technology as their core are already disrupting financial services. Financial services organizations now need to adopt technology faster than before. Processing a loan application can be done in minutes with AI and advanced analytics, thereby providing more scope for customers. Data analytics in banking will enable you to understand the unmet customer needs and help you unfold new consumer-centric business models.

Best Definitive Data Analytics Use Cases in Banking and Financial Services

Most of us know about the data analytics use cases in banking and financial services. Do we need to view them differently after the pandemic? Our experts say that the customer data is changing rapidly, and so are the touchpoints. To successfully implement data analytics in banking, the models should reconsider all the available data from the expanded sources. Let us rethink the advanced analytics use cases with the changing consumer ecosystem.

Credit Modeling – Credit risk modeling is not new in the banking industry. The traditional risk analytics models provided insights based on income sources, loan history, default rates, credit rating, demographics, etc. Many other factors need to be analyzed in conjunction with the standard data. Let us consider the case of consumer loans; different dynamics like social media profiles, utility bills, monthly spending, and savings give more profound insights into the default risk. Unstructured data plays a vital role in credit risk modeling too. AI-based text analysis and consumer persona provide deeper insights into the customers’ financial well-being.

Risk Analysis and Monitoring – Banks and financial services organizations that implement dynamic risk models with advanced analytics seem to be more resilient to significant external changes. Risk models differ between Banks and financial services – credit risk, fraud, and liquidity risk are the major ones for banks; claims risk and fraud for insurance and portfolio risk analysis for investment bankers. The common risk for most financial services firms is fraud detection is continuously evolving. Machine learning, AI, and big data now enable organizations to analyze many transactions, not just based on historical data. Social media profiles, behavioral analytics, predictive analytics , and advanced machine learning models are leveraged collectively for fraud detection.

Customer LifeTime Value – The trickiest one but looks like the most simple one to understand for anyone in the banking perspective. Customer lifetime value provides insights about the future revenue sources from the customer to focus marketing efforts and reduce churn. It is tough to estimate how customer behaviors change with time and the significant factors impacting their decisions. AI-powered advanced models recognize patterns more effectively in the data to provide behavioral insights that humans may not be able to identify.

Product Recommendation Engine – Are we talking about retail? No, product recommendation engines are evolving in banking too. Multiple comparison sites are now available for each financial services product – loan, insurance, mutual funds, credit cards, etc. Consumers can make informed choices, but cross-selling financial products at the right time cater to customer needs and enhances trust. Machine learning models process data in real-time from various content feeds to make the job easier for financial/investment analysts to offer personalized products and services.

Customer segmentation and personalized marketing – Understanding every aspect of the customer is critical for personalization. Customers are now bombarded with different financial products at the same time. How do you know if a customer is looking for an auto loan? Does the customer intend to purchase a home or an automobile? The place and timing of your marketing efforts matter in creating trust and showing intent to act on the marketing messages. You can also reduce awareness marketing efforts if you provide the knowledge at the right stage of the buyer journey.

AI-powered Virtual Assistants – Consider the case of insurance; a loss or damage may not happen multiple times. It is the single touchpoint to show the customers how you care for them and ease the processes. Customers now prefer efficient self-service options to in-person contacts to process their requests. AI-powered virtual assistants add value in answering all the information queries about products, services, and eligibility criteria in financial services. They are also evolving to validate certain criteria based on the rules updated with the machine learning models. It wouldn’t be a surprise to see that an AI-powered assistant does the insurance claims processing in minutes.

Are you interested in more data and analytics use cases in banking and financial services? Get in touch with our experts to get the mind share.

Marketing Desk

Explore our services.

- Modern Enterprise Apps

- Intelligent Automation

- Data Analytics and Insights

- Azure Cloud Solutions

- Modern Work

- Digital & App Innovation

Get Started

Related Posts

- Data-driven Supply Chain and Packaging Solutions in the “New Normal”

- Why do you Need Automated Data Pipelines for Accelerated Insights?

- How to gain advantages with Azure Synapse Analytics Integrations?

- AI and Automation

- Business Applications

- Cloud Infrastructure

- Data and analytics

- Latest Buzz

- Microsoft Copilot

TAKE THE NEXT STEP

- AI & Automation

- Data, Analytics, and Insights

- Azure Cloud Infrastructure

- Digital & App Innovation

- DigitalClerx

- Case Studies

- Infographics

Get the insights that matter

Stay up-to-date with our latest news, updates, and promotions by subscribing to our newsletter.

Copyright © 2008-2023 Saxon. All rights reserved | Privacy Policy

Address: 1320 Greenway Drive Suite # 660, Irving, TX 75038

- Gen AI consulting workshop

- Gen AI for Business

- Microsoft 365 Copilot

- Gen AI for Sales

- Low-Code/No-Code Development

- Microsoft Teams App Development

- Intelligent Business Apps

- Microsoft Power Platform

- App Modernization

- Saxon Vision AI Suite

- Process Intelligence

- Intelligent Document Processing

- Conversational AI

- Robotic Process Automation

- Intelligent Back Office Automation

- Azure AI for Contact Centers

- Data and Analytics

- Microsoft Fabric Services

- Data Engineering and Governance

- Data Migration and Modernization

- Data Visualization & Reporting

- Data Science and Machine Learning

- Azure Consulting Services

- Azure Implementation Services

- Azure Managed Services

- Azure Cost Optimization

- Copilot for Modern Work

- Document Management System

- Intelligent intranet

- Intelligent enterprise search

- Intelligent AI Apps

- DevOps Implementation

- DevOps Consulting Services

- Application Migration

- Azure Integration

- Immersion Day

- 3-Week Pilot Consulting Workshop

- Governance Workshop

- AI Use Case Discovery Workshop

- Cognitive Services POC

- Enterprise Automation Strategy

- Intelligent Sales Nudges

- Azure AI Health Bot

- Yellowbrick

- Automation Anywhere

Banking & Financial Services case studies

Explore case studies, articles, white papers, product info, and more..

- Case Studies

- API Management

- Banking and Financial Services

- B2B Integration

- Financial Accounting Hub

- Healthcare and Life Sciences

- Managed Cloud Services

- Managed File Transfer

- All Case Studies

- Product Info

- Amplify Enterprise Marketplace

- Amplify Integration

- Amplify Platform

- Axway B2B Integration

- Axway Business Network (VAN)

- Axway eInvoicing

- Axway Financial Accounting Hub

- Axway Managed File Transfer

- Axway Validation Authority (VA) Suite

- Specialized Products

- IT Challenges

- Govern APIs

- Secure APIs

- Analyst and research reports

- Manage complexity

- Modernize EDI & B2B

- Move B2B to cloud

- Move MFT to cloud

- Enable Intelligent MFT

- Business Needs

- Accelerate digital projects

- Productize APIs

- Monetize APIs

- Build an API marketplace

- Secure file transfers

- Energy and Utilities

- Government and Public Sector

- Manufacturing, Automotive, and CPG

- Telecommunications

- Transportation and Logistics

- Data sheets

- Infographics

- Reports & survey results

- Solution briefs

- Topical flyers

- White papers

Open banking. The art of the possible in 10 use cases.

- Share this Asset

10 open banking uses cases

How can financial services companies drive real value and service clients better through open banking ? A new report by Altitude Consulting and Axway details a number of use cases to help you visualize the art of the possible in open banking and imagine new ways to grow your organization’s capabilities, gain a competitive edge, and deliver superior customer experiences. Here are 10 of them:

No. 1: Account aggregation

Open banking offers secure APIs for accessing financial account data and benefits all parties: banks, account owners, and fintechs. With open banking, banks have greater control and visibility into third parties that are accessing their clients’ financial data and the purpose for which the data is being used.

No. 2: Consumer spending insights

Financial documents and data from external credit and bank accounts can bridge the gap between banking and buying, uncovering opportunities for banks to proactively engage customers. Customer life stages, psychographics, brand loyalties and other triggers help to create a personalized experience.

No. 3: Buy now, pay later

BNPL (By Now Pay Later) fintechs use the banking systems to verify consumers’ identity, retrieve financial information, verify accounts, conduct KYC checks and make lending decisions. Consent management allows consumers to grant access to data for loan applications and credit approvals which improves conversion rates.

No. 4: Wealth management

Wealth management with open banking capabilities makes serving customers more efficient. Customer permission to retrieve data from external accounts, and conducting a digital KYC, smooths onboarding for new and existing customers looking to take advantage of the bank’s financial planning services.

No. 5: Insurance Sales

Banks can analyze customer data for insurance triggers to provide personalized insurance offers through online and mobile channels. Such triggers are found in personal information updates, purchasing data from external cards aggregated through open banking, and location data from a bank’s mobile app.

No. 6: Personalizing products and experiences

Open banking allows banks to combine data from external sources, including other banks, brokerages, credit issuers and investment managers, and combine it with first party data such as buying history, credit score, income, age and location, to build a deep understanding of each client’s unique needs.

No. 7: Bill payment and management

Improved billing and payment capabilities offer customers more payment options and increase customer engagement. Open banking APIs let billers send bills directly through the bank’s channels and use detailed consumer behavior data to deepen loyalty and offer the right product at the right time.

No. 8: Tax preparation

Open banking provides a number of tax preparation benefits. With a direct connection from bank systems to popular accounting platforms to retrieve tax data, banks will realize operational efficiencies, be able to serve consumer and business clients better, and reduce call volumes during tax season.

No. 9: Payment initiation

Open banking lets consumers and corporations initiate payments directly from their online banking accounts without entering routing data, simplifying the payment experience. Multiple payment options are available within the same payment interface and payments are often processed in minutes or hours.

No. 10: Streamlining account opening

With open banking, digital ID verification and cross- referencing with external accounts reduces manual input by the user, speeding account opening. Funding is done directly from another bank account via ACH transfers. Virtual cards allow new customers to make purchases as soon as the account is funded. * Download this open banking checklist as a pdf

Previous Asset

Take a quick look at the highlights - then get the full story on how Axway improves collaboration and innov...

Amplify API Management Platform helps Commerzbank turn traditional, branch-based services into seamless dig...

Other content in this Stream

Rapidly deploying API-driven products with Axway

The ability for open banking to open up customer data to third party payment vendors will give the banks the ability to provide their customers with better services. In this video, Laurent Van Huffel

Learn about some of the concerns with screen scraping and how open banking can solve common issues while making innovation easier.

Open banking APIs are your financial institution’s product offerings, and your most important channel to market. Here’s why a marketplace helps cater to the business leaders AND product managers.

What are the necessary components in an open banking solution, and does it make more sense to buy a specialized solution or build it yourself? It depends on your objectives.

Learn who's putting the customer first in the economy of embedded finance

Read this infographic to see 6 things you need to know about accessing and using customer data, including what screen scraping is, what the pitfalls are, and how it's different than open banking.

See how Tribanco digitally transformed to go beyond regulatory compliance and find new open banking opportunities?

Start delivering digital banking services to your members

See why and how credit unions and smaller banks are making digital banking services accessible for everyone, anywhere with universal API management

Here are three digital banking example uses cases to help you imagine new ways to grow your organization’s capabilities, gain a competitive edge, and deliver superior customer experiences.

Putting power in the hands of the business line

To better serve their customers with added-value digital services, Commerzbank shifted from the traditional banking market to the open banking market using Axway’s Amplify Platform.

Powered by Axway’s Amplify API Management Platform, Commerzbank is now able to create new business models enabling innovative fintech partnerships.

Take a quick look at the highlights - then get the full story on how Axway improves collaboration and innovation in financial ecosystems.

Amplify API Management Platform helps Commerzbank turn traditional, branch-based services into seamless digital experiences.

Find out how banks are using their data to gain a competitive edge. This opportunity assessment explores 15 popular fintech use cases.

Transparent Data is a Polish technology company that has created its own business category in data software since 2013. Thanks to a unique combination of high technical competence and experience...

There’s a revolution happening in the financial sector, and in many areas, it’s happening fast. Technology is transforming the way we do just about everything, and financial services are no...

PermataBank is one of Indonesia’s leading banks and a pioneer in mobile banking and mobile cash technology. Its success in harnessing the potential of APIs to drive new revenue and build...

- Share this Hub

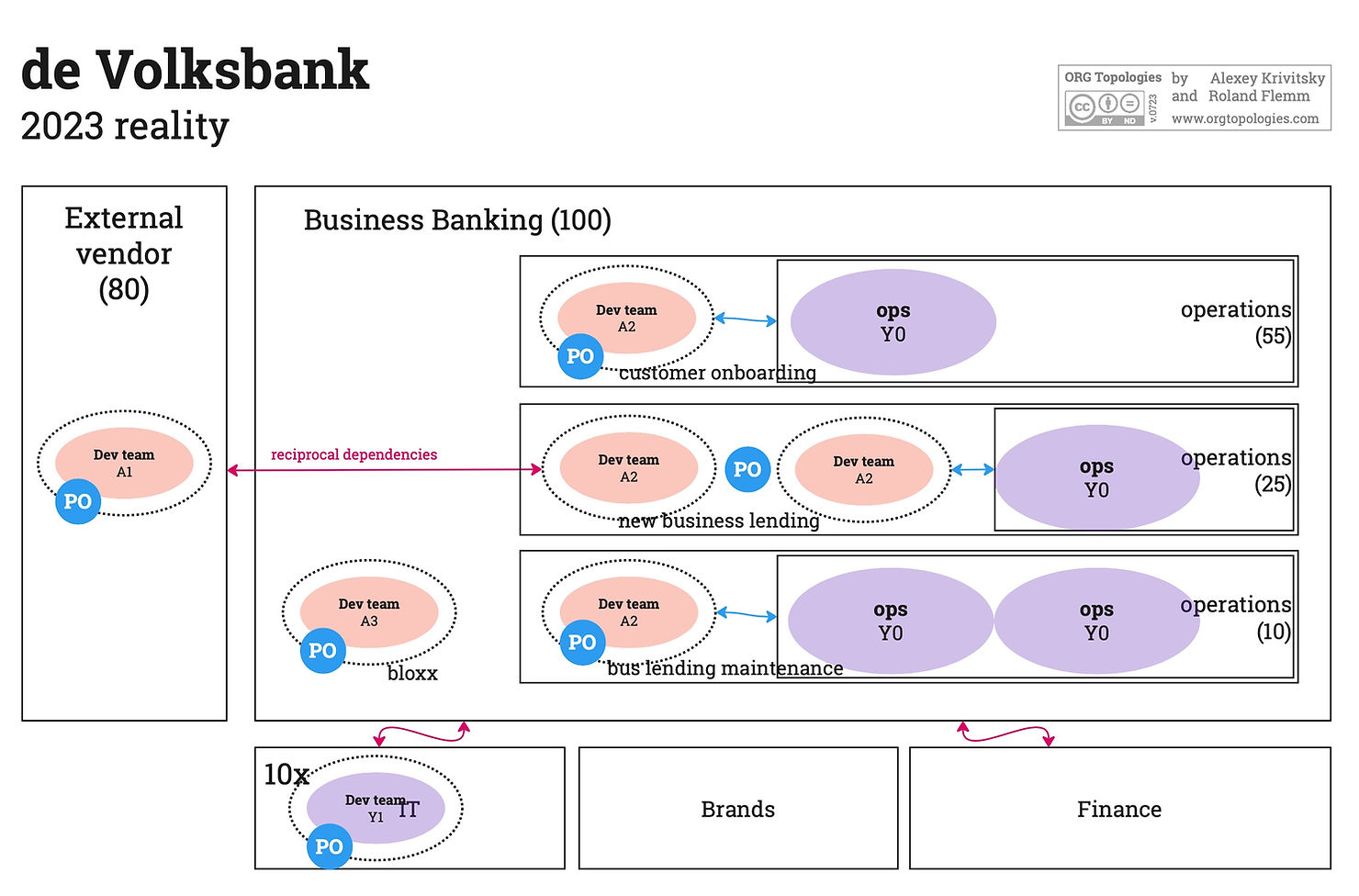

Case Study: the Business Banking Transformation Journey at De Volksbank

- Website for Roland Flemm

- Contact Roland Flemm

- Twitter for Roland Flemm

- LinkedIn for Roland Flemm

- Facebook for Roland Flemm

- GitHub for Roland Flemm

De Volksbank is the fourth largest bank in the Netherlands. The bank was formed two hundred years ago from regional savings banks. Today, de Volksbank focuses on consumers, independent entrepreneurs, and small and medium-sized enterprises. The bank operates mainly in the areas of payments, savings, and mortgages.

In 2021 a new four-year strategic agenda was introduced focusing on growth by strengthening customer relationships and further increasing the banks' social impact. To realize this ambition, a transformation was initiated that aimed at implementing a uniform agile way of working with independent, integrally responsible customer journey teams. The new strategy should make the bank more customer-centric and enable them to get better, faster, and more effective at delivering value to customers.

The transformation impacted the whole bank. In March 2022, about 3,000 people faced either a change of work, a change of team, and/or a change in the way of working. In the new structure, the bank was split into 14 "Hubs". These are value areas with P&L responsibility. Each hub is responsible for a specific customer journey. A Hub is set up integrally, which implies that each hub contains business, IT, and operations. The entire organization "flipped" to the new model in March 2022.

This case study analyzes the transformation journey using Org Topologies™ Scans and focuses on the Business Banking Hub. It covers three organizational design phases:

Org scan of the pre-agile setup before August 2021.

Org scan of the 2022 dVM pilot .

Org scan of the current layout per February 2023.

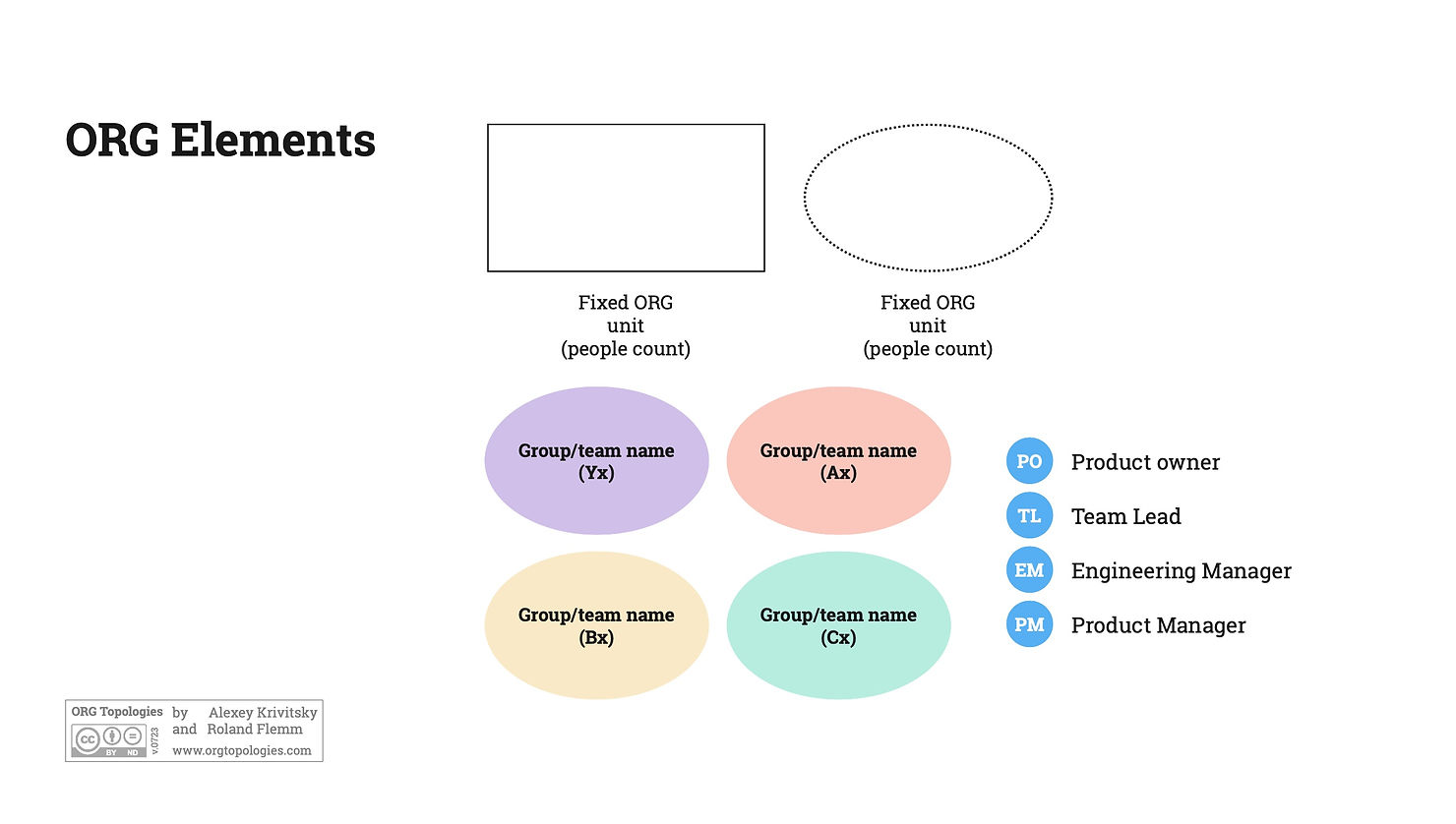

We will clarify the stages with OT maps using the following symbols:

More explanation and background information on Org Topologies™ that help to understand this case study can be found here and here .

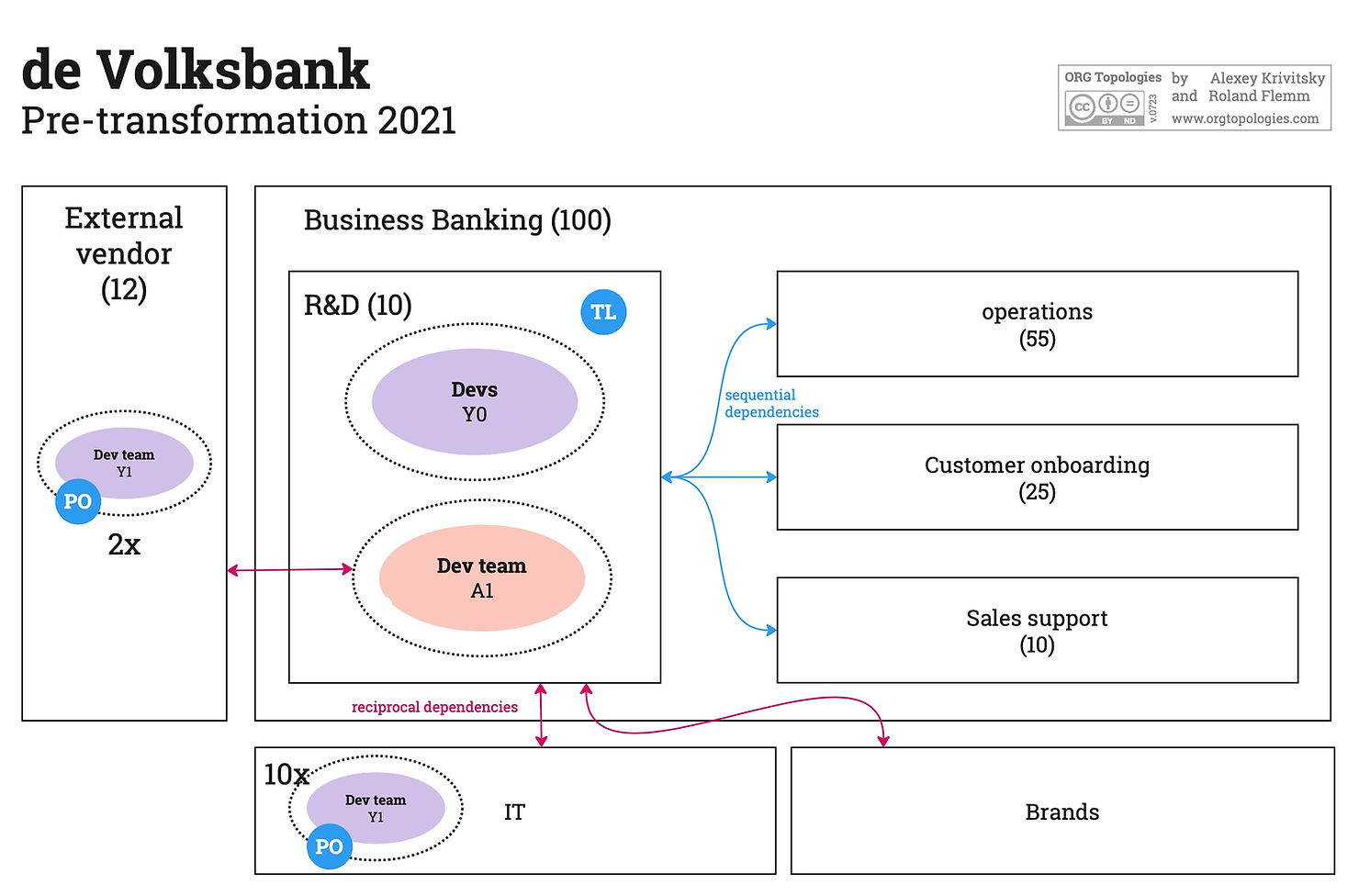

1. Pre-transformation setup before August 2021.

The department "Business Banking" was divided into three sub-departments: Operations, Business Lending Sales Support, and Customer Onboarding. These departments were focused on servicing business customers. A single team "monitoren en verbeteren" (monitor and improve) was responsible for product development. This was the department's R&D team. The picture below is a detailed view of the Business Banking department in deVolksbank prior to the transformation.

Of the 10 people in "monitoren en verbeteren", 6 were tasked to improve the operational workflow of the three operational teams. They had task scope, no product vision, and no value-based prioritization of work. They were working on improvement requests given to them by the operational teams. These requests did not necessarily have high customer value.

They were working as individuals on unprioritized tasks (three operations groups with different requests). They did not have the skills or authorization to make software and configuration changes in the banking systems.

Their work was restricted to:

specifying changes requested by the operational teams,

assigning them as tasks to technical teams somewhere in the adjacent IT group,

chasing progress.

Working as individuals on unprioritized tasks (three operations groups with all kinds of change requests) makes them a Y0-level group on the OT map .

The queue of work was huge due to the long waiting times for the work in progress. Larger and more complex initiatives were hard to implement and took many months, sometimes years to complete. Tasks belonging to these initiatives got stuck in the worklists of teams in the IT department due to unclear decision processes. The people were used to working in an environment where asynchronous communication via email requests was the norm. They were spending most of their time lobbying in IT to get their requests prioritized and negotiating with a vast landscape of stakeholders. A huge amount of time was wasted waiting.

The other 4 people worked as a Scrum team focusing on New Business Lending products. The subgroup's work was specifying and accepting changes in collaboration with an external software company that developed a New Business Lending product. This team specified customer-centric features for the vendor to develop. The team and their PO were decomposing the customer requirements into tasks to hand them over to the vendor's development teams. This makes them an analyst team for the external developers, archetype A1 in "the speculation department" on the OT map.

The New Business Lending team did not suffer from the bank's IT dependencies but had 100% dependency on their external vendor and they had some dependencies on business stakeholders ("Brands"). They were able to deliver value much faster than the teams with internal IT dependencies.

The developers at the vendor were processing tasks for multiple clients. The vendor did not have dedicated teams per client but had two groups of developers working on specific parts of the product.

2. Pilot with feature teams 2021-2022.

Prior to the bank-wide adoption, a new self-invented model (based on team topologies and Spotify) called "dVM" (de Volksbank samenwerkingsModel) was piloted in the Business Banking department. It is noteworthy to mention that this transformation initiative was driven by the Business side of the bank, not by IT, which is more common.

The people working in the R&D team "monitoren en verbeteren" were placed into four groups, each focusing on a specific customer journey. Each group contained one R&D team and one or more service teams. The R&D teams focused on developing products and the service teams kept their focus on daily operations, serving the customer. There was a tight feedback loop between them. The operational teams were important stakeholders, providing valuable customer feedback. Each R&D team had its team PO, prioritizing work on value.

The following groups were created:

The Customer Onboarding group: everything related to smoothly welcoming new customers.

The New Business Lending Group: building new business lending solutions.

The Business Lending Maintenance Group: Supporting existing business lending solutions.

The Bloxx group: developing an approach allowing business customers to configure their own service and product catalog

Each R&D team was formed with cross-functional business people. Each team was able to address a full range of business problems (features) related to their domain but they had no technical expertise. This makes them A1-level teams (analyst teams, or "the speculation department"). The backlogs contained customer-centric features instead of service-oriented tasks.

The fact that the R&D teams did not have IT capabilities was a problem because most of the changes they were working on required changes in IT systems. Some teams were able to do no-code changes, but all 'n all, their technical capabilities were limited.

Although still low on the Org Topologies™ map, this setup was experienced by the team members as a huge improvement because now:

they were working full-time in a steady team,

they were working on the specification and delivery of customer features,