What Is Convergence Theory?

How Industrialization Affects Developing Nations

Danny Lehman/Getty Images

- Key Concepts

- Major Sociologists

- News & Issues

- Research, Samples, and Statistics

- Recommended Reading

- Archaeology

Convergence theory presumes that as nations move from the early stages of industrialization toward becoming fully industrialized , they begin to resemble other industrialized societies in terms of societal norms and technology.

The characteristics of these nations effectively converge. Ultimately, this could lead to a unified global culture if nothing impeded the process.

Convergence theory has its roots in the functionalist perspective of economics which assumes that societies have certain requirements that must be met if they are to survive and operate effectively.

Convergence theory became popular in the 1960s when it was formulated by the University of California, Berkeley Professor of Economics Clark Kerr.

Some theorists have since expounded upon Kerr's original premise. They say industrialized nations may become more alike in some ways than in others.

Convergence theory is not an across-the-board transformation. Although technologies may be shared , it's not as likely that more fundamental aspects of life such as religion and politics would necessarily converge—though they may.

Convergence vs. Divergence

Convergence theory is also sometimes referred to as the "catch-up effect."

When technology is introduced to nations still in the early stages of industrialization, money from other nations may pour in to develop and take advantage of this opportunity. These nations may become more accessible and susceptible to international markets. This allows them to "catch up" with more advanced nations.

If capital is not invested in these countries, however, and if international markets do not take notice or find that opportunity is viable there, no catch-up can occur. The country is then said to have diverged rather than converged.

Unstable nations are more likely to diverge because they are unable to converge due to political or social-structural factors, such as lack of educational or job-training resources. Convergence theory, therefore, would not apply to them.

Convergence theory also allows that the economies of developing nations will grow more rapidly than those of industrialized countries under these circumstances. Therefore, all should reach an equal footing eventually.

Some examples of convergence theory include Russia and Vietnam, formerly purely communist countries that have eased away from strict communist doctrines as the economies in other countries, such as the United States, have burgeoned.

State-controlled socialism is less the norm in these countries now than is market socialism, which allows for economic fluctuations and, in some cases, private businesses as well. Russia and Vietnam have both experienced economic growth as their socialistic rules and politics have changed and relaxed to some degree.

Former World War II Axis nations including Italy, Germany, and Japan rebuilt their economic bases into economies not dissimilar to those that existed among the Allied Powers of the United States, the Soviet Union, and Great Britain.

More recently, in the mid-20th century, some East Asian countries converged with other more developed nations. Singapore , South Korea, and Taiwan are now all considered to be developed, industrialized nations.

Sociological Critiques

Convergence theory is an economic theory that presupposes that the concept of development is

- a universally good thing

- defined by economic growth.

It frames convergence with supposedly "developed" nations as a goal of so-called "undeveloped" or "developing" nations, and in doing so, fails to account for the numerous negative outcomes that often follow this economically-focused model of development.

Many sociologists, postcolonial scholars, and environmental scientists have observed that this type of development often only further enriches the already wealthy, and/or creates or expands a middle class while exacerbating the poverty and poor quality of life experienced by the majority of the nation in question.

Additionally, it is a form of development that typically relies on the over-use of natural resources, displaces subsistence and small-scale agriculture, and causes widespread pollution and damage to the natural habitat.

- Definition of Self-Fulfilling Prophecy in Sociology

- Feminist Theory in Sociology

- Overview of Sociobiology Theory

- How Expectation States Theory Explains Social Inequality

- How Our Aligning Behavior Shapes Everyday Life

- Assessing a Situation, in Terms of Sociology

- Understanding Resocialization in Sociology

- Deviance and Strain Theory in Sociology

- Power Definitions and Examples in Sociology

- What Is the Resource Mobilization Theory?

- Understanding Diffusion in Sociology

- What Is Multiculturalism? Definition, Theories, and Examples

- Hypothetico-Deductive Method

- What Is Groupthink? Definition and Examples

- Definition of Systemic Racism in Sociology

- All About Relative Deprivation and Deprivation Theory

Save 10% on All AnalystPrep 2024 Study Packages with Coupon Code BLOG10 .

- Payment Plans

- Product List

- Partnerships

- Try Free Trial

- Study Packages

- Levels I, II & III Lifetime Package

- Video Lessons

- Study Notes

- Practice Questions

- Levels II & III Lifetime Package

- About the Exam

- About your Instructor

- Part I Study Packages

- Parts I & II Packages

- Part I & Part II Lifetime Package

- Part II Study Packages

- Exams P & FM Lifetime Package

- Quantitative Questions

- Verbal Questions

- Data Insight Questions

- Live Tutoring

- About your Instructors

- EA Practice Questions

- Data Sufficiency Questions

- Integrated Reasoning Questions

Convergence Hypotheses

Convergence refers to a situation where countries with low per capita incomes grow faster than countries with high per capita incomes. Consequently, with time, the per capita income for developing countries converges with that of developed countries.

Types of Convergence Hypotheses

- Absolute convergence.

- Conditional convergence.

- Club convergence.

The neoclassical growth theory forecasts unconditional and conditional convergence. The endogenous growth model, however, does not predict any occurrence of convergence.

Absolute Convergence

The Absolute convergence implies that the developing countries, despite their unique features, will grow and eventually attain the developed countries’ per capita income. Since the neoclassical model assumes that all countries have the same level of technology, the per capita income in all countries should grow at the same rate. However, neoclassical growth theory means that the per capita income level will be equal in all countries, given the prevailing characteristics (does not insinuate the absolute convergence).

Conditional Convergence

Conditional convergence is where the convergence is dependent on countries that have equal saving rates, population growth rates, and production functions. If these conditions hold, the neoclassical growth theory will imply convergence to the same per capita output and steady-state growth rate.

Club Convergence

Club convergence implies a group (club) of only rich and middle-income countries whose income converges to that of the wealthiest country in the world. Therefore, member countries of the club with low per capita income will grow faster than the non-members. Emerging countries will only join the club if they execute necessary institutional changes. If the new members fail to implement these changes, they will fall into a non-convergence gap.

Ways in Which Convergence Occurs

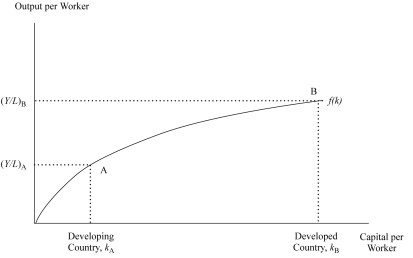

Capital deepening and accumulation : Developed countries are almost at the flattened point of the production function (point B). This implies that more capital injection will not impact output much. On the other hand, developing countries operate at the lowest point of the production function(point A), as seen in the graph below. Therefore, any capital injection will have a positive impact on the output.

- Adoption of technology that is already popular in advanced countries . Developing countries employ technology from developed countries to boost their incomes.

Question 1 A developing country is concerned about its illiteracy and the low standard of living. The government appoints a committee to benchmark an advanced country and develop strategies to increase the country’s output. Which of the following plans considered by the committee will most likely delay convergence with the advanced (developed) country? Creation of policies that encourage the return of highly educated citizens. Enforcing high tariffs on imports to protect the growing local industries. Use of external debt to improve transport and manufacturing infrastructure. Solution The correct answer is B . Enforcing high tariffs on imports to protect the growing local industries will discourage growth, and thus it is not supportive of convergence with developed economies. Question 2 An economic researcher asserts that “many countries with the same population growth rate, savings rate, and production function will eventually have growth rates that converge over time.” The convergence the researcher has described is most likely to be: Conditional convergence. Absolute convergence. Club convergence. Solution The correct answer is A . Conditional convergence depends on countries with the same saving rate, population growth rate, and production function. If this condition holds, then the neoclassical model implies convergence to the same per capita output and steady-state growth rate.

Reading 9: Economic Growth

LOS 9 (j) Explain and evaluate convergence hypotheses.

Offered by AnalystPrep

Effects of Potential GDP Growth Rate on Equity and Fixed Income

The rationale for government incentives and growth in an open economy, forecasting costs, the impact of competitive position on ..., value added.

Value-added, also called active return, is the difference between the managed portfolio return... Read More

The Triangular Arbitrage Opportunity

Every bid-offer quote a dealer displays in the interbank FX market should possess... Read More

Academia.edu no longer supports Internet Explorer.

To browse Academia.edu and the wider internet faster and more securely, please take a few seconds to upgrade your browser .

Enter the email address you signed up with and we'll email you a reset link.

- We're Hiring!

- Help Center

The convergence hypothesis: History, theory, and evidence

1998, Open economies review

Related Papers

Applied Economics Letters

Gerry Boyle

SSRN Electronic Journal

Shlomo Yitzhaki

Sandra Quijada

Economics Bulletin

This paper takes a closer look at the typical growth convergence regression of Barro (1991), Mankiw, Romer and Weil (1992), Sala-i-Martin (1996), and others. By interpreting the two components of the regression coefi¬ cient separately, i.e. the correlation coefficient and the ratio of standard deviations, we distinguish between "time-series" convergence and "cross-section" convergence, and consequently the relationship between I²âˆ’ and Iƒâˆ’convergence. And, using data from the latest Penn World Table database (version 9.1), we investigate the convergence or the lack-of-convergence in samples of countries representing the “World†, OECD and Sub-Saharan Africa. The implications of this study for the neoclassical growth model are also discussed.

Angel De la Fuente

Jeffrey Sachs

KALSOOM ZULFIQAR

Convergence debate has been an important topic of economic growth literature. This article aims to investigate convergence at assorted level of disaggregation among a sample of almost 60 countries. It has tested absolute and conditional convergence hypotheses for a set of developed and developing countries by applying pooled least square methodology. The results suggest absolute convergence for countries having similar characteristics and conditional convergence for countries having heterogeneous structures. Disparity level for each country is also calculated with reference to average steady state income. The study has also scrutinized the role of investment, openness and population growth in accelerating the convergence process.

Annali d’Italia, scientific journal of Italy, №13, VOLUME 1, Florence, Italy

Karen Grigoryan

This paper analyzes the nature, causes, and consequences of income convergence in developing countries, and their attempt to catch-up with developed countries. It also addresses the question of sustainability of the convergence in the near future. In the context of income convergence, the relevance of productivity and welfare growth are discussed as indicators of convergence. The paper examines the catch-up growth and convergence approaches in the example of Armenia as a developing economy.

Robert Waldmann

Journal of Yaşar University

Burak Camurdan

In this paper, we study the GDP per capita convergence in emerging market economies for the period of 1950-2008. As the convergence in emerging market economies hasn’t been concerned as much as in the developed countries in the literature, hereby the situation of the convergence in emerging market economies is tried to be found out by the investigation. For this purpose, GDP per capita convergences in 25 developing countries were tested by ADF unit root test, Nahar and Inder (2002) Test and Kapetanios, Snell, and Shin (KSS) (2003) Test, which is based on the non-linear time series technique. While ADF unit root test allows to infer that there is convergence upon to the used series are stationary, the Nahar and Inder (2002) Test asserts that the existence of the convergence could also infer whether the used series are not stationary. On the other hand, the Kapetanios, Snell, and Shin (KSS) (2003) Test reveals that, if non-linear time series are stationary, the convergence could be in...

Loading Preview

Sorry, preview is currently unavailable. You can download the paper by clicking the button above.

RELATED PAPERS

Daniel Ventosa-Santaulària , Manuel Gómez-Zaldívar

Jean NIYIGABA

Vishal Geete , Shubhangi Jore

Marina Solodova

Journal of Economic Surveys

Nazrul islam

Ali Karshenasan

International Review of Economics & Finance

Bharat Kolluri , Farhad Rassekh

Cambridge Journal of Economics

Guilherme Magacho

Journal of Applied Business and Economics

Dr. Pritish Sahu

Review of Economics and Statistics

Frank Lichtenberg

Economic Modelling

Evangelia Desli

Empirical Economics

Franco Peracchi

Gimem Biyapo

Charles I. Jones

Procedia - Social and Behavioral Sciences

Ayça Gürbüz

Abdul Wajid

Annals of Regional Science

charles amelie

RePEc: Research Papers in Economics

Paschalis Arvanitidis

Aysit Tansel , Nil Demet Güngör

Research Papers in Economics

Santiago Gahn

Rainer Maurer

William Milberg

International Economic Review

Ronald Fischer

RELATED TOPICS

- We're Hiring!

- Help Center

- Find new research papers in:

- Health Sciences

- Earth Sciences

- Cognitive Science

- Mathematics

- Computer Science

- Academia ©2024

This website uses cookies.

By clicking the "Accept" button or continuing to browse our site, you agree to first-party and session-only cookies being stored on your device to enhance site navigation and analyze site performance and traffic. For more information on our use of cookies, please see our Privacy Policy .

- Research Highlights

The convergence hypothesis

Research Highlights Article

April 6, 2020

Are poor countries catching up with rich countries?

Tyler Smith

The economies of today’s wealthiest nations raced ahead of the rest of the world about two centuries ago. That event initiated a new era in economic history, one defined by growth.

More recently, countries like Japan seem to have successfully copied this playbook, and it appears others like China are following suit. But unfortunately those countries are the exception rather than the rule, according to a paper in the Journal of Economic Literature .

Authors Paul Johnson and Chris Papageorgiou found there’s little evidence that national economies are catching up to their richest peers. Most low-income countries haven’t been able to maintain what growth spurts they’ve had like traditional economic theory would predict.

“The consensus that we find in the literature leads us to believe that poor countries, unless something changes, are destined to stay poor,” Johnson told the AEA in an interview.

In fact, slowdowns in the poorest countries have left millions in extreme poverty . Understanding which countries are catching up and how they’re doing so could help explain the elusive origins of economic growth.

The consensus that we find in the literature leads us to believe that poor countries, unless something changes, are destined to stay poor. Paul Johnson

The debate over catch-up growth—what economists have dubbed the convergence hypothesis —has a long history. The authors choose to focus on research published over the last 30 years.

In this recent research, capital, technology, and productivity have been at the root of most understandings of economic growth and convergence. But that has traditionally led economists to conclude that however poor a country starts off, it will adopt the best practices of the rich countries and eventually be just as well-off as their forerunners.

That’s the theory. But when the authors looked at the numbers over the last 60 years that’s not what they saw.

Data from the Penn World Tables —which covers 182 countries—revealed an unprecedented level of global growth over the period, but it was spread unevenly across the globe and across income levels.

The researchers separated countries into three income levels: low, middle, and high.

Each decade, high-income countries tended to grow faster than middle-income countries, which in turn tended to grow faster than low-income countries.

Every group experienced periods of relatively slow growth. But low-income countries actually experienced negative average growth rates during the 80s and 90s. The contractions were mostly driven by periods of extreme violence, corruption, and other state dysfunctions.

This unequal growth has led to steadily more and more dispersed national incomes around the world—the opposite of what a strong version of the convergence hypothesis predicts.

But while there wasn’t any absolute convergence, the researchers did find that the literature supported the idea of “convergence clubs.” In other words, countries that started with a similar income level in 1960 still had a similar income level in 2010, the end of the dataset.

The convergence clubs might be a clue for national leaders. According to Johnson, it suggests that policy interventions need to be bold enough to reach the next rung in the income ladder, or they risk slow, start-and-stop growth.

It also might help make sense of why some countries jump out of low-income clubs and eventually join the richest one, while other countries are stuck in poverty or middle-income traps.

Still other types of convergence are possible. Previous work has found that within some industries, such as manufacturing, convergence is happening. Countries may need to organize their workforces around these sectors to jumpstart growth.

As the authors point out, even half a century is short compared to the long run. The limited data span may mean that pessimism isn’t ultimately warranted, but the authors’ work warns against being complacent.

“There have been signs of a little catch-up over the last few years . . . but we don't know if that will continue,” Johnson said.

“ What Remains of Cross-Country Convergence? ” appears in the March issue of the Journal of Economic Literature.

The Great Divergence

This video explains how technology diffusion contributes to the growing productivity gap between rich and poor countries.

Can pathogen concentrations explain which countries developed sooner?

A new unified growth model of the demographic transition

IFT Summer Sale is Live! Avail up to 50% Discount Now!

- Essential Concept 18: Convergence Hypotheses

According to the convergence hypotheses, countries with low per capita incomes should grow at a faster rate than countries with high per capita income and eventually converge. The neoclassical model predicts two types of convergence: absolute and conditional.

Absolute convergence implies that developing countries, regardless of their particular characteristics, will eventually catch up with the developed countries and match them in per capita output.

Conditional convergence implies that convergence is conditional on the countries having the same saving rate, population growth rate and production function. If these conditions hold the model implies convergence to the same level of per capita output as well as the same steady state growth rate.

However, empirical evidence suggests that some poor countries are converging while others are not. This explained by the club convergence hypothesis.

Club convergence implies that only rich and middle-income countries that are members of the club (Countries which develop appropriate legal, political and economic systems; open trade and capital flow)are converging to the income level of the richest countries of the world. Countries with the lowest per capita income in the club grow at the fastest rate.

Countries outside the club without appropriate institutional structures may fall into a non-convergence trap.

- Essential Concept 1: Ethical Responsibilities Required by the Code and Standards

- Essential Concept 2: Standard Error of Estimate, Coefficient of Determination, Confidence Interval for a Regression Coefficient

- Essential Concept 3: Analysis of Variance (ANOVA)

- Essential Concept 4: Confidence Interval of Regression Coefficient, Predicted Value of the Dependent Variable (Y)

- Essential Concept 5: Problems in Regression Analysis

- Essential Concept 6: Linear vs Log-Linear Trend Models

- Essential Concept 7: Autoregressive (AR) Models

- Essential Concept 8: Supervised Machine Learning Algorithms

- Essential Concept 9: Unsupervised Machine Learning Algorithms

- Essential Concept 10: Data Prep & Wrangling

- Essential Concept 11: Model Training

- Essential Concept 12: Comparison of Scenario Analysis, Decision Trees, and Simulations

- Essential Concept 13: Triangular Arbitrage

- Essential Concept 14: International Parity Conditions

- Essential Concept 15: Effects of Monetary and Fiscal Policy on Exchange Rates

- Essential Concept 16: Growth Accounting Relations

- Essential Concept 17: Theories of Economic Growth

- Essential Concept 19: Regulatory Interdependencies

- Essential Concept 20: Benefits and Costs of Regulation

- Essential Concept 21: Investments in Associates and Joint Ventures

- Essential Concept 22: Business Combinations

- Essential Concept 23: Components of Pension Costs

- Essential Concept 24: Impact of Key DB Pension Assumptions

- Essential Concept 25: Stock Options

- Essential Concept 26: Translation Methods

- Essential Concept 27: Comparison of Current Rate and Temporal Methods

- Essential Concept 28: The CAMELS Approach to Analyzing a Bank

- Essential Concept 29: Analyzing a Property & Casualty Insurance Company

- Essential Concept 30: Analyzing a Life and Health Insurance Company

- Essential Concept 31: Quality of Financial Reports

- Essential Concept 32: Potential Problems that Affect the Quality of Financial Reports

- Essential Concept 33: Integration of Financial Statement Analysis Techniques

- Essential Concept 34: Capital Budgeting: Determining Cash Flows

- Essential Concept 35: Economic Profit, Residual Income, and Claims Valuation

- Essential Concept 36: Modigliani–Miller Propositions

- Essential Concept 37: Dividend Payout Policies

- Essential Concept 38: Evaluating Corporate Governance Policies and Procedures

- Essential Concept 39: Identifying and Evaluating ESG-Related Risks and Opportunities

- Essential Concept 40: Mergers and Industry Life Cycles

- Essential Concept 41: Target Company Valuation

- Essential Concept 42: Intrinsic Value and Sources of Perceived Mispricing

- Essential Concept 43: Return Concepts

- Essential Concept 44: Equity Risk Premium

- Essential Concept 45: Estimating Required Return on Equities

- Essential Concept 46: Top-down and Bottom-up Approaches

- Essential Concept 47: Impact of Competitive Factors in Prices and Costs

- Essential Concept 48: Dividend Discount Model (DDM)

- Essential Concept 49: Gordon Growth Model

- Essential Concept 50: Multistage Dividend Discount Models

- Essential Concept 51: FCFF and FCFE Approaches to Valuation

- Essential Concept 52: Calculating FCFF and FCFE

- Essential Concept 53: Estimating Company Value using Cash Flow Models

- Essential Concept 54: Commonly Used Price Multiples

- Essential Concept 55: EV Multiples

- Essential Concept 56: Residual Income, Economic Value Added (EVA), and Market Value Added (MVA)

- Essential Concept 57: Residual Income Model

- Essential Concept 58: Residual Income Valuation

- Essential Concept 59: Strengths and Weaknesses of Residual Income Models

- Essential Concept 60: Market Approach Methods for Valuing Private Companies

- Essential Concept 61: Valuation Discounts and Premiums for Private Companies

- Essential Concept 62: Forward Pricing and Forward Rate Models

- Essential Concept 63: Riding the Yield Curve or Rolling Down the Yield Curve

- Essential Concept 64: Traditional Term Structure Theories

- Essential Concept 65: Pricing a Bond using a Binomial Tree

- Essential Concept 66: Confirming the Arbitrage-Free Value of a Bond

- Essential Concept 67: Relationships between the Values of a Callable or Putable Bond, Straight Bond, and Embedded Option

- Essential Concept 68: Duration

- Essential Concept 69: Components of a Convertible Bond’s Value

- Essential Concept 70: Structural Versus Reduced-Form Models

- Essential Concept 71: Value of a Bond and its Credit Spread, Given Assumptions about the Credit Risk Parameters

- Essential Concept 72: Credit Analysis of Securitized Debt

- Essential Concept 73: CDS Description; Single Name and Index CDS

- Essential Concept 74: Credit Events and Settlement Protocols

- Essential Concept 75: Principles and Factors which Influence CDS Pricing

- Essential Concept 76: FRA Pricing and Valuation

- Essential Concept 77: Fixed-Income Forward and Futures Contracts

- Essential Concept 78: Interest Rate Swaps

- Essential Concept 79: Binomial Model: Expectations Approach

- Essential Concept 80: The BSM Model

- Essential Concept 81: Delta Hedging and Gamma Risk

- Essential Concept 82: Income Approach to Value Real Estate

- Essential Concept 83: Cost Approach to Value Real Estate

- Essential Concept 84: Net Asset Value Approach - REITs

- Essential Concept 85: Relative Value Approach - REITs

- Essential Concept 86: Private Equity Fund Structures, Terms, Valuation and due Diligence

- Essential Concept 87: Evaluating a PE Fund’s Performance

- Essential Concept 88: Theories Explaining Futures Returns

- Essential Concept 89: Components of Futures Returns

- Essential Concept 90: The Creation/Redemption Process - ETFs

- Essential Concept 91: ETFs in Portfolio Management

- Essential Concept 92: Factor Models in Return Attribution

- Essential Concept 93: Factor Models in Risk Attribution

- Essential Concept 94: Value at Risk

- Essential Concept 95: Sensitivity Risk Measures

- Essential Concept 96: Short-term rates and the business cycle

- Essential Concept 97: Yield Curves

- Essential Concept 98: Decomposition of Value Added

- Essential Concept 99: The Full Fundamental Law

- Essential Concept 100: Market Fragmentation

- Essential Concept 101: Types of Electronic Traders

- KNOWLEDGE CENTER

- IFT GUARANTEE

Sign up to get more!

I have already signed up Login

Additional features are available if you log in

The Convergence Hypothesis: Types and Paths | Economic Growth

Let us make an in-depth study of the Convergence Hypothesis. After reading this article you will learn about: 1. Types of Convergence 2. Possible Paths of Convergence.

Types of Convergence :

There are three types of convergence unconditional convergence, conditional convergence and no convergence.

(i) Unconditional Convergence:

By unconditional convergence we mean that LDCs will ultimately catch up with the industrially advanced countries so that, in the long run, the standards of living throughout the world become more or less the same. The Solow model predicts unconditional convergence under certain special conditions. For example, let us suppose that different countries of the world differed mainly in their capital-labour ratios.

ADVERTISEMENTS:

Normally, rich countries have high capital-labour ratio and high levels of output per worker. By contrast, low income countries have low capital-labour ratios and low levels of output per worker. We also assume that two groups of countries are the same in all other respects such as saving rates, population growth rates and the production function.

If this is true then the Solow model predicts that, in spite of any differences in initial capital-labour ratios, all these countries will ultimately attain the same steady state. Differently put, if countries have the same fundamental characteristics, capital-labour ratios and living standards will unconditionally converge, even though some countries may start from way behind.

(ii) Conditional convergence:

Even if countries differ in their saving rates, population growth rates and production functions (due to unequal access to technology) they will converge to different steady state with different capital-labour ratios and different standards of living in the long run. If countries differ in the fundamental characteristics, the Solow model predicts conditional convergence.

This means that standards of living will converge only within groups of countries having similar characteristics. For example, if there is conditional convergence, a low income country with a low saving rate may catch up, one day or the other, a richer country that also has a low saving rate, but it will never catch up a rich country that has a high saving rate.

One reason for this is that poor countries have less capital per worker and thus higher marginal products of capital than do rich countries. So savers in all countries will be able to earn the highest return by investing in poor countries. Eventually, borrowing abroad will allow initially poor countries’ capital-labour ratios and output per worker to be the same as in initially rich countries.

(iii) No convergence:

The third possibility is no convergence. This means that the low income countries will never catch up over time. Therefore living standards may even diverge due to widening income gap — the rich getting richer and poor getting poorer.

Possible Paths of Convergence :

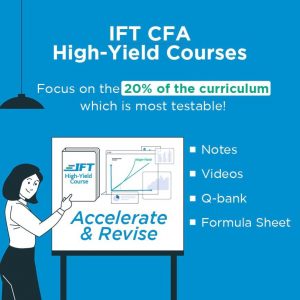

In Fig. 4.14(a) and 4.14(b) we show the possible paths of convergence and divergence of per capita output. In Fig. 4.14(a) T r represents the steady state growth path of the rich country. The slope of this line represents the rate of growth for the poor country. Three options are open to them.

Here T p represents a steady state growth path in which the rich and poor countries grow at the same rate. A favourable shock at time t 0 leads to convergence of output per capita in rich and poor countries as shown by the steady state growth path T p .

An adverse shock that slows down the growth rate of the poor country in the short run but leads to the same steady state growth as in T p is indicated by the growth path T’ p . The dotted line indicates movement outside of steady state.

Fig 4.14(b) shows divergence between the rich and poor countries. T r and T represent the steady state growth paths of the rich and poor country. We find divergence of per capita outputs across two countries over time. Here the scenario is different.

Irrespective of favourable shock (T h ) or an adverse shock (T’ p ) the steady state growth rate is the same as in T p , and long-run income per capita in the rich country will increasingly diverge from that in the poor country. The solid lines in both diagrams are steady state paths whereas the dotted lines represent transitions to equilibrium in response to a shock.

The path T h in Fig 4.14(a) shows how absolute convergence — in the sense of the same growth rates as also the same growth path — occurs. This is a strong form of convergence. A weaker form of convergence — called conditional convergence — is depicted by the paths T’ p and T p which show the same growth rates but different growth paths among countries.

The vertical distance of the growth path of a poor country from that of a rich country represents income differences due to differences in underlying parameters such as savings rates and population growth.

The developing countries can have free access to the technology developed by the pioneers. This implies that latecomers have a potential advantage over pioneers — an advantage of backwardness.

In the course of adopting and adapting new techniques, IRS appear in the guise of learning-by-doing. No doubt the firms which adopt new techniques find an improvement in efficiency following the adoption.

Hence, if firms in LDCs organise themselves so as to profit from the accumulated experienced as fully as do firms in developed countries and such improvements have a ceiling that is reached in finite time or cumulative output, as seems plausible, then catching up in that particular time of production with the technique in question will be complete.

Unfortunately from the point of view of the world’s low income countries there is hardly any empirical support for unconditional convergence. Most studies have found little tendency for low income countries to catch up with their rich counterparts.

Related Articles:

- Solow Model of Economic Growth: Prediction and Theory

- Convergence and Poor Countries: 3 Mechanisms | Economics

- Solow’s Neoclassical Growth Model | Economic Growth | Economics

- Economic Growth in Asian Countries

Convergence Theory: 10 Examples and Definition

Viktoriya Sus (MA)

Viktoriya Sus is an academic writer specializing mainly in economics and business from Ukraine. She holds a Master’s degree in International Business from Lviv National University and has more than 6 years of experience writing for different clients. Viktoriya is passionate about researching the latest trends in economics and business. However, she also loves to explore different topics such as psychology, philosophy, and more.

Learn about our Editorial Process

Chris Drew (PhD)

This article was peer-reviewed and edited by Chris Drew (PhD). The review process on Helpful Professor involves having a PhD level expert fact check, edit, and contribute to articles. Reviewers ensure all content reflects expert academic consensus and is backed up with reference to academic studies. Dr. Drew has published over 20 academic articles in scholarly journals. He is the former editor of the Journal of Learning Development in Higher Education and holds a PhD in Education from ACU.

Convergence theory predicts that cultures worldwide will gradually grow increasingly similar due to globalization.

According to this theory, the further nations progress along their industrialization journey towards becoming fully industrialized powers, they will increasingly emulate other developed countries in terms of technology and cultural norms , leading to one transnational culture .

So, as countries become increasingly linked and globalized, they will tend to imitate each other’s governmental systems (such as democracy rather than communism), economic models (capitalism, socialism, or a blend of both), and collective values.

Such a convergence process is believed to lead to a more homogenous world where nations and societies are increasingly similar.

Definition of the Convergence Theory

The convergence theory states that as the world continues to develop, expansion in technology and globalization will cause cultures around the globe to increasingly become more similar in a process called cultural convergence (Hess, 2016).

Over time, such a convergence of diverse social groups could lead to a unified global society with greater uniformity amongst its members.

According to Wilensky (2002),

“…convergence theory is the idea that as rich countries got richer, they developed similar economic, political, and social structures and to some extent common values and beliefs” (p. 3).

Bryant and Peck (2007) state that “the industrialization process is so strong it substantially transforms any society that is industrializing” (p. 189).

In other words, globalization and increased economic integration are believed to lead to a more homogenous world where different nations and societies become increasingly similar regarding their economic, political, and cultural practices.

Convergence theory provides a helpful lens for studying sociological topics such as socioeconomic development, modernization, and globalization.

Overall, convergence theory is a helpful tool for understanding the effects that increased global interconnectedness can have on societies and cultures worldwide.

10 Examples of Convergence Theory

- The spread of the English language : As countries become more intertwined, English has risen to the top as a global language of commerce, education, and communication. For example, in numerous nations worldwide, it is now employed as an aviation lingua franca, while many international businesses also rely on it when corresponding. In essence, English is the bridge that brings people from around the globe together.

- The rise of high-tech industries : As the world progresses and countries become more interconnected, they often follow similar industrial trends. For instance, biotechnology and information technology are two sectors in which many nations invest heavily; The United States and China both devote considerable resources to cyberspace security research.

- The increase of democracy : For a long time, democracy was considered a concept exclusive to the Western world and was only prevalent in European and American countries. Nonetheless, it has spread to many other nations in recent decades, indicating a trend toward the convergence of political systems toward democracy.

- The spread of consumer culture : The expansion of consumer culture has been accelerated by globalization, leading to an almost worldwide standardization in the types of products consumed. Today, many people worldwide go to McDonald’s, shop at Walmart, and wear clothing made by Nike.

- Religious convergence : As interfaith dialogue and progressive religious movements gain traction, we have begun to see a convergence of beliefs and spiritual practices across cultures. This shift towards accepting different faiths can lead to greater understanding among people from various backgrounds, fostering an environment where diversity is respected and celebrated.

- Social convergence : As countries become more interconnected, they adopt similar social norms and values. It is evident in attitudes toward gender, marriage, and sexuality. So, in some respects, societies are becoming more alike.

- The rise of the middle class : Countries worldwide are increasingly experiencing growth in their middle classes, leading to a convergence of lifestyles and behaviors.

- The spread of mass media : As nations become more interrelated, they often adopt comparable preferences regarding the media they consume. It can result in a more integrated global culture and a greater mutual understanding of diverse cultures.

- The spread of education : Globalization has seen an increased spread of education across the world. Now, many countries are adopting the UK and US systems of education and teaching methods, leading to greater convergence in educational practices.

- The prevalence of global health : The increased spread of medical knowledge and the emergence of international health programs has led to a more unified approach to health care across nations. For example, more countries are adopting the World Health Organization’s guidelines and standards for health.

Origins and History of Convergence Theory

In the mid-1960s, American sociologist Clark Kerr introduced a groundbreaking concept – the theory of convergence. It asserted that societies around the globe were continuously becoming more and more alike despite diverse cultural backgrounds (Brubaker, 2022) .

Kerr believed that this process was being driven by changes in technology, communication, and transportation that allowed for increased international trade and collaboration.

He argued that homogenizing cultures would create a utopian world without conflicts and disparities (Brubaker, 2022).

Kerr’s ideas were developed further by other sociologists in the late 20th century. These theorists argued that convergence was more than just a simple process and could have a tangible impact on how societies interact.

The technological version of Galbraith’s “convergence” has also gained wide popularity. He linked the future of the industrial system with the convergence of two systems – capitalist and socialist (Mishra, 1976).

Galbraith explained the inevitability of “convergence” because the large scale of production, characteristic of developed capitalist and socialist countries, requires an approximately similar planning and organization system.

One of the options for convergence was proposed by the outstanding Dutch mathematician and economist Tinbergen, who put forward the theory of “optimal order” (Don, 2019).

According to Tinbergen, as a result of the synthesis of both systems – some elements of “capitalist efficiency” and “socialist equality” – an “optimal system” is formed, the main principles of which are the peaceful coexistence and business cooperation of states (Don, 2019).

Today, convergence theory is used to understand the effects of globalization and how it impacts different societies. It also explains why specific trends, such as consumer culture and democracy, have become more prevalent in recent years.

Overall, convergence theory has become essential for understanding the forces shaping our world today.

Convergence Theory vs. Divergence Theory

Convergence theory seeks to explain how societies become more alike, while divergence theory accounts for the ways in which they grow increasingly distinct.

Convergence theory suggests that countries adopt similar social norms and values as they become more interconnected (Hess, 2016).

On the other hand, divergence theory claims that as societies move further from each other geographically and culturally, they become increasingly dissimilar (Brubaker, 2022).

So, while some countries embrace same-sex marriage as an accepted form of union, other nations condemn it entirely. Divergence theorists explain this difference due to two societies growing apart and developing distinct values.

Ultimately, divergence and convergence theories explain how societies change over time. While the former focuses on differences between cultures, the latter focuses on similarities that might arise from increased global connections.

Importance of Convergence Theory

Convergence is not just one of the hobbies or inventions but a requirement of the time associated with the search for socio-economic alternatives.

In particular, the 2020 economic crunch made it clear that the world could not adequately respond under the existing socio-economic model since its structure is based on methodological individualism.

Thus, the idea of the adherents of convergence was confirmed that the market form of economy applies only to a part of socio-economic relations and, in many cases, turns out to be harmful and powerless.

Furthermore, convergence theory also has implications for social cohesion and stability in any community.

As societies become more similar, there may be less social tension and conflict as people share similar values, beliefs, and practices, promoting social harmony and reducing the risk of civil unrest.

Notably, convergence theory can encourage international cooperation and collaboration. It suggests that countries can learn from each other’s experiences and adopt best practices to promote growth and development.

Critique of Convergence Theory

As convergence theory has become highly regarded in many fields, it is still subject to criticism since ignores cultural and historical differences, overlooks power and inequality, and oversimplifies complexity .

1. It Ignores Cultural and Historical Differences

Convergence theory assumes that all societies will converge towards similar values, beliefs, and practices as they become more modern or more connected to the global economy.

However, this assumption ignores that different societies have unique cultural and historical backgrounds that shape their development differently (Hay & Couldry, 2011).

For example, the modernization process in Japan has been very different from that in India or Brazil.

2. It Overlooks the role of Power and Inequality

Convergence theory often overlooks the role of power and inequality in shaping social change .

Furthermore, it disregards the fact that many societies may move in different directions, with some populations more likely to experience advantages from convergence than others.

3. It Oversimplifies Complexity

Convergence theory tends to oversimplify the complex social, economic, and political processes that shape social change.

This idea presumes that all societies will progress towards the same goal, regardless of any distinctions in economic standings or governmental systems.

In reality, many factors influence the development of societies, making it difficult to predict which direction a community will take accurately (Form, 1979).

So, while convergence theory may help understand broad trends, it cannot account for the unique characteristics of different societies or the subtle interactions between various factors.

Convergence theory predicts that as the world becomes increasingly globalized, cultures worldwide will gradually grow more similar.

This theory argues that technological, economic, and political developments lead to a convergence of social structures and cultural norms.

The convergence process could lead to a unified global society with greater uniformity among its members, thus providing a helpful lens for studying topics such as socioeconomic development, modernization, and globalization.

Its origins are traced back to the mid-1960s when Clark Kerr states that societies around the globe were continuously becoming more and more alike due to technological, communication, and transportation advancements.

Today, convergence theory is a valuable tool for understanding the effects of increased global interconnectedness on societies and cultures worldwide.

Brubaker, D. (2022). Psychosocial political dysfunction of the republican party. New York: Archway Publishing.

Bryant, C. D., & Peck, D. L. (2007). 21st century sociology: A reference handbook. Thousand Oaks Sage Publications.

Don, F. J. H. (2019). The influence of Jan Tinbergen on Dutch economic policy. De Economist, 167 (3), 259–282. https://doi.org/10.1007/s10645-019-09333- 1

Form, W. (1979). Comparative industrial sociology and the convergence hypothesis. Annual Review of Sociology, 5 , 1–25. https://www.jstor.org/stable/2945945

Hay, J., & Couldry, N. (2011). Rethinking convergence/culture. Cultural Studies, 25 (4-5), 473–486. https://doi.org/10.1080/09502386.2011.600527

Hess, P. N. (2016). Economic growth and sustainable development . London: Abingdon.

Mishra, R. (1976). Convergence theory and social change: The development of welfare in Britain and the Soviet Union. Comparative Studies in Society and History, 18 (1), 28–56. https://www.jstor.org/stable/178161

Wilensky, H. L. (2002). Rich democracies. Univesity of California Press.

- Viktoriya Sus (MA) #molongui-disabled-link Cognitive Dissonance Theory: Examples and Definition

- Viktoriya Sus (MA) #molongui-disabled-link 15 Free Enterprise Examples

- Viktoriya Sus (MA) #molongui-disabled-link 21 Sunk Costs Examples (The Fallacy Explained)

- Viktoriya Sus (MA) #molongui-disabled-link Price Floor: 15 Examples & Definition

- Chris Drew (PhD) https://helpfulprofessor.com/author/chris-drew-phd/ 23 Achieved Status Examples

- Chris Drew (PhD) https://helpfulprofessor.com/author/chris-drew-phd/ 15 Ableism Examples

- Chris Drew (PhD) https://helpfulprofessor.com/author/chris-drew-phd/ 25 Defense Mechanisms Examples

- Chris Drew (PhD) https://helpfulprofessor.com/author/chris-drew-phd/ 15 Theory of Planned Behavior Examples

Leave a Comment Cancel Reply

Your email address will not be published. Required fields are marked *

In order to continue enjoying our site, we ask that you confirm your identity as a human. Thank you very much for your cooperation.

- Search Search Please fill out this field.

- Technical Analysis

Divergence vs. Convergence What's the Difference?

:max_bytes(150000):strip_icc():format(webp)/picture-53893-1440688982-5bfc2a88c9e77c005143c705.png)

Divergence vs. Convergence: An Overview

There are numerous trends and tools in the world of economics and finance. Some of them describe opposing forces, such as divergence and convergence. Divergence generally means two things are moving apart while convergence implies that two forces are moving together. In the world of economics , finance, and trading, divergence and convergence are terms used to describe the directional relationship of two trends , prices, or indicators. But as the general definitions imply, these two terms refer to how these relationships move. Divergence indicates that two trends move further away from each other while convergence indicates how they move closer together.

Key Takeaways

- Divergence occurs when the price of an asset and an indicator move away from each other.

- Convergence happens when the price of an asset and an indicator move toward each other.

- Divergence can be either positive or negative.

- Convergence occurs because an efficient market won't allow something to trade for two prices at the same time

- Technical traders are more interested in divergence as a signal to trade while the absence of convergence is an opportunity for arbitrage.

When the value of an asset, indicator, or index moves, the related asset, indicator, or index moves in the other direction. This is what is referred to as divergence . Divergence warns that the current price trend may be weakening, and in some cases may lead to the price changing direction.

Divergence can be either positive or negative. For example, positive divergence occurs when a stock is nearing a low but its indicators start to rally . This would be a sign of trend reversal, potentially opening up an entry opportunity for the trader. On the other hand, negative divergence happens when prices go higher while the indicator signals a new low.

When divergence does occur, it does not mean the price will reverse or that a reversal will occur soon. In fact, divergence can last a long time, so acting on it alone could be mean substantial losses if the price does not react as expected. Traders generally don't exclusively rely on divergence in their trading activities. That's because it doesn't provide timely trade signals on its own.

Technical analysis focuses on patterns of price movements, trading signals, and various other analytical signals to inform trades, as opposed to fundamental analysis, which tries to find an asset's intrinsic value.

Convergence

The term convergence is the opposite of divergence. It is used to describe the phenomenon of the futures price and the cash price of the underlying commodity moving closer together over time. In most cases, traders refer to convergence as a way to describe the price action of a futures contract.

Theoretically, convergence happens because an efficient market won't allow something to trade for two prices at the same time. The actual market value of a futures contract is lower than the contract price at issue because traders have to factor in the time value of the security. As the expiration date on the contract approaches, the premium on the time value shrinks, and the two prices converge.

If the prices did not converge, traders would take advantage of the price difference to make a quick profit . This would continue until prices converged. When prices don't converge, there is an opportunity for arbitrage . Arbitrage is when an asset is bought and sold at the same time, in different markets, to take advantage of a temporary price difference. This situation takes advantage of inefficiencies in the market.

Key Differences

Technical traders are much more concerned with divergence than convergence, largely because convergence is assumed to occur in a normal market. Many technical indicators commonly use divergence as tools, primarily oscillators . They map out bands (both high and low ones) that occur between two extreme values. They then build trend indicators that flow within those boundaries.

Divergence is a phenomenon that is commonly interpreted to mean that a trend is weak or potentially unsustainable. Traders who employ technical analysis as part of their trading strategies use divergence to read the underlying momentum of an asset.

Convergence occurs when the price of an asset, indicator, or index moves in the same direction as a related asset, indicator, or index in technical analysis. For example, there is convergence when the Dow Jones Industrial Average (DJIA) shows gains at the same time that its accumulation/distribution line is increasing.

Patterns Wizard. " Divergence: Everything Traders Should Know ."

PFOREX. " Divergence and Convergence ."

Babypips. " 9 Rules for Trading Divergences ."

:max_bytes(150000):strip_icc():format(webp)/GettyImages-1325646084-8fd7180c3a104578bd968e0804b7b566.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

What is convergence theory in sociology?

This theory is one of social change that has been given by economic professor Clark Kerr in a book by him and his colleagues called ’Industrialism and Industrial Man’ in the 1960s. The convergence theory is the one which postulates that all the societies as they move from the early industrial development to complete industrialization tend to move towards a condition of similarity in terms of the general societal and technological norms. This is to say that as the societies move towards development they look become alike will similar structures, which means that the differences among the societies will reduce as they are ultimately on the same path of development. This would thus lead to a single global culture.

This theory given by Clark Kerr is what is known as the ‘logic of industrialization’ which he has also mentioned in his writing, this logic is the thesis of the theory and states that industrialization everywhere has similar consequences whether the society is a capitalist one or a communist one.

It is believed that the third world nations are supposed to get out of their conditions of poverty through the process of convergence as they take up the form of western industrial societies.

The convergence theory is often related to the study of modernization, it is believed that the path of development is the one that has been taken by the western industrial societies, which will be undertaken by every society in order to reach complete development and modernization. Thus there is a foxed pattern of development which will be followed. There is thus a convergence if the ideas attitudes and beliefs, thus the overall way of thinking and doing things.

Thus we see that while the convergence theory has made many countries into market economies such as the ones found in the western societies, as it has in Russia and Vietnam which were communist countries earlier and are now market economies.

https://www.thoughtco.com/convergence-theory-3026158

https://www.encyclopedia.com/social-sciences/encyclopedias-almanacs-transcripts-and-maps/convergence-theories

We believe in sharing knowledge with everyone and making a positive change in society through our work and contributions. If you are interested in joining us, please check our ‘About’ page for more information

Quickonomics

Convergence (Economic)

Definition of convergence (economic).

Convergence in economics refers to the hypothesis that poorer economies’ per capita incomes will tend to grow at faster rates than richer economies. As a result, all economies should eventually converge in terms of per capita income. In detail, it assumes that with the appropriate policies and institutional arrangements, developing countries have the potential to catch up with the economic development levels of advanced economies over time. This theory is based on the premise that there are diminishing returns to capital in wealthier countries, leading to slower growth rates, whereas in poorer countries, the opposite is true.

A classic example of economic convergence can be observed in the case of South Korea. Post the Korean War, South Korea was one of the poorest countries in the world, with a GDP per capita comparable to levels found in the poorer countries of Africa and Asia. However, through significant investments in education, infrastructure, and technology, alongside fostering a conducive policy environment for economic growth, South Korea transformed into a high-income country. This rapid economic development significantly closed the gap between South Korea and more developed countries, exemplifying the concept of convergence.

Another example is seen in the rapid growth of China since the economic reforms in the late 20th century. Initially, China’s GDP per capita was significantly lower than that of Western countries. Through extensive reforms, opening up to international trade, and investments in human and physical capital, China has shown remarkable rates of growth, thus converging towards the income levels of more developed economies.

Why Economic Convergence Matters

Understanding economic convergence is crucial for policy-making and long-term planning for both developing and developed countries. For emerging economies, the convergence theory implies that adopting certain policies—such as improving education and health infrastructure, promoting technological advancements, and maintaining stable economic policies—can lead to higher growth rates and an improved standard of living. For advanced economies, the theory suggests that innovation and productivity improvements are vital for maintaining economic leadership and avoiding stagnation.

Economic convergence also highlights the potential for reducing global inequality. By understanding and facilitating the conditions under which convergence can occur, international organizations and governments can better address disparities in wealth and development.

Frequently Asked Questions (FAQ)

What are the conditions necessary for economic convergence to occur.

For economic convergence to happen, several conditions are often considered necessary. These include access to technology, stable political and economic environments, sound macroeconomic policies, investment in human capital (education and health), and the ability to absorb and innovate upon existing technologies. Furthermore, institutional quality, such as property rights and rule of law, plays a significant role in determining whether a country can take advantage of the catch-up growth opportunity.

Is economic convergence guaranteed for all developing countries?

Economic convergence is not guaranteed for all developing countries. While the theory suggests that poorer economies have the potential to grow faster than wealthier ones, success depends on a variety of factors, including the implementation of effective economic policies, the quality of institutions, and the country’s openness to trade and investment. Additionally, external factors such as geopolitical risks, global economic conditions, and environmental challenges can influence a country’s growth trajectory.

How is economic convergence measured?

Economic convergence can be assessed through various indicators, with GDP per capita being the most common measure. By comparing GDP per capita growth rates of developing countries with those of developed countries over time, economists can gauge whether convergence is occurring. Another approach is to look at productivity levels, technological adoption, and improvements in health and education outcomes as proxies for a country’s convergence towards higher living standards.

Can divergence happen instead of convergence?

Yes, in some cases, divergence, rather than convergence, can occur. Divergence refers to the process where income gaps between countries widen over time rather than narrow. This can happen due to reasons such as political instability, poor governance, lack of access to markets, or failure to invest in human and physical capital. The divergence phenomenon underscores the importance of conducive policies and institutions in ensuring that countries are able to catch up with the more developed economies.

To provide the best experiences, we and our partners use technologies like cookies to store and/or access device information. Consenting to these technologies will allow us and our partners to process personal data such as browsing behavior or unique IDs on this site and show (non-) personalized ads. Not consenting or withdrawing consent, may adversely affect certain features and functions.

Click below to consent to the above or make granular choices. Your choices will be applied to this site only. You can change your settings at any time, including withdrawing your consent, by using the toggles on the Cookie Policy, or by clicking on the manage consent button at the bottom of the screen.

Convergence: Theory and Evidence

- First Online: 25 November 2010

Cite this chapter

- Sascha Sardadvar 2

Part of the book series: Contributions to Economics ((CE,volume 1))

785 Accesses

Considerations on growth theory inevitably raise the question of whether different economies converge to each other in terms of output, income, or related measures. Interest in cross-country disparities of wealth and their causes is omnipresent in international politics. In fact, the issue has become so important that it is now officially a major objective of the European Union, as discussed in the Introduction. Although there exist various definitions of what constitutes convergence, this study will refer to just one definition of convergence, which combines two concepts:

This is a preview of subscription content, log in via an institution to check access.

Access this chapter

Subscribe and save.

- Get 10 units per month

- Download Article/Chapter or eBook

- 1 Unit = 1 Article or 1 Chapter

- Cancel anytime

- Available as PDF

- Read on any device

- Instant download

- Own it forever

- Available as EPUB and PDF

- Compact, lightweight edition

- Dispatched in 3 to 5 business days

- Free shipping worldwide - see info

- Durable hardcover edition

Tax calculation will be finalised at checkout

Purchases are for personal use only

Institutional subscriptions

There is an inconsistency found in these two quotes, as the first refers to output, while the second refers to wealth. These concepts are obviously different from each other despite their frequent treatment as identical concepts. In the context of this chapter, convergence refers to any process where income – either produced or earned – converges to the same level. The next chapter will then take up the topic of why output and income within one economy are in fact two different things, and why they should be distinguished, especially in a regional context.

Available from: http://unstats.un.org/unsd/default.htm , queried on 05-July-2007.

Austria, Belgium, Denmark, Finland, France, Germany, Greece, Republic of Ireland, Italy, Luxembourg, the Netherlands, Portugal, Spain, Sweden, United Kingdom; note that both German republics are included for the data from 1970 to 1990.

Armenia, Azerbaijan, Belarus, Estonia, Georgia, Kazakhstan, Kyrgyzstan, Latvia, Lithuania, Moldova, Russia, Tajikistan, Turkmenistan, Ukraine, Uzbekistan.

Argentina, Bolivia, Brazil, Chile, Colombia, Ecuador, Paraguay, Peru, Uruguay, Venezuela.

It is interesting to note that what nowadays seems to be a common and easily understood term in economics and politics referred to a different thing 20 years ago, as can be seen from contemporary encyclopaedias. For instance, Leipold ( 1987 , p. 1068) describes convergence as a theory that forecasts similar solutions for comparable challenges with which differently organised industrial societies will be confronted (“… in der Konvergenztheorie [wird] die Auffassung vertreten, daß unterschiedlich organisierte Industriegesellschaften mit vergleichbaren Herausforderungen konfrontiert sind und dementsprechend auch ähnliche Lösungen anwenden müssen.”).

Despite these considerations on similarities of regions, Barro and Sala-i-Martin ( 1990 ) included three regional dummy variables (south, midwest and west), which made their analysis actually a test on conditional convergence.

Gross regional product is called gross state product (GSP) in the USA.

The variables considered in the study are measures for primary and secondary school enrolment rates, government consumption, “political stability” and “market distortions.”

This idea of a 2% rule has been questioned by Quah ( 1996 ), who compares such interpretations of regression results to Galton’s fallacy; a regression towards the mean, it is argued, is uninformative for a distribution’s dynamics.

The results that follow considered “male upper-level schooling,” life expectancy, fertility rate, government consumption, “rule of law,” “democracy,” changes in terms of trade, investments ratio, and inflation.

The regressor, \(\beta \) , tends to \(\tilde \beta \) as t tends to 0, and tends to 0 as t approaches infinity, which is why it may also be interpreted on its own.

Abreu M, de Groot HLF, Florax RJGM (2005) A meta-analysis of β-convergence: The legendary 2%. J Econ Surv 19:389–420

Article Google Scholar

Barro RJ, Sala-i-Martin XX (1990) Economic growth and convergence across the United States, National Bureau of Economic Research Working Paper 3419

Google Scholar

Barro RJ, Sala-i-Martin XX (1992) Convergence. J Polit Econ 100:223–251

Barro RJ, Sala-i-Martin XX (1995) Economic growth. McGraw-Hill, New York, NY

Barro RJ, Sala-i-Martin XX (2004) Economic growth, 2nd edn. MIT Press, Cambridge, MA and London

Baumol WJ (1986) Productivity growth, convergence, and welfare: What the long run data show. Am Econ Rev 76(5):1072–1085

Cheshire P, Magrini S (2000) Endogenous processes in European regional growth: convergence and policy. Growth and Change 31(4):455–479

Ertur C, Koch W (2007) Growth, technological interdependence and spatial externalities: theory and evidence. J Appl Econom 22(6):1033–1062

European Commission (2006) InfoRegio Factsheet KN-76-06-084-EN-D

Fischer MM, Stirböck C (2006) Pan-European regional income growth and club-convergence – insights from a spatial econometric perspective. Ann Reg Sci 40 (3):1–29

Gandolfo G (1997) Economic dynamics, 3rd edn. Springer, Berlin, Heidelberg and New York, NY

Islam N (2003) What have we learnt from the convergence debate? J Econ Surv 17(3):309–362

Keilbach M (2000) Spatial knowledge spillovers and the dynamics of agglomeration and regional growth. Physika, Heidelberg

King RG, Rebelo ST (1989) Transitional dynamics and economic growth in the neoclassical model, National Bureau of Economic Research Working Paper 3185

Leipold H (1987) Konvergenztheorie. In: Dichtl, E and Issing, O Vahlens Großes Wirtschaftslexikon – Band 3. Taschenbuch Verlag, Munich, Vahlen, Beck and Deutscher

Maddison A (2003) The world economy – historical statistics Reprint 2006. OECD, Paris

Mankiw NG, Romer D, Weil DN (May 1992) A contribution to the empirics of economic growth. Q J Econ 107:407–437

Myrdal G (1957) Economic theory and under-developed regions Reprint 1964. Duckworth, London

Quah DT (1993) Galton’s fallacy and tests of the convergence hypothesis. Scand J Econ 95(4):427–443

Quah DT (1996) Empirics for economic growth and convergence. Eur Econ Rev 40(6):1353–1375

Romer D (1996) Advanced macroeconomics. McGraw-Hill, New York, NY

Sala-i-Martin XX (1996a) The classical approach to convergence analysis. Econ J 106(437):1019–1036

Sala-i-Martin XX (1996b) Regional cohesion: evidence and theories of regional growth and convergence. Eur Econ Rev 40(6):1325–1352

United Nations (2000) Economic survey of Europe 2000, No. 1. United Nations, New York, NY and Geneva

Vayá E, López-Bazo E, Moreno R, Suriñach J (2004) Growth and externalities across economies: an empirical analysis using spatial econometrics. In: Anselin, L, Florax, RJ, GM, Rey, Sergio J (eds) Advances in spatial econometrics: methodology. Tools and Applications, Berlin, Springer

Download references

Author information

Authors and affiliations.

Department of Socioeconomics, Vienna University of Economics and Business, Institute for Economic Geography and GIScience, Nordbergstraße 15, 1090, Vienna, Austria

Asst. Prof. Sascha Sardadvar

You can also search for this author in PubMed Google Scholar

Corresponding author

Correspondence to Sascha Sardadvar .

Rights and permissions

Reprints and permissions

Copyright information

© 2011 Springer-Verlag Berlin Heidelberg

About this chapter

Sardadvar, S. (2011). Convergence: Theory and Evidence. In: Economic Growth in the Regions of Europe. Contributions to Economics, vol 1. Physica-Verlag HD. https://doi.org/10.1007/978-3-7908-2637-1_4

Download citation

DOI : https://doi.org/10.1007/978-3-7908-2637-1_4

Published : 25 November 2010

Publisher Name : Physica-Verlag HD

Print ISBN : 978-3-7908-2636-4

Online ISBN : 978-3-7908-2637-1

eBook Packages : Business and Economics Economics and Finance (R0)

Share this chapter

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Publish with us

Policies and ethics

- Find a journal

- Track your research

COMMENTS

Convergence theory is an economic theory that presupposes that the concept of development is. defined by economic growth. It frames convergence with supposedly "developed" nations as a goal of so-called "undeveloped" or "developing" nations, and in doing so, fails to account for the numerous negative outcomes that often follow this economically ...

The sources of convergence. Abramovitz and David (1996: 21) provide a succinct definition of the conver-gence hypothesis, "Under certain conditions, being behind gives a productivity laggard the ability to grow faster than the early leader. This is the main con-tention of the 'convergence hypothesis'.''.

Convergence theory is a theory that explores the concept that as nations transition into highly industrialized nations they will develop similar cultural traits.

Solution. The correct answer is A. Conditional convergence depends on countries with the same saving rate, population growth rate, and production function. If this condition holds, then the neoclassical model implies convergence to the same per capita output and steady-state growth rate. Reading 9: Economic Growth.

Theorem 2.1.9. If a sequence {an} converges to a, then any subsequence {ank} of {an} also converges to a. Let an = ( − 1)n for n ∈ N. Solution. Then the sequence {an} is divergent. Indeed suppose by contradiction that. limn → ∞an = ℓ. Then every subsequence of {an} converges to a number ℓ ∈ R.

The idea of convergence in economics (also sometimes known as the catch-up effect) is the hypothesis that poorer economies' per capita incomes will tend to grow at faster rates than richer economies. In the Solow-Swan model, economic growth is driven by the accumulation of physical capital until this optimum level of capital per worker, which is the "steady state" is reached, where output ...

The hypothesis that per capita output converges across economies over time represents one of the oldest controversies in economics. This essay surveys the history and development of the hypothesis, focusing particularly on its vast literature since the mid-1980s. A summary of empirical analyses, econometric issues, and various tests of the convergence hypothesis are also presented. Moreover ...

Catch-Up Effect: The catch-up effect is a theory speculating that poorer economies will tend to grow more rapidly than wealthier economies, and so all economies in time will converge in terms of ...

Following Durlauf et al., the idea that initial conditions are of importance can be formalized into a definition of convergence as follows: ... In contrast to cross-sectional analysis, time-series analysis of convergence "places the convergence hypothesis in an explicitly dynamic and stochastic environment" (Bernard and Durlauf 1995, ...

The sources of convergence Abramovitz and David (1996: 21) provide a succinct definition of the convergence hypothesis, " Under certain conditions, being behind gives a productivity laggard the ability to grow faster than the early leader. This is the main contention of the 'convergence hypothesis'.''.

The debate over catch-up growth—what economists have dubbed the convergence hypothesis —has a long history. The authors choose to focus on research published over the last 30 years. In this recent research, capital, technology, and productivity have been at the root of most understandings of economic growth and convergence.

of club convergence as a competing hypothesis with conditional convergence. The origin of the current debate is in the absolute convergence hypothesis, which sug-gests that countries converge to one another in the long-run independently of initial condi-tions. Since an economy's long-run equilibrium depends on its structural characteristics ...

Essential Concept 18: Convergence Hypotheses. According to the convergence hypotheses, countries with low per capita incomes should grow at a faster rate than countries with high per capita income and eventually converge. The neoclassical model predicts two types of convergence: absolute and conditional.

Let us make an in-depth study of the Convergence Hypothesis. After reading this article you will learn about: 1. Types of Convergence 2. Possible Paths of Convergence. Types of Convergence: There are three types of convergence unconditional convergence, conditional convergence and no convergence. (i) Unconditional Convergence: By unconditional convergence we mean that LDCs will ultimately ...

Definition of Convergence Convergence in economics refers to the hypothesis or phenomenon where poorer economies' per capita incomes tend to grow at a faster rate compared to richer economies. This concept suggests that over time, all economies should converge in terms of income per capita, assuming that they have similar savings rates ...

CONVERGENCE THEORIESThe idea that societies move toward a condition of similarity—that they converge in one or more respects—is a common feature of various theories of social change. The notion that differences among societies will decrease over time can be found in many works of eighteenth and nineteenth century social thinkers, from the prerevolutionary French philosophes and the ...

Definition of the Convergence Theory. The convergence theory states that as the world continues to develop, expansion in technology and globalization will cause cultures around the globe to increasingly become more similar in a process called cultural convergence (Hess, 2016).. Over time, such a convergence of diverse social groups could lead to a unified global society with greater uniformity ...

The element of difference in convergence hypothesis is the distance from the steady state, which is, in neoclassical sense, changing over time and over considered economies. The often-asserted misinterpretation (and confusion with the absolute convergence) is then that poor economies should grow faster than rich economies.

Convergence theory proposes that the behavior of a crowd is a resultant of individuals joining who have underlying dispositions. The phrase, ''birds of a feather flock together,'' is commonly used ...