AML KYC Risk Rating Assessment Template, Methodology, Rating Matrix – Download Template

AML Risk Assessment Template and Sample Rating Matrix | Downloadable Template & Raw Data

When onboarding new customers, and throughout the relationship with each customer, financial institutions are required by regulators to perform anti-money laundering (AML) and know-your-customer (KYC) risk assessments to determine a customer’s overall money laundering risk.

Firms must comply with the Bank Secrecy Act and its implementing regulations ( Anti-Money Laundering rules ). The purpose of these rules is to help detect and report suspicious activity including money laundering, terrorist financing, securities fraud, and market manipulation.

When conducting due diligence on new or existing customers, firms normally use a risk assessment template and matrix, similar to the ones presented in the sections below, to determine the overall risk of the client.

Click here to let me know if you have any questions regarding this publication | Ogbe Airiodion (Senior AML/KYC/Compliance Consultant ).

Risk Rating Calculation Models

Risk assessment templates used by financial institution firms are either in Excel, in a third-party platform, or built into and managed within an internal tool.

These risk assessment templates/matrices have detailed risk scoring logic and formulas that calculate the overall risk score for a client.

Key Assessment Factors

The theory supporting risk assessment tools and templates is based on the concept that a client’s risk AML profile can be measured by applying data-driven and risk-based calculations on risk categories identified by financial experts and the regulatory community.

To determine a customer’s overall risk rating, a select list of variables is assessed, and each one is rated as low, medium, or high risk. (Some firms only have low and high-risk classification – no medium risk).

Note that risk factors and scores for clients may vary by a financial institution, jurisdiction, and customer segment as different types of customers will have different types of risks associated with them.

For example, a customer’s country of domicile or business registration might be rated low if the customer is domiciled in a low-risk country (e.g., the U.S.) or rated high if the customer is located in a high-risk country (e.g., Colombia or Cuba).

Free Money Management Tool

(Personal & Business)

Sign-up Today - Free.

Start Managing Your Finances. Don't Wait

Sample Risk Assessment Template

Click here to download the below KYC CDD Risk Rating Calculation Table in Excel so you can use it for your purposes. Please note that the below-average score rating is just a simple average.

CDD Risk Score Calculation (Sample)

Applying Weights to Your Risk Calculations

Please note that we have not weighted any of the risk factors higher than the others. It is up to you and your firm (based on your firm’s risk appetite) to determine the weights to apply to each of these risk components.

Firms often assign higher weight factors to a customer’s source of wealth, country of residency, purpose of account, industry, etc.

Below is an example:

Risk Rating Scores – Tables & Raw Data

For risk scores used by financial firms across the industry, see the below tables. Click here to download the raw data: Risk Rating Scores for Assigning CDD Risk Ratings

| Risk Level for Country of Government |

| Risk Level for Country of Incorporation |

| Risk Level for Country of Operation |

| Risk Level for Authorized Signers |

| Risk Level for Country of Nationality |

| Risk Level for Country of Residency |

| Risk Level (Government Income) |

| Risk Level for Industry |

| Risk Level for Legal Structure |

| Risk Level for Management |

| Risk Level for Owners |

| Risk Level for Primary Regulatory Body |

| Risk Level for Purpose of Account |

| Risk Level for Source of Wealth |

| Risk Level for High Risk Transactions |

Risk Rating Scores – Country of Incorporation

| Country of Incorporation | Risk Level for Country of Incorporation | Score |

| Afghanistan | High | 5 |

| Åland Islands | High | 5 |

| Albania | High | 5 |

| Algeria | High | 5 |

| American Samoa | Low | 1 |

| Andorra | High | 5 |

| Angola | High | 5 |

| Anguilla | Medium | 3 |

| Antarctica | Low | 1 |

| Antigua and Barbuda | Medium | 3 |

| Argentina | Medium | 3 |

| Armenia | Low | 1 |

| Aruba | Medium | 3 |

| Australia | Low | 1 |

| Austria | Low | 1 |

| Azerbaijan | High | 5 |

| Bahamas (the) | High | 5 |

| Bahrain | Medium | 3 |

| Bangladesh | Medium | 3 |

| Barbados | Medium | 3 |

| Belarus | High | 5 |

| Belgium | Low | 1 |

| Belize | High | 5 |

| Benin | Medium | 3 |

| Bermuda | Medium | 3 |

| Bhutan | Low | 1 |

| Bolivia, Plurinational State of | High | 5 |

| Bonaire, Sint Eustatius and Saba | Low | 1 |

| Bosnia and Herzegovina | Medium | 3 |

| Botswana | Low | 1 |

| Bouvet Island | Low | 1 |

| Brazil | Medium | 3 |

| British Indian Ocean Territory (the) | Low | 1 |

| Brunei Darussalam | Low | 1 |

| Bulgaria | Low | 1 |

| Burkina Faso | Low | 1 |

| Burundi | Medium | 3 |

| Cabo Verde | Low | 1 |

| Cambodia | Medium | 3 |

| Cameroon | Medium | 3 |

| Canada | Low | 1 |

| Cayman Islands (the) | Medium | 3 |

| Central African Republic (the) | High | 5 |

| Chad | Medium | 3 |

| Chile | Low | 1 |

| China | Medium | 3 |

| Christmas Island | Low | 1 |

| Clipperton Island | Low | 1 |

| Cocos (Keeling) Islands (the) | Low | 1 |

| Colombia | High | 5 |

| Comoros | Medium | 3 |

| Congo | Medium | 3 |

| Congo (the Democratic Republic of the) | High | 5 |

| Cook Islands (the) | High | 5 |

| Costa Rica | High | 5 |

| Côte d’Ivoire | High | 5 |

| Croatia | Low | 1 |

| Cuba | High | 5 |

| Curaçao | Medium | 3 |

| Cyprus | High | 5 |

| Czech Republic (the) | Low | 1 |

| Denmark | Low | 1 |

| Djibouti | Low | 1 |

| Dominica | Medium | 3 |

| Dominican Republic (the) | High | 5 |

| Ecuador | High | 5 |

| Egypt | High | 5 |

| El Salvador | High | 5 |

| Equatorial Guinea | High | 5 |

| Eritrea | High | 5 |

| Estonia | Low | 1 |

| Ethiopia | High | 5 |

| Falkland Islands (the) [Malvinas] | Low | 1 |

| Faroe Islands (the) | Low | 1 |

| Fiji | Low | 1 |

| Finland | Low | 1 |

| France | Low | 1 |

| French Guiana | Low | 1 |

| French Polynesia | Low | 1 |

| French Southern Territories (the) | Low | 1 |

| Gabon | Low | 1 |

| Gambia (The) | Low | 1 |

| Georgia | Low | 1 |

| Germany | Low | 1 |

| Ghana | Low | 1 |

| Gibraltar | Medium | 3 |

| Greece | Low | 1 |

| Greenland | Low | 1 |

| Grenada | High | 5 |

| Guadeloupe | Low | 1 |

| Guam | Low | 1 |

| Guatemala | High | 5 |

| Guernsey | Medium | 3 |

| Guinea | High | 5 |

| Guinea-Bissau | High | 5 |

| Guyana | Low | 1 |

| Haiti | High | 5 |

| Heard Island and McDonald Islands | Low | 1 |

| Holy See (the) [Vatican City State] | Low | 1 |

| Honduras | High | 5 |

| Hong Kong | Medium | 3 |

| Hungary | Low | 1 |

| Iceland | Low | 1 |

| India | High | 5 |

| Indonesia | High | 5 |

| Iran (the Islamic Republic of) | High | 5 |

| Iraq | High | 5 |

| Ireland | Low | 1 |

| Isle of Man | Medium | 3 |

| Israel | Low | 1 |

| Italy | Low | 1 |

| Jamaica | High | 5 |

| Japan | Low | 1 |

| Jersey | Medium | 3 |

| Jordan | Low | 1 |

| Kazakhstan | High | 5 |

| Kenya | High | 5 |

| Kiribati | Low | 1 |

| Korea (the Democratic People’s Republic of) | High | 5 |

| Korea (the Republic of) | Low | 1 |

| Kosovo | Low | 1 |

| Kuwait | Medium | 3 |

| Kyrgyzstan | High | 5 |

| Lao People’s Democratic Republic (the) | High | 5 |

| Latvia | High | 5 |

| Lebanon | High | 5 |

| Lesotho | Low | 1 |

| Liberia | High | 5 |

| Libya | High | 5 |

| Liechtenstein | High | 5 |

| Lithuania | Low | 1 |

| Luxembourg | Medium | 3 |

| Macao | High | 5 |

| Macedonia (the former Yugoslav Republic of) | Low | 1 |

| Madagascar | Low | 1 |

| Malawi | Low | 1 |

| Malaysia | Medium | 3 |

| Maldives | Low | 1 |

| Mali | Low | 1 |

| Malta | Medium | 3 |

| Marshall Islands (the) | High | 5 |

| Martinique | Low | 1 |

| Mauritania | Low | 1 |

| Mauritius | Medium | 3 |

| Mayotte | Low | 1 |

| Mexico | High | 5 |

| Micronesia (the Federated States of) | Low | 1 |

| Moldova (the Republic of) | High | 5 |

| Monaco | High | 5 |

| Mongolia | Low | 1 |

| Montenegro | Medium | 3 |

| Montserrat | Medium | 3 |

| Morocco | Low | 1 |

| Mozambique | Low | 1 |

| Myanmar | High | 5 |

| Namibia | Low | 1 |

| Nauru | High | 5 |

| Nepal | Low | 1 |

| Netherlands (the) | Low | 1 |

| New Caledonia | Low | 1 |

| New Zealand | Low | 1 |

| Nicaragua | High | 5 |

| Niger (the) | Low | 1 |

| Nigeria | High | 5 |

| Niue | High | 5 |

| Norfolk Island | Low | 1 |

| Northern Mariana Islands (the) | Low | 1 |

| Norway | Low | 1 |

| Oman | Low | 1 |

| Pakistan | High | 5 |

| Palau | Medium | 3 |

| Palestine, State of | High | 5 |

| Panama | High | 5 |

| Papua New Guinea | High | 5 |

| Paracel Islands | High | 5 |

| Paraguay | Medium | 3 |

| Peru | High | 5 |

| Philippines (the) | Medium | 3 |

| Pitcairn | Low | 1 |

| Poland | Low | 1 |

| Portugal | Low | 1 |

| Puerto Rico | Low | 1 |

| Qatar | Low | 1 |

| Réunion | Low | 1 |

| Romania | Low | 1 |

| Russian Federation (the) | High | 5 |

| Rwanda | Low | 1 |

| Saint Barthélemy | Low | 1 |

| Saint Helena, Ascension and Tristan da Cunha | Low | 1 |

| Saint Kitts and Nevis | High | 5 |

| Saint Lucia | Medium | 3 |

| Saint Martin (French part) | Low | 1 |

| Saint Pierre and Miquelon | Low | 1 |

| Saint Vincent and the Grenadines | Medium | 3 |

| Samoa | Medium | 3 |

| San Marino | Low | 1 |

| Sao Tome and Principe | Medium | 3 |

| Saudi Arabia | High | 5 |

| Senegal | Low | 1 |

| Serbia | Medium | 3 |

| Seychelles | Medium | 3 |

| Sierra Leone | Medium | 3 |

| Singapore | Medium | 3 |

| Sint Maarten (Dutch part) | Medium | 3 |

| Slovakia | Low | 1 |

| Slovenia | Low | 1 |

| Solomon Islands (the) | Low | 1 |

| Somalia | High | 5 |

| South Africa | Low | 1 |

| South Georgia and the South Sandwich Islands | Low | 1 |

| South Sudan | High | 5 |

| Spain | Low | 1 |

| Spratly Islands | High | 5 |

| Sri Lanka | Low | 1 |

| Sudan (the) | High | 5 |

| Suriname | Low | 1 |

| Svalbard and Jan Mayen | Low | 1 |

| Swaziland | Low | 1 |

| Sweden | Low | 1 |

| Switzerland | Medium | 3 |

| Syrian Arab Republic (the) | High | 5 |

| Taiwan (Province of China) | Low | 1 |

| Tajikistan | High | 5 |

| Tanzania, United Republic of | High | 5 |

| Thailand | Low | 1 |

| Timor-Leste | Medium | 3 |

| Togo | Medium | 3 |

| Tokelau | Low | 1 |

| Tonga | Low | 1 |

| Trinidad and Tobago | Low | 1 |

| Tunisia | High | 5 |

| Turkey | High | 5 |

| Turkish Republic of Northern Cyprus (Northern Cyprus) | High | 5 |

| Turkmenistan | Medium | 3 |

| Turks and Caicos Islands (the) | Medium | 3 |

| Tuvalu | Low | 1 |

| Uganda | High | 5 |

| Ukraine | High | 5 |

| United Arab Emirates (the) | High | 5 |

| United Kingdom (the) | Low | 1 |

| United States (the) | Low | 1 |

| United States Minor Outlying Islands (the) | Low | 1 |

| Uruguay | Medium | 3 |

| Uzbekistan | High | 5 |

| Vanuatu | Medium | 3 |

| Venezuela, Bolivarian Republic of | High | 5 |

| Viet Nam | Low | 1 |

| Virgin Islands (British) | Medium | 3 |

| Virgin Islands (U.S.) | Low | 1 |

| Wallis and Futuna | Low | 1 |

| Western Sahara | Low | 1 |

| Yemen | High | 5 |

| Zambia | Low | 1 |

| Zimbabwe | High | 5 |

Risk Rating Scores – Country of Operation

| Country of Operation | Risk Level for Country of Operation | Score |

| Afghanistan | High | 5 |

| Åland Islands | High | 5 |

| Albania | High | 5 |

| Algeria | High | 5 |

| American Samoa | Low | 1 |

| Andorra | High | 5 |

| Angola | High | 5 |

| Anguilla | Medium | 3 |

| Antarctica | Low | 1 |

| Antigua and Barbuda | Medium | 3 |

| Argentina | Medium | 3 |

| Armenia | Low | 1 |

| Aruba | Medium | 3 |

| Australia | Low | 1 |

| Austria | Low | 1 |

| Azerbaijan | High | 5 |

| Bahamas (the) | High | 5 |

| Bahrain | Medium | 3 |

| Bangladesh | Medium | 3 |

| Barbados | Medium | 3 |

| Belarus | High | 5 |

| Belgium | Low | 1 |

| Belize | High | 5 |

| Benin | Medium | 3 |

| Bermuda | Medium | 3 |

| Bhutan | Low | 1 |

| Bolivia, Plurinational State of | High | 5 |

| Bonaire, Sint Eustatius and Saba | Low | 1 |

| Bosnia and Herzegovina | Medium | 3 |

| Botswana | Low | 1 |

| Bouvet Island | Low | 1 |

| Brazil | Medium | 3 |

| British Indian Ocean Territory (the) | Low | 1 |

| Brunei Darussalam | Low | 1 |

| Bulgaria | Low | 1 |

| Burkina Faso | Low | 1 |

| Burundi | Medium | 3 |

| Cabo Verde | Low | 1 |

| Cambodia | Medium | 3 |

| Cameroon | Medium | 3 |

| Canada | Low | 1 |

| Cayman Islands (the) | Medium | 3 |

| Central African Republic (the) | High | 5 |

| Chad | Medium | 3 |

| Chile | Low | 1 |

| China | Medium | 3 |

| Christmas Island | Low | 1 |

| Clipperton Island | Low | 1 |

| Cocos (Keeling) Islands (the) | Low | 1 |

| Colombia | High | 5 |

| Comoros | Medium | 3 |

| Congo | Medium | 3 |

| Congo (the Democratic Republic of the) | High | 5 |

| Cook Islands (the) | High | 5 |

| Costa Rica | High | 5 |

| Côte d’Ivoire | High | 5 |

| Croatia | Low | 1 |

| Cuba | High | 5 |

| Curaçao | Medium | 3 |

| Cyprus | High | 5 |

| Czech Republic (the) | Low | 1 |

| Denmark | Low | 1 |

| Djibouti | Low | 1 |

| Dominica | Medium | 3 |

| Dominican Republic (the) | High | 5 |

| Ecuador | High | 5 |

| Egypt | High | 5 |

| El Salvador | High | 5 |

| Equatorial Guinea | High | 5 |

| Eritrea | High | 5 |

| Estonia | Low | 1 |

| Ethiopia | High | 5 |

| Falkland Islands (the) [Malvinas] | Low | 1 |

| Faroe Islands (the) | Low | 1 |

| Fiji | Low | 1 |

| Finland | Low | 1 |

| France | Low | 1 |

| French Guiana | Low | 1 |

| French Polynesia | Low | 1 |

| French Southern Territories (the) | Low | 1 |

| Gabon | Low | 1 |

| Gambia (The) | Low | 1 |

| Georgia | Low | 1 |

| Germany | Low | 1 |

| Ghana | Low | 1 |

| Gibraltar | Medium | 3 |

| Greece | Low | 1 |

| Greenland | Low | 1 |

| Grenada | High | 5 |

| Guadeloupe | Low | 1 |

| Guam | Low | 1 |

| Guatemala | High | 5 |

| Guernsey | Medium | 3 |

| Guinea | High | 5 |

| Guinea-Bissau | High | 5 |

| Guyana | Low | 1 |

| Haiti | High | 5 |

| Heard Island and McDonald Islands | Low | 1 |

| Holy See (the) [Vatican City State] | Low | 1 |

| Honduras | High | 5 |

| Hong Kong | Medium | 3 |

| Hungary | Low | 1 |

| Iceland | Low | 1 |

| India | High | 5 |

| Indonesia | High | 5 |

| Iran (the Islamic Republic of) | High | 5 |

| Iraq | High | 5 |

| Ireland | Low | 1 |

| Isle of Man | Medium | 3 |

| Israel | Low | 1 |

| Italy | Low | 1 |

| Jamaica | High | 5 |

| Japan | Low | 1 |

| Jersey | Medium | 3 |

| Jordan | Low | 1 |

| Kazakhstan | High | 5 |

| Kenya | High | 5 |

| Kiribati | Low | 1 |

| Korea (the Democratic People’s Republic of) | High | 5 |

| Korea (the Republic of) | Low | 1 |

| Kosovo | Low | 1 |

| Kuwait | Medium | 3 |

| Kyrgyzstan | High | 5 |

| Lao People’s Democratic Republic (the) | High | 5 |

| Latvia | High | 5 |

| Lebanon | High | 5 |

| Lesotho | Low | 1 |

| Liberia | High | 5 |

| Libya | High | 5 |

| Liechtenstein | High | 5 |

| Lithuania | Low | 1 |

| Luxembourg | Medium | 3 |

| Macao | High | 5 |

| Macedonia (the former Yugoslav Republic of) | Low | 1 |

| Madagascar | Low | 1 |

| Malawi | Low | 1 |

| Malaysia | Medium | 3 |

| Maldives | Low | 1 |

| Mali | Low | 1 |

| Malta | Medium | 3 |

| Marshall Islands (the) | High | 5 |

| Martinique | Low | 1 |

| Mauritania | Low | 1 |

| Mauritius | Medium | 3 |

| Mayotte | Low | 1 |

| Mexico | High | 5 |

| Micronesia (the Federated States of) | Low | 1 |

| Moldova (the Republic of) | High | 5 |

| Monaco | High | 5 |

| Mongolia | Low | 1 |

| Montenegro | Medium | 3 |

| Montserrat | Medium | 3 |

| Morocco | Low | 1 |

| Mozambique | Low | 1 |

| Myanmar | High | 5 |

| Namibia | Low | 1 |

| Nauru | High | 5 |

| Nepal | Low | 1 |

| Netherlands (the) | Low | 1 |

| New Caledonia | Low | 1 |

| New Zealand | Low | 1 |

| Nicaragua | High | 5 |

| Niger (the) | Low | 1 |

| Nigeria | High | 5 |

| Niue | High | 5 |

| Norfolk Island | Low | 1 |

| Northern Mariana Islands (the) | Low | 1 |

| Norway | Low | 1 |

| Oman | Low | 1 |

| Pakistan | High | 5 |

| Palau | Medium | 3 |

| Palestine, State of | High | 5 |

| Panama | High | 5 |

| Papua New Guinea | High | 5 |

| Paracel Islands | High | 5 |

| Paraguay | Medium | 3 |

| Peru | High | 5 |

| Philippines (the) | Medium | 3 |

| Pitcairn | Low | 1 |

| Poland | Low | 1 |

| Portugal | Low | 1 |

| Puerto Rico | Low | 1 |

| Qatar | Low | 1 |

| Réunion | Low | 1 |

| Romania | Low | 1 |

| Russian Federation (the) | High | 5 |

| Rwanda | Low | 1 |

| Saint Barthélemy | Low | 1 |

| Saint Helena, Ascension and Tristan da Cunha | Low | 1 |

| Saint Kitts and Nevis | High | 5 |

| Saint Lucia | Medium | 3 |

| Saint Martin (French part) | Low | 1 |

| Saint Pierre and Miquelon | Low | 1 |

| Saint Vincent and the Grenadines | Medium | 3 |

| Samoa | Medium | 3 |

| San Marino | Low | 1 |

| Sao Tome and Principe | Medium | 3 |

| Saudi Arabia | High | 5 |

| Senegal | Low | 1 |

| Serbia | Medium | 3 |

| Seychelles | Medium | 3 |

| Sierra Leone | Medium | 3 |

| Singapore | Medium | 3 |

| Sint Maarten (Dutch part) | Medium | 3 |

| Slovakia | Low | 1 |

| Slovenia | Low | 1 |

| Solomon Islands (the) | Low | 1 |

| Somalia | High | 5 |

| South Africa | Low | 1 |

| South Georgia and the South Sandwich Islands | Low | 1 |

| South Sudan | High | 5 |

| Spain | Low | 1 |

| Spratly Islands | High | 5 |

| Sri Lanka | Low | 1 |

| Sudan (the) | High | 5 |

| Suriname | Low | 1 |

| Svalbard and Jan Mayen | Low | 1 |

| Swaziland | Low | 1 |

| Sweden | Low | 1 |

| Switzerland | Medium | 3 |

| Syrian Arab Republic (the) | High | 5 |

| Taiwan (Province of China) | Low | 1 |

| Tajikistan | High | 5 |

| Tanzania, United Republic of | High | 5 |

| Thailand | Low | 1 |

| Timor-Leste | Medium | 3 |

| Togo | Medium | 3 |

| Tokelau | Low | 1 |

| Tonga | Low | 1 |

| Trinidad and Tobago | Low | 1 |

| Tunisia | High | 5 |

| Turkey | High | 5 |

| Turkish Republic of Northern Cyprus (Northern Cyprus) | High | 5 |

| Turkmenistan | Medium | 3 |

| Turks and Caicos Islands (the) | Medium | 3 |

| Tuvalu | Low | 1 |

| Uganda | High | 5 |

| Ukraine | High | 5 |

| United Arab Emirates (the) | High | 5 |

| United Kingdom (the) | Low | 1 |

| United States (the) | Low | 1 |

| United States Minor Outlying Islands (the) | Low | 1 |

| Uruguay | Medium | 3 |

| Uzbekistan | High | 5 |

| Vanuatu | Medium | 3 |

| Venezuela, Bolivarian Republic of | High | 5 |

| Viet Nam | Low | 1 |

| Virgin Islands (British) | Medium | 3 |

| Virgin Islands (U.S.) | Low | 1 |

| Wallis and Futuna | Low | 1 |

| Western Sahara | Low | 1 |

| Yemen | High | 5 |

| Zambia | Low | 1 |

| Zimbabwe | High | 5 |

Risk Rating Scores – Country of Government

| Country of Government | Risk Level for Country of Government | Score |

| Afghanistan | High | 5 |

| Åland Islands | High | 5 |

| Albania | High | 5 |

| Algeria | High | 5 |

| American Samoa | Low | 1 |

| Andorra | High | 5 |

| Angola | High | 5 |

| Anguilla | Medium | 3 |

| Antarctica | Low | 1 |

| Antigua and Barbuda | Medium | 3 |

| Argentina | Medium | 3 |

| Armenia | Low | 1 |

| Aruba | Medium | 3 |

| Australia | Low | 1 |

| Austria | Low | 1 |

| Azerbaijan | High | 5 |

| Bahamas (the) | High | 5 |

| Bahrain | Medium | 3 |

| Bangladesh | Medium | 3 |

| Barbados | Medium | 3 |

| Belarus | High | 5 |

| Belgium | Low | 1 |

| Belize | High | 5 |

| Benin | Medium | 3 |

| Bermuda | Medium | 3 |

| Bhutan | Low | 1 |

| Bolivia, Plurinational State of | High | 5 |

| Bonaire, Sint Eustatius and Saba | Low | 1 |

| Bosnia and Herzegovina | Medium | 3 |

| Botswana | Low | 1 |

| Bouvet Island | Low | 1 |

| Brazil | Medium | 3 |

| British Indian Ocean Territory (the) | Low | 1 |

| Brunei Darussalam | Low | 1 |

| Bulgaria | Low | 1 |

| Burkina Faso | Low | 1 |

| Burundi | Medium | 3 |

| Cabo Verde | Low | 1 |

| Cambodia | Medium | 3 |

| Cameroon | Medium | 3 |

| Canada | Low | 1 |

| Cayman Islands (the) | Medium | 3 |

| Central African Republic (the) | High | 5 |

| Chad | Medium | 3 |

| Chile | Low | 1 |

| China | Medium | 3 |

| Christmas Island | Low | 1 |

| Clipperton Island | Low | 1 |

| Cocos (Keeling) Islands (the) | Low | 1 |

| Colombia | High | 5 |

| Comoros | Medium | 3 |

| Congo | Medium | 3 |

| Congo (the Democratic Republic of the) | High | 5 |

| Cook Islands (the) | High | 5 |

| Costa Rica | High | 5 |

| Côte d’Ivoire | High | 5 |

| Croatia | Low | 1 |

| Cuba | High | 5 |

| Curaçao | Medium | 3 |

| Cyprus | High | 5 |

| Czech Republic (the) | Low | 1 |

| Denmark | Low | 1 |

| Djibouti | Low | 1 |

| Dominica | Medium | 3 |

| Dominican Republic (the) | High | 5 |

| Ecuador | High | 5 |

| Egypt | High | 5 |

| El Salvador | High | 5 |

| Equatorial Guinea | High | 5 |

| Eritrea | High | 5 |

| Estonia | Low | 1 |

| Ethiopia | High | 5 |

| Falkland Islands (the) [Malvinas] | Low | 1 |

| Faroe Islands (the) | Low | 1 |

| Fiji | Low | 1 |

| Finland | Low | 1 |

| France | Low | 1 |

| French Guiana | Low | 1 |

| French Polynesia | Low | 1 |

| French Southern Territories (the) | Low | 1 |

| Gabon | Low | 1 |

| Gambia (The) | Low | 1 |

| Georgia | Low | 1 |

| Germany | Low | 1 |

| Ghana | Low | 1 |

| Gibraltar | Medium | 3 |

| Greece | Low | 1 |

| Greenland | Low | 1 |

| Grenada | High | 5 |

| Guadeloupe | Low | 1 |

| Guam | Low | 1 |

| Guatemala | High | 5 |

| Guernsey | Medium | 3 |

| Guinea | High | 5 |

| Guinea-Bissau | High | 5 |

| Guyana | Low | 1 |

| Haiti | High | 5 |

| Heard Island and McDonald Islands | Low | 1 |

| Holy See (the) [Vatican City State] | Low | 1 |

| Honduras | High | 5 |

| Hong Kong | Medium | 3 |

| Hungary | Low | 1 |

| Iceland | Low | 1 |

| India | High | 5 |

| Indonesia | High | 5 |

| Iran (the Islamic Republic of) | High | 5 |

| Iraq | High | 5 |

| Ireland | Low | 1 |

| Isle of Man | Medium | 3 |

| Israel | Low | 1 |

| Italy | Low | 1 |

| Jamaica | High | 5 |

| Japan | Low | 1 |

| Jersey | Medium | 3 |

| Jordan | Low | 1 |

| Kazakhstan | High | 5 |

| Kenya | High | 5 |

| Kiribati | Low | 1 |

| Korea (the Democratic People’s Republic of) | High | 5 |

| Korea (the Republic of) | Low | 1 |

| Kosovo | Low | 1 |

| Kuwait | Medium | 3 |

| Kyrgyzstan | High | 5 |

| Lao People’s Democratic Republic (the) | High | 5 |

| Latvia | High | 5 |

| Lebanon | High | 5 |

| Lesotho | Low | 1 |

| Liberia | High | 5 |

| Libya | High | 5 |

| Liechtenstein | High | 5 |

| Lithuania | Low | 1 |

| Luxembourg | Medium | 3 |

| Macao | High | 5 |

| Macedonia (the former Yugoslav Republic of) | Low | 1 |

| Madagascar | Low | 1 |

| Malawi | Low | 1 |

| Malaysia | Medium | 3 |

| Maldives | Low | 1 |

| Mali | Low | 1 |

| Malta | Medium | 3 |

| Marshall Islands (the) | High | 5 |

| Martinique | Low | 1 |

| Mauritania | Low | 1 |

| Mauritius | Medium | 3 |

| Mayotte | Low | 1 |

| Mexico | High | 5 |

| Micronesia (the Federated States of) | Low | 1 |

| Moldova (the Republic of) | High | 5 |

| Monaco | High | 5 |

| Mongolia | Low | 1 |

| Montenegro | Medium | 3 |

| Montserrat | Medium | 3 |

| Morocco | Low | 1 |

| Mozambique | Low | 1 |

| Myanmar | High | 5 |

| Namibia | Low | 1 |

| Nauru | High | 5 |

| Nepal | Low | 1 |

| Netherlands (the) | Low | 1 |

| New Caledonia | Low | 1 |

| New Zealand | Low | 1 |

| Nicaragua | High | 5 |

| Niger (the) | Low | 1 |

| Nigeria | High | 5 |

| Niue | High | 5 |

| Norfolk Island | Low | 1 |

| Northern Mariana Islands (the) | Low | 1 |

| Norway | Low | 1 |

| Oman | Low | 1 |

| Pakistan | High | 5 |

| Palau | Medium | 3 |

| Palestine, State of | High | 5 |

| Panama | High | 5 |

| Papua New Guinea | High | 5 |

| Paracel Islands | High | 5 |

| Paraguay | Medium | 3 |

| Peru | High | 5 |

| Philippines (the) | Medium | 3 |

| Pitcairn | Low | 1 |

| Poland | Low | 1 |

| Portugal | Low | 1 |

| Puerto Rico | Low | 1 |

| Qatar | Low | 1 |

| Réunion | Low | 1 |

| Romania | Low | 1 |

| Russian Federation (the) | High | 5 |

| Rwanda | Low | 1 |

| Saint Barthélemy | Low | 1 |

| Saint Helena, Ascension and Tristan da Cunha | Low | 1 |

| Saint Kitts and Nevis | High | 5 |

| Saint Lucia | Medium | 3 |

| Saint Martin (French part) | Low | 1 |

| Saint Pierre and Miquelon | Low | 1 |

| Saint Vincent and the Grenadines | Medium | 3 |

| Samoa | Medium | 3 |

| San Marino | Low | 1 |

| Sao Tome and Principe | Medium | 3 |

| Saudi Arabia | High | 5 |

| Senegal | Low | 1 |

| Serbia | Medium | 3 |

| Seychelles | Medium | 3 |

| Sierra Leone | Medium | 3 |

| Singapore | Medium | 3 |

| Sint Maarten (Dutch part) | Medium | 3 |

| Slovakia | Low | 1 |

| Slovenia | Low | 1 |

| Solomon Islands (the) | Low | 1 |

| Somalia | High | 5 |

| South Africa | Low | 1 |

| South Georgia and the South Sandwich Islands | Low | 1 |

| South Sudan | High | 5 |

| Spain | Low | 1 |

| Spratly Islands | High | 5 |

| Sri Lanka | Low | 1 |

| Sudan (the) | High | 5 |

| Suriname | Low | 1 |

| Svalbard and Jan Mayen | Low | 1 |

| Swaziland | Low | 1 |

| Sweden | Low | 1 |

| Switzerland | Medium | 3 |

| Syrian Arab Republic (the) | High | 5 |

| Taiwan (Province of China) | Low | 1 |

| Tajikistan | High | 5 |

| Tanzania, United Republic of | High | 5 |

| Thailand | Low | 1 |

| Timor-Leste | Medium | 3 |

| Togo | Medium | 3 |

| Tokelau | Low | 1 |

| Tonga | Low | 1 |

| Trinidad and Tobago | Low | 1 |

| Tunisia | High | 5 |

| Turkey | High | 5 |

| Turkish Republic of Northern Cyprus (Northern Cyprus) | High | 5 |

| Turkmenistan | Medium | 3 |

| Turks and Caicos Islands (the) | Medium | 3 |

| Tuvalu | Low | 1 |

| Uganda | High | 5 |

| Ukraine | High | 5 |

| United Arab Emirates (the) | High | 5 |

| United Kingdom (the) | Low | 1 |

| United States (the) | Low | 1 |

| United States Minor Outlying Islands (the) | Low | 1 |

| Uruguay | Medium | 3 |

| Uzbekistan | High | 5 |

| Vanuatu | Medium | 3 |

| Venezuela, Bolivarian Republic of | High | 5 |

| Viet Nam | Low | 1 |

| Virgin Islands (British) | Medium | 3 |

| Virgin Islands (U.S.) | Low | 1 |

| Wallis and Futuna | Low | 1 |

| Western Sahara | Low | 1 |

| Yemen | High | 5 |

| Zambia | Low | 1 |

| Zimbabwe | High | 5 |

Source of Wealth

| Source of Wealth | risk_source_of_wealth | Score |

| Employment (Salaried) | Low | 1 |

| Employment (Retirement Income) | Low | 1 |

| Employment (Self-employed) | Medium | 3 |

| Business Earnings | Medium | 3 |

| Inheritance/Family Gift | High | 5 |

| Insurance Proceeds/Settlement | Medium | 3 |

| Divorce Settlement | Low | 1 |

| Investment Income/Returns | Medium | 3 |

| Winnings (Government Lottery) | Low | 1 |

| Winnings (Non-Government Lottery) | Low | 1 |

| Earnings (Sale of Business) | Low | 1 |

| Earnings (Sale of Property) | Low | 1 |

| Earnings (Sale of Investments) | Low | 1 |

Click here ( Risk Rating Scores for Assigning CDD Risk Ratings ) to download the full data for all the risk rating factors listed in the below table:

Click here to let me know if you have any questions: Contact Ogbe Airiodion | Sr AML/KYC Compliance Consultant

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures .

For the Public

FINRA Data provides non-commercial use of data, specifically the ability to save data views and create and manage a Bond Watchlist.

For Industry Professionals

Registered representatives can fulfill Continuing Education requirements, view their industry CRD record and perform other compliance tasks.

For Member Firms

FINRA GATEWAY

Firm compliance professionals can access filings and requests, run reports and submit support tickets.

For Case Participants

Arbitration and mediation case participants and FINRA neutrals can view case information and submit documents through this Dispute Resolution Portal.

Need Help? | Check System Status

Log In to other FINRA systems

Anti-Money Laundering (AML) Template for Small Firms

FINRA provides a template for small firms to assist them in fulfilling their responsibilities to establish the Anti-Money Laundering (AML) compliance program required by the Bank Secrecy Act (BSA) and its implementing regulations and FINRA Rule 3310 . The template provides text examples, instructions, relevant rules and websites and other resources that are useful for developing an AML plan for a small firm.

Firms should also note that they may access all of the guidance FINRA has provided regarding FINRA Rule 3310 at the Anti-Money Laundering main page.

Changes to the AML Template Updated July 18, 2018

The template has been updated to reflect member firms’ obligations under FINRA Rule 3310 in light of the Financial Crimes Enforcement Network’s (FinCEN) final rule on Customer Due Diligence Requirements for Financial Institutions (CDD Rule).

Additional changes include updated rule cites and resources, with hyperlinks directly to the cited material and additional guidance issued since the template was last updated.

Changes to the AML Template Updated September 8, 2020

The template has been updated to reflect recent guidance, including the red flags described in Regulatory Notice 19-18 (May 2019).

- Need Assistance? Con tact our support team

- Verify Certificates

- Anti-Financial Crime

- Anti-Money Laundering

- Fraud & Investigations

- Risk Management

- Certified Money Laundering Prevention Professional (CMLP)

- Certified Anti-Financial Crime Professional (CFCP)

- Certified Audit and Investigations Professional (CAIP)

- Certifications

- Online Courses

- Expert Webinars

- Learning Paths

- Completion Certificates

- Global Community

- Live Tutoring

- Resource Hub

- Interactive LMS

- Jobs by FCA

Unlocking Success: The Art of AML Risk Assessment Methodology

Understanding AML Risk Assessment

In the realm of Anti-Money Laundering (AML) compliance, conducting a comprehensive and effective AML risk assessment is crucial. This section will delve into the importance of AML risk assessment, highlight the limitations of traditional assessment methods, and explore the benefits of adopting a risk-based approach to AML.

Importance of AML Risk Assessment

The importance of AML risk assessment cannot be overstated. It serves as the foundation for a robust AML compliance program, enabling financial institutions and organizations to identify, assess, and mitigate the risks associated with money laundering and terrorist financing activities. By conducting a thorough risk assessment, institutions can gain a clear understanding of their vulnerabilities, develop appropriate internal controls, and implement risk mitigation strategies.

Traditional AML risk assessment methods have proven to be inadequate in identifying risks, as evidenced by recent high-profile financial crime cases. To address this, a more holistic and dynamic approach is necessary. AML risk assessment should focus on customer behavior, patterns, and interactions rather than relying solely on static data. This approach allows institutions to identify and respond to emerging risks in a timely manner, ensuring the effectiveness of their AML compliance efforts.

Limitations of Traditional AML Risk Assessment Methods

Traditional AML risk assessment methods often suffer from limitations that hinder their effectiveness. These methods tend to rely heavily on historical data and pre-defined risk factors, which may not adequately capture the ever-changing nature of money laundering and terrorist financing activities. Additionally, the static nature of these assessments makes it challenging to identify new and emerging risks.

To overcome these limitations, institutions should adopt a more dynamic and data-driven approach to AML risk assessment. By leveraging technology and data analytics, institutions can gain deeper insights into customer behavior and transaction patterns, enabling them to identify suspicious activities more accurately and efficiently.

Benefits of a Risk-Based Approach to AML

A risk-based approach to AML is a proactive and targeted approach that allocates resources based on the level of risk exposure. This approach allows institutions to focus their efforts and resources on areas that pose the highest risk, ensuring a more efficient use of resources and a more effective risk mitigation strategy. By adopting a risk-based approach, institutions can identify and prioritize the highest-risk customers, transactions, and geographic regions, enabling them to implement appropriate internal controls and monitoring systems.

Moreover, a risk-based approach enables institutions to tailor their AML compliance program to their specific risk profile, ensuring that the necessary measures are in place to address the identified risks effectively. This approach not only enhances the institution’s ability to detect and prevent money laundering and terrorist financing activities but also helps to maintain regulatory compliance.

In conclusion, understanding the importance of AML risk assessment, recognizing the limitations of traditional methods, and embracing a risk-based approach are crucial steps for institutions seeking to combat money laundering and terrorist financing effectively. By leveraging technology, adopting a dynamic approach, and allocating resources based on risk exposure, institutions can enhance their AML compliance efforts and contribute to a safer financial system.

Evolving Regulatory Landscape

As the fight against money laundering and terrorist financing intensifies, the regulatory landscape for Anti-Money Laundering (AML) continues to evolve. Compliance professionals must stay up-to-date with the global AML regulatory bodies, key directives, and the role of organizations like the Financial Crimes Enforcement Network (FinCEN).

Global AML Regulatory Bodies

One of the key international organizations dedicated to preventing money laundering and terrorism financing is the Financial Action Task Force (FATF). With 37 member jurisdictions, the FATF plays a crucial role in establishing global AML compliance standards. They release updated AML/CFT (Combating the Financing of Terrorism) recommendations regularly, providing guidance to member countries on implementing effective AML measures.

Key AML Directives and Regulations

In addition to global regulatory bodies, various countries and regions have enacted their own AML directives and regulations. For example, the European Union released the Fifth Anti-Money Laundering Directive (5AMLD) in 2018, which went into effect in January 2020. This directive aims to strengthen the EU’s AML framework and enhance transparency in financial transactions. The European Union also introduced the Sixth Anti-Money Laundering Directive (6AMLD) in late 2018, which went into effect in June 2021. This directive focuses on preventing money laundering and terrorism financing globally ( Flagright ).

Role of Financial Crimes Enforcement Network (FinCEN)

The Financial Crimes Enforcement Network (FinCEN) is a key player in enforcing AML regulations in the United States. FinCEN operates under the guidance of the Bank Secrecy Act (BSA), which focuses on anti-money laundering and other financial crimes. FinCEN works closely with financial institutions to detect and prevent illicit financial activities. Non-compliance with the BSA can result in severe penalties, including imprisonment and fines of up to $250,000 ( Flagright ).

Staying informed about global AML regulatory bodies, key directives, and the role of organizations such as FinCEN is essential for compliance professionals. By understanding the regulatory landscape, organizations can develop robust AML risk assessment methodologies and ensure compliance with relevant AML regulations.

Red Flags for Suspicious Activity

In the realm of anti-money laundering (AML) risk assessment, identifying red flags for suspicious activity is crucial for financial institutions and other entities to detect and prevent money laundering and terrorist financing activities. Red flags serve as indicators that warrant further investigation. In this section, we will explore red flags in customer behavior, documentation and information, as well as transactions and sources of funds.

Red Flags in Customer Behavior

One of the key red flags indicating suspicious activity is when clients exhibit secrecy or evasiveness about key details such as identity, source of money, beneficial owner, or payment method choice. Clients withholding such information may be attempting to hide their identity or the source of funds. Financial institutions should be vigilant when clients display these behaviors, as they could be potential indicators of illicit activities.

Red Flags in Documentation and Information

Another red flag to watch out for is the presentation of fake documents, avoidance of personal contact, refusal to provide necessary information, and the use of unverifiable email addresses. These behaviors could indicate attempts to conceal connections to terrorist activities or the source of funds ( Sanction Scanner ). Financial institutions must exercise due diligence in verifying the authenticity of documents and information provided by clients to ensure compliance with AML regulations.

Red Flags in Transactions and Sources of Funds

Unusual transaction patterns can also raise red flags for suspicious activity. Financial institutions should be wary of transactions involving parties from high-risk countries with no apparent commercial reason, multiple transactions between parties in a short time, or transactions involving individuals below the legal age. These could indicate potential money laundering or terrorist financing activities. Additionally, suspicious indicators related to the source of funds include inconsistent economic profiles, unexplained cash collateral, unverified sources of high-risk funds, and the presence of multiple or foreign bank accounts. These red flags should prompt further investigation to ensure compliance and mitigate the risk of money laundering.

By being aware of these red flags, financial institutions and other entities can enhance their AML risk assessment processes and implement appropriate measures to detect and prevent suspicious activities. It is essential to establish robust systems and procedures to promptly identify and address any red flags that may arise. Regular training and awareness programs can also help employees recognize and report potential red flags for suspicious activity, fostering a strong culture of compliance and risk management.

Enhancing AML Risk Assessment with Technology

With the ever-evolving landscape of financial crimes, leveraging technology has become crucial in enhancing Anti-Money Laundering (AML) risk assessment processes. By incorporating advanced tools and techniques, financial institutions can improve the accuracy, efficiency, and effectiveness of their AML risk assessment methodologies. This section explores the role of technology in AML risk assessment, the benefits of leveraging data analytics and machine learning, and the advantages of automation in AML/CFT (Combating the Financing of Terrorism) processes.

Role of Technology in AML Risk Assessment

Technology plays a pivotal role in modern AML risk assessment methodologies. It enables financial institutions to streamline and strengthen their compliance efforts by automating various aspects of the AML process. Advanced algorithms and artificial intelligence are deployed to analyze vast amounts of data, allowing for the identification of potential risks and suspicious activities that might otherwise go unnoticed. By leveraging technology, institutions can create dynamic risk profiles of customers and entities, enabling them to prioritize high-risk accounts and transactions for focused investigations ( Financial Crime Academy ).

Leveraging Data Analytics and Machine Learning

Data analytics and machine learning have revolutionized the way AML risk assessments are conducted. By integrating big data analytics into AML/CFT efforts, financial institutions can uncover hidden patterns and trends in large datasets, aiding in the identification of complex money laundering networks, terrorist financing channels, and emerging risks. These technologies enable institutions to detect unusual transactional patterns, flagging potentially suspicious activities for further investigation. By utilizing machine learning algorithms, systems can learn from historical data and adapt to evolving risk landscapes, enhancing the effectiveness of risk assessments.

Benefits of Automation in AML/CFT Processes

Automation has transformed AML/CFT processes, resulting in increased efficiency and effectiveness. By automating customer onboarding, enhanced due diligence, and transaction monitoring, financial institutions can streamline their operations, reduce manual errors, and allocate more resources to investigating genuine risks. Automated reporting tools ensure timely and accurate submissions to regulatory authorities, enhancing transparency and regulatory compliance. Real-time transaction monitoring facilitated by automation enables swift identification and response to potential AML/CFT risks, preventing illicit transactions from going unnoticed. These advancements in automation significantly enhance financial security and help institutions stay ahead of evolving risks ( LinkedIn ).

By embracing technology in AML risk assessment methodologies, financial institutions can better combat money laundering and terrorist financing activities. The integration of advanced tools and techniques allows for more accurate risk profiling, efficient allocation of compliance efforts, and timely detection of suspicious activities. Through the use of data analytics, machine learning, and automation, financial institutions can strengthen their AML/CFT processes, ensuring compliance with regulatory requirements and promoting a safer financial ecosystem.

Implementing an Effective AML Risk Assessment Framework

To effectively combat money laundering and terrorist financing, financial institutions must implement a robust AML risk assessment framework. This framework enables the detection, evaluation, and mitigation of risks associated with these illicit activities, allowing institutions to allocate resources, implement appropriate controls, and prioritize efforts to manage and mitigate these risks ( FinScan ).

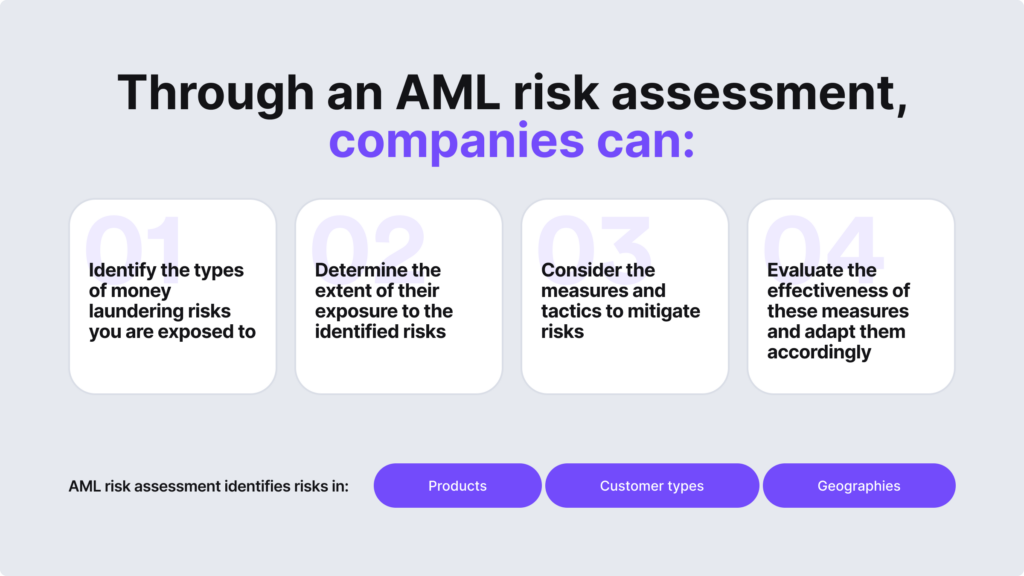

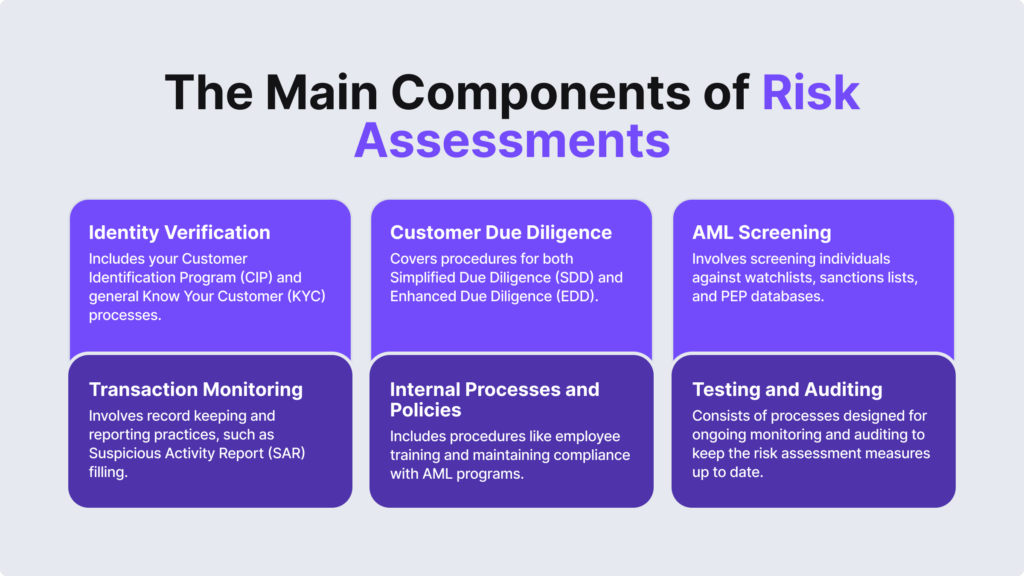

Components of AML Risk Assessment

An effective AML risk assessment framework consists of several key components. These components work together to create a comprehensive system for identifying, assessing, and managing risks related to money laundering and terrorist financing.

Risk Identification : The first step in AML risk assessment is the identification of potential risks. This involves analyzing internal and external factors that may contribute to money laundering or terrorist financing activities. Factors such as customer profiles, transaction patterns, geographic locations, and the nature of products and services offered are considered during this process.

Risk Assessment : Once risks are identified, they need to be assessed to determine their likelihood and potential impact. This assessment helps institutions allocate resources effectively and prioritize efforts to manage and mitigate risks. Risk assessment involves evaluating the adequacy of existing controls and determining the residual risk that remains after implementing these controls.

Risk Mitigation : After assessing risks, institutions must develop and implement strategies to mitigate them. This may involve enhancing customer due diligence procedures, implementing transaction monitoring systems, conducting staff training programs, and establishing robust internal policies and procedures to address identified risks.

Ongoing Monitoring and Review : AML risk assessment is not a one-time exercise. Institutions must continuously monitor and review their risk assessments to ensure they remain effective and aligned with changing regulatory requirements and emerging risks. Regular reviews help identify gaps, update risk profiles, and enhance risk management strategies.

Developing a Risk-Based Approach

A risk-based approach is crucial in AML risk assessment. This approach involves prioritizing resources and efforts based on the level of risk posed by customers, transactions, and geographic locations. By focusing on higher-risk areas, institutions can allocate resources effectively and implement appropriate controls to manage these risks.

To develop a risk-based approach, financial institutions should:

- Establish risk thresholds and criteria for customer due diligence, transaction monitoring, and enhanced due diligence measures.

- Implement systems and processes to identify and categorize customers based on their risk profiles.

- Regularly review and update risk assessment methodologies to adapt to changing risks and regulatory requirements.

- Foster a culture of risk awareness and compliance throughout the organization.

By adopting a risk-based approach, institutions can better allocate resources, enhance compliance efforts, and effectively manage AML risks.

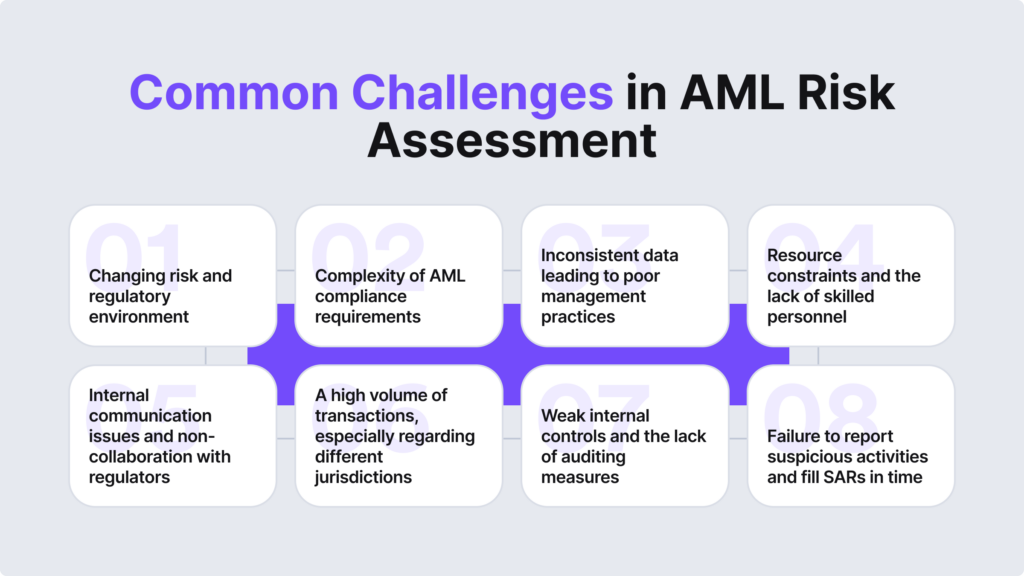

Challenges and Considerations in AML Risk Management

Implementing an effective AML risk assessment framework is not without its challenges. Financial institutions must carefully consider and address these challenges to ensure compliance and better manage financial and reputational risks.

Some key challenges and considerations in AML risk management include:

Regulatory Compliance : Institutions must ensure that their risk assessment framework aligns with regulatory requirements and guidelines issued by global AML regulatory bodies. Regular revisions and continuous improvement are necessary to keep up with evolving regulations.

Data Quality and Integration : Accurate and reliable data is essential for effective risk assessment. Institutions should ensure the quality and integrity of data used in their risk assessment processes. Integration of data from multiple sources and systems is important to obtain a comprehensive view of the risks.

Advanced Technology Solutions : Leveraging technology solutions, such as AML risk assessment software and AI-supported AML solutions, can significantly enhance risk management efforts. Financial institutions should explore technological advancements to improve accuracy, efficiency, and effectiveness in AML risk assessment and compliance.

Staff Training and Awareness : Institutions should invest in training programs to enhance staff knowledge and awareness of AML risks and regulatory requirements. Regular training sessions and updates on emerging risks and typologies help build a strong compliance culture.

By addressing these challenges and considerations, financial institutions can implement an effective AML risk assessment framework that aligns with regulatory expectations and helps mitigate financial crimes associated with money laundering and terrorist financing.

Role of AML Risk Assessment in Compliance

AML risk assessment plays a critical role in ensuring compliance with anti-money laundering regulations and mitigating the risks associated with money laundering and terrorist financing. This section explores the requirements for AML risk assessment, the need for regular updates and maintenance, and the importance of independent testing and compliance programs.

BSA/AML Risk Assessment Requirements

In the United States, the Bank Secrecy Act (BSA), enforced by the Financial Crimes Enforcement Network (FinCEN), focuses on anti-money laundering and other financial crimes. Non-compliance with BSA/AML requirements can result in severe penalties, including imprisonment and fines of up to $250,000 ( Flagright ).

To comply with BSA/AML regulations, financial institutions are required to develop a well-developed BSA/AML risk assessment. This risk assessment assists banks in identifying money laundering and terrorist financing risks, and in developing appropriate internal controls. It enables better application of risk management processes and supports compliance with regulatory requirements ( FFIEC ).

Updating and Maintaining AML Risk Assessment

While banks are not required to update the BSA/AML risk assessment on a continuous or specified periodic basis, regular updates are necessary to reflect changes in products, services, customers, and geographic locations. It is crucial to ensure that the risk assessment accurately reflects the risks associated with money laundering, terrorist financing, and other illicit financial activities.

The risk assessment should consider all relevant risk categories, including products, services, customers, and geographic locations. By analyzing information related to these risk categories, banks can determine their ML/TF (money laundering/terrorist financing) and other illicit financial activity risks. This helps in developing effective risk mitigation strategies and complying with regulatory expectations.

Independent Testing and Compliance Programs

To ensure the effectiveness of the AML risk assessment process, financial institutions should establish robust compliance programs. These programs should be based on the institution’s risk profile and address the assessed risks. Risk-based monitoring systems should be implemented to detect and report suspicious activities. Additionally, independent testing should be conducted to review the BSA/AML risk assessment in place and evaluate the adequacy of the compliance program.

Independent testing involves an objective assessment of the AML risk assessment methodology, internal controls, policies, procedures, and processes. It helps to identify any gaps or weaknesses in the risk assessment and compliance program. By conducting regular independent testing, financial institutions can ensure that their AML risk assessment remains effective and aligned with regulatory requirements.

In conclusion, AML risk assessment is a fundamental component of compliance with anti-money laundering regulations. Financial institutions must adhere to BSA/AML risk assessment requirements and update the risk assessment regularly to reflect changes in their risk profiles. Implementing independent testing and maintaining robust compliance programs are crucial for ensuring the effectiveness of the AML risk assessment process and overall regulatory compliance.

AML Risk Assessment Methodology

In the realm of Anti-Money Laundering (AML) compliance, having a robust and effective risk assessment methodology is crucial. The International Monetary Fund (IMF) plays a significant role in the development and implementation of the AML/CFT (Combating the Financing of Terrorism) risk assessment methodology. This methodology provides a systematic approach to identify, assess, and understand the money laundering and terrorism financing risks faced by countries ( IMF ).

Role of IMF in AML/CFT Risk Assessment

The IMF has developed a comprehensive set of tools to enable its surveillance function to evaluate vulnerabilities to macroeconomic and financial shocks in member countries. These tools have been integrated into the AML/CFT risk assessment methodology, allowing for a more coherent analysis of vulnerabilities. The IMF also conducts technical assistance missions to help countries implement this methodology and build their capacity in undertaking risk assessments and managing AML/CFT processes at the national level ( IMF ).

Dynamic Approach to Risk Assessment Methodology

The evolving nature of risks related to money laundering and terrorism financing requires a dynamic approach to the implementation of the AML/CFT risk assessment methodology. National authorities must adapt their methodologies to changes in risks and vulnerabilities to effectively combat these illicit activities. Regular updates and capacity building are necessary to ensure the methodology remains effective in identifying and mitigating money laundering and terrorism financing risks ( IMF ).

Updating and Adapting to Changing Risks

Countries implementing the AML/CFT risk assessment methodology must continuously update their approaches and tools to address the changing nature of risks. This includes staying informed about new money laundering and terrorism financing techniques, emerging technologies, and evolving regulatory frameworks. Regular updates to the risk assessment methodology, along with ongoing capacity building, are essential to ensure its effectiveness in combating illicit activities.

By adopting the AML/CFT risk assessment methodology, countries can develop a more targeted and tailored approach to combating money laundering and terrorism financing. This methodology provides a structured framework for identifying and understanding the unique risks faced by each country, enabling the development of effective strategies and measures to mitigate those risks. With the guidance and support of organizations like the IMF, countries can enhance their AML/CFT efforts and contribute to the global fight against financial crime.

Technology Solutions for AML Compliance

In the ever-evolving landscape of AML compliance, technology plays a crucial role in bolstering efforts to combat money laundering and financial crimes. Various AI-supported solutions and software are available to help organizations enhance their AML compliance measures. Let’s explore some of these technology solutions for AML compliance.

AI-Supported AML Solutions

AI-supported AML solutions have revolutionized the way financial institutions approach compliance. These solutions leverage advanced algorithms and artificial intelligence to streamline processes such as onboarding, customer due diligence, and transaction monitoring. By automating these tasks, AI-supported AML solutions reduce manual errors and free up resources for investigating genuine risks, thereby enhancing financial security.

Transaction Monitoring Software

Transaction monitoring software is a legal requirement for businesses under AML obligations. It enables organizations to detect high-risk and suspicious activities associated with financial transactions. With real-time monitoring capabilities, transaction monitoring software allows businesses to identify potential money laundering or illicit activities promptly. Additionally, organizations can customize search options and apply advanced search parameters to minimize false positives. Transaction monitoring software plays a crucial role in preventing financial crimes and ensuring compliance.

AML Transaction Screening Tools

AML transaction screening tools are essential for businesses in verifying the sender and receiver of financial transactions. These tools enable organizations to instantly check for any adverse media or negative news associated with individuals or entities involved in the transactions. By including news related to financial crimes such as money laundering, terrorist financing, and corruption, AML transaction screening tools aid institutions in identifying and mitigating risks. These tools employ advanced algorithms and artificial intelligence to customize search options and minimize false positives, enhancing the effectiveness of AML compliance.

Adverse Media Screening

Adverse media screening is a crucial component of KYC (Know Your Customer) and AML processes. By searching for negative media news related to individuals or entities, adverse media screening helps businesses identify and protect themselves from risks. It includes news on various financial crimes, such as money laundering, terrorist financing, corruption, and arms trafficking. Adverse media screening adds an extra layer of control in the customer onboarding process, in addition to sanctions and politically exposed person (PEP) scans. By leveraging global coverage of adverse media data, organizations can strengthen their AML compliance measures and mitigate potential risks.

By adopting AI-supported AML solutions, transaction monitoring software, AML transaction screening tools, and adverse media screening, organizations can enhance their AML compliance efforts. These technology solutions improve efficiency, streamline processes, and enable organizations to allocate resources effectively to combat money laundering and financial crimes. Moreover, technology-driven advancements in AML compliance contribute to a more secure and transparent financial system.

Best Practices for AML Risk Assessment

When it comes to AML (Anti-Money Laundering) risk assessment, following best practices is crucial for financial institutions to effectively identify and mitigate potential risks associated with money laundering and terrorist financing. Here are some key best practices to consider:

Risk Identification in AML

The first step in AML risk assessment is the identification of risks. This involves assessing whether the customer poses a higher level of risk, checking if they are a politically exposed person (PEP), and determining if they are associated with people on a recognized sanctions list or negative publicity. By conducting thorough due diligence and implementing robust KYC (Know Your Customer) procedures, financial institutions can better understand the risk profile of their customers and tailor their AML measures accordingly.

Assessing Risk Associated with Services

Financial institutions should also assess the risk associated with the services they provide. This involves considering if the services fall into higher-risk sectors and looking out for red flags in the customer’s behavior, such as consistent patterns in the type of services required ( Skillcast ). By conducting a thorough analysis of the services offered and closely monitoring customer behavior, institutions can identify potential risks and take appropriate measures to mitigate them.

Considering Geographical Location

Geographical location is an important factor in AML risk assessment, as certain jurisdictions pose a higher ML/TF (Money Laundering/Terrorist Financing) risk level than others. Financial institutions should consider the risk associated with different jurisdictions and ensure that they have adequate measures in place to address the specific risks associated with each location ( Skillcast ). By staying informed about global AML regulations and conducting country-specific risk assessments, institutions can enhance their understanding of regional risks and implement targeted preventive measures.

Evaluating Type of Transactions

AML risk assessment should also take into account the type of transactions involved. This includes cash transactions, wire transfers, and transactions involving cryptocurrencies or non-fungible tokens (NFTs). It is important to understand the source of funds and assess any transactions involving payments to unrelated third parties. By evaluating the nature and complexity of transactions, financial institutions can identify potential red flags and implement appropriate measures to detect and prevent money laundering and terrorist financing activities.

By following these best practices, financial institutions can enhance their AML risk assessment processes and ensure compliance with regulatory requirements. It is important to regularly update and maintain the AML risk assessment framework to adapt to changing risks and regulatory expectations. Leveraging technology solutions, such as AI-supported AML solutions and transaction monitoring software, can also aid in streamlining the risk assessment process and enhancing the overall effectiveness of AML compliance ( FinScan ). By adopting a risk-based approach and implementing best practices, financial institutions can better safeguard themselves against financial crimes and contribute to a more secure financial system.

To effectively combat money laundering and terrorist financing, financial institutions must employ robust AML risk assessment methodology . This methodology serves as a foundation for identifying, assessing, and mitigating the risks associated with financial crimes. By implementing a structured approach, institutions can allocate resources efficiently and prioritize their efforts to combat illicit activities.

The International Monetary Fund (IMF) plays a crucial role in promoting effective AML/CFT risk assessment practices worldwide. It provides guidance and support to member countries in developing and implementing risk assessment frameworks. The IMF emphasizes the need for a comprehensive and dynamic approach to risk assessment that takes into account evolving risks and changing regulatory landscapes.

A dynamic approach to AML risk assessment methodology involves regular updates and adaptations to address emerging risks. This methodology recognizes that money laundering and terrorist financing techniques are constantly evolving, requiring financial institutions to stay vigilant and proactive in their risk assessment practices. By regularly reviewing and updating their risk assessment frameworks, institutions can effectively identify and respond to new and emerging risks.

Financial institutions must continuously monitor and evaluate the effectiveness of their risk assessment methodologies to ensure they remain relevant and aligned with changing risks. This includes staying informed about evolving typologies, regulatory developments, and industry best practices. By proactively adapting their risk assessment methodologies, institutions can enhance their ability to detect and prevent financial crimes.

Technology solutions play a vital role in supporting the implementation of effective AML risk assessment methodologies. Financial institutions can leverage various AI-supported AML solutions, such as transaction monitoring software and AML transaction screening tools, to enhance their risk assessment capabilities. Additionally, adverse media screening tools can help identify potential risks associated with customers or entities by monitoring news sources, watchlists, and other relevant data.

In conclusion, an effective AML risk assessment methodology is crucial for financial institutions to identify, assess, and mitigate the risks associated with money laundering and terrorist financing. By adopting a dynamic approach and leveraging technology solutions, institutions can enhance their ability to combat financial crimes and maintain compliance with regulatory requirements. Regular updates, adaptations, and a proactive mindset are essential to stay ahead of evolving risks in the ever-changing landscape of financial crimes.

Defending Against Financial Crimes: Crafting Robust AML Policies

The Ultimate Weapon: Real Estate Money Laundering Legislation Revealed

AML/CTF Risk Factors For CDD/KYC

Stay Ahead of Financial Crime: Implementing an AML Compliance Program

The Hidden Rewards: Exploring AML Technology Job Salaries

Stay Ahead of the Game: Streamlining Your OFAC Screening Process

Privacy overview.

Sign up to our newsletter and get our Ultimate AML Compliance Guide sent to your inbox

How to Conduct an AML Risk Assessment

All UK businesses have a responsibility to prevent money laundering and other forms of financial crime.

Risk assessments are a key component of any firm's anti-money laundering (AML) tool kit, and can help businesses to measure the likelihood that they will inadvertently support or engage in criminal behaviour.

The Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017 (MLR 2017) made it a legal requirement for UK businesses in the regulated sector to adopt a risk based approach to their anti-money laundering efforts. This not only helps reduce the damage done by money laundering to the UK economy but gives companies flexibility in how they design and deploy their anti-money laundering procedures; as such risk assessments can vary between companies and sectors.

This guide explains what risk assessments are, and how any business can apply them to combat money laundering while meeting their regulatory compliance obligations.

What is an AML Risk Assessment?

A money laundering risk assessment is a process that analyses a business's risk of exposure to financial crime. The process aims to identify which aspects of the business put it at risk of exposure to money laundering or terrorist financing. It achieves this by monitoring and assessing known vulnerabilities, also commonly referred to as Key Risk Indicators (KRIs).

Anti-money laundering risk assessments form part of the required risk based approach . They should form part of, and tie into, a company’s overarching strategy to avoid facilitating the laundering of illicit funds.

There are two types of risk assessments required as part of a risk based approach. These are a companywide risk assessment and risk assessments of individual transactions.

A company-wide risk assessment is a floor to ceiling review of a business to identify what external risks of money laundering they face and where in their business is at risk of being exploited by criminals seeking to launder illicit funds. Once this is done it is used as the foundation for a company to design their risk assessment and anti-money laundering processes.

After identifying and highlighting the money laundering risks their company is facing, directors then must design an appropriate risk assessment procedure to ensure they identify any potential transaction that is part of a money laundering scheme.

Why are AML Risk Assessments Required

Certain businesses are required to conduct anti-money laundering risk assessments under Regulation 18 of the Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017 (MLR 2017).

On a practical level, a risk assessment could help a business to:

- use a risk-based approach to identifying and preventing money laundering.

- understand the risks associated with various business relationships and commercial activities.

- create policies, procedures, and controls that actively reduce the risk of financial crime.

- make more informed decisions about employees and clients.

- identify transactions and relationships that involve an at-risk or sanctioned country.

- Evaluate risk reduction measures.

Ultimately, an AML checks risk assessment can help businesses to reduce the risk of money laundering and terrorist financing. These measures are an essential part of any anti-money laundering compliance program, and can help organisations to stay on the right side of the law

Money Laundering Risk Indicators

Businesses can conduct a money laundering risk assessment by monitoring key risk indicators. International authorities generally apply five primary categories of risk indicator that businesses should assess:

- The size, nature, and complexity of a business.

- The type of customer involved (e.g. B2B or B2C).

- The types of products and services involved in a transaction.

- The methods used to onboard new customers and communicate with existing ones.

- Geographical factors

By assessing these individual factors, businesses can allocate a risk rating to a transaction or customer relationship. Ratings of low, medium, and high can be used when applying a simple risk range, whereas more advanced risk ranges extend to very low and very high ratings.

How to do a Company-wide risk assessment

The first step of this assessment is for directors and employees to work together to identify how their business could be used to facilitate money laundering and how likely this is to happen. It is important to note that UK regulation requires that staff have sufficient training to be able to spot these risks. There is no set way that this assessment has to be carried out but it must review every aspect of the business. Once this has been done sufficient procedures should be designed and put in place to negate these risks.

It important that this process be well documented; as a company may be asked to prove it is compliant with UK anti-money laundering regulations , especially if it has been implicated in a money laundering scheme.

Things to consider in a companywide risk assessment are:

- The risks posed to their industry

- The risks posed by their business structure

- The risks posed by their products and/or services

- The risks posed by their business processes

- The risks posed by the geographical areas they operate in

- The risks posed by their distribution and payment channels. E.g. cash over the counter, bank transfers etc

- The risks posed by their customer base

This process should be reviewed every 12 to 18 months, or if a business undergoes any significant changes, and any necessary changes to internal procedures made.

How to perform an Anti-Money Laundering risk assessment

An anti-money laundering risk assessment’s purpose is to gauge if a transaction, and any individual involved in it, is possibly involved in money laundering and if any anti-money laundering checks need to be carried out or even if the transaction should not be performed at all.

The companywide risk assessment will have highlighted the greatest areas of risk and in these cases thorough anti-money laundering checks should be performed as a matter of course. Risk assessments should still be applied to transactions that were decided to be low risk in the companywide risk assessment.

A risk assessment is largely based on intuition and knowledge of how criminals exploit the private sector to launder money as well as proscribed business processes. It is therefore imperative, and a company’s responsibility, that the staff performing these assessments have the adequate training and tools to perform them.

There are some general key risk drivers that should be considered in each risk assessment:

- Clients seeking undue anonymity or secrecy and not willingly revealing their identity

- Clients acting through a third party

- A third party not being transparent about who they are acting on behalf of or who the ultimate beneficiary is

- Clients introduced to you by a third party, as you do not know the due diligence that has taken place

- Clients you have not obtained via the methods usual to the business

- Clients involved with cash based businesses

- Clients from abroad, especially from countries with low regulatory standards, high corruption or sanctions

- Clients from outside the usual customer base

- Clients involved in emerging sectors or who’s business has recently pivoted

- Clients with, or operating for an individual with, high net worth

- Clients wanting to deal in cash

- Clients with a criminal history

- Politically exposed clients

- Large transactions

- One off transactions

If the risk assessment finds any of these key risk drivers, any other risk drivers specific to a business as found in its companywide risk assessment or has any concerns then the company’s anti-money laundering check procedures should be followed.

Regardless of whether a risk is found or not, the findings of and methods applied in the risk assessment should be recorded.

Assessing High-Risk Activities

Businesses must pay particular attention to any high-risk activities when conducting a risk assessment. Each year, the UK government publishes a National Risk Assessment (NRA) that outlines the latest trends in money laundering and terrorist financing. This can help when prioritising certain activities as part of a risk-based approach to compliance.

In the UK's 2020 NRA, the following activities were identified as high-risk:

- conveyancing

- client account services

- trust and company formation

- financial technology services

- cash-related services

- the use of crypto assets and virtual money

Businesses should carefully consider whether their compliance framework does enough to identify and address these risks.

At the same time, organisations must pay close attention to the warning signs of money laundering and adjust their policies, controls, and procedures accordingly. This is especially true when dealing with customers and transactions that involve jurisdictions classified as high-risk by the Financial Action Task Force (FATF).

Risk Assessment during Customer Onboarding

A risk assessment can form a substantial part of the customer onboarding process. This opportunity should be used to conduct thorough due diligence before forming closer ties with an individual or organisation.

As part of an onboarding risk assessment, customers should be vetted for money laundering and terrorist financing risk factors. This process should include screening for adverse media, sanctions, and politically exposed persons (PEPs).

In addition to the above, businesses ought to be cautious when dealing with customers that perform actions that are at odds with their profile. This might happen if a customer suddenly attempts to enter into a high-value transaction, pay via a previously unrelated entity, or engage in a transaction that makes no commercial sense.

If a risk assessment flags any of these factors it may be necessary to ask further questions of a potential customer, or even to file a suspicious activity report (SAR).

Improve Your Approach to Risk Assessments with Red Flag Alert

Risk assessments are essential for businesses that need to comply with anti-money laundering regulations. Not only can they help to protect the economy from the threat of financial crime, but they can also prevent financial and reputational damage to the organisations involved.