How Reliance Became India's Biggest Company [Reliance Industries Case Study]

Devashish Shrivastava

Reliance Industries Limited (RIL) is an Indian organization headquartered in Mumbai, India. Founded by Dhirubhai Ambani, the present Reliance Industries CEO is his son Mukesh Ambani.

Reliance has its entities across domains like vitality, petrochemicals, materials, common assets, retail, and broadcast communications. Reliance is one of the most prominent businesses in India, the biggest "traded on an open market" organization in India by showcase capitalization, and the biggest organization in India as estimated by income after it outperformed Indian Oil Corporation sometime back. On 18 October 2007, Reliance Industries became the first Indian company to cross $100 billion market capitalization.

The organization is positioned 106th on the Fortune Global 500 rundown of the world's greatest enterprises as of 2019 . It was positioned eighth among the Top 250 Global Energy Companies by Platts in 2016. Reliance continues to be India's biggest exporter, representing 8% of India's all-out exports with an estimation of Rs 147,755 crore and access to business sectors in 108 countries. Reliance is answerable for nearly 5% of the legislature of India's complete income from traditions and extracts obligation. In 2019, Reliance Industries Limited became the first Indian business to cross Rs 9 lakh crore valuation mark.

This post by StartupTalky is a case study on Reliance Industries Limited, which will let you know about Reliance company, Reliance Industries founder, Reliance Industries CEO, Reliance Company details, Reliance services company, History of Reliance Industries, Marketing Strategy of RIL, Growth, Revenue, Profit of Reliance Industries Limited and more.

History And Origin Of Reliance Industries Limited Marketing Strategy Of Reliance Industries Limited Growth And Future Of Reliance IndustriesLimited Revenue And Profit Of Reliance Industries Limited

History And Origin Of Reliance Industries Limited

In 1966, Reliance Textiles Engineers Pvt. Ltd. was consolidated in Maharashtra . It built a manufactured textures plant around the same time at Naroda in Gujarat . On 8 May 1973, it moved towards becoming Reliance Textiles Industries Limited. In 1975, the organization extended its business into materials with "Vimal" forming its image in the later years.

The organization held its initial open offering (IPO) in 1977. Sidhpur Mills, a materials organization, was amalgamated with Reliance Textiles in 1979. In 1980, the organization extended its polyester yarn business by setting up a Polyester Filament Yarn Plant in Patalganga (Maharashtra) with monetary and specialized coordinated efforts from E. I. duPont de Nemours and Co., U.S.

In 1985, the name of the organization was changed from Reliance Textiles Industries Ltd. to Reliance Industries Limited. Between 1985 to 1992, the organization extended its introduced limit with regards to delivering polyester yarn by more than 145,000 tons per year.

In 1993, Reliance went to the capital markets abroad for assets through a worldwide depository issue of Reliance Petroleum. In 1996, it turned into the first private division organization in quite a while to be appraised by worldwide FICO assessment offices. In 1995/96, the organization entered the telecom business through a joint endeavor between NYNEX, USA, and advanced Reliance Telecom Private Limited in India.

In 2001, Reliance Industries Limited and Reliance Petroleum Ltd. turned into India's two biggest organizations as far as all major monetary parameters were considered. In 2001–02, Reliance Petroleum converged with Reliance Industries. In 2002, Reliance reported India's greatest gas revelation (at the Krishna Godavari bowl) in almost three decades. The setup volume of gaseous petrol was more than 7 trillion cubic feet, proportionate to about 1.2 billion barrels of unrefined petroleum.

This was the first, historically speaking, disclosure by an Indian private company. In 2002–03, RIL bought a larger stake in Indian Petrochemicals Corporation Ltd. (IPCL), India's second-biggest petrochemicals organization, from the administration of India. IPCL later converged with RIL in 2008.

In 2005 and 2006, the organization revamped its business by de-merging its interests in control age and appropriation, money-related administrations, and media transmission administrations into four separate entities. In 2006, Reliance entered the retail showcase in India with the dispatch of its retail location position under the brand name 'Reliance Fresh'. By the end of 2008, Reliance retail had near 600 stores crosswise over 57 urban communities in India.

In November 2009, Reliance Industries gave 1:1 extra offers to its investors . In 2010, Reliance entered the broadband administrations showcase with the securing of Infotel Broadband Services Limited; the latter was the main effective bidder for the skillet India fourth-age (4G) range sale held by the legislature of India.

Around the same time, Reliance and Bharat Petroleum declared an association in the oil and gas business. BP took a 30% stake in 23 oil and gas creation sharing agreements that Reliance works in India, including the KG-D6 hinder for $7.2 billion. Reliance likewise shaped a 50:50 joint endeavor with BP for sourcing and showcasing gas in India. In 2017, RIL set up a joint endeavor with Russian Company Sibur for setting up a Butyl elastic plant in Jamnagar (Gujarat) that became operational by 2018. Click here to know about the Subsidiaries that make Reliance successful .

Reliance Industries is currently one of the biggest Indian multinational conglomerates that has diversified into many verticals today. Reliance Industries headquarters is in Mumbai, Maharashtra, of which, Reliance is the largest publicly-traded company by market capitalisation.

Marketing Strategy Of Reliance Industries Limited

The organization was established by Dhirubhai Ambani and Champaklal Damani in the 1960s as Reliance Commercial. The marketing mix of Reliance covers 4Ps (product, price, place, and promotion) and explains Reliance Industries' marketing strategy is as follows:

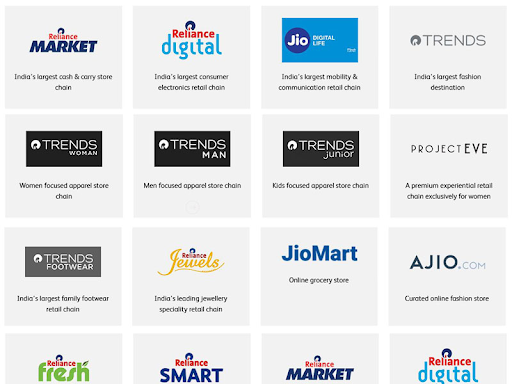

Reliance Industries Limited is perhaps the greatest aggregate in India. Its business is available in different segments which are concentrated to comprehend Reliance's item system in its showcasing blend. The retail segment incorporates Reliance Fresh, Big Bazaar, Reliance Mart, Reliance Market, Reliance Home Kitchen, Reliance iStore, Reliance Solar, and more.

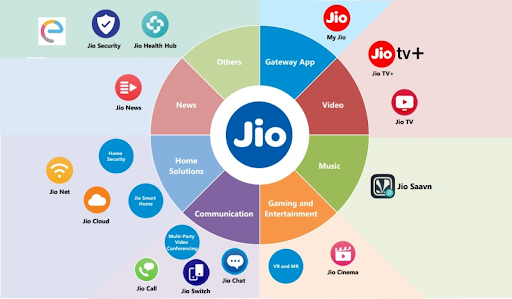

Reliance Life Sciences is associated with medicines, plants, and biotechnology as it has some expertise in marking, assembling, and promoting Reliance enterprises items in bio-pharmaceuticals. Reliance's coordination comprises transportation, dissemination, coordination, inventory network-related exercises, and telemetry arrangements. Reliance Jio Infocomm Ltd . is a broadband specialist co-op that gives 4G administrations. Relicord is claimed by Reliance Life Sciences and gives blood banking administrations. Reliance Industrial Infrastructure Limited deals with the development and activity of pipelines for moving oil-based commodities . Subsequently, this gives an outline of the contributions of Reliance Industries.

Reliance Industries Limited pursues a distinctive valuing methodology for various segments. Thus, the advertising blend and evaluation technique of Reliance Industries is unique in light of rivalry and market administration in certain parts. It pursues entrance valuing for retail, media transmission, and well-being. At the point when the organization propelled Reliance Jio, it offered free Jio administrations to its clients during the dispatch time frame to build a piece of the pie. Be that as it may, the retail and media transmission parts are at misfortune; however, the organization is giving ideas to clients to build its client base.

The evaluating choices on its oil business rely upon the full-scale condition components and worldwide market situation to a great extent. Reliance Fresh outlets, for example, secure their items directly from the source, eliminating the middlemen in this way. This is advantageous to the shopper as the markdown price and value decrease. Reliance Industries performs exhaustive evaluation before valuing its choices, and this evaluation is a persuasive factor for its ascent in the aggressive market.

Reliance Industries has a solid nearness all over India. Reliance Retail is the biggest retailer that has more than 1500 stores crosswise over India. Here are the investors that makes Reliance Retail, one of the largest retailer in India . Different brands like Reliance Fresh, Reliance Footprint, Reliance Digital, and Reliance Trends have arrived in Tier 1 and Tier 2 urban areas.

Reliance Jio sim administrations are accessible crosswise over significant areas and its network has improved significantly over the last years.

Reliance Industries' dispersion system is so well-arranged that it has a strong grip across the country. Reliance gets crude materials directly from the source; consequently, it has pulled in an enormous number of clients because of the advertisements. Reliance clients can speak with the agents by calling administrations or online channels.

Reliance Industries meets with its shareholders in annual general meetings, which it holds every year. This Annual General Meeting (AGM) was held virtually on July 15, 2020, which became the first virtual AGM after TCS had done it on June 11, 2020. The Ministry of Corporate Affairs (MCA), owing to the current circumstances, has permitted companies to hold their Annual General Meetings through video conferencing or other Audio Visual means to avoid large public gatherings. The meeting with all the shareholders was held on 15th July at 2 PM through a video conferencing platform. This was the 43rd AGM for Reliance Industries Limited. Many big announcements were made during today’s AGM, where the most significant of them all is that Google has announced that it will invest $4.5 billion, which is approximately INR 33,737 crores in Reliance Jio at a stake of 7.7 %. After only 2 days since Google announced that it will invest $10 billion or INR 75,000 crores in the Indian digital market, Reliance has made this announcement. Google has joined Facebook in the big investors' list of Jio, a subsidiary of Reliance Industries Limited. RIL announced in the AGM that Google along with Reliance Jio will work on developing low-cost, entry-level mobile devices with a customized version of Android to serve millions of new customers in India. Mukesh Ambani informed that these mobile phones will come with the support of the future of wireless networks - 5G, and the Google Play services. Sundar Pichai also sent a video message regarding the partnership between Google and Jio Platforms. In the video message, he said, “Getting technology into the hands of more people is a big part of Google’s mission. To organize the world’s information and make it universally accessible and useful is another part of the mission. Through this partnership with Jio Platforms, we see the chance to have an even greater impact than either company could have alone. ”

Everyone should have access to the internet. Proud to partner with @reliancejio to increase access for the hundreds of millions in India who don’t own a smartphone with our 1st investment of $4.5B from the #GoogleForIndia Digitization Fund. https://t.co/1fP8iBZQfm — Sundar Pichai (@sundarpichai) July 15, 2020

He also added, “This partnership is a key part of Google’s next chapter of investments in India. Our investment of $4.5 billion in Jio is the first and biggest through the digitization fund of $10 billion. I am excited that the collaboration will focus on the increase in access for hundreds of millions of Indians who do not currently own a smartphone and the improved mobile experience for all.“ Mukesh Ambani informed the shareholders of RIL that Jio Phone still remains the most affordable 4G supporting phone. He informed that about 100 million Indians have upgraded their feature phones to Jio Phones, but 350 million Indians still own a 2G feature phone and are waiting to upgrade to an affordable and conventional smartphone. He said that Jio aims to develop affordable 5G phones at only a fraction of its cost and to achieve this they need an equally value-engineered smartphone Operating System which will be provided to them by Google under their new partnership.

Mukesh Ambani further said, “Putting a smartphone in the hands of every Indian is our aim. India is standing at the doorsteps of the 5G era. They should not be deprived of the benefits that the digital and the data revolution offers. Jio is determined to make India ‘2G Mukt ’ ”.

Mukesh Ambani also talked about the ‘Digital India’ movement. It is very clear that this partnership of Google with Jio Platforms will definitely help India towards its goal of ‘Digital India’.

Previously, the AGMs have been held by Reliance at many different venues that including auditoriums, football stadiums, and other big grounds. For the last few years, however, Birla Matushri Sabhaghar has been the venue for the meetings. In 2020, however, owing to the Coronavirus (COVID-19) pandemic, companies are compelled to hold these meetings online through video conferencing. In the pandemic-stricken year, like all the previous years, the meeting was held between the shareholders of the company. The annual report of the company was presented to them, which contained the performance and strategies of the company. The new plans and features for the next year were also included. Furthermore, the shareholders got to ask questions and vote on topics that were related to the functioning and betterment of the company. It was during the Annual General Meeting of 2016, that Reliance Jio was commercially launched, which changed the face of the telecom industry and brought about an internet revolution in India. The previous meeting, which was the 42nd AGM, was held in The Birla Matushri Sabhaghar on 12th August 2019. The key points of the meeting were:

- Announcement of the launch of Jio Fibre service.

- Mukesh Ambani said that they have a clear roadmap for becoming a zero net debt company by 31st March 2021. This feat was achieved much earlier than expected and RIL have become a zero net debt company a few days ago after it raised around ₹1.69 lakh crore from global investors such as Facebook.

- The announcement of the launch of the new 4K supported Jio Set Top Box.

- Mukesh Ambani announced to the shareholders that the company's turnover has crossed ₹130,000 crores, making it India's largest retailer and 4 times larger than the 2nd retailer. The company became larger than all other major retailers in the country put together.

Reliance Industries is vigorously working on publicizing and brand advancement. The special procedure in the advertising blend of Reliance Industries is engaged towards 360-degree marketing and forceful brand advancement. Reliance uses the slogan "Development is Life" and has typified its slants of taking individuals together. RIL proprietor Mr. Mukesh Ambani has now owned the Mumbai Indians franchise for a long time, and the purchase of a cricket team has been instrumental in bringing the Reliance brand under the spotlight.

Reliance Industries has roped in Bollywood celebrity Hrithik Roshan for underwriting Reliance Telecom. It declares limits and leads for different special exercises at various Reliance outlets. Because of its solid image mindfulness, Reliance Industries has pulled in clients at its stores. Customer happiness has lead to its expanded client base. Consequently, this covers the promoting blend of Reliance Industries.

Growth And Future Of Reliance Industries Limited

The Indian economy remained the quickest developing significant economy on the planet in 2018. In FY 2018-19, the evaluated Gross Domestic Product development rate was 6.8%, driven by solid private utilization development at 8.1%. The economy kept on seeing an expansion in speculations with gross fixed capital formation development at a six-year high of 10%. Know the Reasons why Reliance Industry's profit increased by 35% in 2021 .

For FY 2018-19, India's oil request developed at about 3% y-o-y with utilization-driven request development in gas (+8.1%), Gasoil (+3.0%), and stream fuel (+9.1%). The interest was driven by powerful development in business vehicle deals and solid air traffic development during the year. On the provincial side, though tractor deals and three-wheeler deals declined from the highs of FY 2017-18, they kept on developing in twofold digits.

Household request development for petrochemical items was solid with both polymer and polyester requests developing at 7.0% y-o-y. Reliance Jio has impelled India to turn into the biggest versatile information devouring economy on the planet. With omnipresent and dependable information administrations, information systems are progressively being utilized for media and stimulation, instruction, showcase data, and exchanges.

The appropriation of advanced exchanges saw exponential development. UPI installments developed from 0.7% of GDP in FY 2017-18 to 4.7% in FY 2018-19 while charge card development found the middle value of a solid 32% y-o-y in FY 2018-19. Individual utilization patterns stayed solid with individual credit at a sound 18% y-o-y. Reliance Retail keeps on profiting by solid interest development crosswise over purchaser staples, optional merchandise, and its capacity to convey an unrivaled client experience and offer.

Refining And Marketing - Weak Light Distillate Cracks Lead Down Margins

During the year, benchmark Brent oil costs were up 22% due to geopolitical pressures, supply interruptions from Venezuela, Iran, and Libya just as OPEC+ creation cuts. Request development was affected by the high siphon level costs in the US and different economies coupled with the slow development in the Chinese economy.

RIL's gross refining edges declined to $9.2/bbl due to feeble light distillate breaks; this was somewhat counter-balanced by flexible center distillate splits. Operational greatness and adaptability helped Reliance keep up a noteworthy $4.3/bbl premium over the territorial benchmark-Singapore Refining Margins. The strong presentation by Reliance's refining business was bolstered by proactive unrefined sourcing, enhancing of item yields, and vigorous hazard in a difficult domain.

Petrochemicals - Resilient Business Model Shining Through

Petrochemicals business conveyed its best execution with an EBITDA commitment of 37,645 crores, up by 45.6% y-o-y. Petrochemical generation was additionally at a record high of 37.7 MMT, up 16% y-o-y.

The solid outcomes were accomplished in a situation of declining usage rates in key item chains with a new supply increase. This exhibits the strength of Reliance's action plan which is dependent on linkages between refining and petrochemical chains, feedstock adaptability, and wide item portfolio. While polymer chain edges were affected by new supplies out of the US Ethane-based wafers, polyester bind gains kept on increasing, driven by solid PTA and PX edges. With the initiation of ethane splitting at Nagothane, the key parts of Reliance's petrochemical speculation cycle are adding to its income.

Oil And Gas Exploration And Production

Reliance has attempted the improvement of High-Pressure High Temperature (HPHT) R-Cluster, Satellite-Cluster, and D55 (MJ) fields. First gas from R-Cluster is normal by mid-2020 followed by Satellite Cluster and MJ fields. The new improvement will use Reliance's collaboration with BP, the existing framework in the Krishna-Godavari Basin, and the downturn in the capital hardware and specialist organization advertise.

Reliance Retail - Growth Across All Key Consumption Basket

Reliance Retail accomplished a record turnover of INR 1,30,566 crore, up 88.7% y-o-y. Turnover development was driven by quick store extension and strong development in same-store-deals. Reliance Retail accomplished its most elevated EBITDA of INR 6,201 crores, up 145% y-o-y. The solid working presentation was driven by a 100 bps improvement in EBITDA to 4.7%. Proceeding with a solid development force, Reliance Retail has accomplished an income CAGR of 55% and EBITDA CAGR of 76% in the last 5 years.

Reliance Retail had 10,415 retail locations in more than 6,600 towns and urban areas covering a zone of 22.0 million sq. ft. as of March 2019. A record footfall of more than 500 million was witnessed during the year, a development of 44% y-o-y. Reliance Retail is working on plans to dispatch a separate new commerce stage which will empower little shippers across India to contend in a computerized age.

Digital Services - Strong Traction In Subscriber Addition And User Engagement

Reliance Jio has over 400 million users to date and is currently India's biggest portable telecom administrator positioned by Adjusted Gross Revenue (AGR). Jio comes out on top if Average Revenue Per User (ARPU) (126.2/month) is considered along with sound normal voice utilization (823 minutes for every client every month) and normal information utilization (10.9 GB per client every month).

Jio is intending to give a worldwide standard wireline framework and administration in India through FTTH and Enterprise contributions. To quicken this rollout, RIL has made vital investments in Hathway Cable, Datacom Limited, and DEN Networks Limited. Jio likewise keeps on executing its arrangements of building an advanced biological system spreading crosswise over media, excitement, trade, training, human services, and horticulture.

Media - Strengthening Offering Ahead Of Evolving Market Trends

Reliance is focused on offering media content for the Indian market as a feature of its computerized administration's bunch. As a component of this dedication, Reliance is putting resources into the production of unique substance significant for the developing patterns in media utilization. Through possessed substance motors and cooperative organizations, Reliance is building a broad media content library that will take into account all portions of the crowd and dovetail with its wide conveyance stages.

Reliance's media organization Network18 proceeded on its development direction and put resources into key regions to fill blank spaces and sustain its position as a leader.

Advanced Platforms

During the year, Reliance started stage-driven association procedures to tap the noteworthy potential for its organizations to improve proficiency and encourage educated and basic leadership procedures.

Land Developments

RIL went into a Memorandum of Understanding (MoU) with the Government of Maharashtra to build a Global Economic Digital and Services Hub with worldwide associations. RIL through its completely claimed backup has gone into an MoU with NMSEZ to a sub-rent place that is known for around 4,000 sections of land alongside related improvement rights. The project will usher in industry revolution 4.0 in Maharashtra and prompt critical industrial development by offering world-class infrastructure and collaboration with the best of worldwide innovation organizations in the areas of Innovation and Learning, Research and Development, Technological Advancement, and Manufacturing and Service capacities.

Indian Film Combine

RIL through its completely claimed backup has procured a dominant stake in the Indian Film Combine, and it is building a Drive-in Theater, Hotel, Retail Mall, and Clubhouse at Bandra Kurla Complex (BKC) in Mumbai.

JIO World Center

Reliance is also building a best-in-class, world-class convention center, performing arts theater, retail mall, office space, and clubhouse at Bandra Kurla Complex (BKC), Mumbai. These undertakings are planned for making BKC the most alluring retail, entertainment, and cultural area of Mumbai city backed by a world-class convention center.

The last two years were portrayed by unstable, large-scale financial conditions. Adding to vulnerability were higher oil costs in the principal half of the year and expanding geopolitical pressures as the year progressed. Reliance accomplished its best execution in this condition with record commitment from its petrochemicals, retail, and advanced administrations units. "Strong working execution for the year underscored the quality of the petrochemicals business that we have fortified throughout the last speculation cycle. Moreover, our purchaser organizations keep on scaling new statures with industry driving measurements. The adaptability of retail and computerized administration business stages has made an exceptional incentive for all partners," a Reliance representative added.

Revenue And Profit Of Reliance Industries Limited

Reliance accomplished solidified income of INR 6,22,809 crores ($90.1 billion), an expansion of 44.6% when contrasted with INR 4,30,731 crores in the earlier year. The increment in income was fundamental because of volume expansion with the adjustment of petrochemicals undertakings and oil cost-related to increment of refining and petrochemical items. The higher volumes in the petrochemicals business are by virtue of the first entire year of tasks of new petrochemical offices. Reliance's solidified income was bolstered by powerful development in retail and computerized administrations business which recorded an expansion of 88.7% and 94.5% in income individually when contrasted with the earlier year. Reliance Industries Limited reported a 26.2% year-on-year (Y-o-Y) increase in its consolidated net profit for FY22 at INR 67,845 cr. Reliance Industries Limited recorded a 47% Y-o-Y growth in its revenue, which became INR 7.92 lakh crore in FY22. The annual revenue of the digital services business of RIL crossed the 1 lakh crore mark for the first time in FY22. Reliance Industries Limited's digital arm also recorded an all-time high EBITDA of INR 40,268 Cr during the year. The retail business of Reliance also recorded annual revenue of around INR 2 lakh crore and a record annual EBITDA of INR 12,423 cr.

The gross revenue of the Reliance JIO platform increased by 17.1% in FY22, which was recorded at INR 95,804 cr. The net profit of the same increased by 23.6%, which became INR 15,487 cr. The EBITDA of the Jio platforms rose by 20.9%, thereby becoming INR 39,112 cr during FY22.

Now, you might also want to take a look at the list of Startups funded by Reliance through the accelerator program.

What is the history of Reliance company?

The organization was established by Dhirubhai Ambani and Champaklal Damani in the 1960s as Reliance Commercial. It was later renamed as Reliance Industries and diversified into financial services, petroleum refining, and the power sector.

Who is the owner of Reliance?

Dhirubhai Ambani founded the Reliance Group, and Mukesh Ambani is the owner of Reliance Industries Limited.

Who is the CEO of Reliance Industries?

Mukesh Ambani is known as the Reliance Industries CEO.

How much of Reliance does Ambani own?

The Ambani family holds approximately 46.32% of the total shares, whereas public shareholders, including FII and corporate bodies, constitute the remaining 53.68%.

Must have tools for startups - Recommended by StartupTalky

- Convert Visitors into Leads- SeizeLead

- Payment Gateway- Razorpay

- Hosting- Hostinger

- Graphics Designing- Canva

- Spy on your Competitors (Use code ST30 for 30% off) Adspyder

Details of the FirstCry IPO That Opens on August 6

FirstCry's parent company, BrainBees Solutions Ltd, has announced that its red herring prospectus (RHP) indicates that the IPO would begin on August 6 and conclude on August 8. FirstCry reportedly plans to ask for a valuation between $2.9 and $3 billion when it goes public. Among the

Project Execution for the Green National Highway Corridor

With loan assistance of $500 million and a total project cost of $1288.24 million (INR 7,662.47 crore), the Government of India and the World Bank have signed an agreement for the construction of the Green National Highway Corridors Project (GNHCP) in the states of Himachal Pradesh, Rajasthan,

Physics Wallah Launches INR 250 Crore in JEE/NEET Scholarships

Physics Wallah, one of the major players in the field of education in India, has introduced the NSAT (National Scholarship Common Admission Test) 2024, which is the organization's most ambitious scholarship program to date. Students who are studying for the NEET-UG and IIT-JEE examinations are eligible to receive

Stephan Morgenstern: A Profile of Business Innovation and Philanthropy

Stephan Morgenstern's rise in the world of multi-level marketing (MLM) is a testament to his exceptional drive and vision. From his days in the slums of Berlin to the skyscrapers of Dubai in the UAE, Morgenstern Stephan's journey has been marked by resilience and innovation. His

Reliance Industries is India’s largest company in terms of market cap (as of 7 Feb 2024) and is involved in energy, refining, textiles, retail, and telecommunications business. Incorporated by the famous tycoon Mr. Dhirubhai Ambani and managed by Mr. Mukesh D. Ambani. It is the 100th largest company worldwide. As of 7 Feb 2024, Reliance Industries market cap stood at INR19.05 lakh crore.

Here are the quick stats about the Reliance Industry:

| Founded by | Mr. Dhirubhai Ambani |

| Industry | Conglomerate |

| Founded In | 1958 |

| Company Type | Public |

| Headquarter | Mumbai, Maharashtra, India |

| Area Served | Across the globe |

| Key Person | Mukesh Ambani, Chairman & Managing Director |

| Products | Oil and Gas, Chemicals, Telecommunications, Retail, Media, etc. |

| Revenue | INR 974,864 crore (US$118 billion) in 2023 |

| Profit after tax (PAT) | INR 73,670 crore (US$8.96 billion) in 2023 |

| Total assets | INR 1,607,431 crore (US$195 billion) in 2023 |

| Subsidiaries | Jio Platforms, Reliance Reliance Retail, Network18 Group, Alok Industries, Reliance Foundation, Indiawin Sports, Global Corporate Security. |

Marketing Strategy

Reliance Industries Limited has a wide range of target audiences to serve. So, let us understand how the company serves its offerings using the Marketing Mix Model framework, which covers understanding its product, pricing, advertising, & distribution strategies.

Product Strategy

Reliance Industries, one of India’s largest conglomerates, spans various sectors and accounts for 20% of the nation’s exports. Its portfolio includes Reliance Fresh, Reliance Trends, Reliance Mart, and more.

Pricing Strategy

Reliance Industries follows different pricing strategies for different sectors. This company follows the pricing penetration for retail, telecommunications, and health. When Reliance launched Jio, it offered free services to its customers to enhance its market share.

The telecommunications industry was at a loss, but Jio still decided on providing unprecedented offers to customers to increase their customer base. This led to a complete revolution in the industry as smaller players could not fight such a rough battle and hence had to shut shop. Outlets such as Reliance Fresh provide products directly to the consumer at a discounted price. Reliance Industries focuses on pricing analysis before making a price decision. This strategy has helped them gain unrivalled positions in the industry.

Place & Distribution Strategy

Reliance Industries has a strong presence throughout the nation. Reliance Retail is the largest retailer with more than 1500 stores in the country, and other brands such as Reliance Fresh, Reliance Footprint, and Reliance Digital have reached Tier 1 and Tier 2 cities. While Tier 3 is still majorly yet to experience the wonders of the company.

Promotion & Advertising Strategy

The promotional strategy of the Reliance industry is a mix of all types of theories, including pamphlets, ads, and word of mouth. Reliance also focused on 360 branding and brand promotion. They use the tagline “Growth is Life” and have encapsulated their sentiments about taking people together.

Reliance Industries Limited owner Mukesh Ambani also acquired the rights of the Mumbai Indians for 10 years, bringing the Reliance brand to the limelight. After that, Jio launched in the market with the hashtag #DigitalIndia, which encourages youth to be digitally active. Reliance Industries’ success factor for Jio ensuring the deliverables to their consumers to make them habituated to the service, which impacted their competitors in ways they hadn’t even imagined!

Marketing Campaign

Reliance marketing campaigns keep the brand presence alive in consumers’ minds and build trust, which directly impacts the goodwill of the company. Let’s get into the market campaigns of Reliance:

- Reliance Jio launched a campaign named Jio Dhana Dhan in 2017. This campaign is still ongoing and holds the market with their new updated products and services.

- Reliance Retail enhanced its advertisement volume after the pandemic to retain audience attention.

- For its marketing campaigns, Reliance Digital mainly focuses on showcasing the latest technology products, features, and services available at its stores. One of the recent ad video campaigns was named “Technology se Rishta Jodo”. This ad was a big hit on the internet, with 9m+ views, and it even got many positive comments.

SWOT Analysis

Let’s move into the SWOT analysis of Reliance Industries. It includes a deep study of the company’s strengths, weaknesses, opportunities, and threats.

- Reliance Industries is India’s biggest conglomerate company in terms of revenue and profitability. It is a well-known brand across the globe.

- It is diversified into several businesses like telecom, retail, petroleum, media, and many more. This reduces the effect of seasonality on the company’s performance.

- The company is successful because they have a holistic approach to growth and progress. This has been demonstrated by their decades of complete dominance over people’s hearts.

- Reliance Industries is also heavily involved in CSR activities like sustainable development, education, healthcare, uplifting the financially unfortunate, girl child protection, etc.

- Reliance Industries’ market position is hard to maintain when it comes to high competition in the market. However, this risk is somewhat minimized due to the company’s dynamic and competent management.

- The company also faced controversies and conflicts such as stock manipulation, the Krishna Godavari Basin gas issue, etc. While many of these controversies turned out to be hoaxes, they still hold enough power to materially affect the stock price.

Opportunities

- Reliance Industries also partnered with other brands to expand their business, by using small-scale manufacturers to meet high demand during peak seasons.

- To avoid competition, Reliance Industries should consider buying small and weak players in the industries. This tactic has also proven quite effective in consistently increasing its profits.

- Tying up with the global oil industry players will help the Reliance industry to boost its oil business.

- In recent times, Reliance Industries’ sales growth rate has declined. This could be taken as nothing more than a hiccup or the beginning of a trend.

- High competition from big conglomerates such as Adani can reduce Reliance’s market share in some sectors.

There is no doubt that, at the moment, Reliance is the largest public company in India, with a strong brand image and brilliant marketing strategies. Reliance Industries is leading in various sectors like petroleum, oil, retail, and gas because of its product quality and efficiency.

Reliance Industries’ growth motto is “Growth is life”. Their marketing strategies, such as 360 branding and strategic partnerships, have contributed to their success. However, many segments operate in a competitive environment, which could dampen the revenue growth of the company in the long term. In summation, always do a thorough research before investing in the company and consult your financial advisor.

Frequently Asked Questions (FAQs):

1. Who is the owner of Reliance Industries?

Ans. Mr. Mukesh Ambani

2. What type of company is Reliance Industries?

Ans. It is an Indian multinational conglomerate headquartered in Mumbai.

3. What are the products of Reliance Industries?

Ans. Reliance Industries has a long list of products ranging from textiles, petroleum, refining, telecommunications, groceries, and many more.

4. When was the Reliance Industries founded?

Ans. The company was founded in 1958.

5. Which companies come under Reliance Industries?

Ans: Reliance Retail, Jio, Reliance Fresh, Reliance Foundations, Reliance Trends, Reliance Digital, and many more. Disclaimer: The securities, funds, and strategies mentioned in this blog are purely for informational purposes and are not recommendations.

Related Posts

ICICI Vs HDFC Bank: Which Has Larger Market Capitalization?

Dabur Case Study: Business Model, Financial Statements, & Swot Analysis

Bikaji Foods Case Study – Product Portfolio, Financial Statements, & Swot Analysis

Pocketful is an advanced trading platform that empowers traders with cutting-edge technology. we provide innovative tools and resources to make trading more accessible and practical., quick links.

- Open an Account

- Pocketful Web

- Pocketful App

- Investment Tool

- Trading Tool

- Support Portal

- Referral Program

- Calculators

- Stocks Pages

- Government Schemes

- Index Heat Map

- Stock Screener

- Mutual Funds

- Terms & Conditions

- Policies & Procedures

- Privacy Policy

- Press & Media

We are a concern of PACE Group. Pocketful is an investing platform that helps people be better investors. Pocketful unlocks the discoverability of new investment and trading ideas.

Join the waitlist.

Add your details and start your journey toward a better future with Pocketful in your investing career.

You have successfully subscribed to the newsletter

There was an error while trying to send your request. Please try again.

Business Korbo

Business Analysis and Case Study

The Reliance Industries Case Study: A Lesson in Success

Reliance Industries is a powerhouse conglomerate that has firmly established itself as one of India’s largest and most influential companies. With a rich history and remarkable evolution, Reliance Industries has diversified into various key business segments, including petrochemicals, refining, oil and gas exploration, retail, telecommunications, and more. Let’s delve into the captivating journey of this extraordinary corporation.

Table of Contents

Reliance industries’ historical footprint and transformation.

Reliance Industries was founded by the visionary entrepreneur, Dhirubhai Ambani, in 1966. Starting as a textile manufacturing company, it swiftly expanded and diversified its operations under Dhirubhai’s astute leadership. Over the years, the company has grown exponentially, continually reinventing itself to adapt to changing market dynamics.

Diversification as a Strategic Imperative

Reliance Industries’ growth and success can be attributed to its strategic decisions and unwavering commitment to diversification. The company has consistently sought new sectors for expansion, leveraging its existing strengths and expertise. This calculated approach has allowed Reliance Industries to navigate market uncertainties effectively.

The company’s foray into various industries was driven by a well-defined rationale. For instance, its entry into the telecommunications sector with Reliance Jio aimed to disrupt the industry by offering affordable pricing, extensive network coverage, and digital services. Such calculated moves have enabled Reliance Industries to stay ahead of its competitors and shape the landscape of multiple sectors.

Vertical Integration: A Pillar of Reliance Industries’ Success

Reliance Industries’ business strategy heavily revolves around vertical integration. By integrating its operations across various stages of the value chain, the company has achieved significant cost efficiencies, reduced dependency on external suppliers, and gained greater control over its product offerings .

This comprehensive approach to vertical integration has enabled Reliance Industries to streamline its operations, improve supply chain management, and enhance overall productivity. By tightly integrating its refining, petrochemicals, retail, and telecommunications businesses, the company has established a strong foundation for sustained growth.

Market Position and Competitive Advantage

Reliance Industries enjoys a dominant market position across several industries due to a combination of factors that contribute to its competitive advantage. Let’s explore some key aspects that set Reliance Industries apart from its competitors:

1. Extensive Infrastructure: Reliance Industries boasts a robust and extensive infrastructure network that spans refining, petrochemicals, retail, and telecommunications. This infrastructure forms the backbone of its operations and enables efficient production, distribution, and delivery of products and services.

2. Technological Capabilities: The company’s relentless focus on technological advancements has propelled its growth and differentiation. Reliance Industries has consistently invested in cutting-edge technologies, allowing it to enhance efficiency, improve customer experience, and foster innovation across its business segments.

3. Strong Distribution Network: Reliance Industries has built an impressive distribution network, spanning both urban and rural areas. This extensive reach enables the company to effectively cater to diverse customer segments, thereby amplifying its market penetration and competitive edge.

Reliance Industries’ ability to leverage its strengths in infrastructure, technology, and distribution has contributed significantly to its market leadership and sustained success.

Financial Performance and Notable Investments

Reliance Industries’ financial performance has been exceptional, reflecting its strong market position and strategic investments. The company has consistently demonstrated robust revenue growth, driven by its diverse business portfolio and market-leading positions across sectors.

In terms of investments, Reliance Industries has made significant strides both domestically and internationally. These investments have been aimed at expanding its presence, exploring new growth opportunities, and diversifying its revenue streams. Notable acquisitions and investments include those in the energy, retail, and technology sectors, strengthening the company’s position in key markets.

Reliance Jio: Transforming India’s Telecom Landscape

One of the most remarkable ventures undertaken by Reliance Industries is Reliance Jio, its telecommunications subsidiary. Reliance Jio’s entry into the Indian telecom market disrupted the industry and revolutionized connectivity for millions. The company adopted a disruptive business model, offering affordable pricing, expansive network coverage, and a host of digital services.

Reliance Jio’s remarkable success not only transformed India’s telecom landscape but also had a profound impact on Reliance Industries as a whole. The subsidiary’s rapid growth and rising market share contributed significantly to the overall financial performance and valuation of Reliance Industries.

Corporate Social Responsibility: Making a Difference

Reliance Industries takes its corporate social responsibility (CSR) seriously and is committed to sustainable development. The company has undertaken numerous initiatives in areas such as education, healthcare, rural development, and environmental sustainability.

Through various philanthropic projects, Reliance Industries has positively impacted the lives of millions of people. It has established educational institutions, healthcare facilities, and community centers, empowering communities and fostering inclusive growth.

Overcoming Challenges and Mitigating Risks

Like any major conglomerate, Reliance Industries faces a range of challenges and risks in its operations. These include regulatory hurdles, market volatility, geopolitical risks, and competition. However, the company has demonstrated resilience and agility in navigating these obstacles.

Reliance Industries’ ability to adapt to changing regulations, proactively manage market risks, and leverage its diversified business portfolio has enabled it to mitigate potential disruptions effectively. By leveraging its strengths and leveraging emerging opportunities, the company has consistently managed to stay ahead of the curve.

Future Outlook and Growth Prospects

Looking ahead, Reliance Industries is poised for continued growth and expansion. The company has outlined ambitious plans for diversification and expansion into emerging sectors. These plans encompass areas such as renewable energy, e-commerce, and digital services, capitalizing on technological advancements and evolving market dynamics.

Reliance Industries’ relentless focus on innovation, strategic investments, and its ability to anticipate and adapt to market trends positions it favorably for future success. As the company continues to evolve, it is well-positioned to seize emerging opportunities and maintain its status as a powerhouse conglomerate.

In conclusion, Reliance Industries has emerged as a leading conglomerate in India, with a rich history of transformation and diversification. Through strategic decision-making, vertical integration, and a focus on competitive advantage, the company has cemented its market leadership across multiple industries. Reliance Industries’ financial performance, notable investments, and telecommunications venture, Reliance Jio, have been instrumental in shaping its success. The company’s commitment to corporate social responsibility, ability to overcome challenges, and forward-looking growth strategies further solidify its position as an exemplar of corporate excellence.

By Business Korbo

Related post, strategic partnerships: how to choose and leverage them, crafting a competitive advantage: business strategy essentials, balancing short-term and long-term business strategies, leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Scaling Up: Strategies for Growing Your Business | businesskorbo

In-Depth Case Study on Marketing Strategy of Reliance – Top 3 Competitor Analysis included

By Aditya Shastri

Cracking the marketing strategy of reliance.

In this case study, we will go through the marketing strategy of Reliance Industries, one of India’s most successful companies which is ranked #96 on the list of Fortune 500 companies.

In 1960, Dhirubhai Ambani formed Reliance Industries Limited in Mumbai, Maharashtra with a dream of making it the largest company in India. Since then, the organisation has grown and diversified itself across different industries and sectors over all these years.

As of 2020, it is India’s largest private sector company and is ranked #96 on the list of Fortune 500 companies.

This case study focuses on Reliance Industries, Jio and its Retail business, along with their marketing mix, competitors analysis, marketing strategies and campaigns undertaken by them.

Let’s now get into the details by learning more about the company.

Reliance Industries Limited (RIL) is one of India’s largest conglomerates, currently headquartered in Mumbai, Maharashtra is run under the guidance of Mukesh Ambani, who is currently the Chairman and Managing Director (MD) of the company.

It has its presence in a variety of sectors such as Oil Refinery, Telecommunications, Textiles, Retail, Media & Entertainment, Financial Services and the Software sector. Given that it has a presence in various sectors, it has about 94 subsidiaries in total.

It is one of India’s most profitable companies and is known for its stints into exploring and expanding into new ventures. Reliance’s business culture can be summed up with its tagline “Growth is Life”.

It is also one of the companies that constantly work on Corporate Social Responsibility (CSR) to empower the lives of millions of people in India. In March 2012, the American Chemistry Council accredited Reliance Industries as a ‘Responsible Care Company’.

Reliance Industries Limited is slated as one of the key driving engines that will help India reach its GDP projections in the years to come.

Now that you know about the company, let’s start understanding the marketing strategy of Reliance Industries by first knowing its target audience.

Marketing Strategy of Reliance Industries: Target Audience of Reliance

Targeting the lower middle class in rural to the high-class citizens living in metros, Reliance Industries doesn’t want to leave any stone unturned when it comes to business. Reliance Industries Limited caters to a wide range of consumers with its diverse range of goods and services ranging from oil-to-telecom, and even more with its retail division serving another dynamic set of customers.

Let us just take an example of Reliance Retail itself, retail goods such as apparels and groceries are a basic necessity so here it attracts all kinds of customers.

In the case of Reliance Jio, The segment that Jio has concentrated upon are people with smartphones looking for high-speed internet and good mobile services.

So Instead of asking ‘Who is the target audience of RIL?’, the question should be ‘Who isn’t, the audience of RIL?’.

So, Reliance Industries Limited has a wide target audience to serve. Let’s dig a little deeper and learn more about the company with a SWOT analysis:

SWOT Analysis: Reliance Industries

| Robust positioning across several categories. | Court cases and lawsuits | Expanding business by setting up new plants. | Sudden economic recessions. |

| Strong brand name with a good financial position. | Abandoning contracts affects global growth and expansion. | Come up with new and lucrative offers in Reliance JIO. | New rules by the govt. against oil. |

| Owners of the world’s largest oil refinery. | Controversies revolving around the company. | Have a global footprint by investing in international projects. | Cut-throat competition. |

| Challenging the competitors with massy products like Reliance JIO. | —– | Acquiring competitors. | —- |

| Making a stronghold in the retail industry by expanding its subsidiaries. | —- | —- | —- |

Reliance’s Marketing Mix

Marketing Mix is a model that helps us understand a company based on its Product, Price, Place, Promotion. The marketing mix of Reliance will help you understand the 4P’s of the company.

In Reliance Industries Limited’s case, it has launched a wide range of products, from petrochemicals to retail to healthcare, etc. but we will understand its main businesses in this model that are,

- Reliance O2C

- Reliance Jio

- Reliance Retail

Marketing Mix Of Reliance: Product

1. oil to chemical (o2c).

Talking about the Oil to Chemical business, it includes oil refining, oil marketing and petrochemical products and services. Simplifying things further,

- Its Oil-Refining products include Refined Crude Oil

- Oil-Marketing includes Petroleum Products

- Petrochemicals include Polymers and Polyester Product Chains

- RIL also indulges in producing and distributing natural gas.

2. Reliance Jio

Reliance Jio section offers Digital and Telecommunication services. It offers services Jio 4G Sim Cards, Jio Gigafiber, Jio Setup Box and various other value-added services.

- The Value-Added Services (VAS) include Jio Cloud, Jio Security, Jio Play, Jio Cinema, Jio TV etc.

- Jio also offers affordable 4G mobile phones.

The below picture showcases Reliance Jio’s portfolio,

3. Reliance Retail

Reliance Retail is the largest retailer in India and it has spread its outlets all across India.

- The retail industry comprises Reliance New, Reliance Mart, Reliance Digital, Reliance Home Kitchen, Reliance Home Kitchen, Reliance iStore, and many more

- These outlets offer various products from Groceries to Electronics to Fashion.

The below picture showcases Reliance Retail’s portfolio,

Marketing Mix Of Reliance: Price

The pricing of different products or services varies for different segments. The D2C segment, i.e., retail, telecommunications, and health care has competitive and affordable prices compared to its petrochemicals sector. Let’s understand each one in detail:

- In the O2C business, the pricing is as per the industry standards in most of the cases as it’s a Business to Business (B2B) selling.

- The pricing is largely dependent upon the prices of crude oil and the current global market.

- The Prices are also set or agreed upon based on contractual agreements which are different from the industry pricings.

In the telecommunication sector, Reliance Jio implements a cost-based pricing strategy. Cost-based pricing refers to offering affordable prices so that every individual can use its offerings. Not only this, Reliance’s marketing strategy includes a penetration pricing strategy, meaning that they charge their customers very nominal rates to acquire a large base and market share quickly and gradually increase prices once the goal is achieved.

With the introduction of Reliance Jio, the company created a disruption in the market with its well-thought-out strategy.

- Jio being the telecom sector leader it forces its competitors to charge as per their data tariffs.

- It has various 4G Data Packs which helps the customer buy as per their convenience

- Jio’s Giga fibres and setup box are charged as per the industry charges

- Jio’s 4G Phone is priced as low as Rs. 3,000.

- The retail division charges extremely competitive pricing.

- In the groceries division, the pricing is extremely competitive but also gives out offers and discounts especially on JioMart

- The pricing in the electronic division depends on the products of various companies and RIL has very little price influence on it

- In the Apparel Division, prices are set as on the lines of middle-class demographics and also give out discounts and offers from time to time

Marketing Mix Of Reliance: Place

With multiple subsidiaries and ten associate firms, Reliance Industries Limited is a giant in the retail sector. RIL’s retail outlets are located in prime locations, making it super convenient for consumers to get their desired products.

With outstanding business performance and consumer satisfaction, you won’t find anyone who’s not either aware of or uses RIL’s product or service.

Let’s understand each sector in detail:

- RIL’s O2C is a completely Business to Business (B2B) entity, the place parameter is not necessarily of full importance as most of the orders and consignments are done based on their previous works

- Moreover, Reliance Industries Limited has been in the business for close to 50 years now and being the largest private sector company, everyone in the O2C business knows about its work.

- Reliance Jio has about 1700+ stores all over the country under the name of Jio Digital Stores

- It also has numerous sub-partners who help customers with recharges, new sims and other services.

- It is constantly working on increasing its stores all over India to increase the customer experience

- It also takes online orders of the above services and provides home deliveries of the same

- Reliance Retail operates about 12,201 stores across 7,000+ cities across India

- It also takes online orders through Jio Mart and Ajio apps to provide home delivery of the products and thus making the life of customers easier

Marketing Mix Of Reliance: Promotion

The promotion strategy of RIL is neat and subtle. They use a mix of trendy and emotional touch campaign ideas to deliver their brand message. Since promotion is one of the major expenses for companies, the marketing strategy of reliance industries strategically uses more BTL mediums as compared to ATL activities.

Not just this, the company also engages in various philanthropic activities as a part of CSR.

Let’s understand each segment in detail:

- RIL’s O2C business doesn’t focus much on the promotion aspect as it’s a B2B entity

- However, its work speaks for itself and thus facilitates healthy word of mouth promotion

- Although, RIL focuses a lot on Corporate Social Responsibility (CSR) activities every year

- It also recently announced that the company will bear all the vaccination costs of its employees

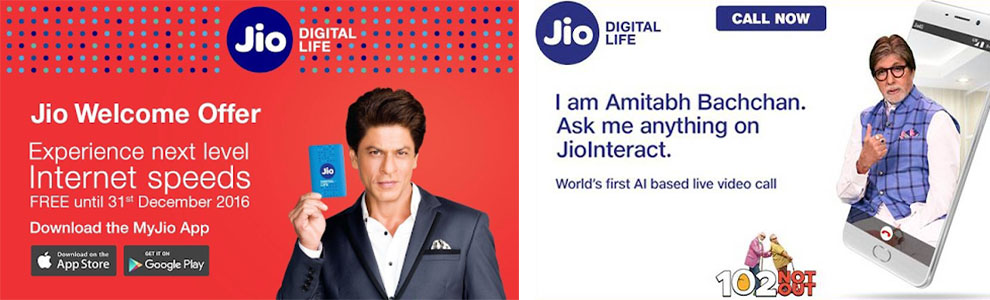

- Reliance Jio has been active in promoting itself regularly through various mediums.

- It has a strong social media presence and is present on Facebook, Twitter, Instagram, Linkedin and Youtube

- On the offline part, it uses Newspaper and TV as the primary medium of promotions

- Currently, Deepika Padukone and Ranveer Singh are its brand ambassadors

- Previously, notable figures such as Amitabh Bachhan, Shah Rukh Khan have been a part of this journey

- It also has a tie-up with Hotstar Disney+ which helps them in promoting themselves even better

- Reliance Retail uses an aggressive marketing policy as it’s in a highly competitive sector.

- Reliance Retail’s brands such as Ajio, Fresh, Footprints etc. have their own social media presence and are present on Facebook, Instagram, Twitter, Linkedin, Pinterest and Youtube

- It also uses Newspaper and Television as a primary offline medium of promotion and also has brand ambassadors like Vicky Kaushal, Janvi Kapoor and Keerthy Suresh

Now that you have an overall understanding of Reliance Industries Limited, what it offers to the customers, let’s take a look at what their competitors are up to in the next section.

Competitors Analysis of Reliance

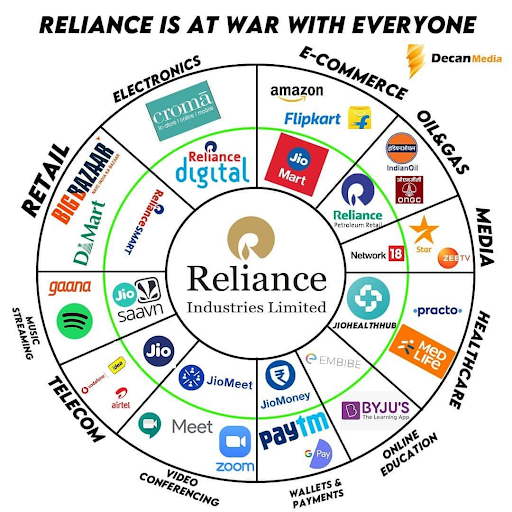

To give your mind an idea of who Reliance’s competitors are, look at the image below.

Yes, Reliance Industries is into so many categories that it is competing with Google with Jio Pay, Dmart with Reliance Retail, Embibe with Byju’s and many other players.

Reliance Industries is now almost in every major sector but narrowing the competition study to Reliance Industries Limited’s current prospects which are Reliance O2C, Reliance Jio and Reliance Retail will help us understand this analysis better

Let’s start with Reliance O2C’s competitive analysis

1. Reliance O2C & Its Competitors

As we know the base of Reliance Industries Limited, on which it stands, is its O2C business as also most of the current revenue comes from here. it faces its competition with the below-mentioned companies.

- Oil and Natural Gas Corporation (ONGC)

- Indian Oil Corporation Limited (IOCL)

- Bharat Petroleum Corporation Limited (BPCL)

So Reliance O2C ranges itself in categories such as Petrochemicals, Oil Refining and Oil exploration and Petroleum products it competes against a group of government entities like ONGC, BPCL and IOCL.

But what sets Reliance O2C apart is that it constantly reinvests its profit in making the process better whereas the Government being a majority holder of the companies like ONGC, BPCL and IOCL, takes out a hefty profit in its account as dividend every year. So this has created a wide gap between Reliance O2C and its competitors.

Reliance O2C kind of has a partial monopoly in the offerings it provides.

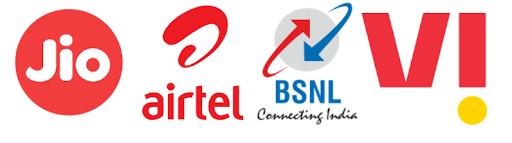

2. Reliance Jio & Its Competitors

Reliance Jio is the fast-growing subsidiary of the conglomerate and has gained a good market share since it first launched back in 2016 by offering 4G services free of cost for a year.

- Since that day, it has been unstoppable in adding new customers every year compared to its competitors like Vodafone Idea, Airtel and BSNL.

- But now, things are kind of slowing down for Jio as Airtel has been working hard and has also been successful in adding more customers than Jio since the Covid-19 pandemic

- However, the other competitors that are Vodafone Idea and BSNL have lost more customers than ever due to their poor quality of customer service and experience.

So to conclude, Reliance Jio still has a healthy market share but Airtel has now emerged as an equally competitive candidate in terms of services and the experience offered.

3. Reliance Retail & Its Competitors

Reliance Industries Limited has been focusing on the retail business for years now but in the last two to three years it has increased its focus on this segment. It has acquired a lot of retail companies and startups in the last two to three years and thus making its intentions clear of establishing itself as “The Retail Leader” just like it had done with Jio a few years ago.

The retail arm of Reliance has been working on conquering both the online and offline mode of retail by acquiring the Future Group and launching Jio Mart

Its primary competitors are Dmart, Amazon and Flipkart. However, all its competitors are working along the same lines of increasing their presence both online and offline either through acquisitions or through building things from scratch.

The Future Group which is acquired by Reliance Retail is under the scrutiny of the Supreme Court and the acquisition has been halted temporarily as Amazon has accused Future Group of violating an agreement previously agreed upon.

As it is an industry that is yet to establish thoroughly, only time will tell us whose efforts were appreciated by the customers.

Now with this, you have an idea about how the competition is folding out in the industry in general, let’s now understand the strategy that Reliance Industries Limited is implementing to place itself ahead of its competitors in the next section.

Marketing Strategy of Reliance

Marketing strategy helps companies achieve business objectives. There are several marketing strategies like product/service innovation, marketing investment, customer experience, etc. which have helped a brand grow and place itself better in the market.

Reliance Industries’ marketing strategy focuses on implementing aggressive marketing tactics for its telecom subsidiary, Reliance Jio and retail subsidiary, Reliance Retail as they are Business to Consumer (B2C) businesses.

So starting with Reliance Jio,

1. Marketing Strategies of Reliance Jio

Jio advertises aggressively during prime time events such as IPL in India.

- Their “Jio Dhan Dhana Dhan” campaign is one of the most successful campaigns of all time.

- It was launched during IPL 2017 edition and is still in the running since then.

Jio has launched a new online portal called Jio Mart for home delivery of its products in collaboration with its sister company Reliance Retail.

2. Marketing Strategies of Reliance Retail

Reliance Retail has recently started working aggressively to increase its presence in India. The company has launched Jio Mart that offers home delivery of products and services to its customers.

- Jio Mart does not charge any delivery fee as of now whereas its competitors like Amazon and Flipkart charge a mandatory delivery fee irrespective of the size of the order. This distinguishes Jio Mart from its customers.

It is also currently working in onboarding Local Kirana Stores and Petty shops from all the regions of India and help them with home delivery services for their products and offerings

This is how the marketing strategy of Reliance Industries is placed so that it can be one step ahead of its competitors.

Competitive Advantage in the Marketing Strategy of Reliance Industries:

- With a strong brand name and good positioning in the market, RIL manages to create a sense of credibility and trust among its target users.

- As the company has been awarded various recognitions in the past for its excellent work and great financial holdings, the marketing strategy of the reliance industry’s focal point is CSR activities and doing things that focus on the holistic growth of the company to create a positive image in the eyes of stakeholders and users.

- Reliance’s marketing strategy includes using marketing mediums like TVCs, billboards, etc to increase brand loyalty among its users.

- To dig deep and know more about its user base and attract new consumers, Reliance Industries actively sponsors and promotes sports in India. RIL owns the IPL team Mumbai Indians and holds around 65% stake in the Indian Super League to promote football in the country.

Reliance Marketing Strategy: Marketing Campaigns of Reliance

Marketing campaigns are implemented to create a brand’s presence in the minds of customers and to build trust which directly results in better goodwill of the company and further word of mouth promotions of the company.

1. Reliance Jio

Jio uses Social Media, Television Ads, Print Media and an OTT (Over The Top) platform called Hotstar to advertise their campaigns. Of the famous campaigns, Reliance Jio had launched a long term campaign named Jio Dhan Dhana Dhan back in 2017. The campaign is still running as it’s a long term campaign that is updated year on year based on the new products and service launches of the company.

This campaign primarily focuses on targeting the youths and cricket fans of the country as they run this campaign around the start of the Indian Premier League (IPL) which is India’s premier domestic cricket competition.

Popular celebrities such as Shah Rukh Khan, Amitabh Bachhan, Deepika Padukone and Ranveer Singh are roped in as brand ambassadors for these campaigns. Jio has also partnered with a lot of IPL Teams and that also helps them use cricket players as their brand ambassadors.

Reliance Jio’s recent advertisement featuring Deepika Padukone and Ranveer Singh.

2. Reliance Retail

Reliance Retail has increased its advertising volumes to capture the audience’s attention since the pandemic has begun. It is yet to unveil a proper long term marketing campaign just like its sister company Jio’s “Jio Dhan Dhana Dhan” campaign.

However, it releases topical and event-based advertisements during the festivals to create its presence in the minds of the consumers.

So to expand its retail business with full potential, Reliance Retail should come up with a long term campaign just like its sister company Reliance Jio has done. Maybe, the long term campaign is in the works or it might be halted for a moment temporarily until the Future group deal is cleared which only the time would tell us.

3. Reliance Digital

For its marketing campaigns, Reliance Digital usually focuses on showcasing the latest technology products, features, and services that are available at its stores.

The recent video ad campaign launched by Reliance Digital, named “Technology se Rishta Jodo” (meaning, “Connect your relationship with technology”), aims to educate and empower people who may be hesitant or fearful of using technology. The ad features relatable scenarios of individuals of different ages and backgrounds who are shown overcoming their fear of technology with the help of Reliance Digital’s products and services.

The campaign aims to resonate with a broad audience, as it acknowledges that there are many people who may feel left behind in this rapidly changing digital world. By highlighting Reliance Digital’s role in bridging the gap between people and technology, the campaign encourages viewers to connect with technology and use it to improve their lives.

The campaign has been successful so far, with over 9 million views on YouTube and positive feedback from viewers. Through this campaign, Reliance Digital has effectively communicated its brand values and positioned itself as a trusted partner for people looking to embrace technology.

With this, we have come to the end of this case study. So let’s go through the quick conclusion of the same.

In all its market sectors, Reliance Industries Limited enjoys global leadership in its O2C business. With Jio being its fastest-growing business, it has all the proper marketing campaigns and strategies in place. However, Incase of Reliance Retail, it is yet to work out its marketing campaigns and strategies to ensure it operates on its maximum potential and thrives in offering customers a better experience with its products and services.

Liked our work? Interested in learning more? Do check our website for more. Also, if you’re interested in Digital Marketing, you can check out our Free Digital Marketing Masterclass by Karan Shah.

Let us know your thoughts in the comment section down below. Thank you for reading, and if you liked our then do share the blog in your circle.

Until then, see you next time!

Author's Note: My name is Aditya Shastri and I have written this case study with the help of my students from IIDE's online digital marketing courses in India . Practical assignments, case studies & simulations helped the students from this course present this analysis. Building on this practical approach, we are now introducing a new dimension for our online digital marketing course learners - the Campus Immersion Experience. If you found this case study helpful, please feel free to leave a comment below.

Aditya Shastri

Lead Trainer & Head of Learning & Development at IIDE

Leads the Learning & Development segment at IIDE. He is a Content Marketing Expert and has trained 6000+ students and working professionals on various topics of Digital Marketing. He has been a guest speaker at prominent colleges in India including IIMs...... [Read full bio]

Thanks 🌻 So much helpful for my case study assignment .

An insightful examination of Reliance’s marketing strategy. It’s impressive to observe how different their approaches are across sectors.

Submit a Comment Cancel reply

Your email address will not be published. Required fields are marked *

Submit Comment

This site uses Akismet to reduce spam. Learn how your comment data is processed .

Related Posts

Full case study on the marketing strategy of acc.

by Aditya Shastri | Jul 31, 2024

Quick Read ACC Cement's marketing strategy focuses on innovative advertising, digital...

A Step-by-step guide on the Detailed Business Model Of IBM

Quick Read IBM's business model revolves around innovative digital marketing, diverse...

Elaborative Business Model of Infosys – Explained

by Aditya Shastri | Jul 30, 2024

Quick Read The Infosys business model is centred on IT services and consulting. This...

" * " indicates required fields

I’m Interested in This Masterclass

By providing your contact details, you agree to our Terms of Use & Privacy Policy

New Cloudera research: The State of Enterprise AI and Modern Data Architectures

Cloudera | Customer

- My Applications

success stories

- Reliance Industries Limited Success Story

- Resources Library

Related Resources

Your form submission has failed..

This may have been caused by one of the following:

- Your request timed out

- A plugin/browser extension blocked the submission. If you have an ad blocking plugin please disable it and close this message to reload the page.

Fiscal prudence and proactive risk management formed the guide rails for navigating a challenging macro environment. Despite synchronised raising of policy rates by Central Banks and volatility in commodity prices, we contained the rise in finance costs while ensuring the Balance Sheet has strength and liquidity to support growth initiatives.

Alok Agarwal

Srikanth Venkatachar

Soumyo Dutta

Anshuman Thakur

Dinesh Taluja

Saurabh Sancheti

C. S. Borar

Raj Mullick

Sumit Mantri

Global Economy

Global economy grew 3.4% in CY22, slowing from the post-COVID rebound of 6.2% in CY21. Growth was in-line with pre-pandemic average (2015- 19) of 3.4% despite Russia-Ukraine conflict and aggressive rate hikes by central banks. Advanced economies (AEs) saw above-trend growth of 2.7% in CY22, higher than the 2.1% average seen in the five years prior to the pandemic. This was led by strong growth in both US and Euro area which grew at 2.1% % and 3.5% respectively. Inflationary pressures remained near multi-decade highs in AEs, with US inflation averaging 8% Y-o-Y (highest since 1980s), while Euro area inflation also averaged a multi-decade high of 8.4%. Developed market central banks aggressively tightened their monetary policy to address inflation, with US Federal Reserve raising rates by 450bps in CY22, while European Central Bank hiked rates by 250 bps. Emerging Market and Developing Economies (EMDEs) grew 4% in CY22, below the pre-pandemic average of 4.4% due to slowdown in Chinese economy amidst frequent lockdowns. China growth eased to 3%, well below the pre-pandemic average of 6.7% on continued zero-COVID policy and housing downturn. Crude oil prices were elevated during FY 2023, averaging $93/bbl, remaining above $100/bbl in first half of the fiscal year due to Russia-Ukraine conflict, but receding in the second half with Chinese demand slowing and release of strategic petroleum reserves from OECD countries.

Global growth is expected to slow in CY23 to 2.8% as the lagged impact of synchronised global monetary tightening. Growth in advanced economies is expected to decelerate to 1.3%, with US and Euro area growth expected at 1.6% and 0.8% respectively. Effect of rapid rate hikes over last one year as well as emerging credit crunch risks from US regional banks remain key concerns for advanced economies. Emerging markets growth is expected to hold near pre-pandemic average at ~3.9% in CY23, supported by India and China. China growth is expected to rebound to 5.2% in CY23 from 3% on reopening of the economy after three years and continued monetary policy support. India is expected to remain amongst the fastest growing economies as per IMF.

Indian Economy

The Indian economy remained relatively stable amidst the global imbalances caused by the RussiaUkraine conflict. The economy grew at 7.2% in FY 2022-23, down from 9.1% in FY 2021-22, as per the National Statistical Office data release.

The spike in global commodity prices pushed up prices in India too, with retail inflation peaking at 7.79% in April 2022, above the medium-term target band of 2%-6% of the RBI. The RBI took stringent measures to combat the rising prices, hiking repo rate six times in FY 2022-23, from 4% at the beginning of May 2022 to 6.5% at the close of the financial year. Private consumption, however, witnessed a strong surge fuelling a boost in production across sectors. Domestic sector services activity remained resilient with average Services PMI higher at 57.5 in FY23 vs 52.2 in FY22. Manufacturing too remained robust with average manufacturing PMI higher at 55.8 in FY23 vs 54.1 in FY22. Credit growth gained traction with year-on-year growth of 15% (as of March ’23) while deposit growth lagged with year-on-year growth of 9.6%, leading to a rise in incremental credit-deposit ratio.

India overtook Japan and Germany to become the third largest automobile market in terms sales in December 2022. India also emerged as the second largest mobile phone manufacturer globally. India’s digital adoption continues in an accelerated way. UPI payments continued their impressive run in FY 2022-23, with transaction volumes almost doubling from ~45 billion in FY 2021-22 to ~84 billion in FY 2022-23, while transaction value also surged to ~139 lakh crore in FY 2022-23 from ~84 lakh crore in FY 2021-22. The pan- India monthly mobile data traffic stood at 14.4 Exabyte in 2022 with 3.2x growth over last five years. Rapid digitisation supported by solid infrastructure is driving efficiency and productivity in the economy. India’s external sector continued to gain strength as FY23 merchandise exports grew to $447 billion, growing at 6% Y-o-Y and services exports grew to $322 billion, growing at 27% Y-o-Y.

Global supply chain improvements and falling commodity prices coupled with softening domestic demand are likely to moderate inflation to 5.1% in the current financial year. With a growing working age population, a large domestic market, boost to infrastructure development and advent of digitisation, India is well positioned to be the fastest growing large economy in the world. India GDP is expected to grow at 6.5% in FY24.

Performance Overview

Reliance delivered strong annual performance amid macro headwinds caused by geo-political conflicts, disruptions in commodity trade flows and economic downturn. Resilience of Reliance’s strategic and operational capabilities reflected in its ability to adapt to dynamic business environments and navigate through complex business situations. Growth was supported by agile and efficient operations by all business teams with sound strategic planning and implementation.

Earnings growth was led by rebound in O2C business, backed by healthy domestic demand, strong fuel margins and high utilisation rates. Oil and gas segment performance reflected volume growth in KG D6 gas production, higher gas price realisations and margin improvements. Operational efficiencies continued with 100% uptime.

Consumer business segments continued to strengthen their positions in the market with aggressive expansion of footprint and strategically prudent acquisitions. Jio successfully launched True 5G services across over 2,300 towns and cities, thereby continuing to offer enhanced digital experiences to its subscribers. The retail business broadened its product and distribution base further, making available a vast assortment of products and brands to its consumers at affordable prices.

Reliance Jio Financial Services is demerged. The new entity is expected to unlock value for shareholders and give them an opportunity to be a part of a new growth platform.